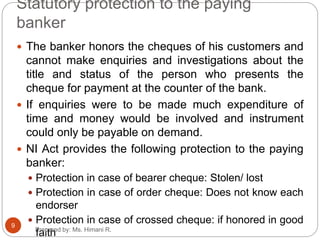

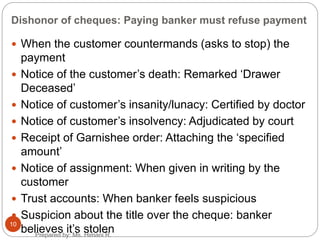

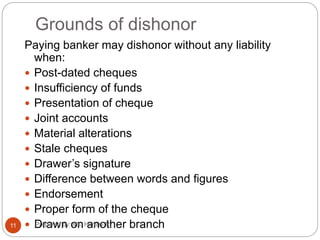

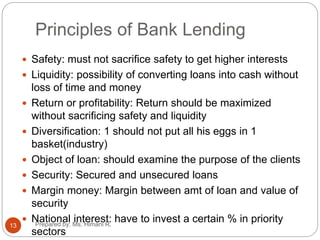

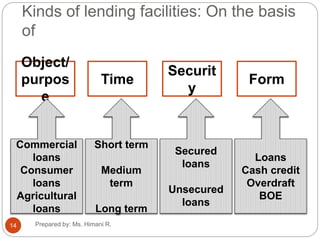

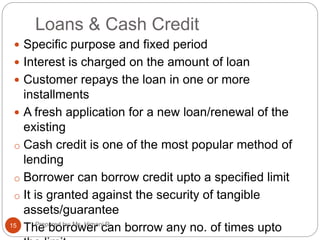

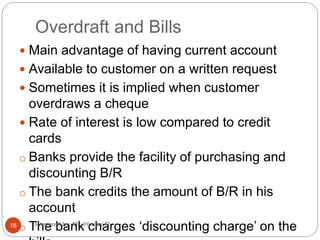

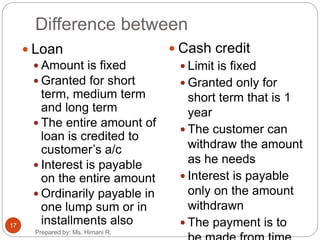

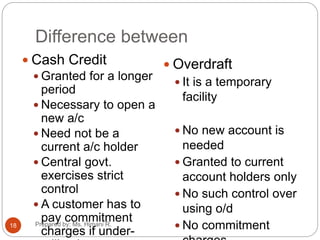

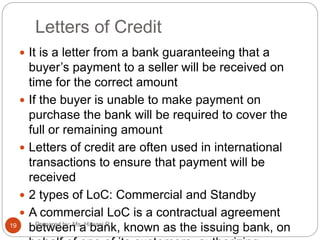

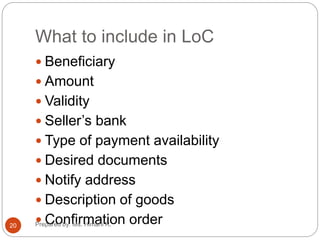

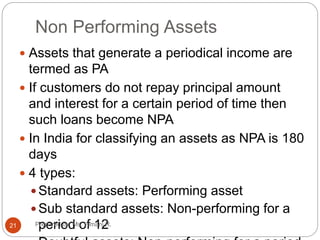

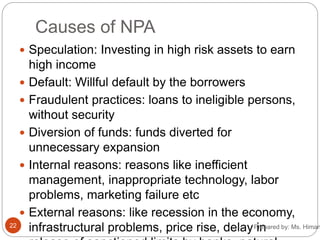

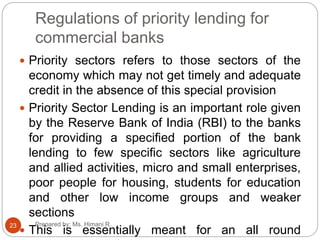

This document provides an overview of various banking operations including the roles of collecting and paying bankers, types of lending facilities, and non-performing assets. It discusses the duties of collecting bankers to carefully collect checks and notify customers of dishonored checks. Paying bankers must take precautions when honoring checks and can refuse payment for specific reasons. Banks offer various lending facilities like loans, cash credits, overdrafts and letters of credit. Non-performing assets are loans where borrowers do not repay principal or interest for a certain period.