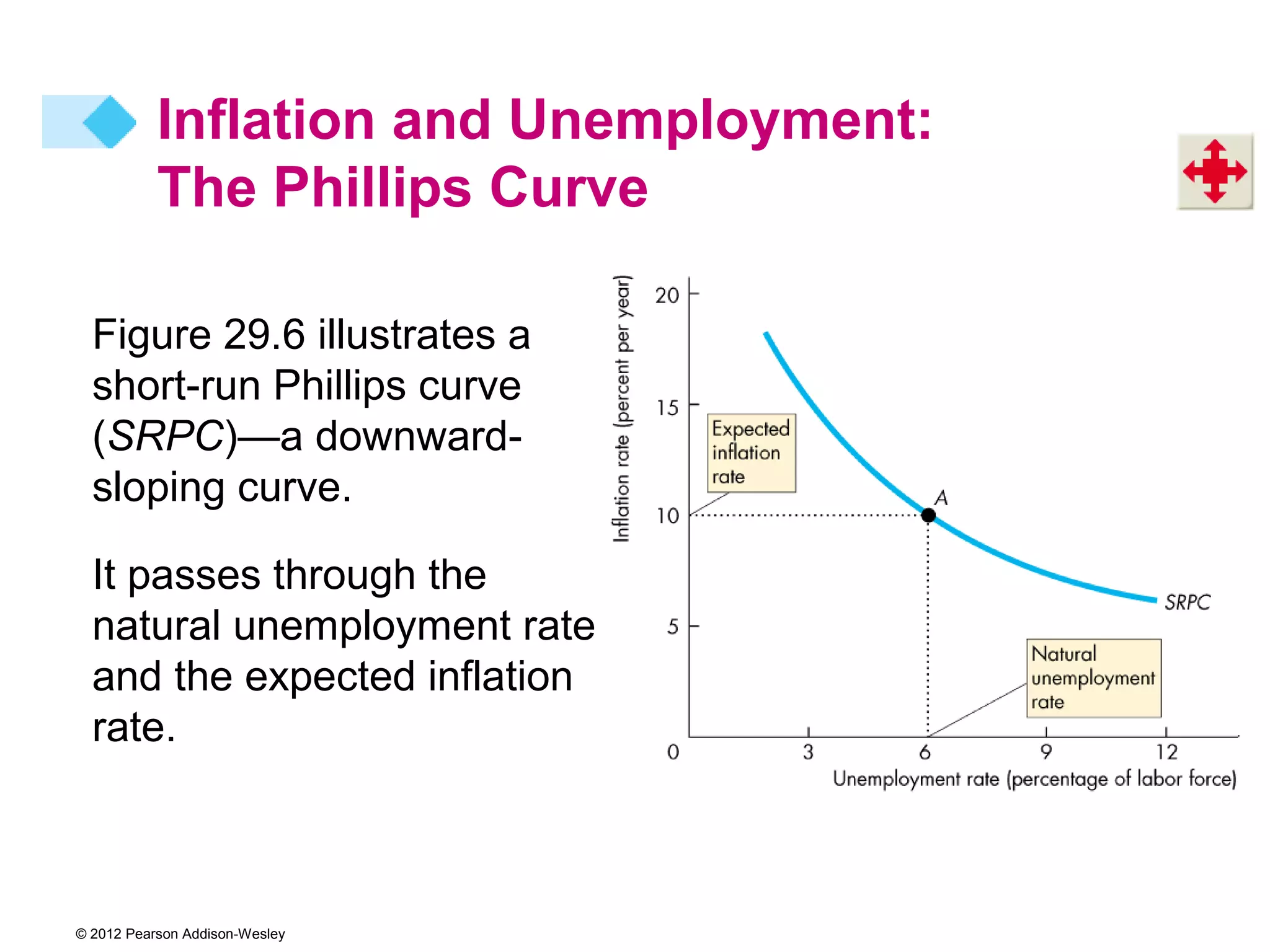

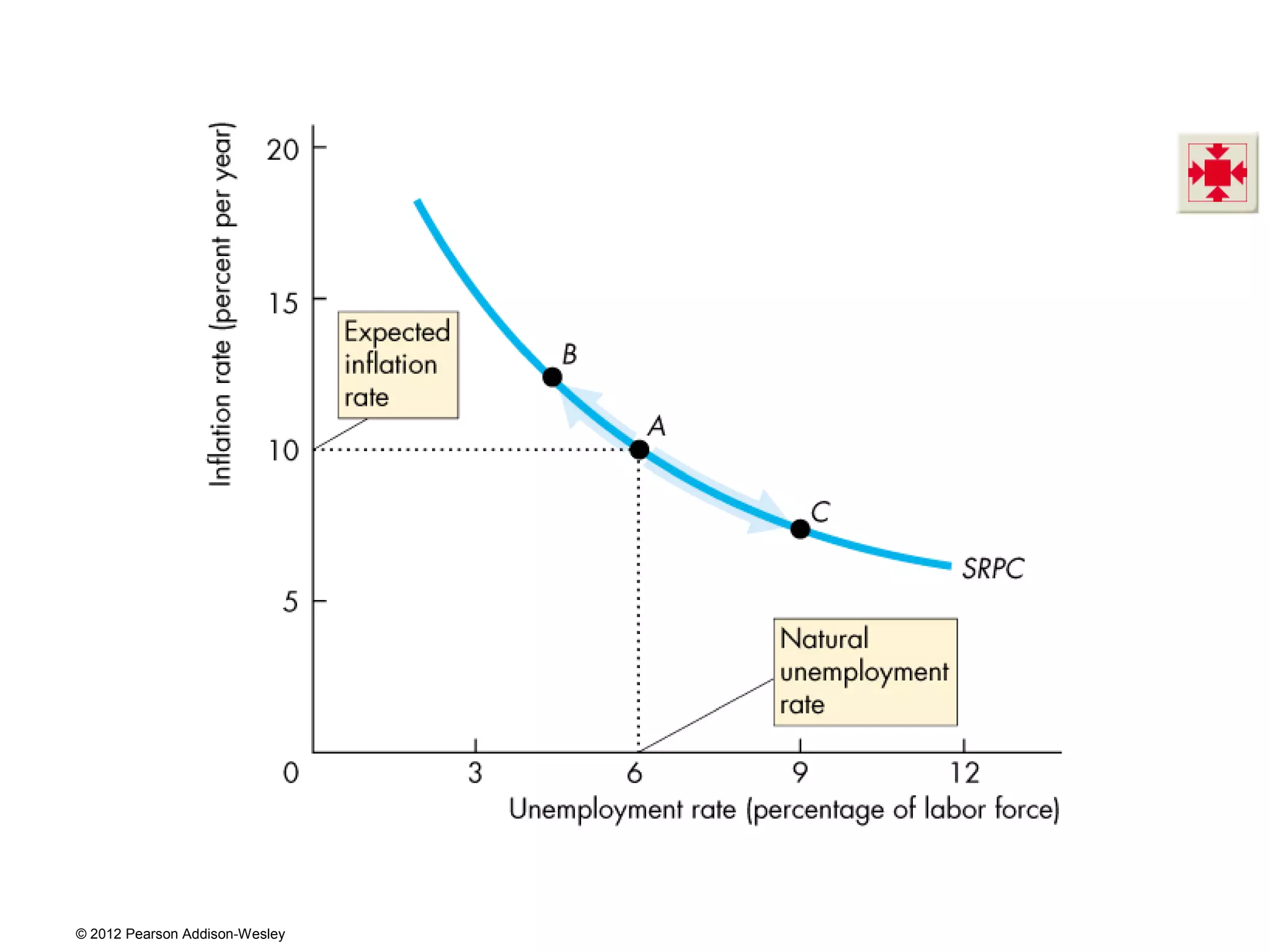

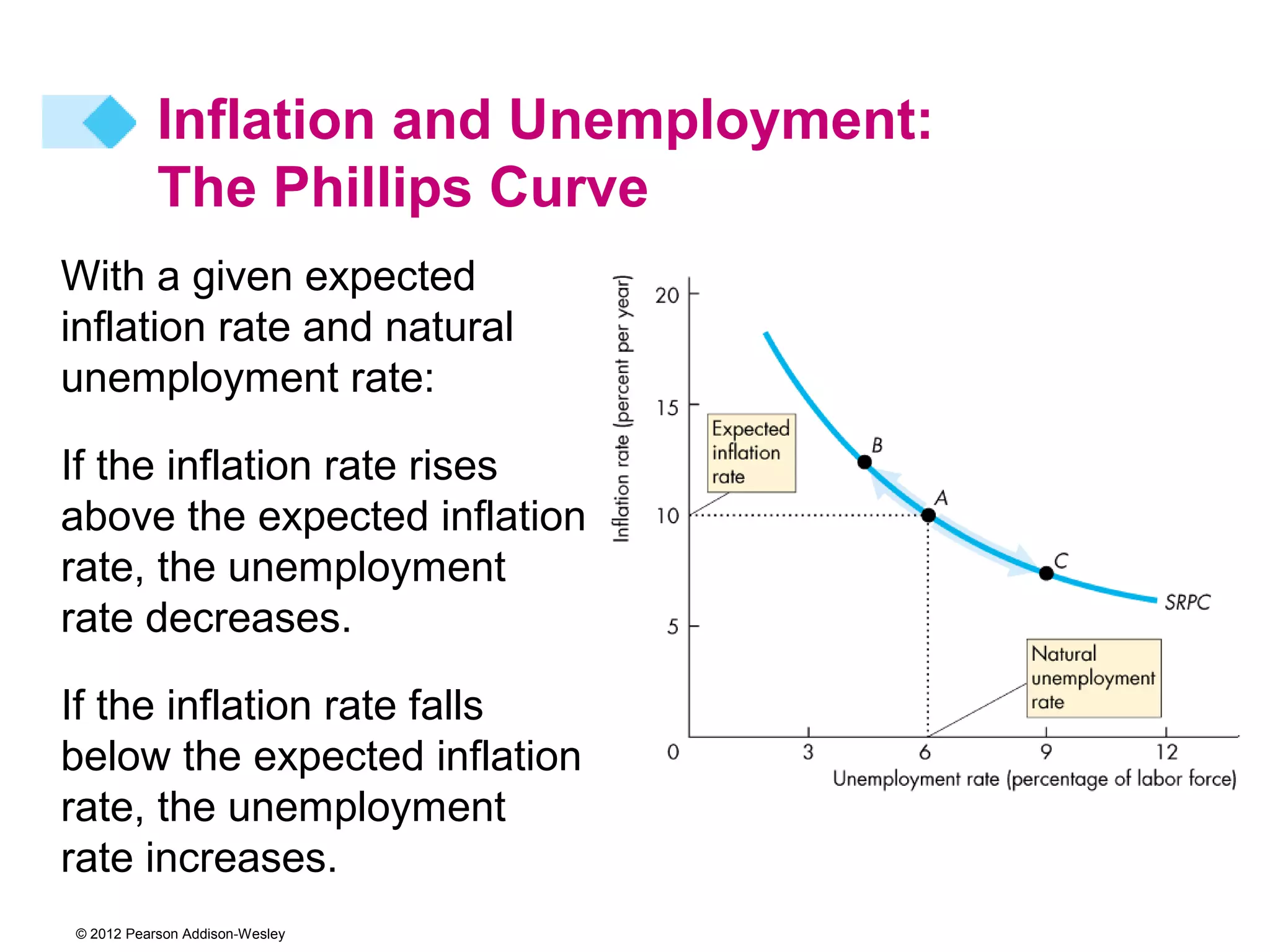

