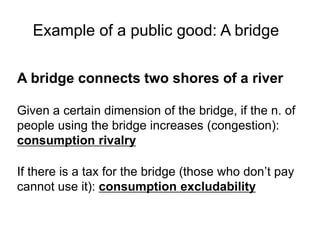

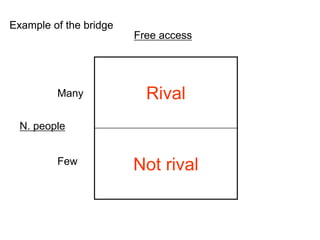

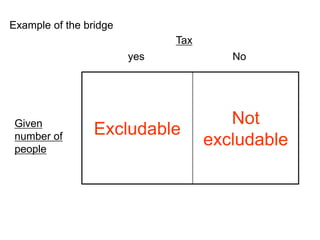

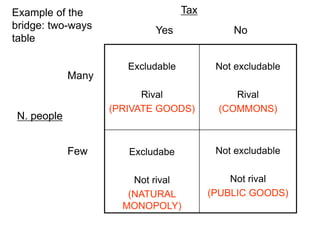

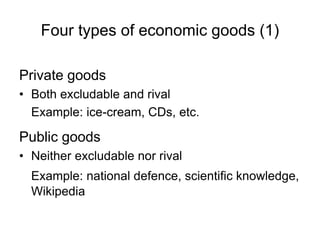

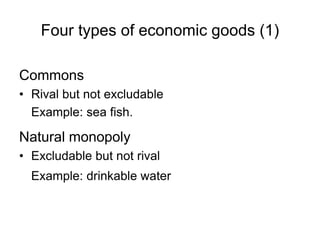

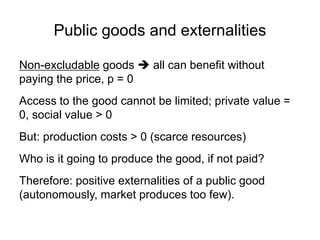

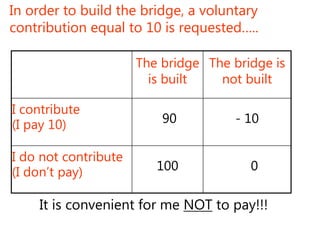

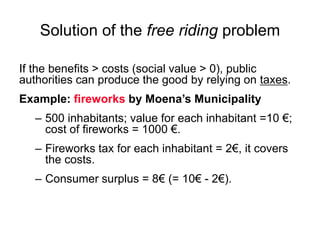

This document discusses different types of economic goods and the role of public goods and common resources. It defines public goods as non-excludable and non-rival, which leads to market failure due to free-riding. As a solution, public authorities supply public goods through taxation. Common resources are rival but non-excludable, resulting in overexploitation in the "tragedy of the commons" without regulation or property rights enforced by the public administration. The document concludes that differentiating goods by excludability and rivalry is key to understanding the appropriate role of markets and government.