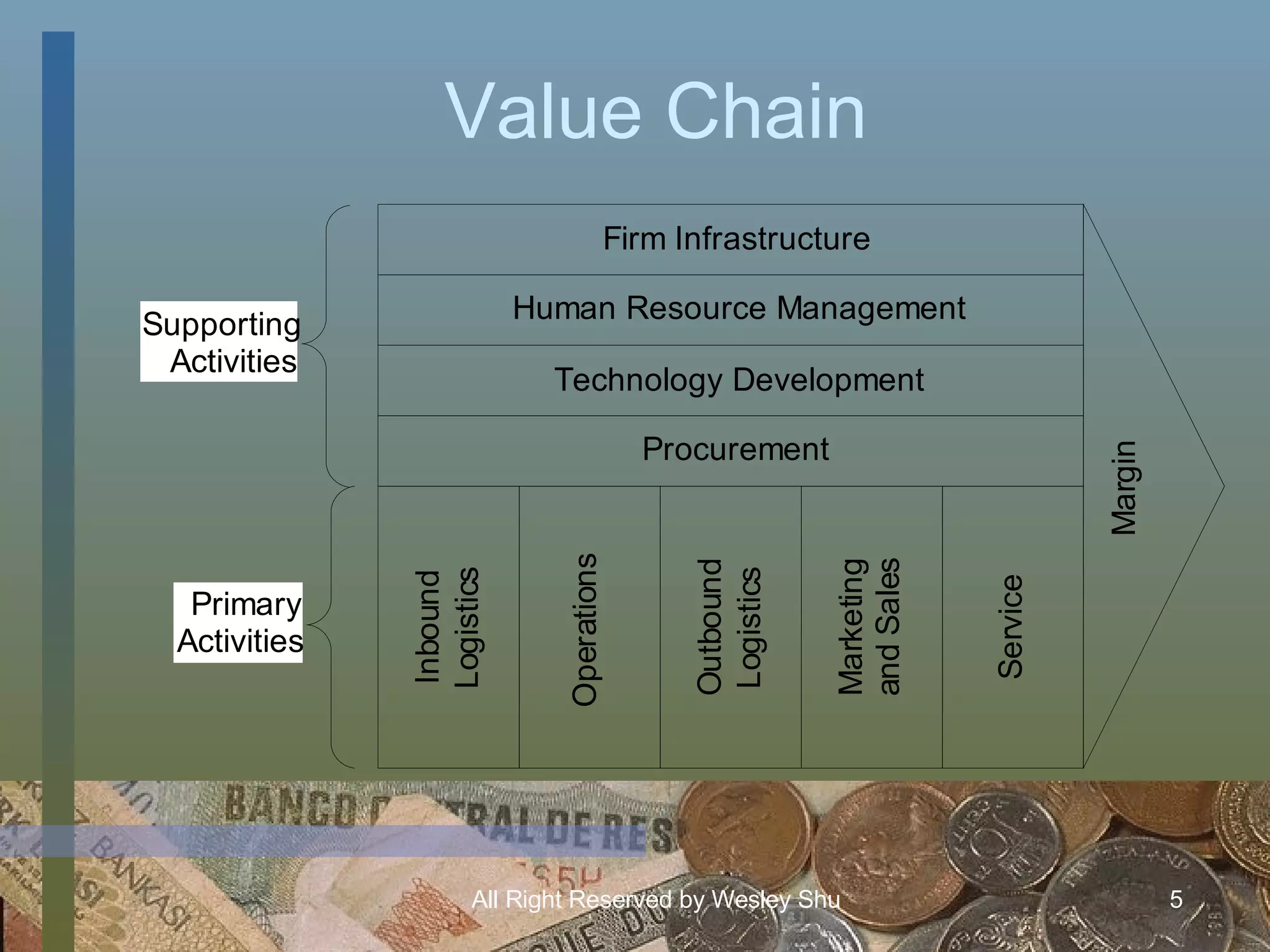

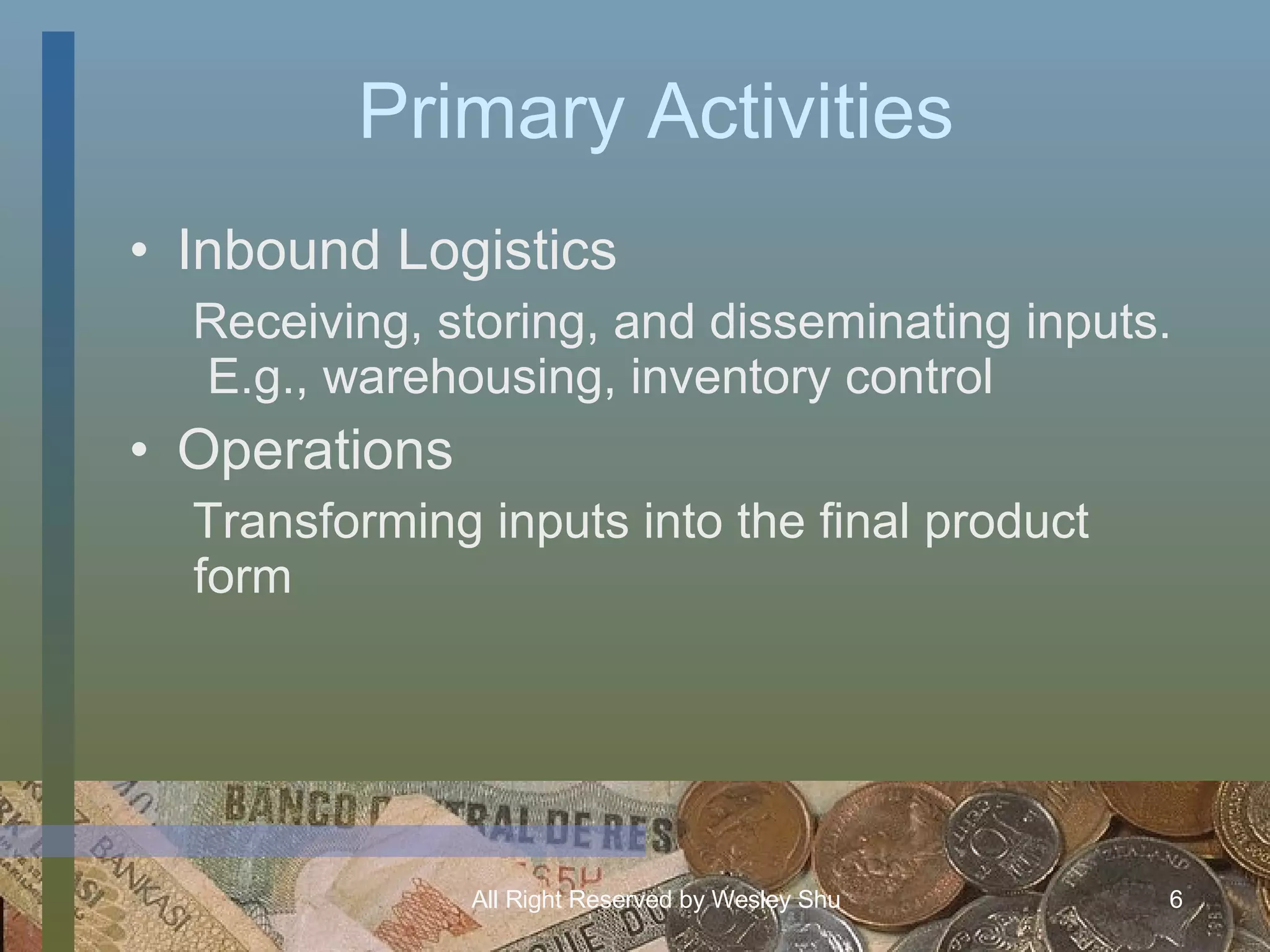

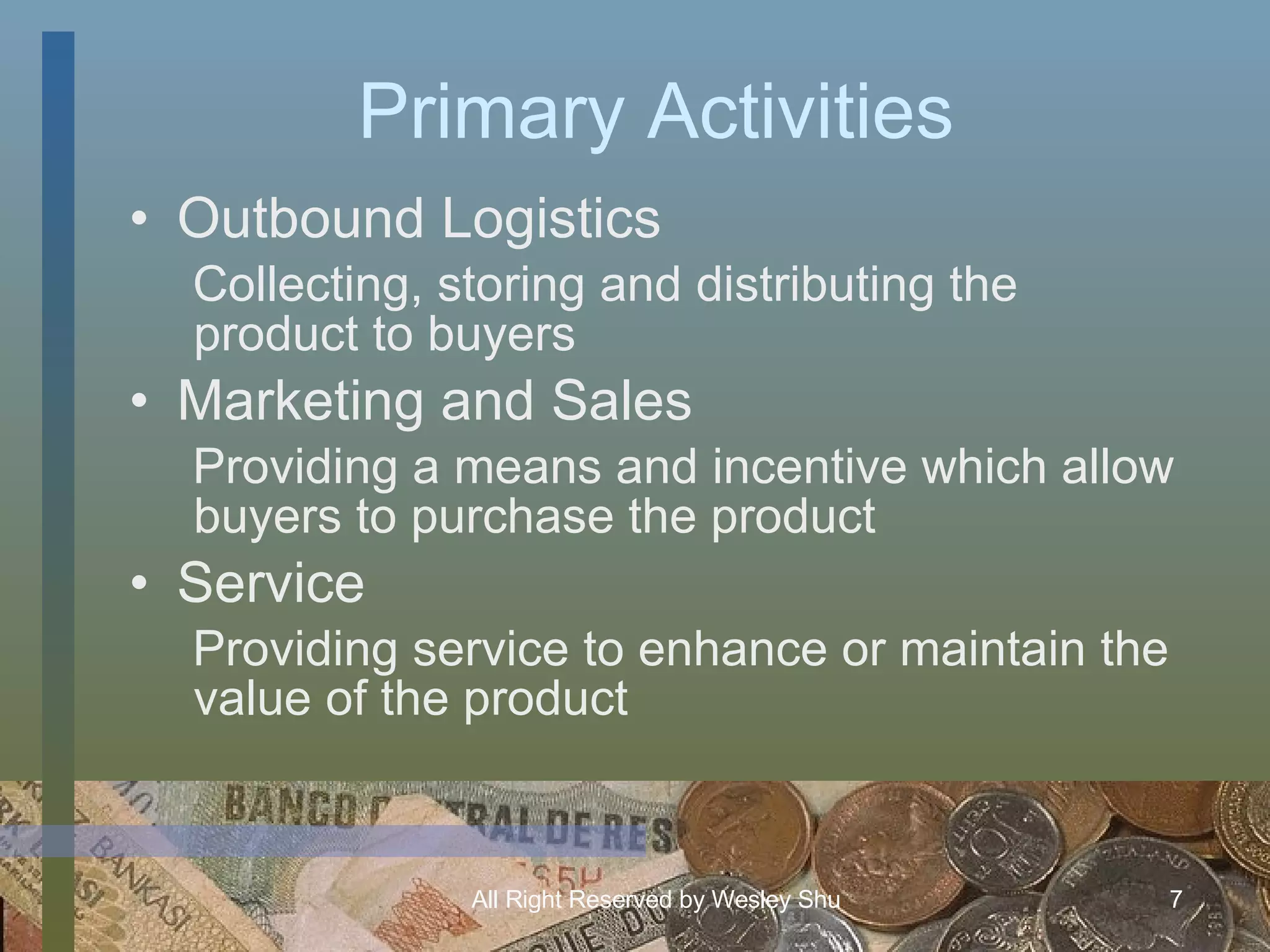

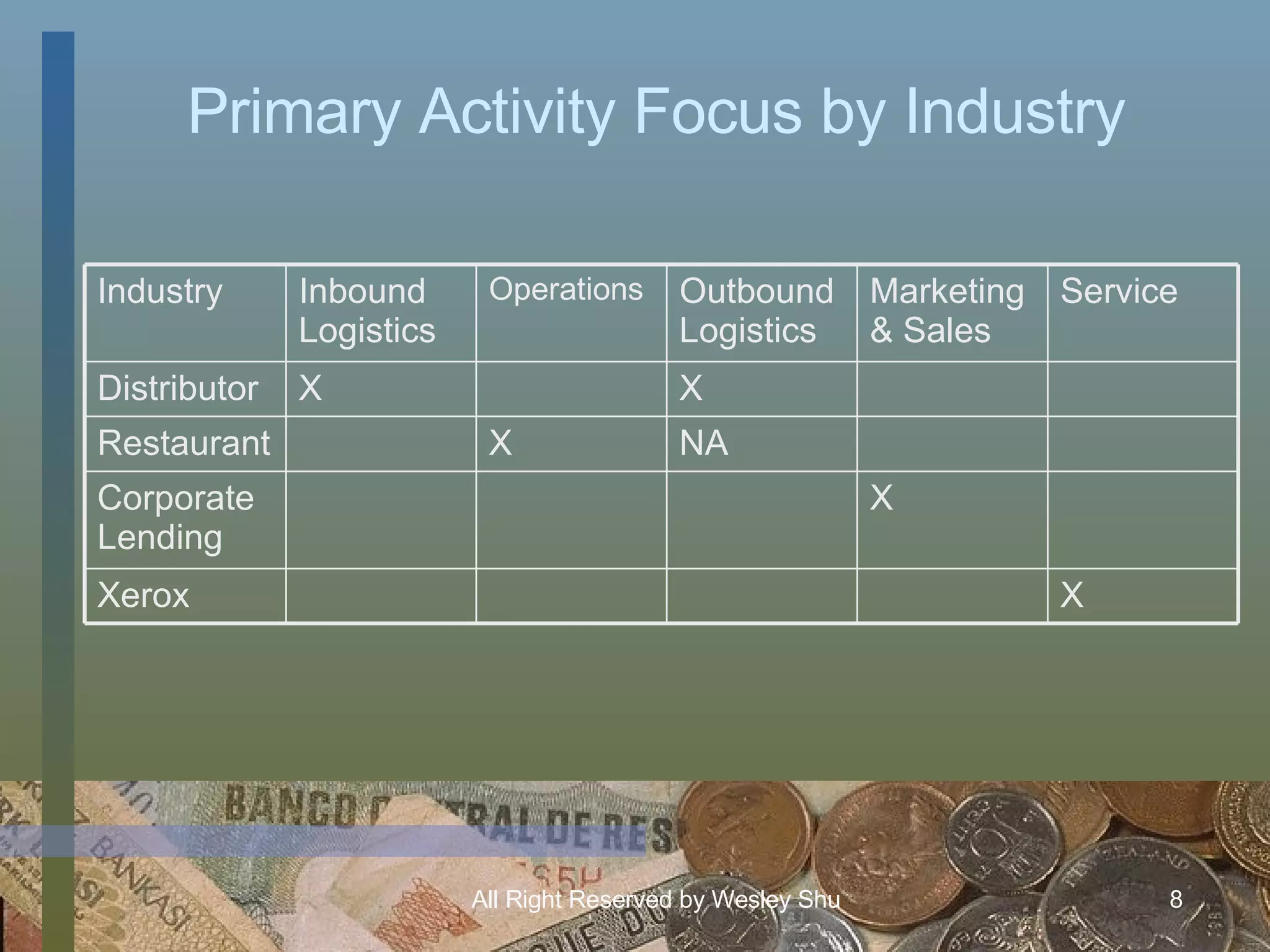

