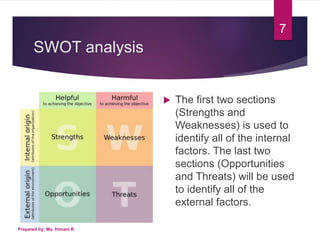

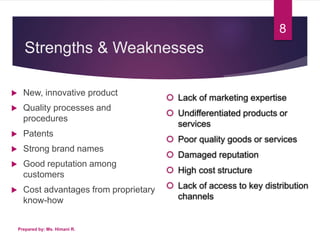

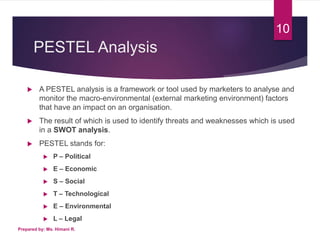

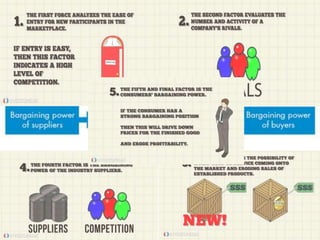

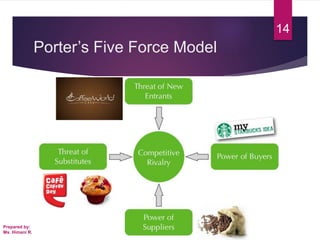

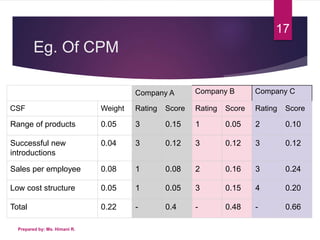

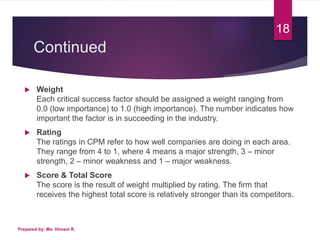

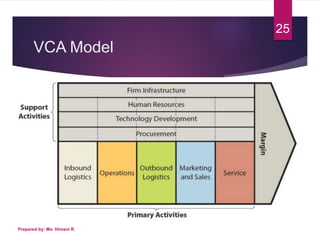

The document provides an overview of various frameworks and models for analyzing a company's competitive advantage, including PESTEL analysis, SWOT analysis, Porter's Five Forces model, the competitive profile matrix, and value chain analysis. It discusses how these tools can be used to identify internal strengths and weaknesses as well as external opportunities and threats to help a company gain and sustain a competitive advantage in its industry. The document is a presentation on competitive advantage delivered by Ms. Himani.