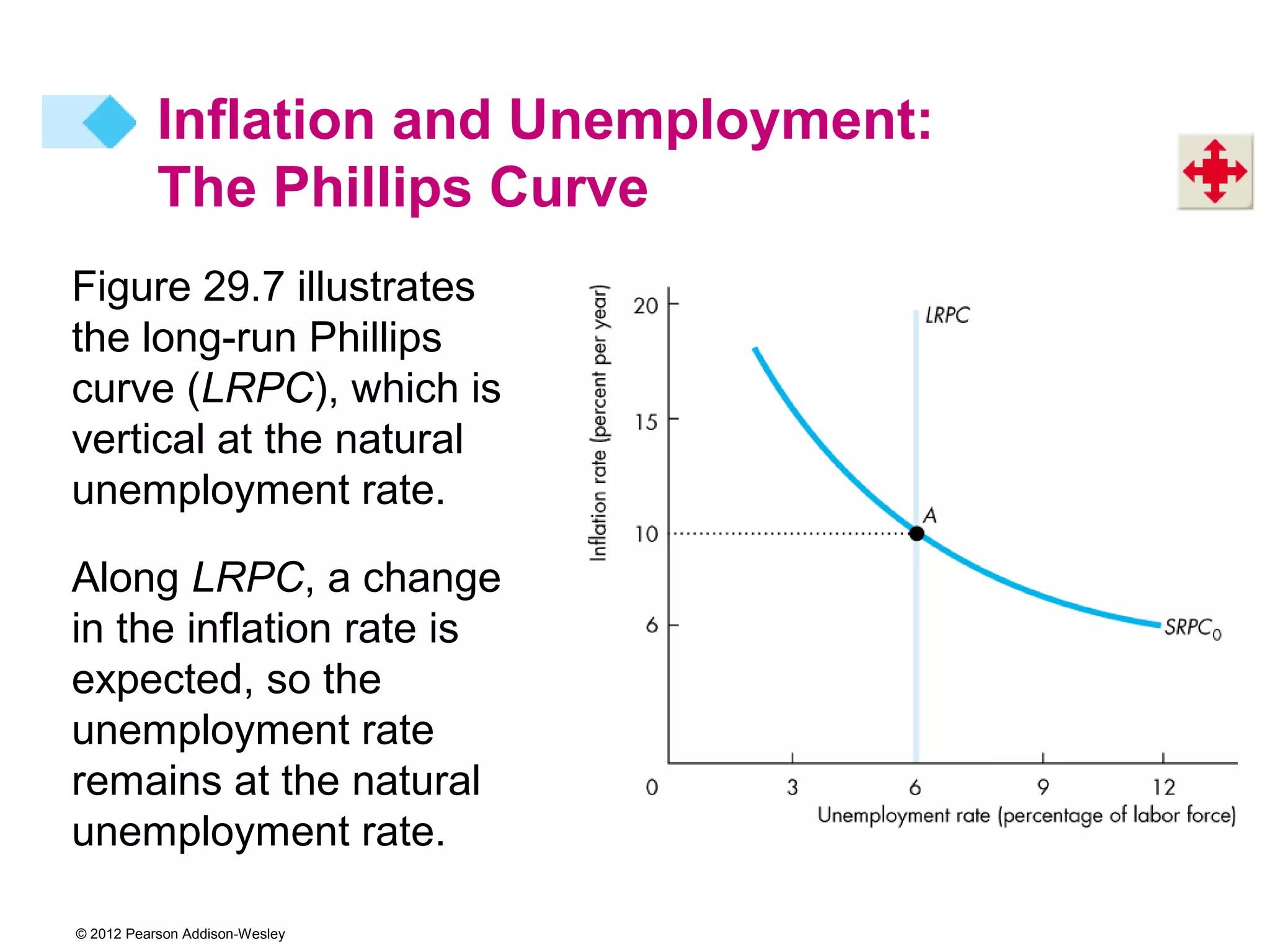

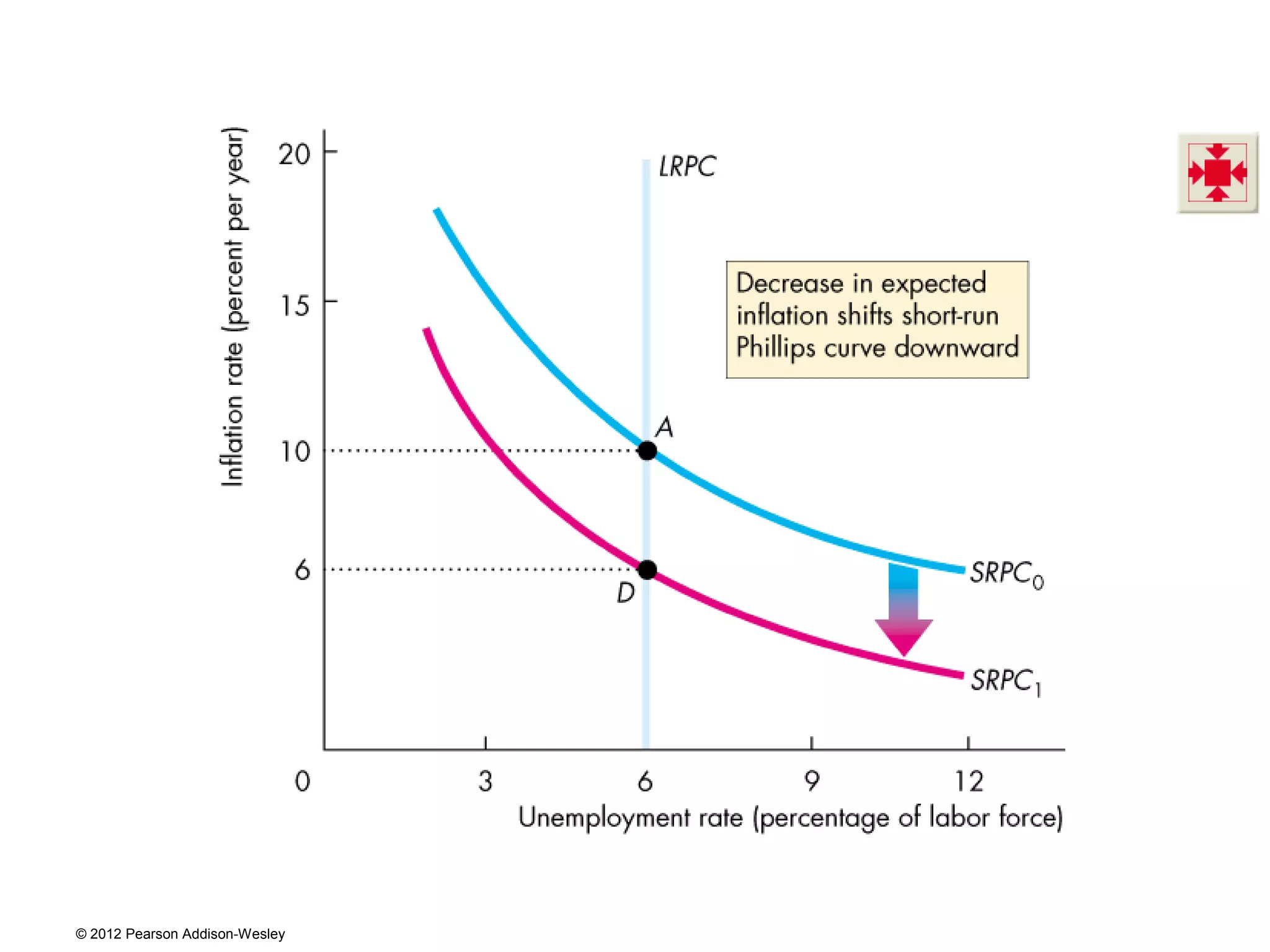

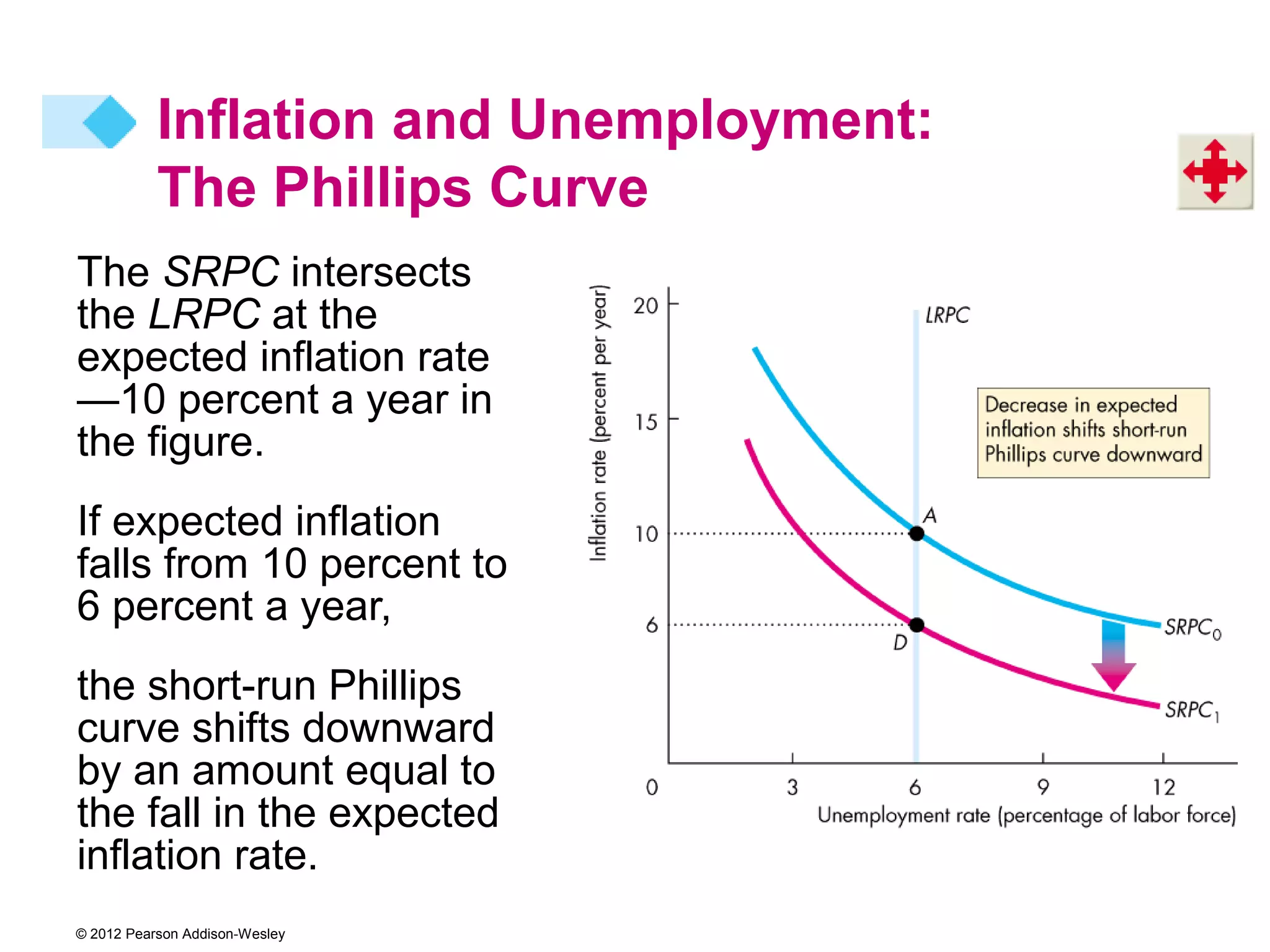

