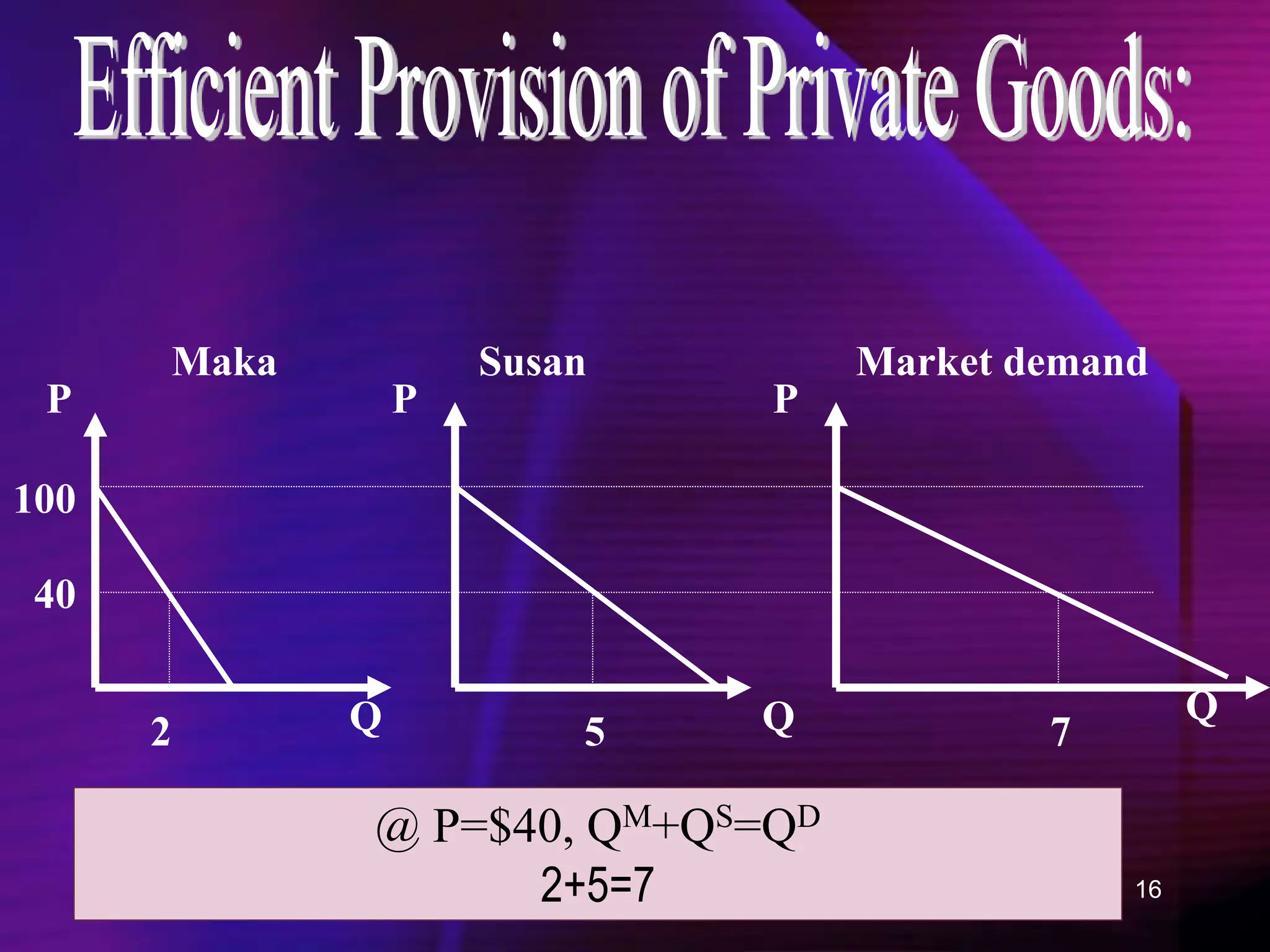

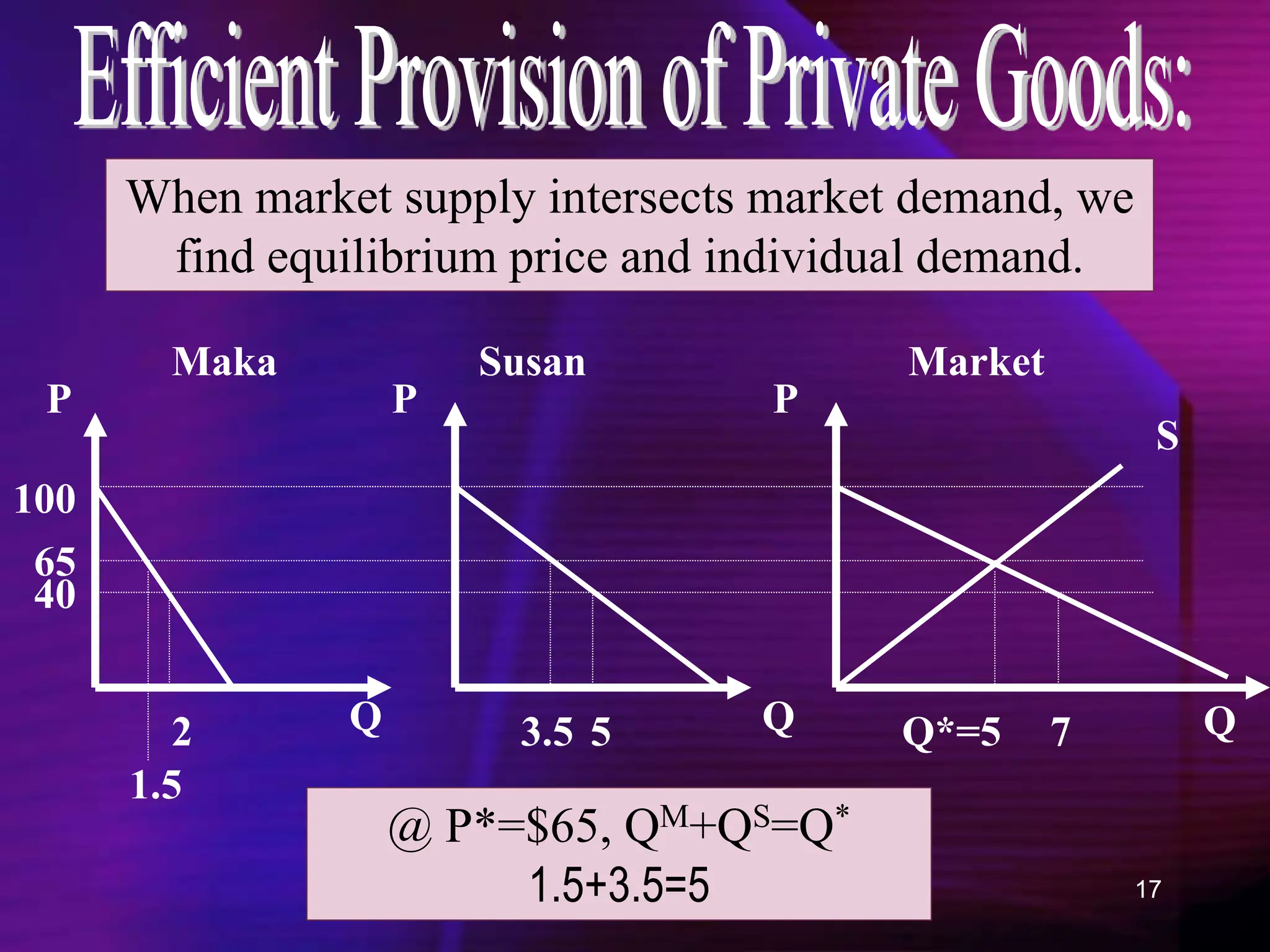

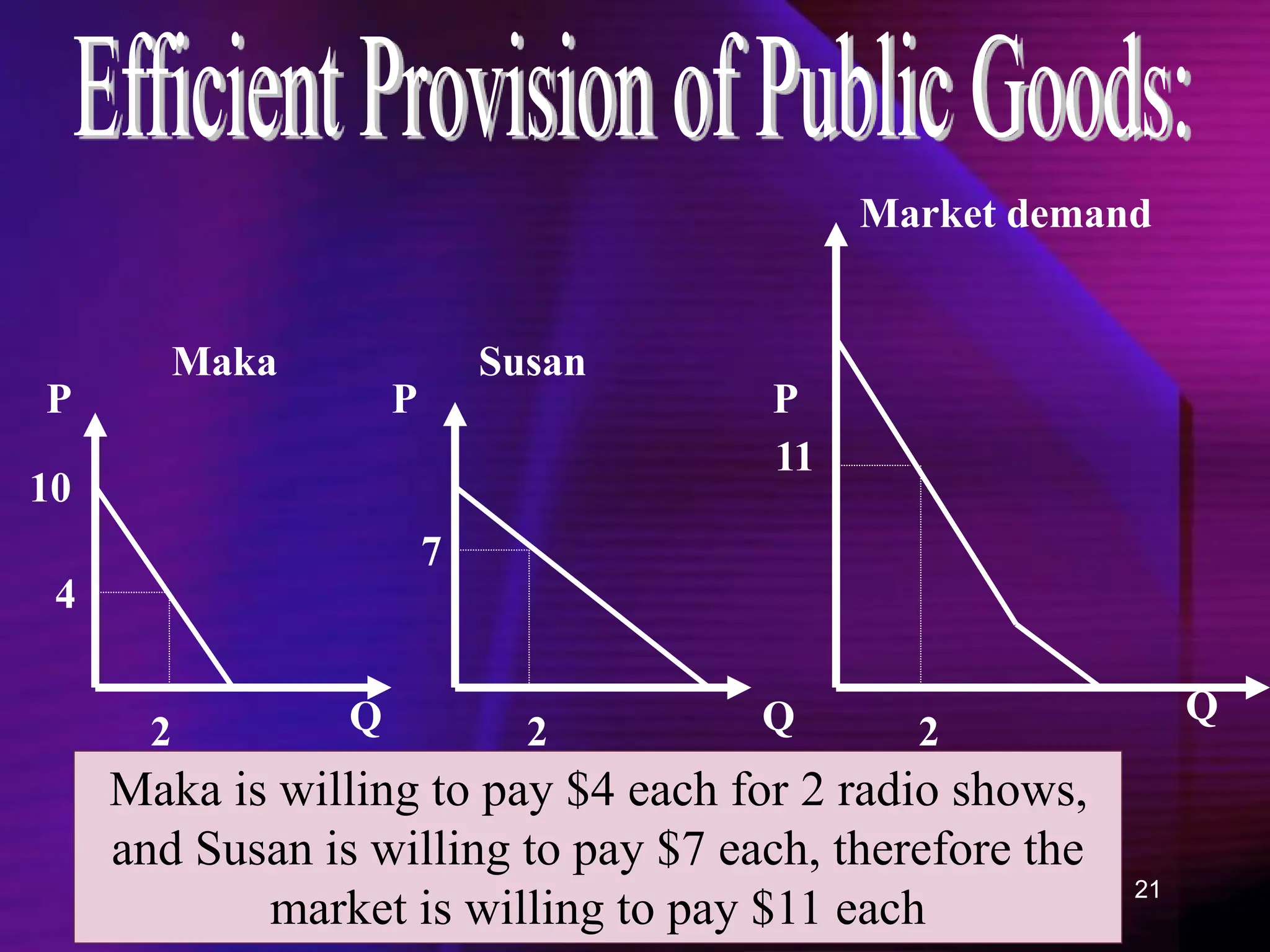

