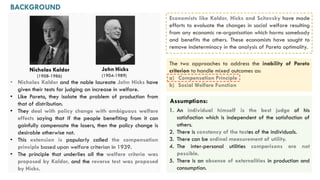

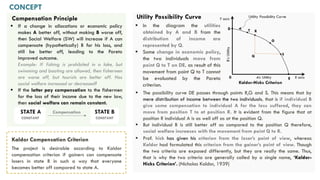

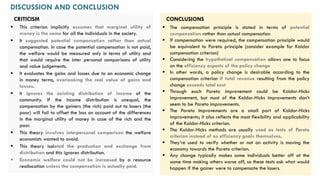

The document discusses the Kaldor-Hicks compensation principle, which aims to evaluate economic changes and their impact on social welfare by determining if those who benefit can compensate those who lose. It highlights the theoretical framework laid out by economists Nicholas Kaldor and John Hicks, emphasizing that potential compensation is more important than actual compensation in assessing policy changes. The document also critiques the principle for its assumptions, such as constant utility and its isolation of production from distribution.