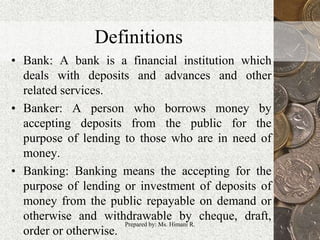

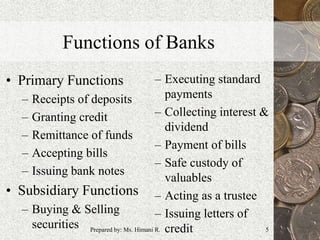

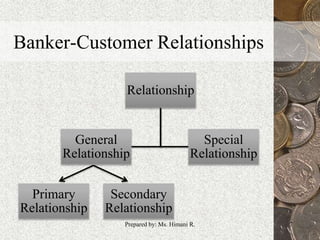

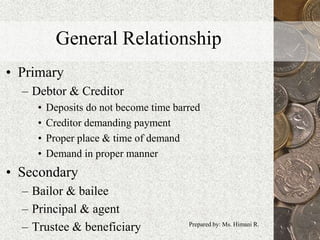

This document provides an overview of banking law and operations. It defines key terms like bank, banker, and banking. It describes the characteristics and functions of banks, including their primary functions of accepting deposits and granting credit, as well as subsidiary functions like buying/selling securities. The document defines customer and explores the general and special relationships between bankers and customers. It examines obligations like honoring checks, maintaining secrecy, and following customer directions. The document concludes by outlining some rights and duties of bankers, such as the right of lien and the right to charge interest.