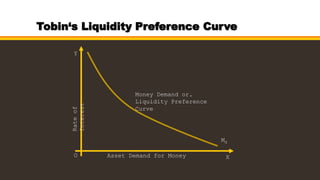

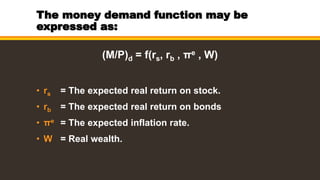

Tobin's portfolio balance approach views money as one of many assets individuals hold in their investment portfolios. It recognizes that people face a tradeoff between safe assets like money that earn no interest versus risky bonds that do earn interest. According to Tobin, individuals seek to diversify their portfolio to balance these risks and returns. Tobin's liquidity preference curve shows that as interest rates rise, individuals will hold less money and more bonds, and vice versa as interest rates fall. Overall, Tobin's approach views the demand for money as jointly determined with other assets based on rates of return, inflation, and total wealth.