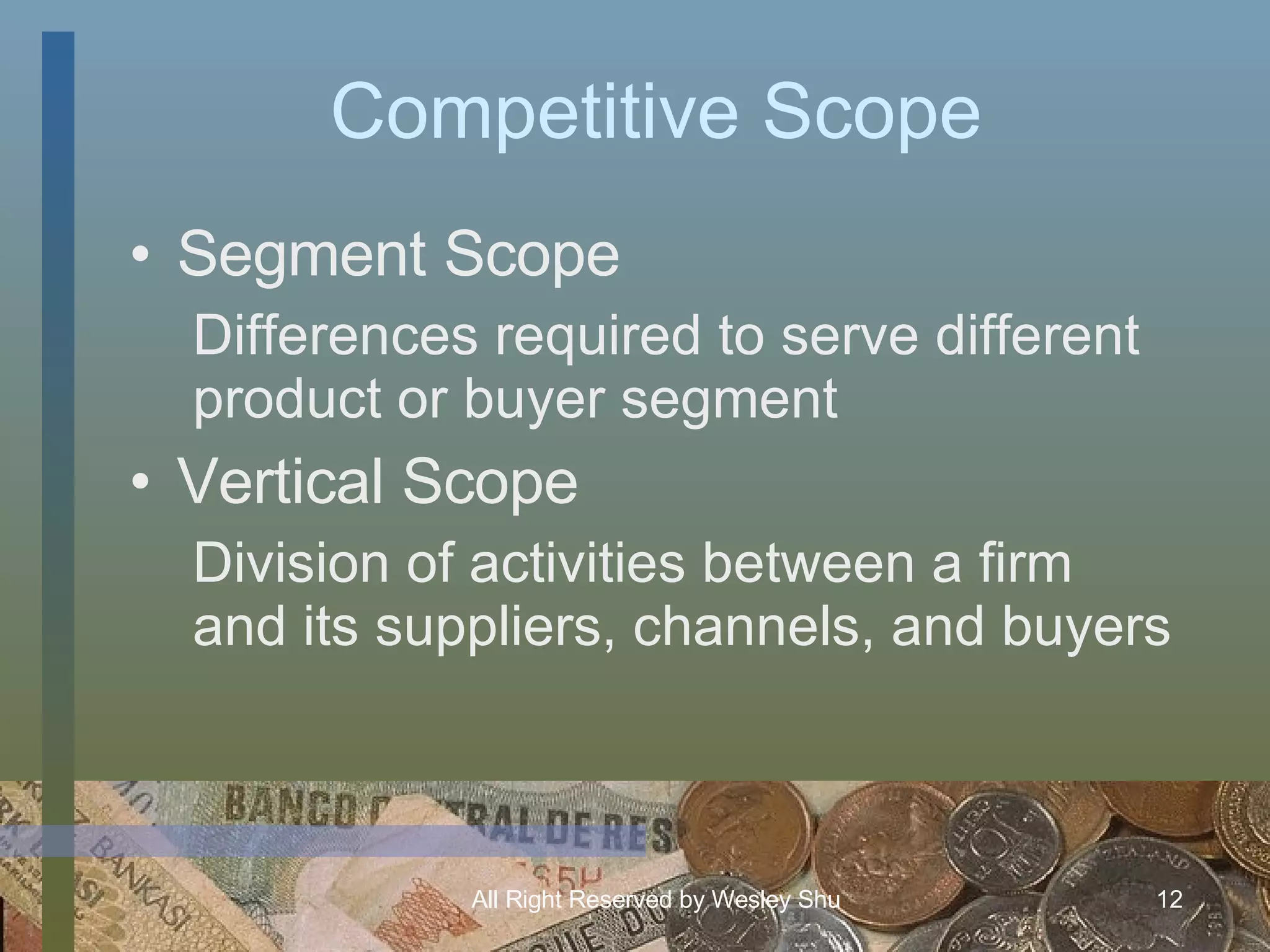

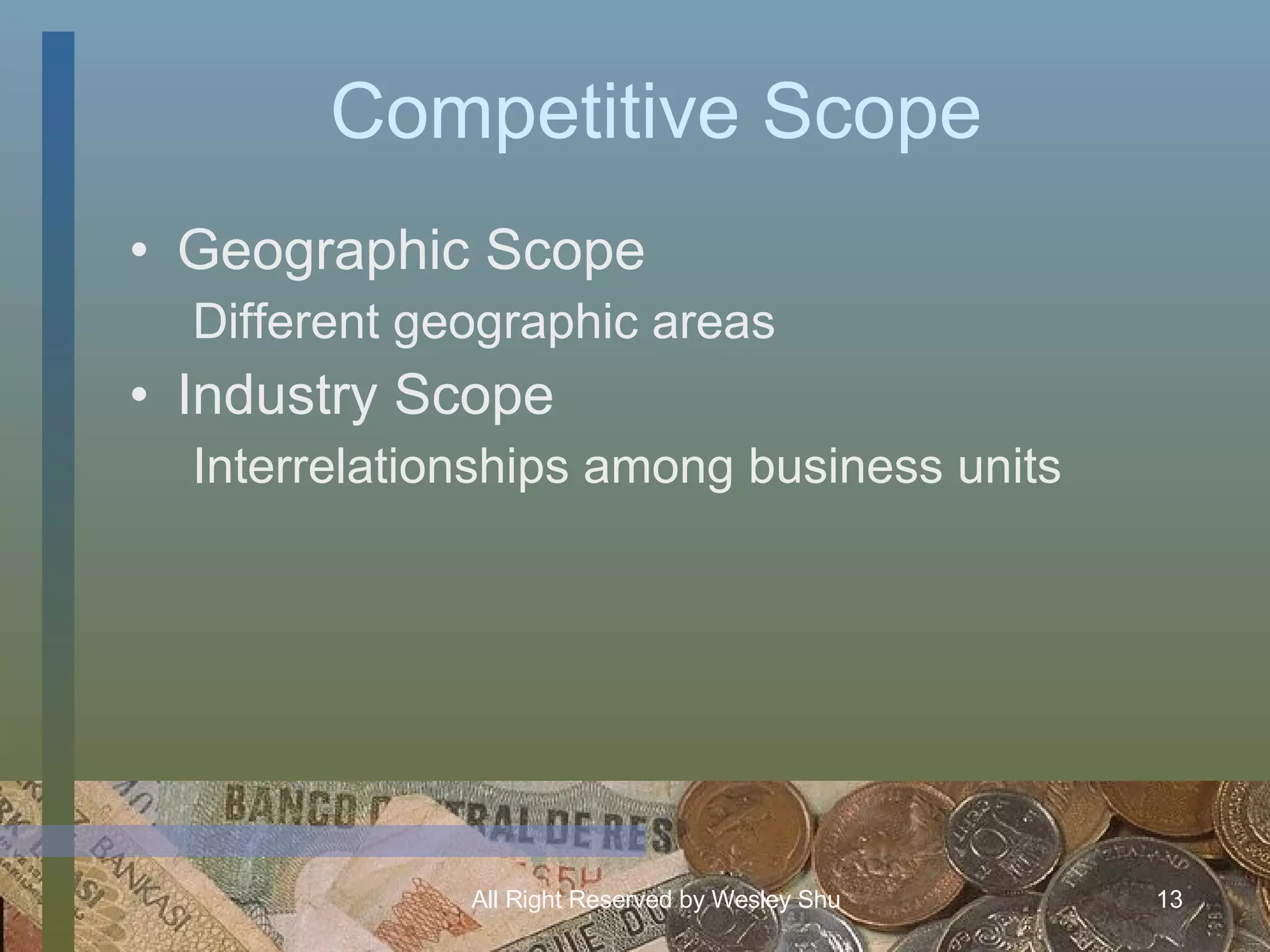

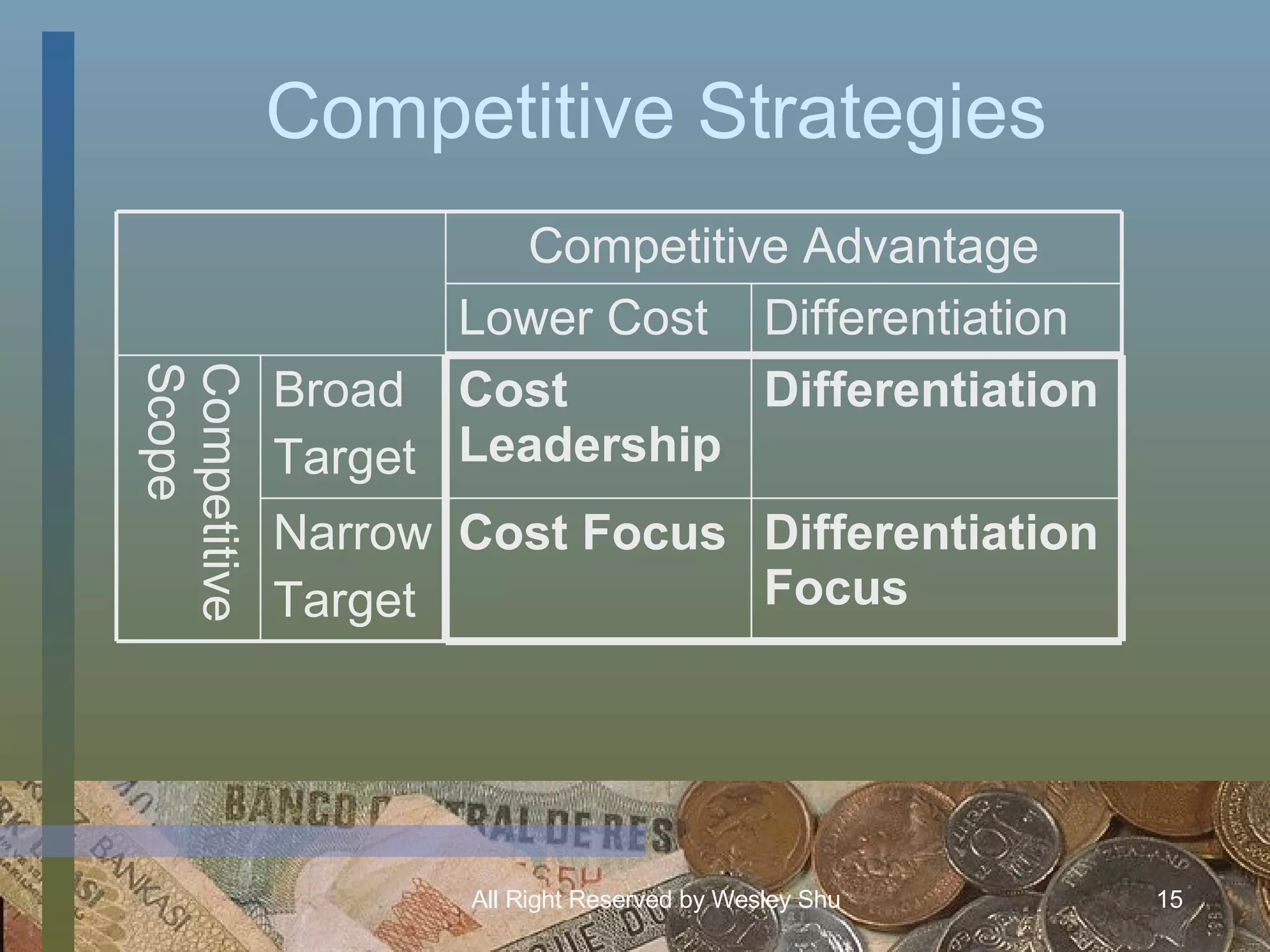