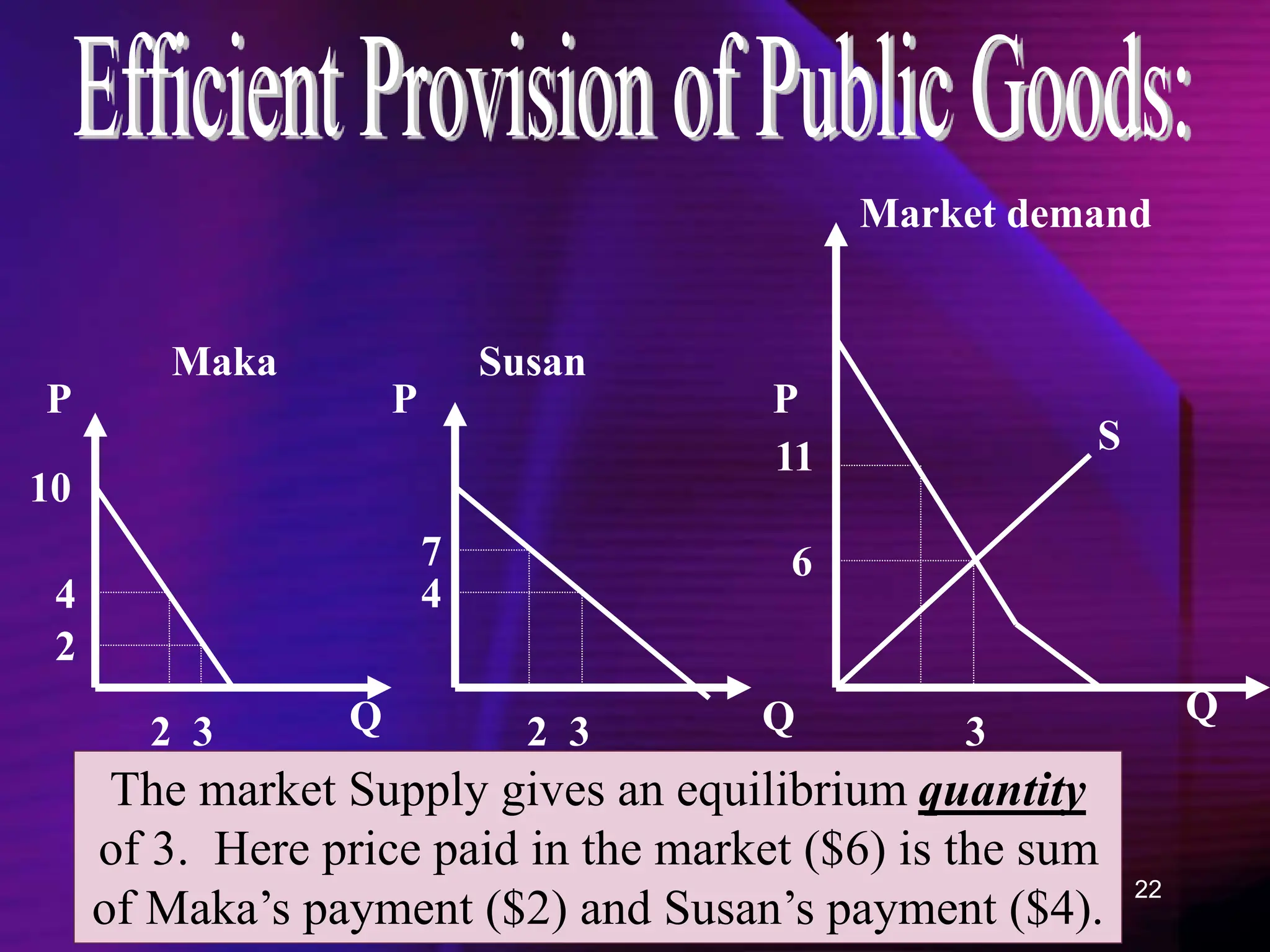

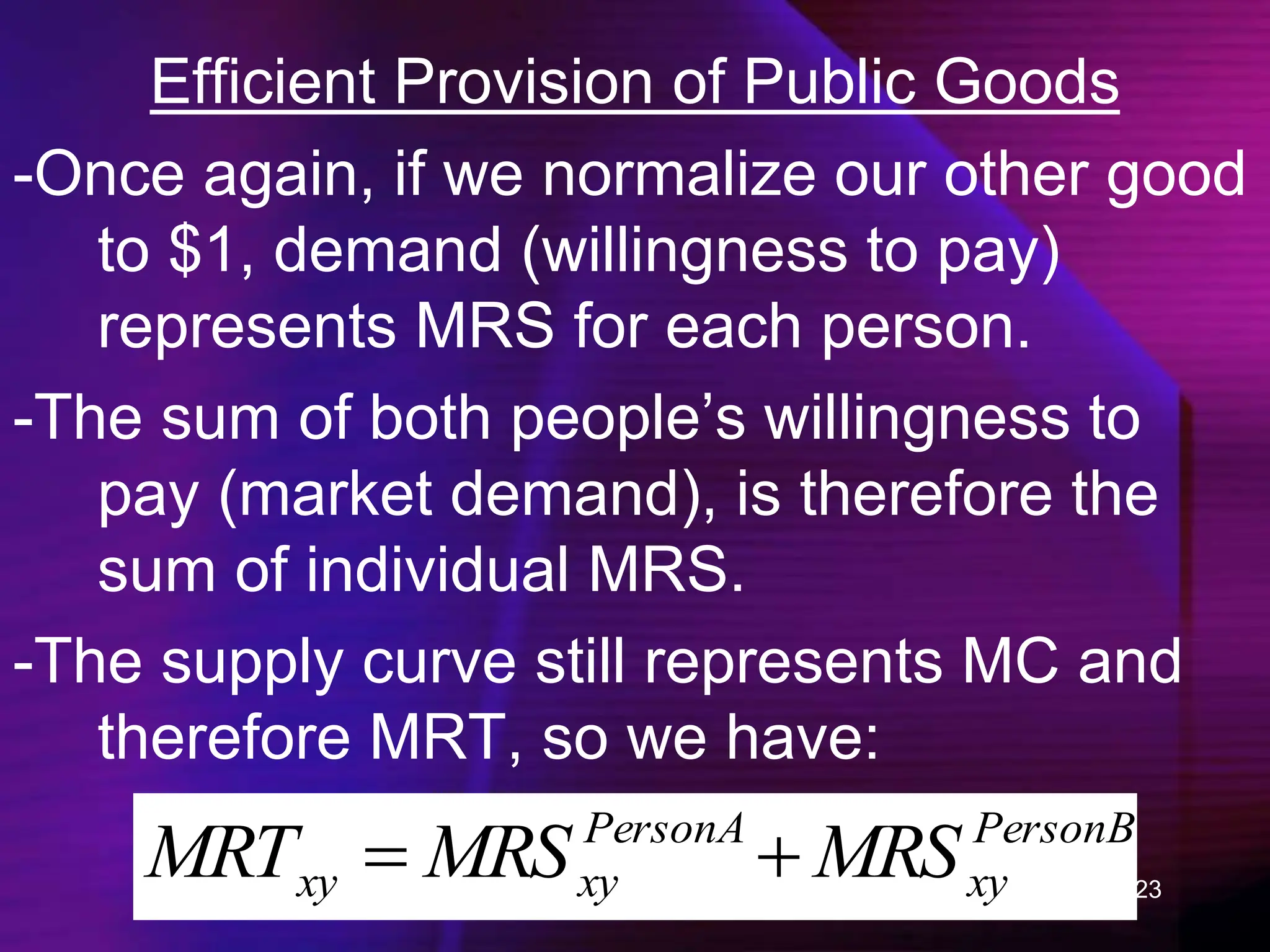

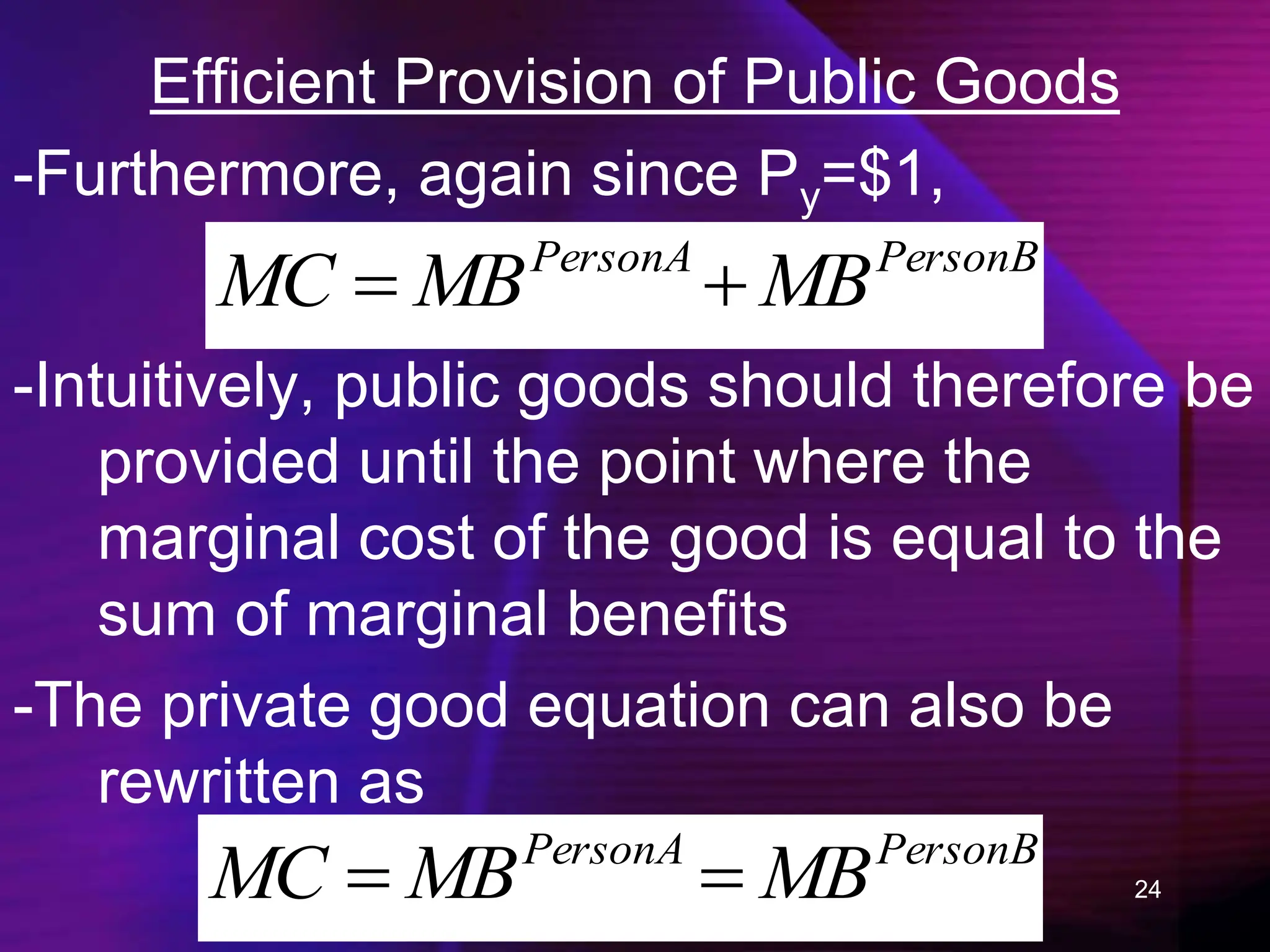

