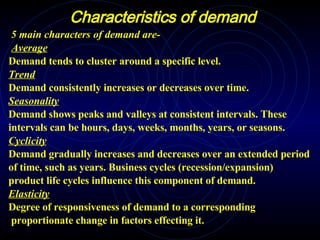

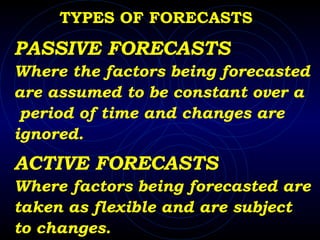

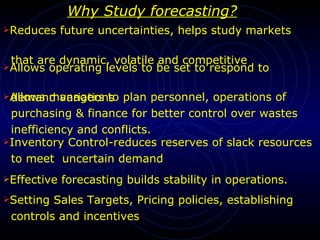

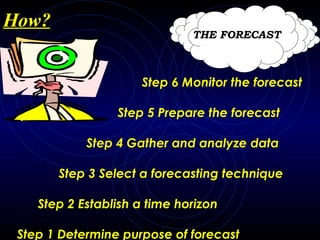

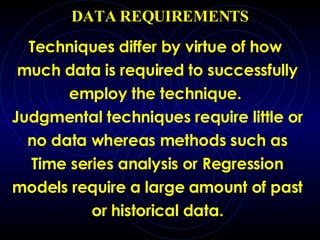

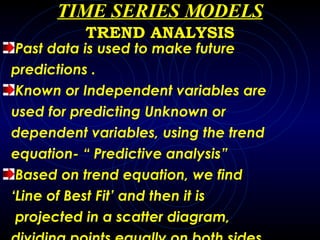

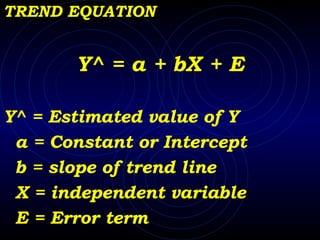

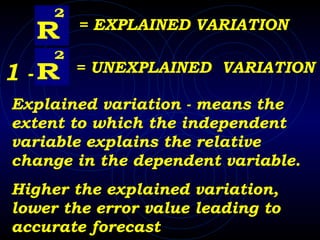

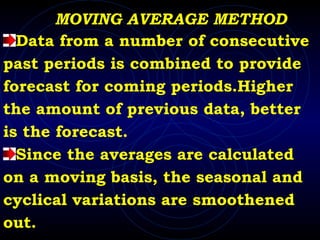

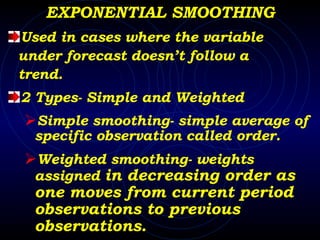

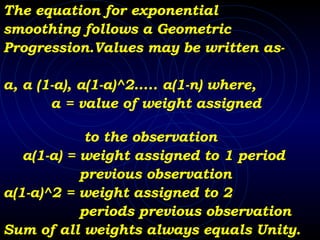

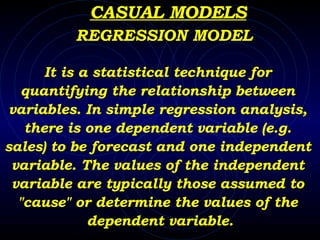

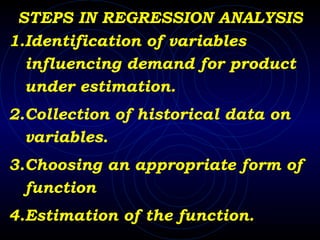

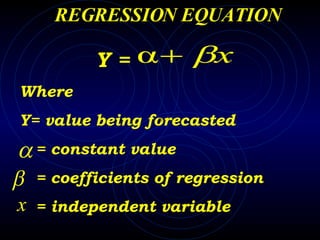

Demand forecasting involves determining what products are needed, where, when, and in what quantities. It is a customer-focused activity that supports logistics planning like capacity, inventory, and business planning. Demand forecasting techniques can be qualitative like surveys or quantitative like time series analysis and regression models. The choice of technique depends on factors like the time period, data availability, and purpose of the forecast. Effective demand forecasting provides benefits like reduced uncertainties and improved operations.