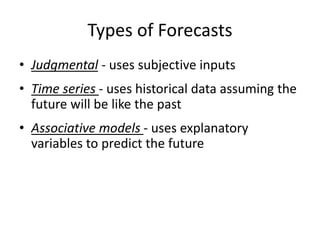

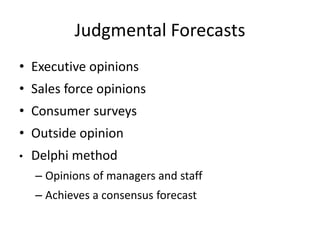

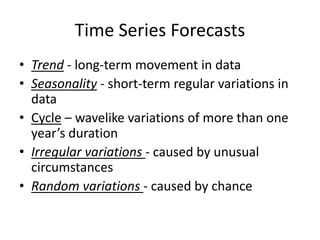

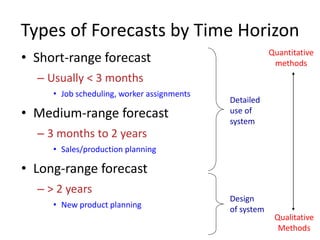

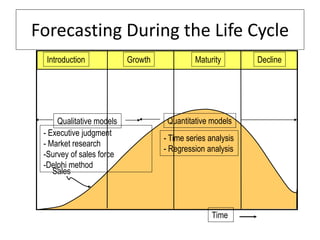

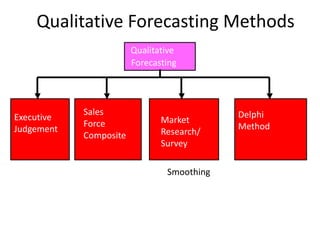

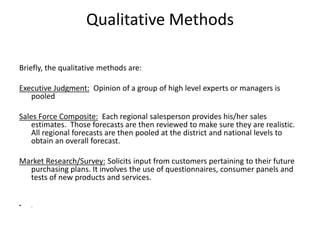

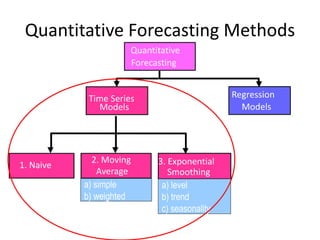

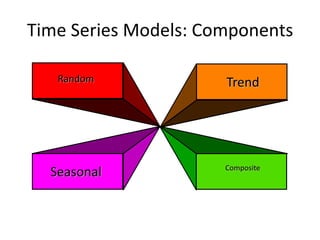

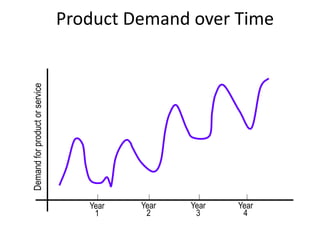

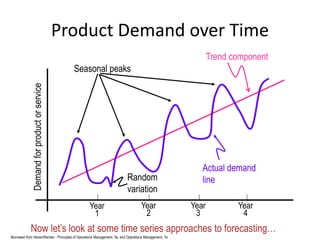

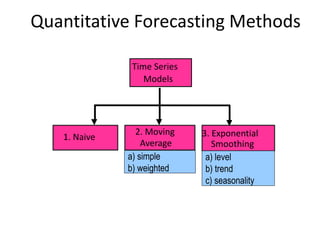

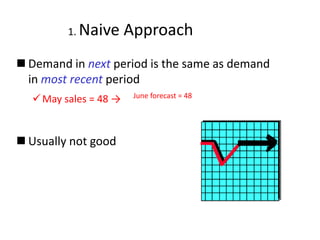

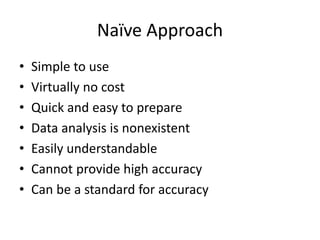

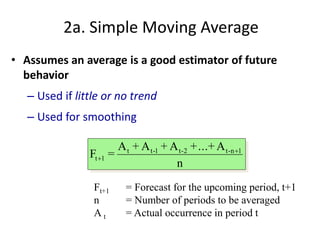

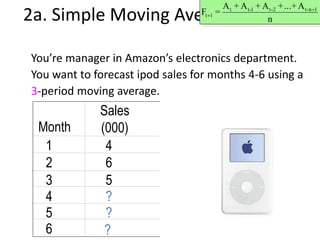

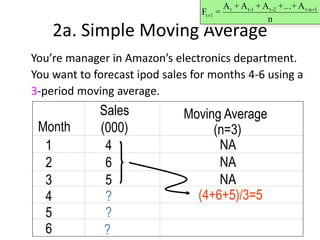

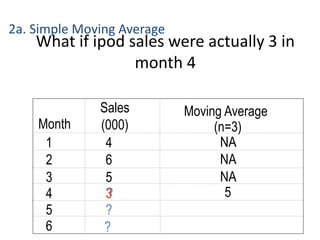