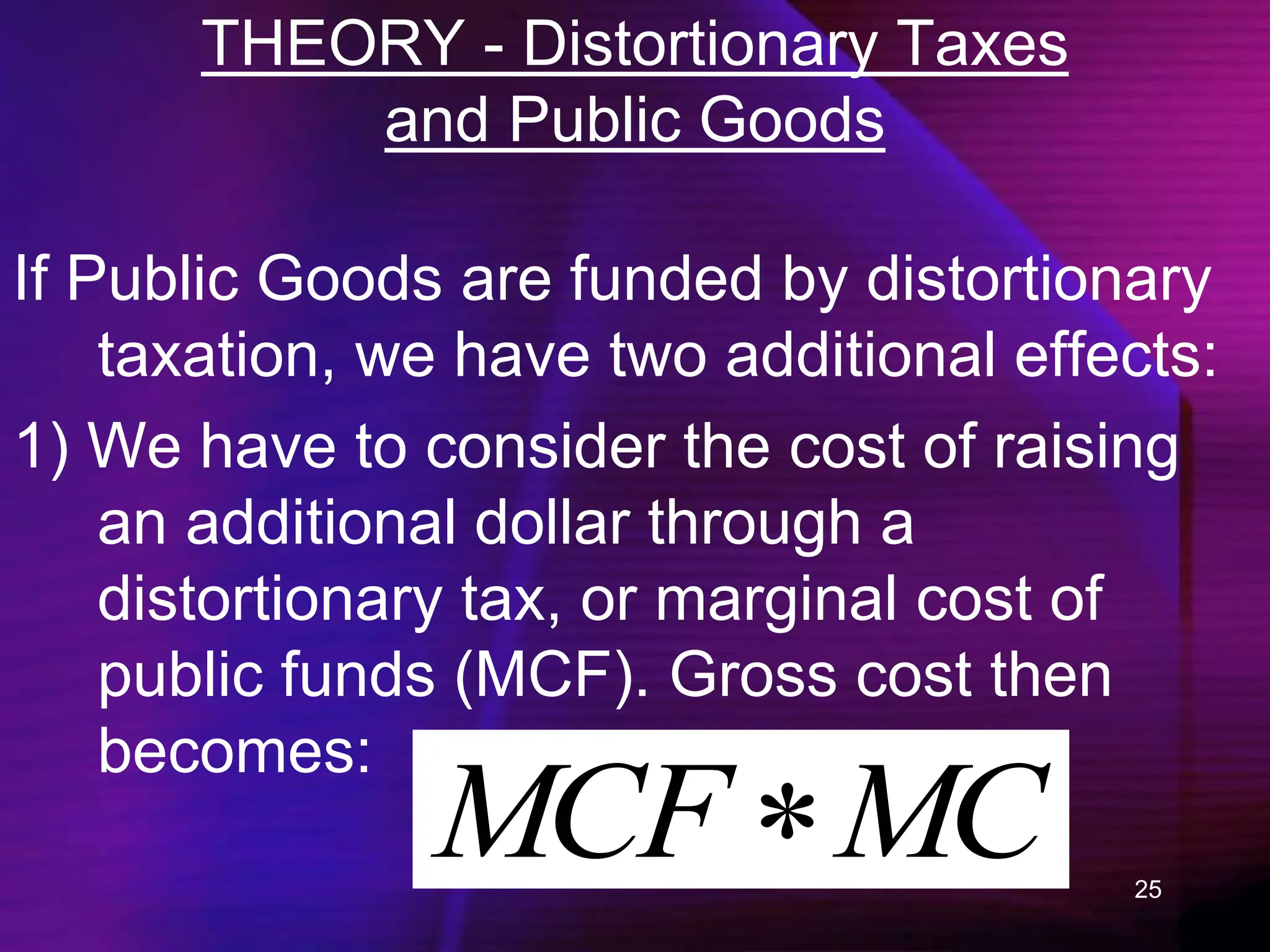

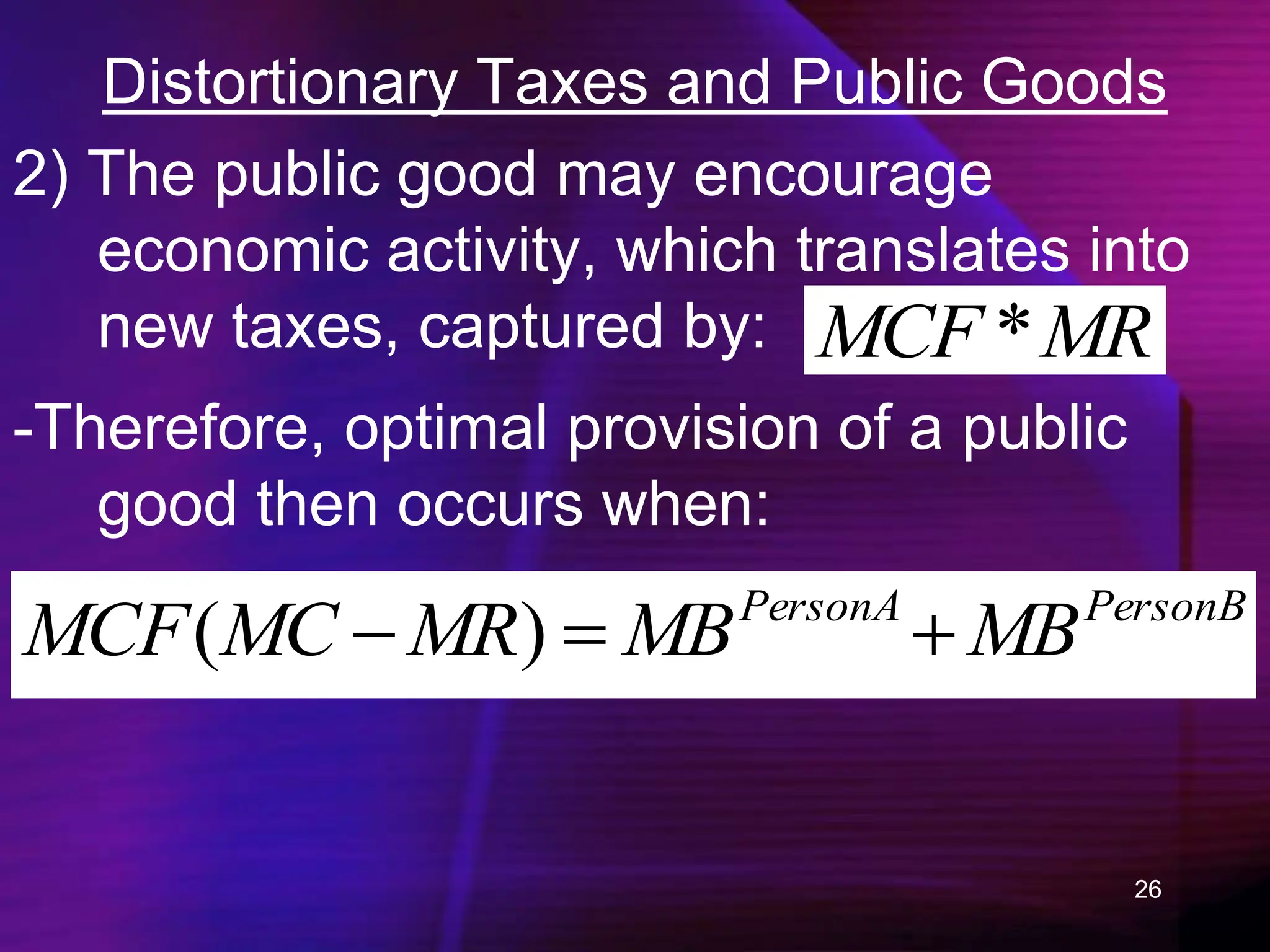

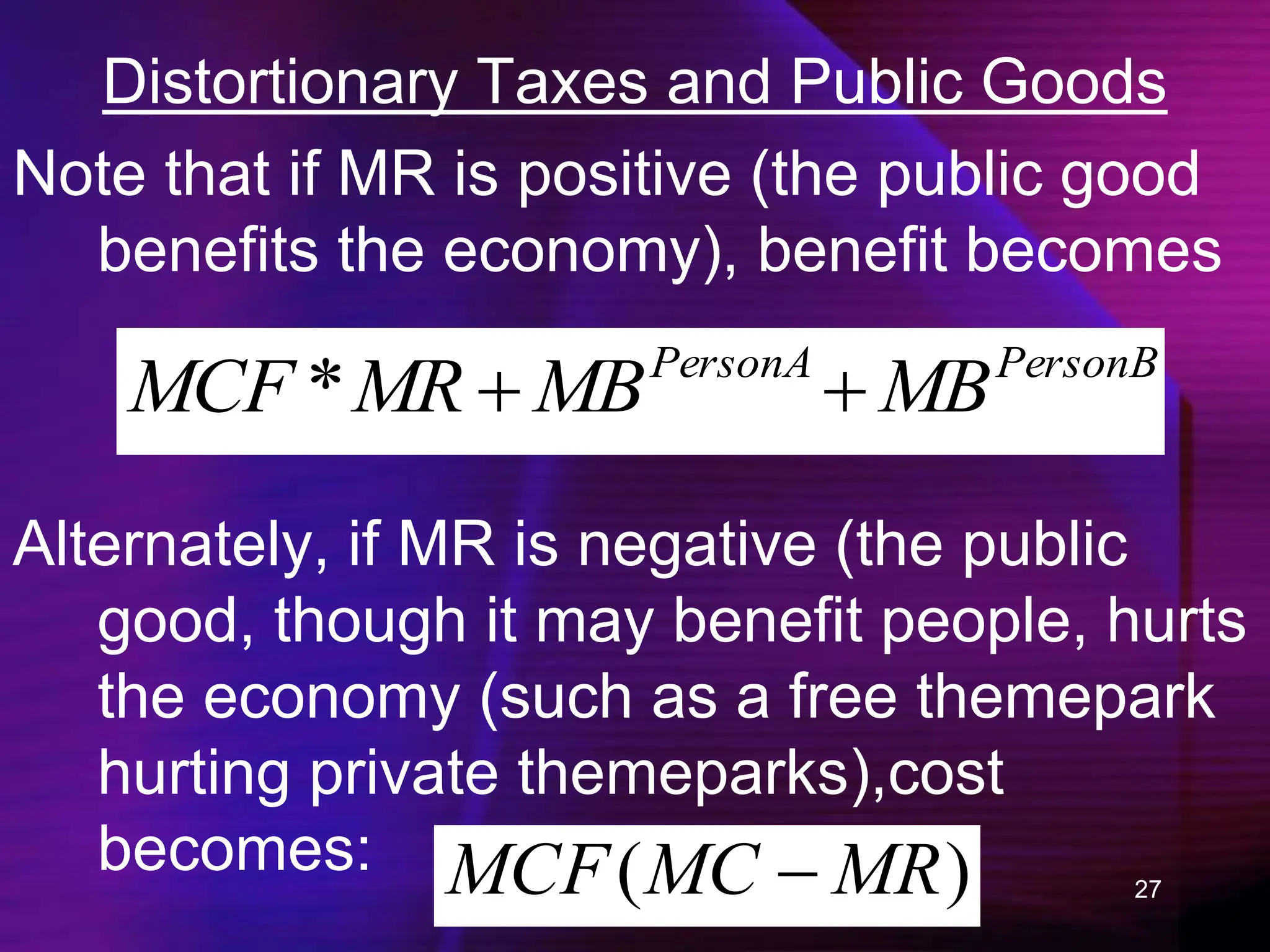

This document discusses frameworks for analyzing public expenditures and the efficient provision of public goods. It begins by introducing the topics of public goods, externalities, income redistribution, and cost-benefit analysis. It then focuses on defining public goods and the problems that arise from their non-rival and non-excludable nature. Specifically, it addresses how to efficiently provide public goods when individuals have different valuations and incentives to free ride. It also examines how distortionary taxation can impact the optimal provision level of public goods. Finally, it discusses the privatization of government functions and the debate around private versus public provision.