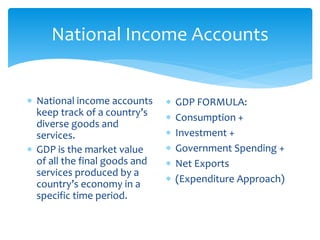

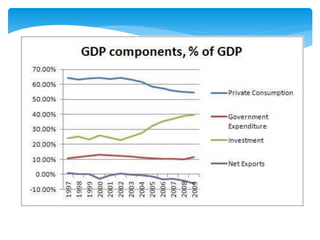

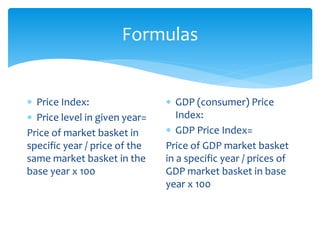

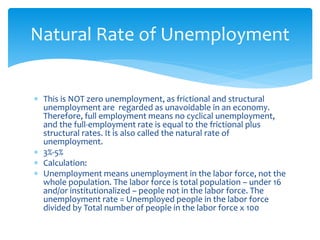

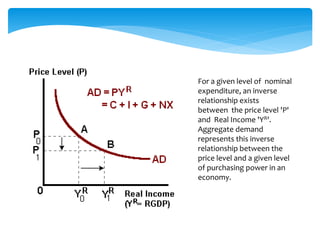

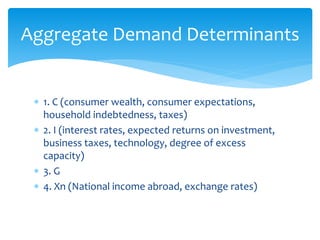

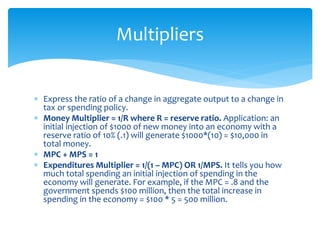

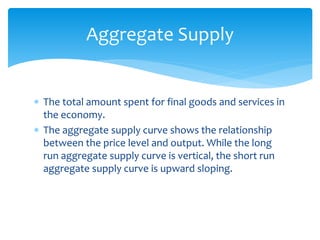

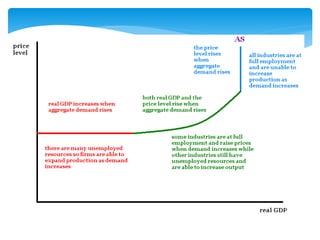

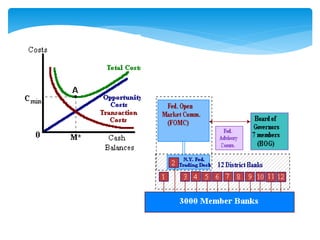

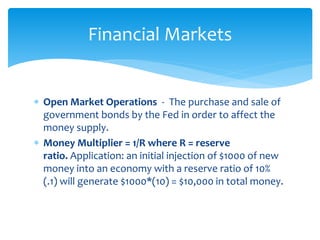

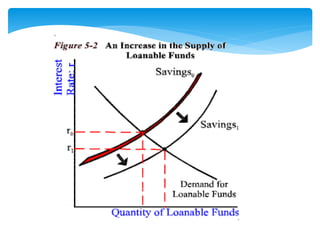

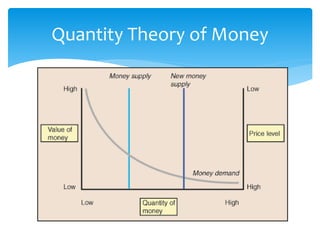

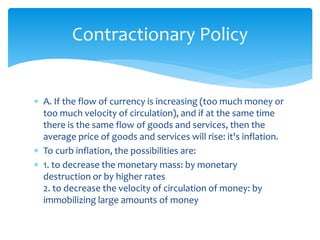

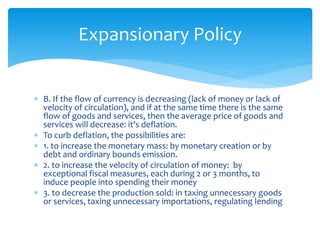

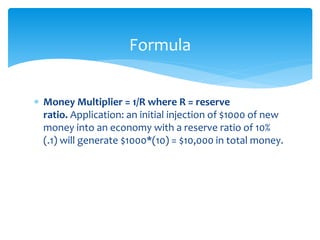

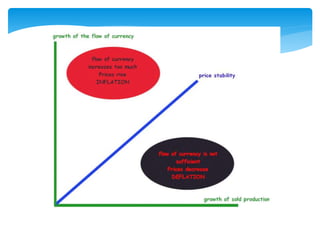

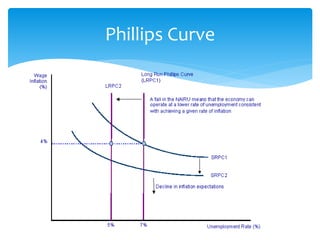

