The document discusses the Sharpe index model for portfolio management. [1] It presents an equation that divides a stock's expected return into two parts: return due to market movements and return independent of the market. [2] Beta indicates a stock's sensitivity to market changes and can be used to estimate systematic and unsystematic risk. [3] The variance of a portfolio is calculated based on the systematic risk and unsystematic risk of the stocks within it.

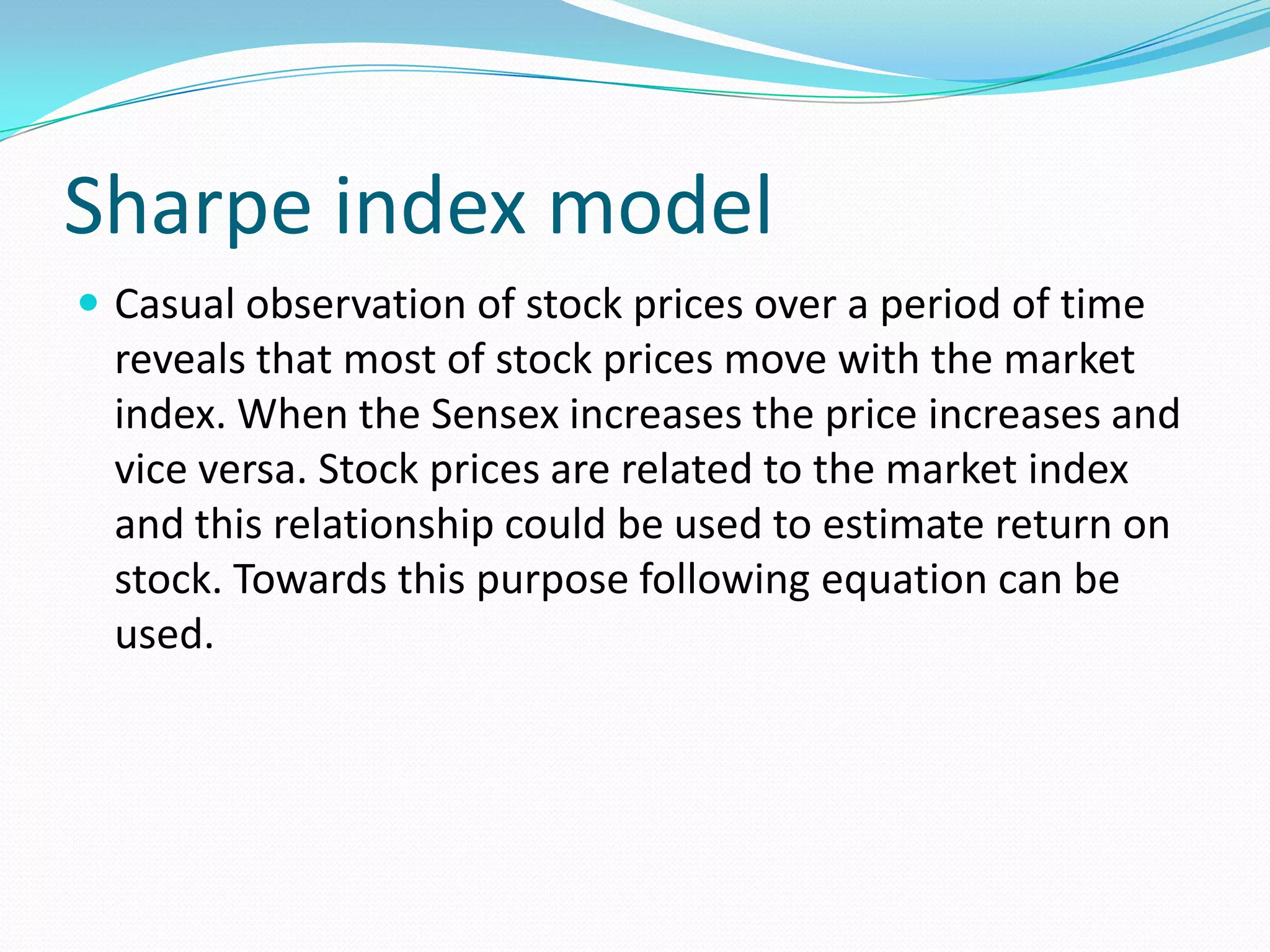

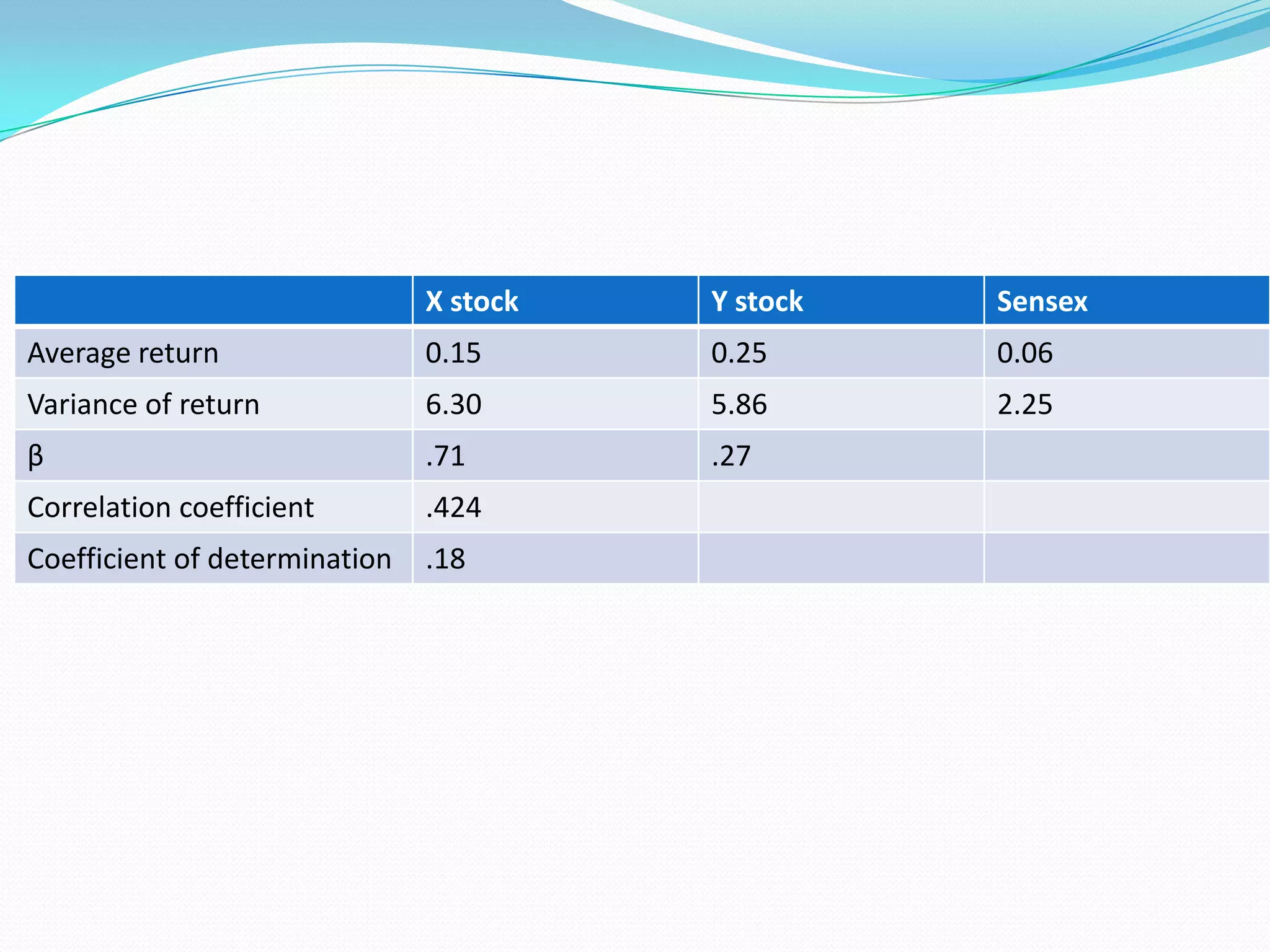

![ From this the portfolio variance can be derived

σ²p = [ (Σxiβi)²σ²m] + [ Σxi² ei²]

σ²p = variance of portfolio

σ²m = expected variance of index

ei²= variation in security return not related to the market index

xi = the portion of stock i in the portfolio](https://image.slidesharecdn.com/3-sharpeindexmodel-120203041221-phpapp02/75/3-sharpe-index-model-9-2048.jpg)

