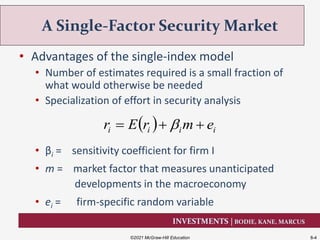

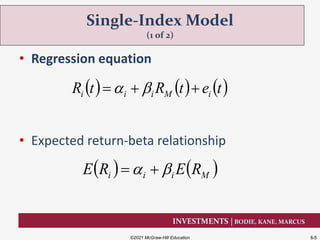

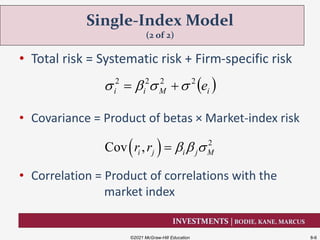

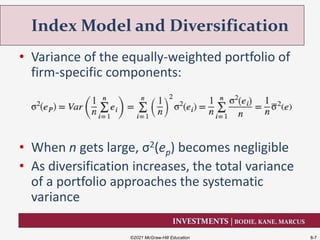

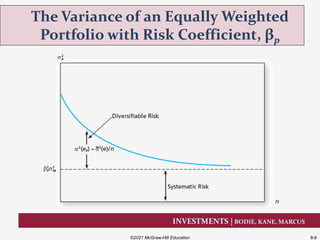

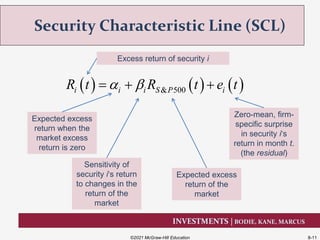

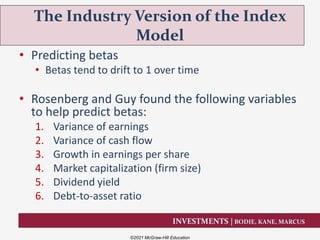

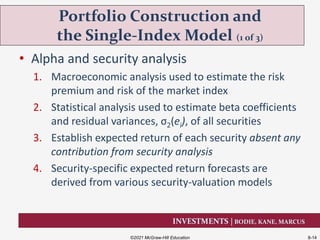

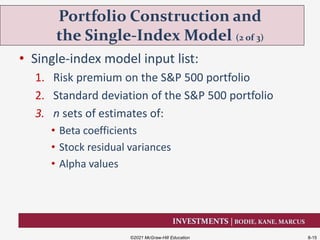

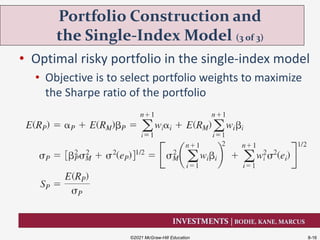

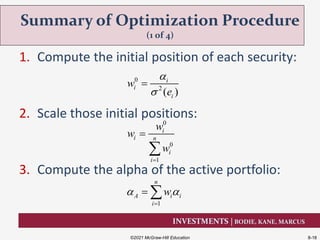

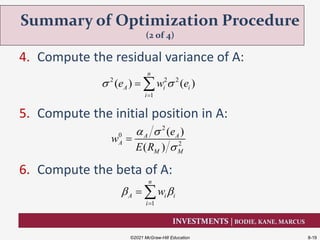

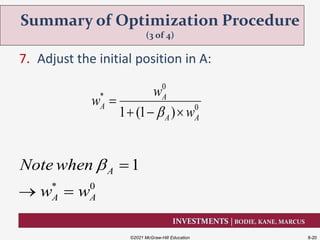

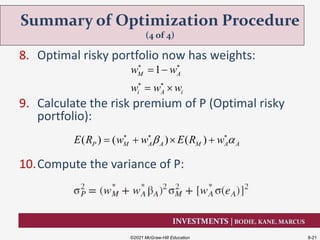

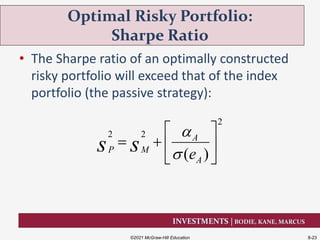

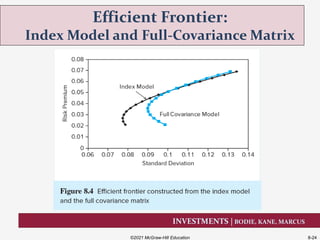

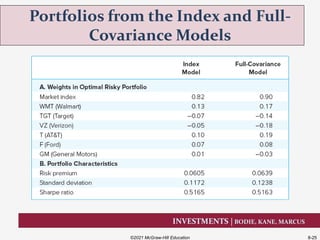

This document summarizes key aspects of index models from the textbook "Investments" by Bodie, Kane, and Marcus. It discusses the advantages of index models over the Markowitz model, including requiring fewer estimates and enhancing security risk analysis. The single-index model relates security return to market return through sensitivity coefficients. While the full Markowitz model is theoretically superior, the index model is more practical and reduces estimation risk.