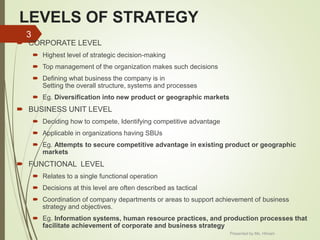

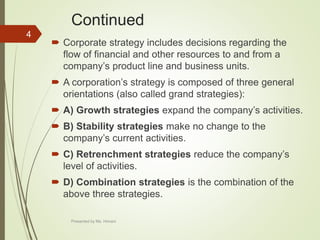

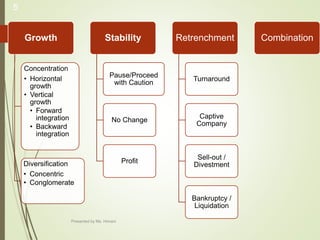

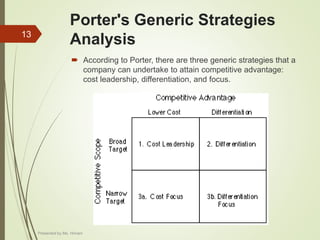

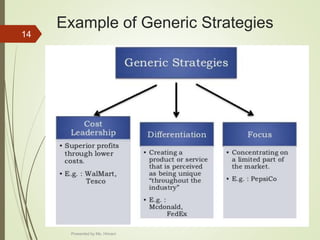

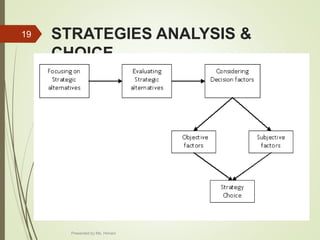

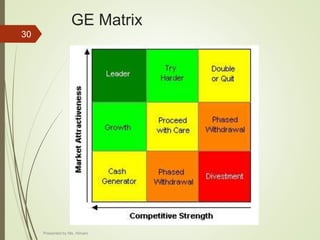

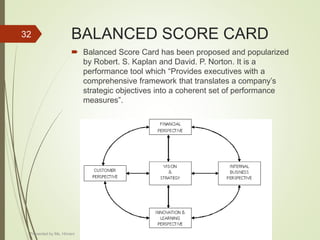

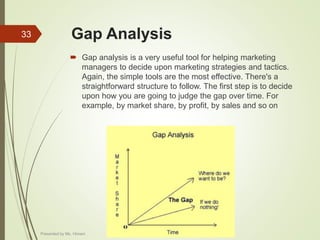

This document outlines various corporate level strategies including growth, stability, and retrenchment strategies. It discusses concentration, diversification, pause/proceed with caution, and turnaround strategies. The document also covers business level strategies like cost leadership, differentiation, and focus strategies. Finally, it discusses building and restructuring the corporation through various routes like start-ups, acquisitions, mergers, and divestments.