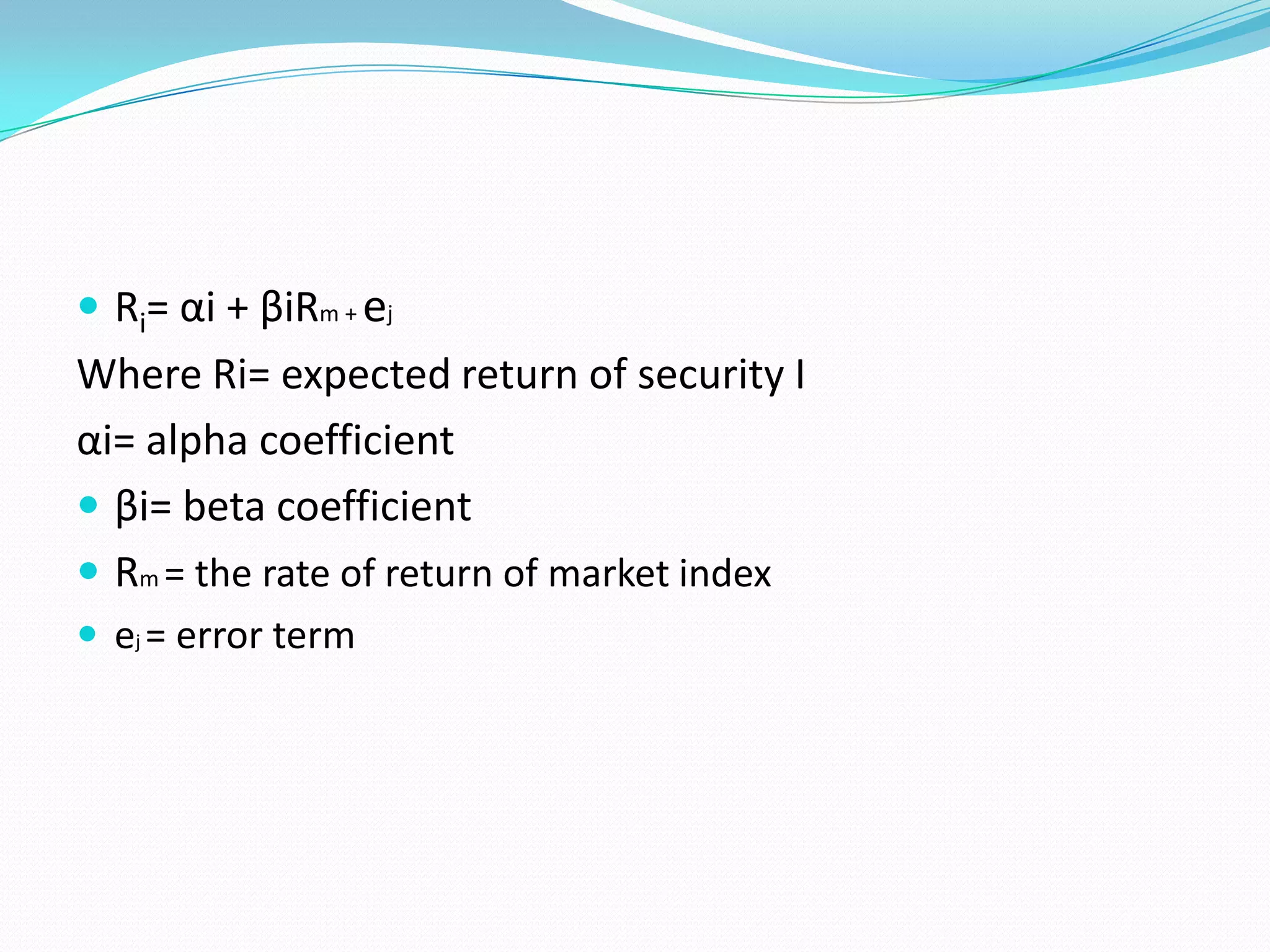

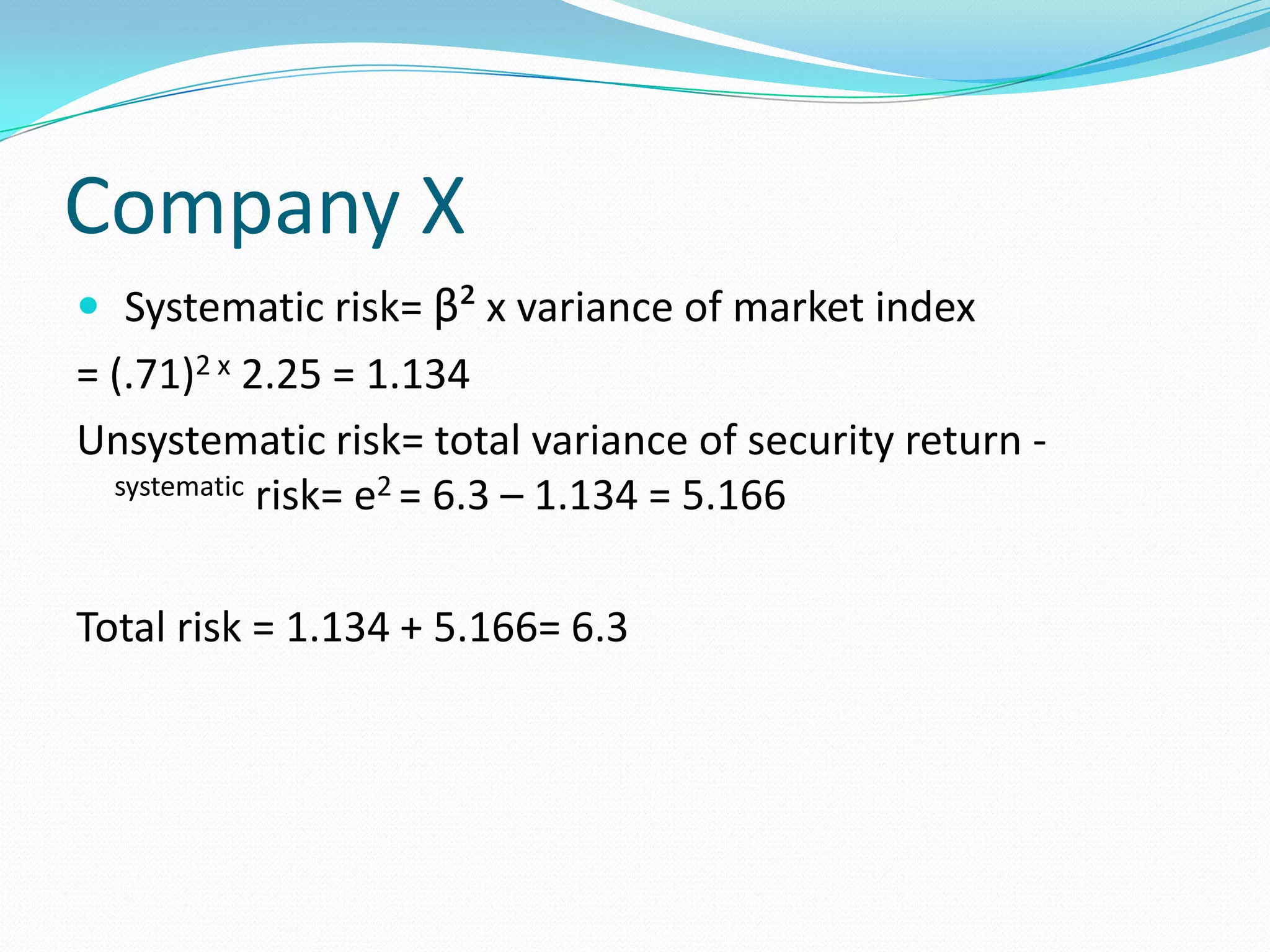

![Company y

Systematic risk = βi² x σ²m

(.27)2 x 2.25 = 0.1640

Unsystematic risk = total variance of security return – systematic risk

= 5.86 - .1640 = 5.696

σ²p = [ (Σxiβi)²σ²m] + [ Σxi² ei²]

= {(.5 x .71 + .5 x .27)2 x 2.25} + {(.5) 2 (5.166) + (.5) 2

(5.696)}

= (.540 + 2.716)

= 3.256](https://image.slidesharecdn.com/3-sharpeindexmodel-120203041221-phpapp02/75/3-sharpe-index-model-13-2048.jpg)