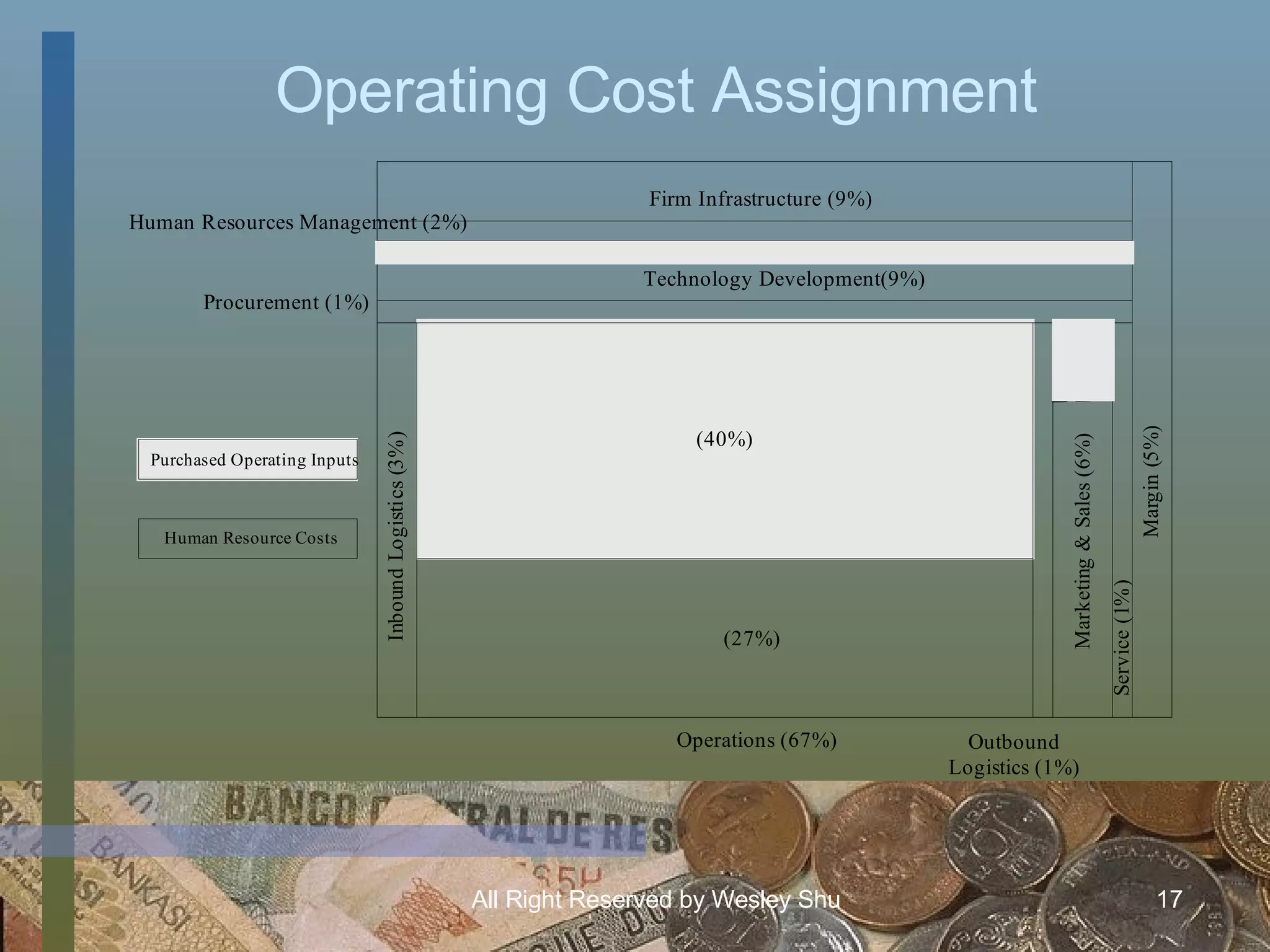

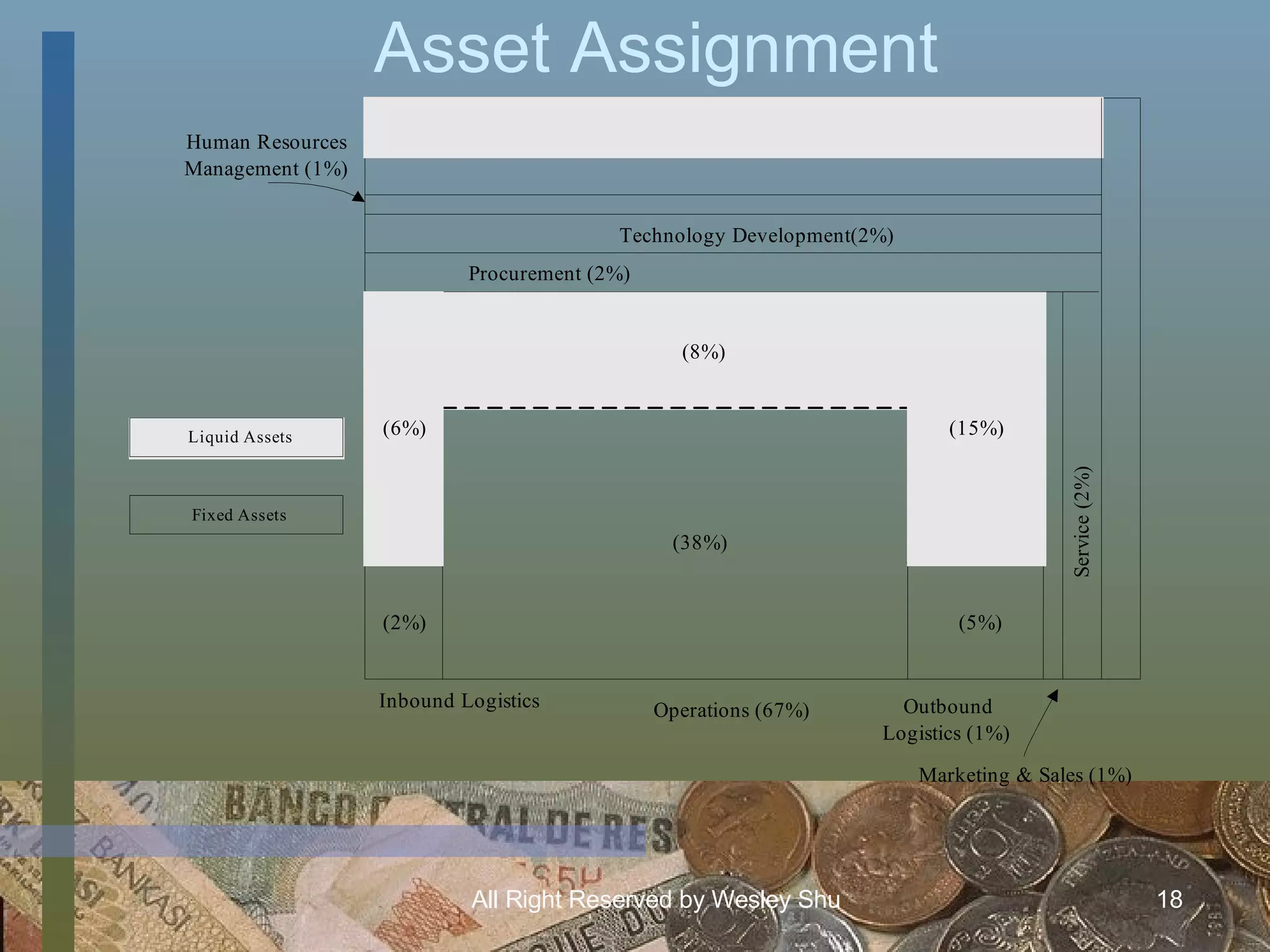

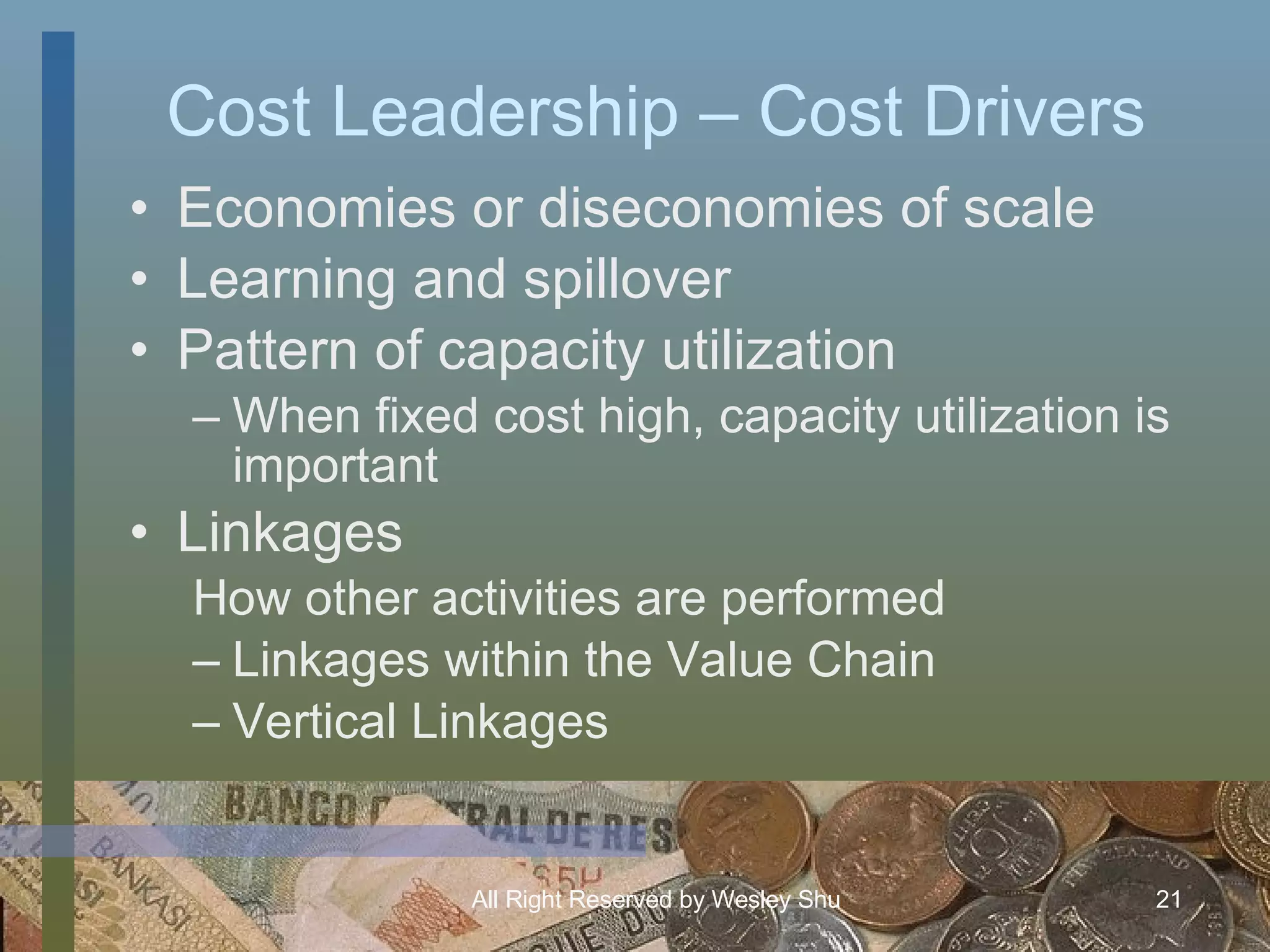

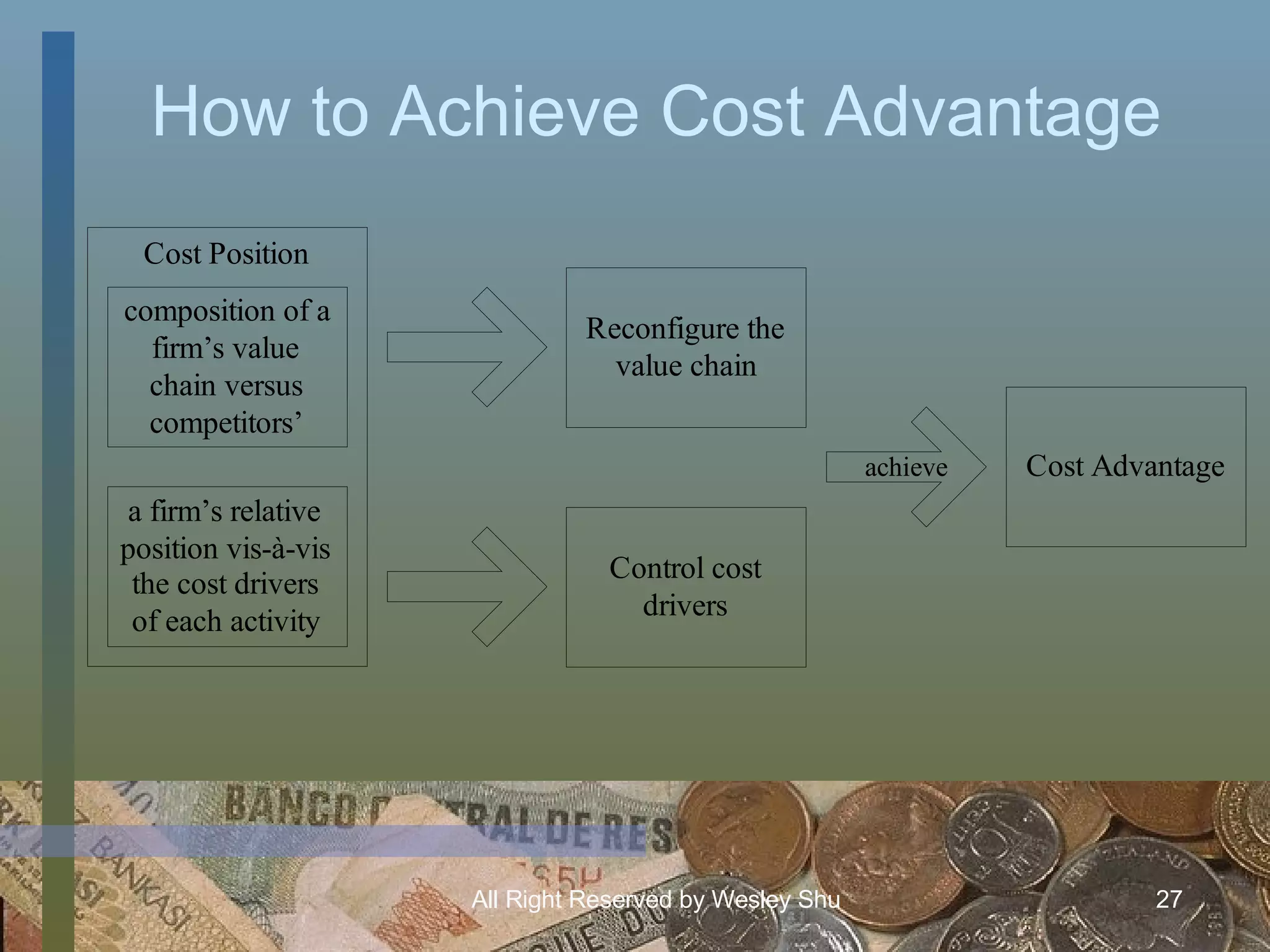