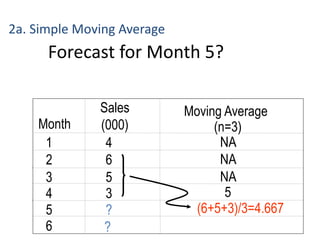

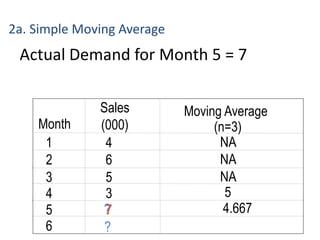

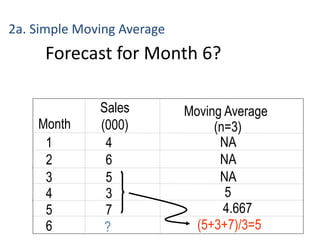

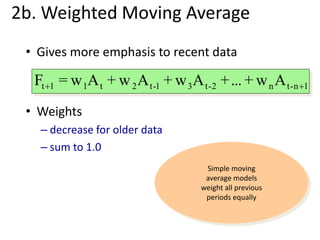

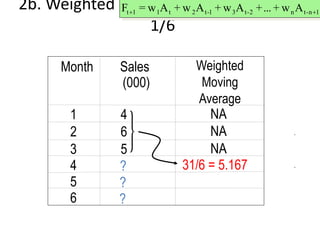

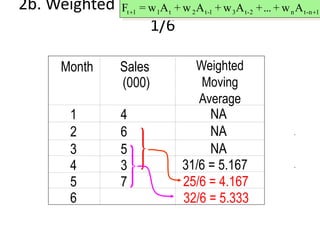

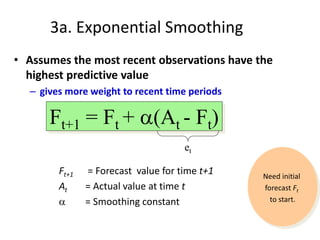

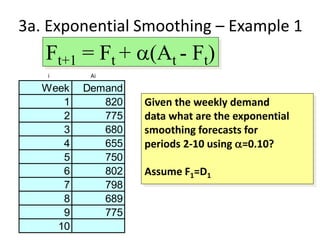

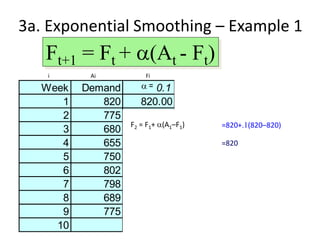

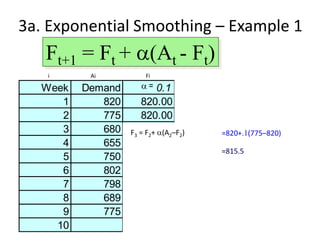

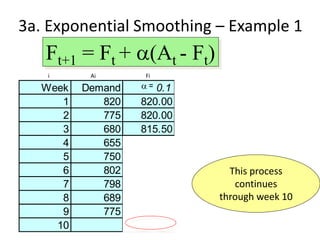

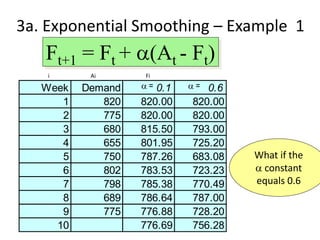

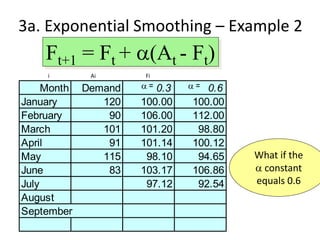

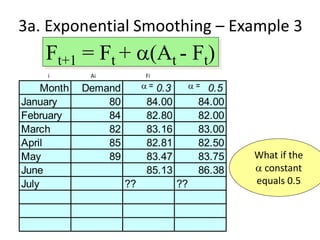

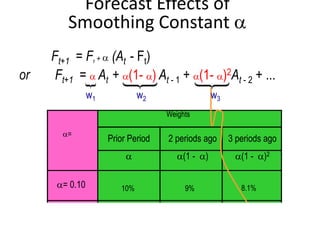

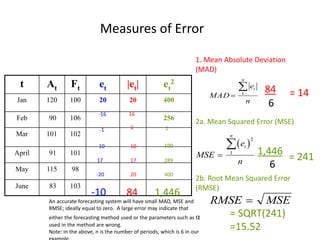

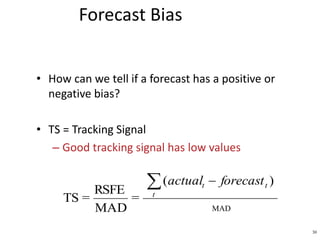

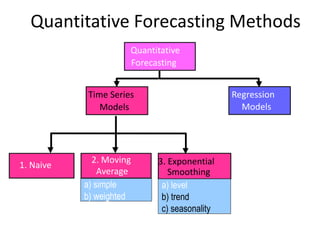

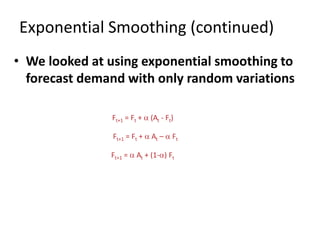

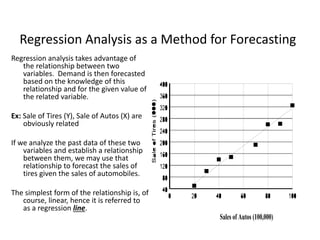

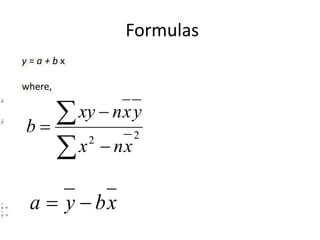

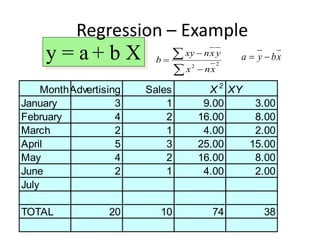

This document discusses forecasting methods used in production and operations management. It defines forecasting as predicting future values based on historical data. The key types of forecasts discussed are judgmental forecasts using subjective inputs, time series forecasts using historical data patterns, and associative models using explanatory variables. Time series methods covered include simple moving averages, weighted moving averages, and exponential smoothing. Exponential smoothing gives more weight to recent periods to generate forecasts. Quantitative forecasting methods are chosen based on the forecast horizon and data available.