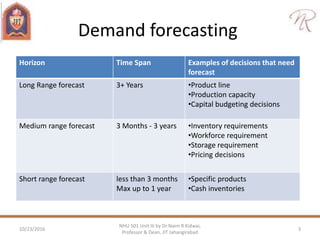

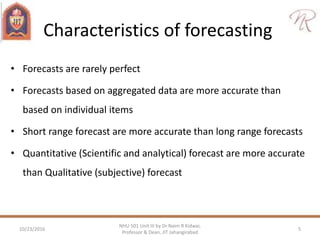

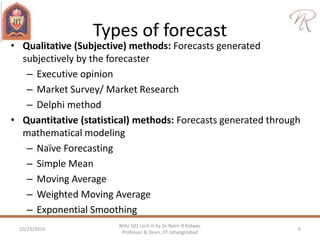

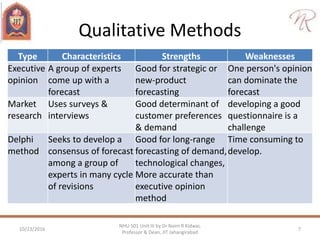

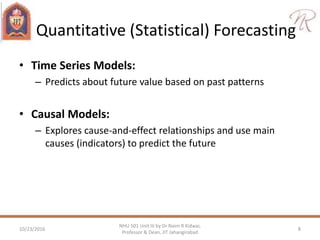

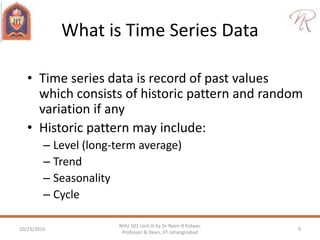

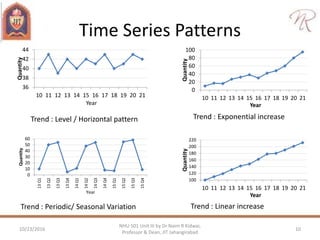

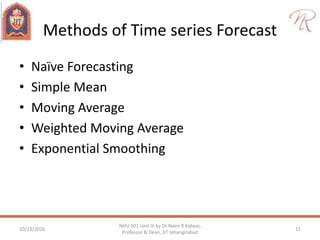

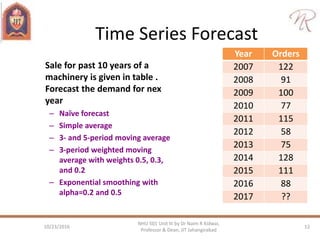

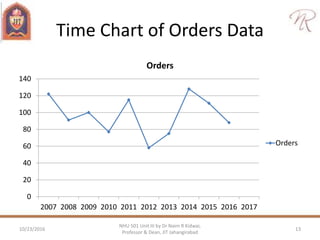

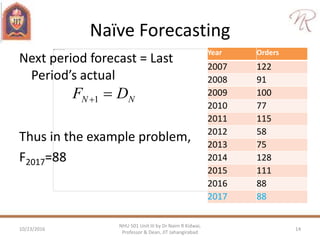

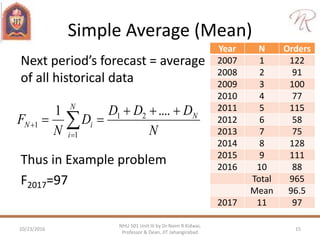

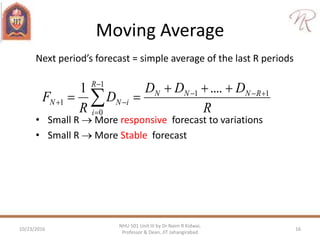

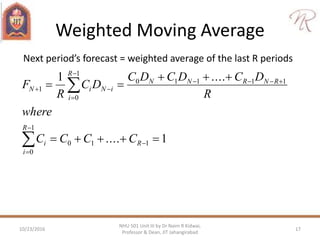

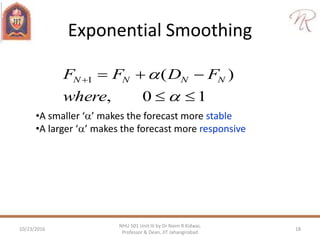

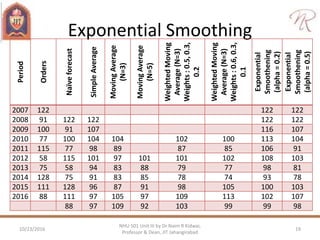

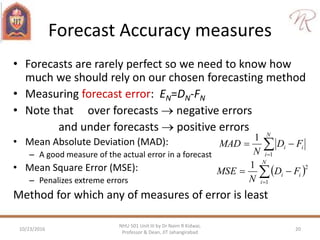

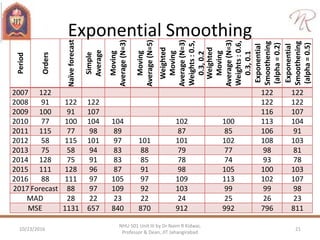

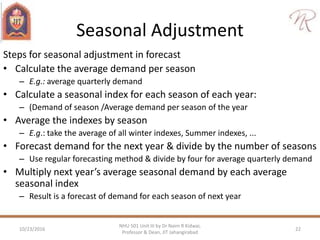

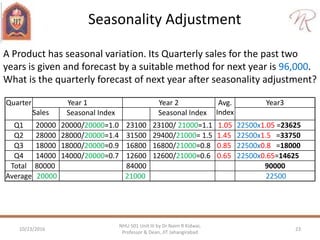

The document discusses demand forecasting and cost estimation, detailing the characteristics and methods of forecasting, types of forecasts, and their importance in decision-making. It emphasizes the necessity of accurate forecasts for long-term planning, production, and workforce scheduling, and outlines qualitative and quantitative forecasting methods as well as techniques for seasonal adjustments. Additionally, it includes calculations for different forecasting techniques and highlights the importance of measuring forecast accuracy.