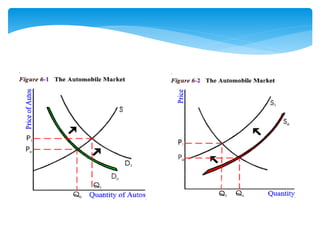

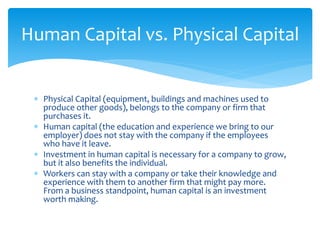

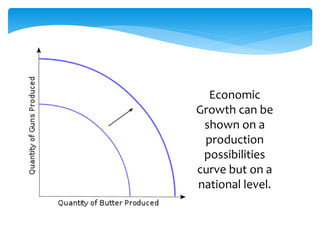

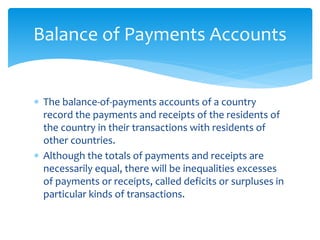

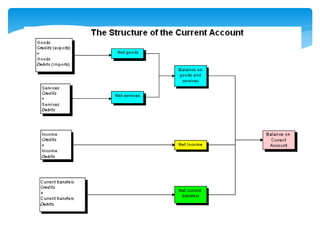

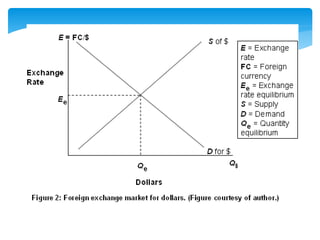

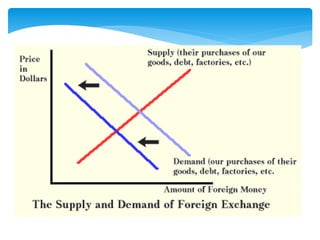

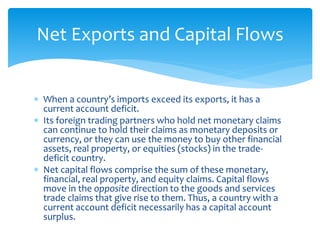

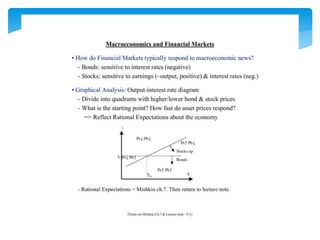

The document provides a comprehensive review of basic economic concepts including resources, scarcity, opportunity costs, and trade-offs. It discusses various economic indicators like GDP, inflation, unemployment types, and fiscal and monetary policy impacts on the economy. Additionally, it covers the role of financial markets, currency exchange, and the balance of payments in international trade.