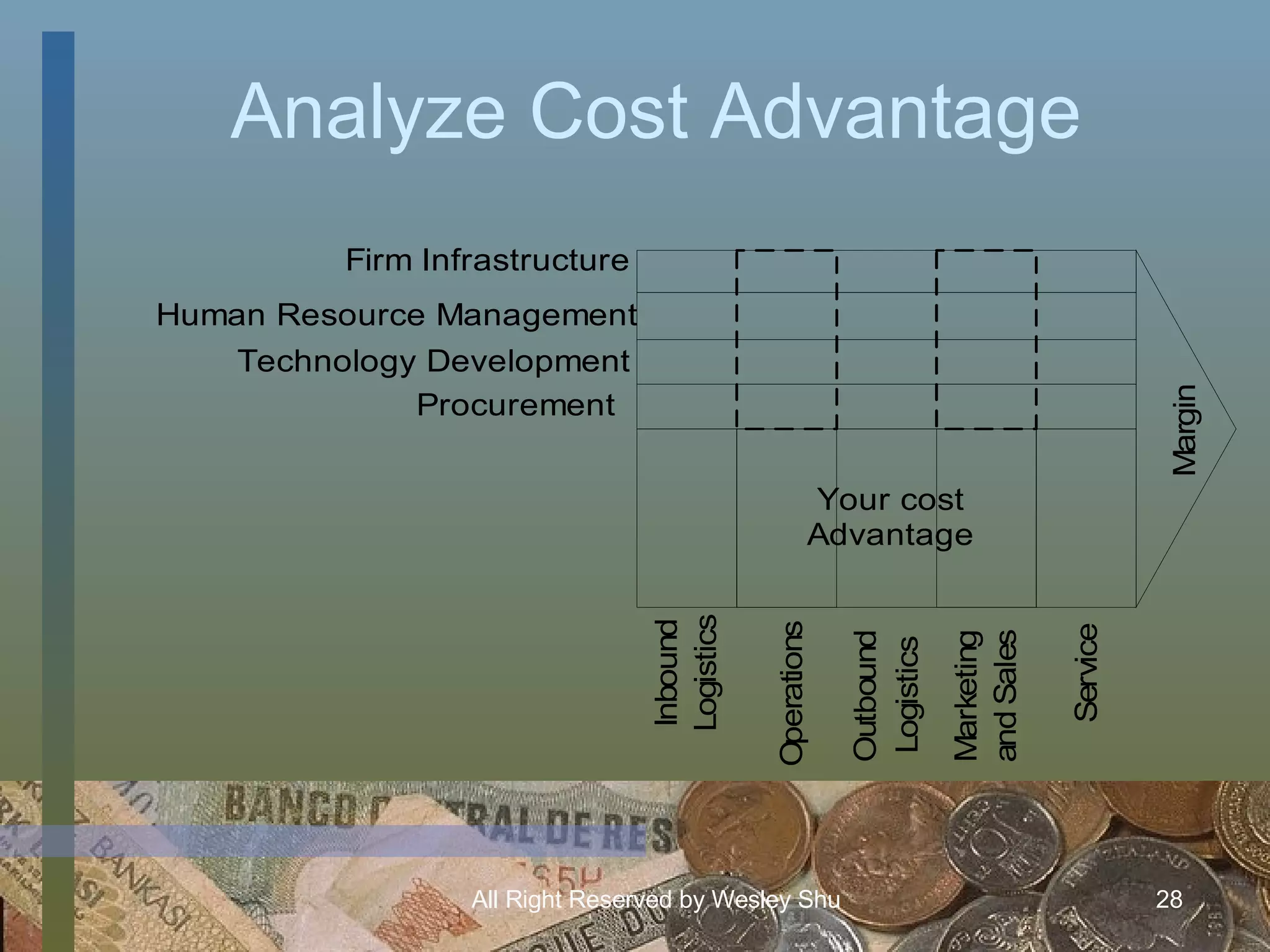

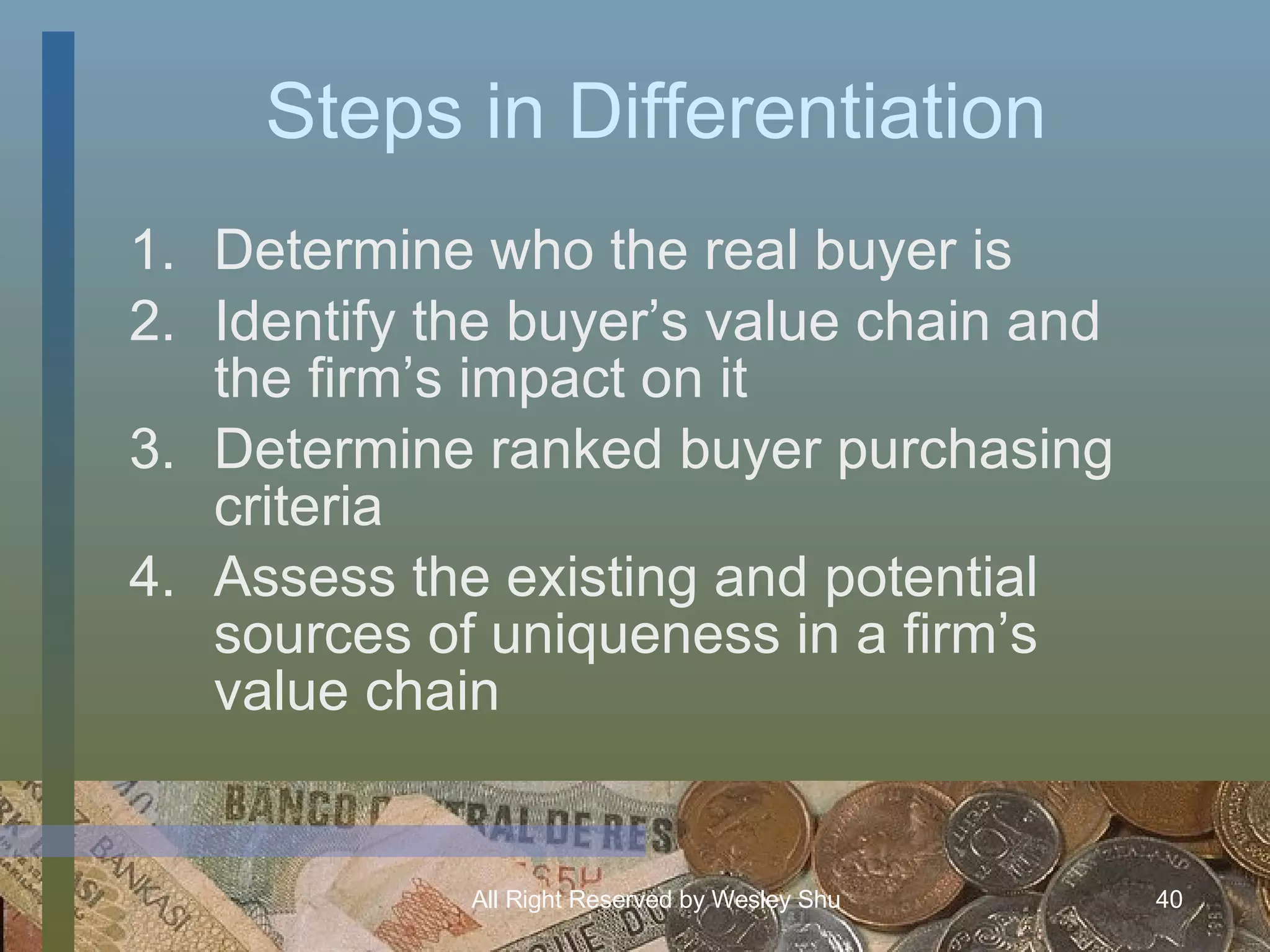

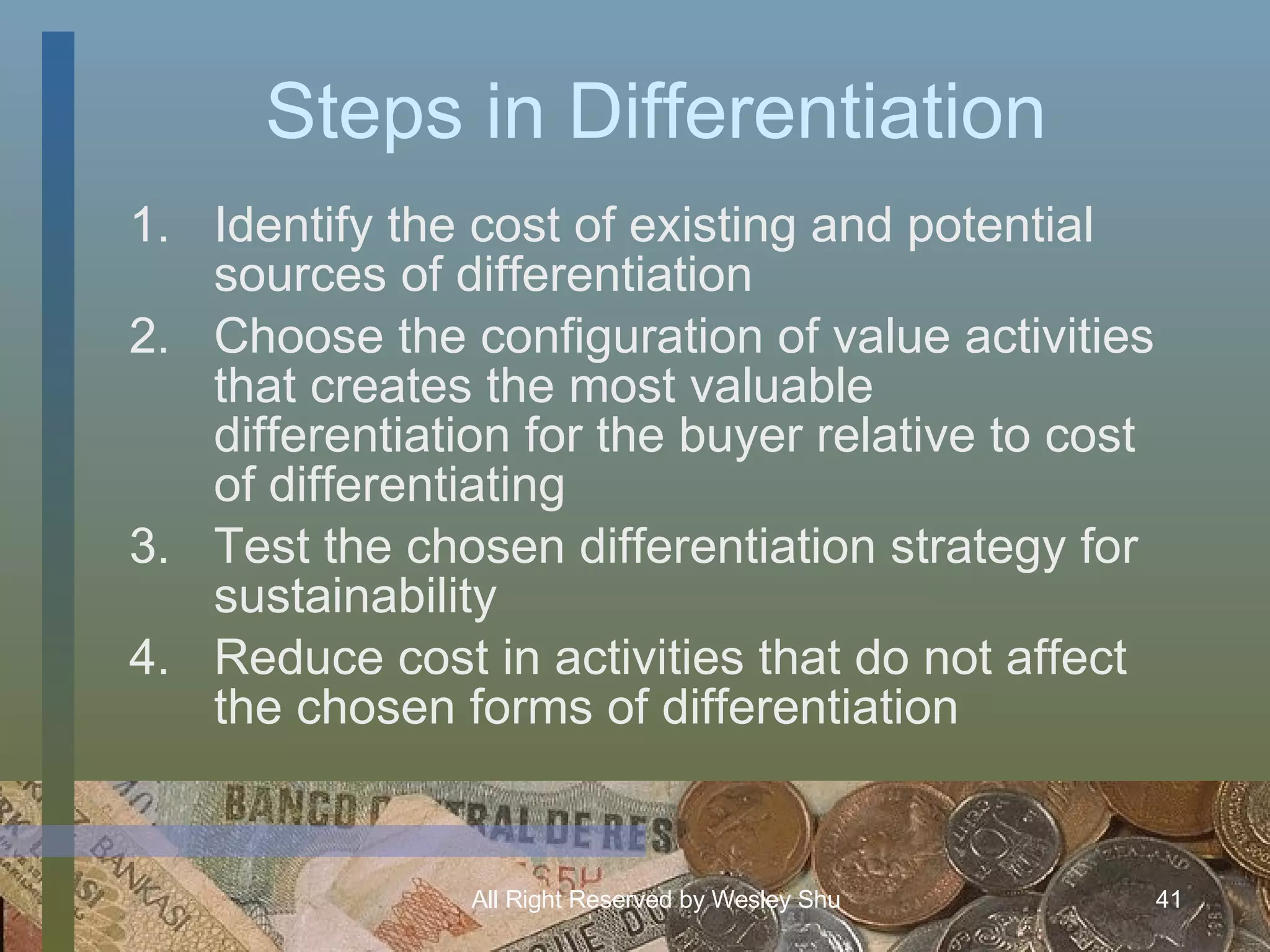

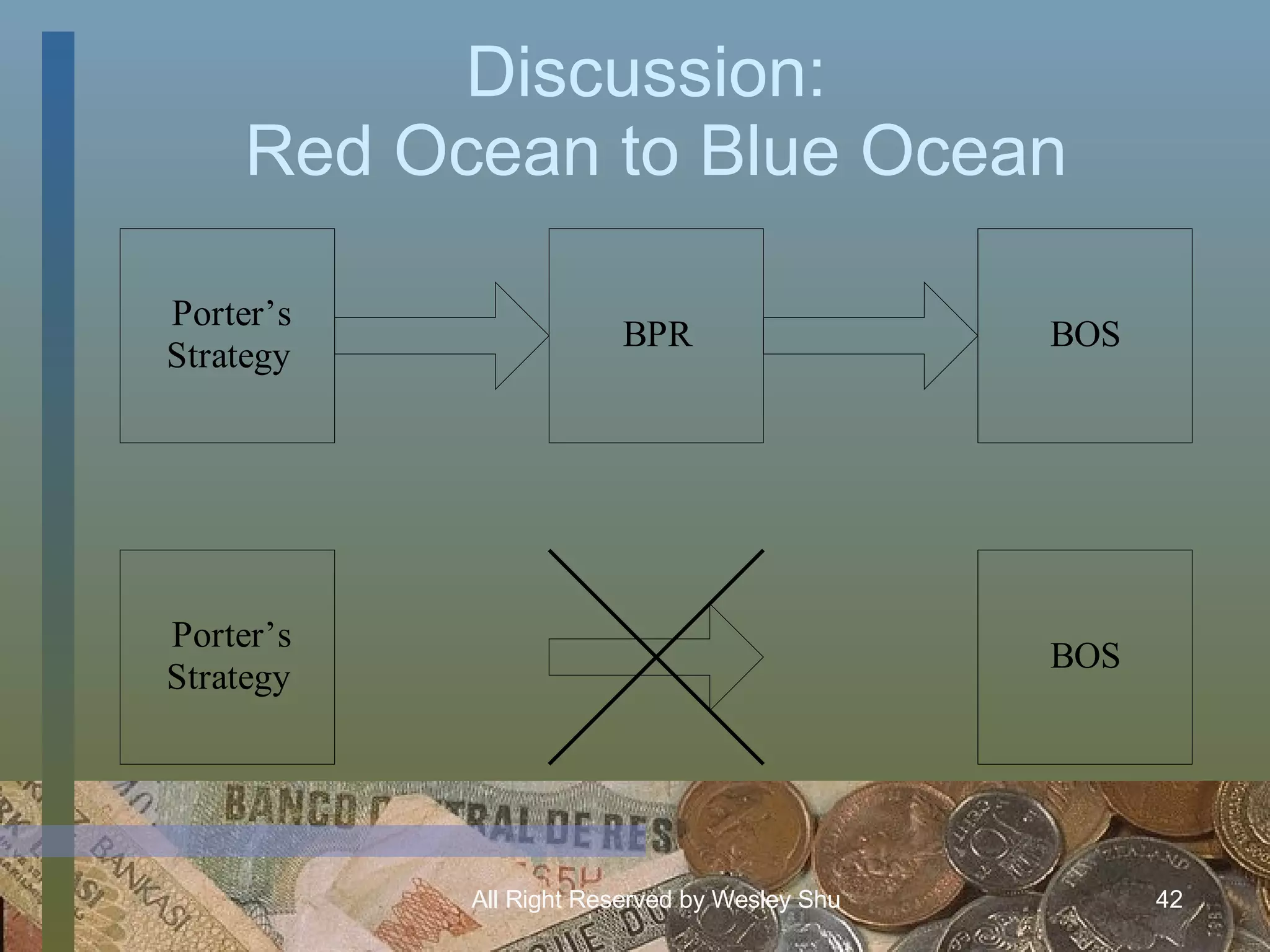

The document discusses Michael Porter's concepts of competitive advantage and value chain analysis. It explains that firms can achieve competitive advantage through cost leadership or differentiation. Value chain analysis involves identifying activities that contribute to these strategies and analyzing the sources of competitive advantage. Primary and support activities are discussed along with cost drivers and how to control costs to achieve a cost advantage. Differentiation strategies are also covered, including identifying sources of differentiation and determining how to create buyer value through differentiation.