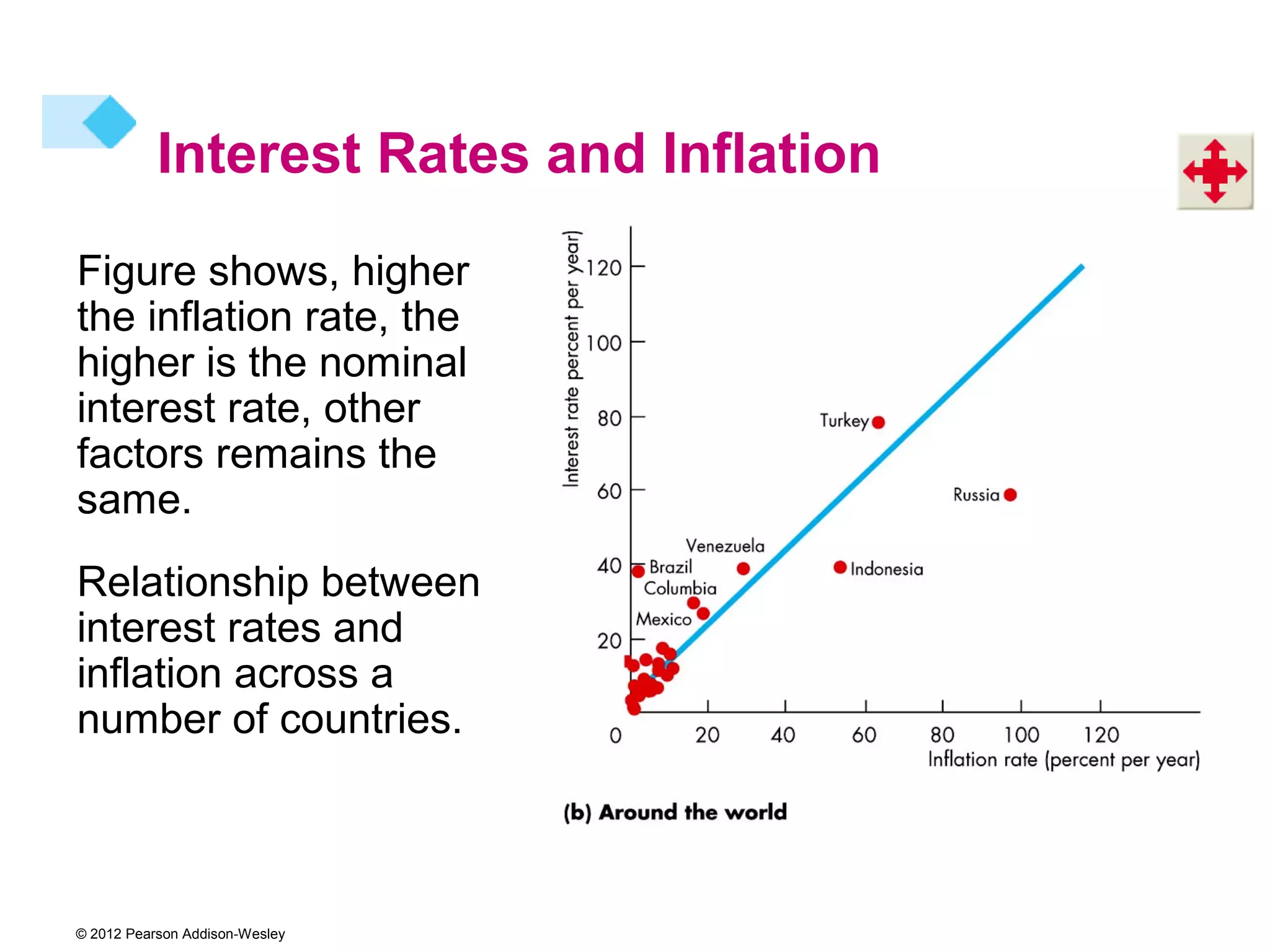

The document discusses the Phillips curve and the relationship between inflation and unemployment. It describes the short-run Phillips curve as downward sloping, showing that higher inflation is linked to lower unemployment. The long-run Phillips curve is vertical at the natural rate of unemployment, so inflation changes do not affect unemployment. The document also examines how interest rates are determined based on real rates, expected inflation, and risk differences between countries. Higher inflation is associated with higher nominal interest rates.