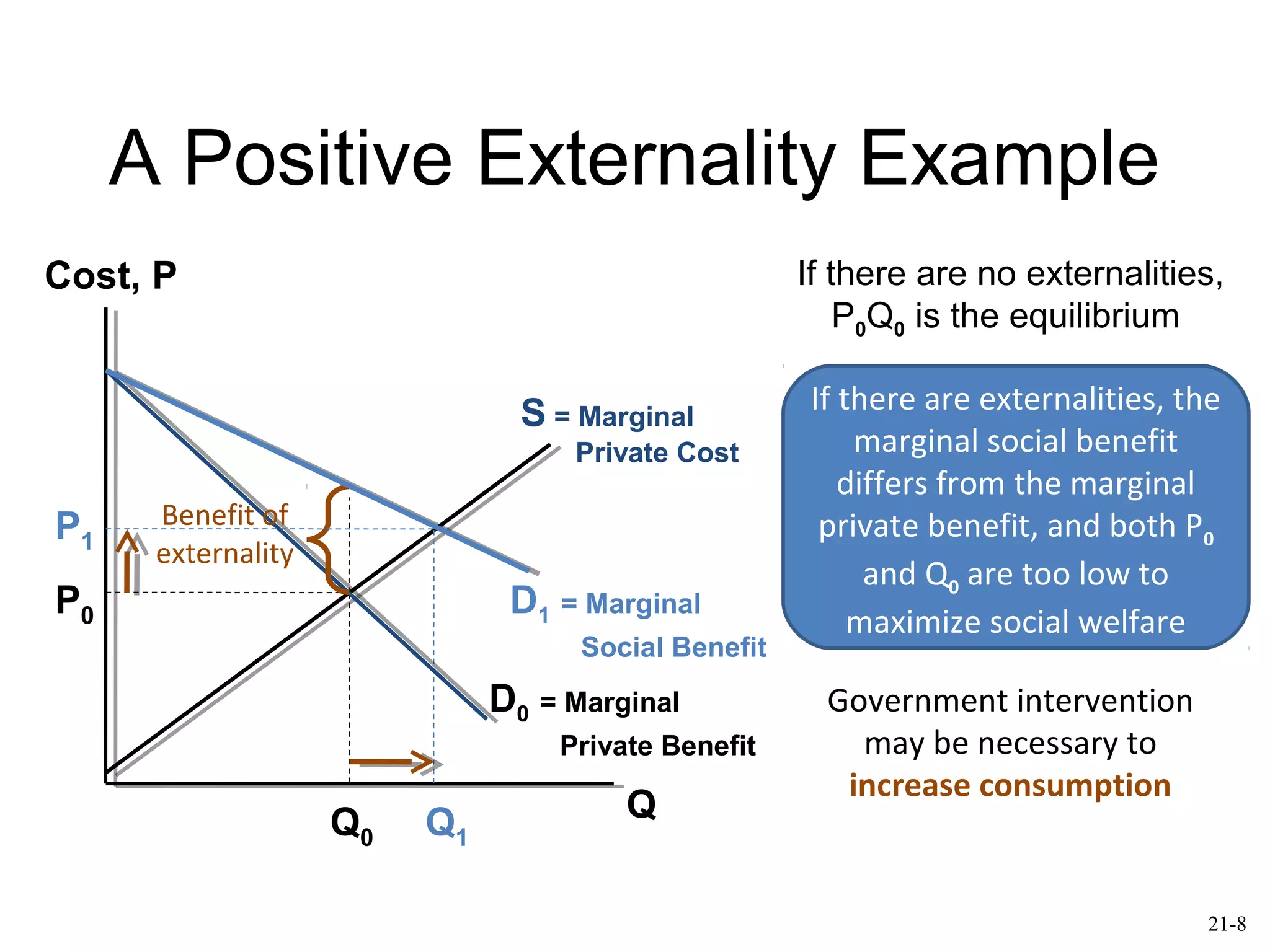

This document discusses various types of market failures including externalities, public goods, and imperfect information. It provides examples of negative and positive externalities and how they can lead to inefficient market outcomes. Methods for dealing with externalities include direct regulation, tax incentives, and market incentives. Public goods are nonexclusive and nonrival, but their value is difficult to determine via markets due to free rider problems. Imperfect information between buyers and sellers can also cause market failures. While government intervention may aim to correct market failures, governments can also fail due to issues like lack of proper incentives, information, and flexibility.