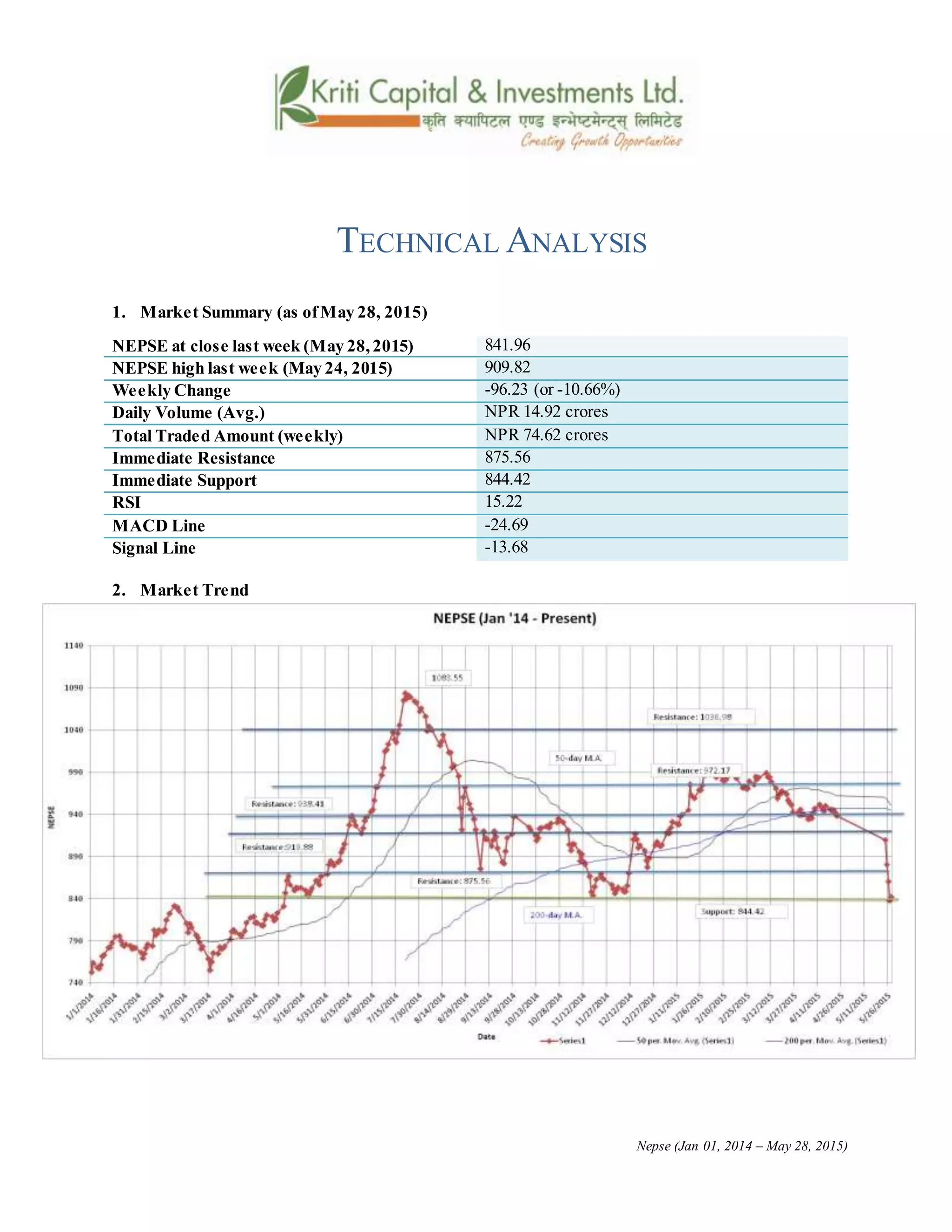

- NEPSE declined 10.66% over the week to close at 841.96, with daily trading volume and total weekly trading amount decreasing.

- Most technical indicators showed negative signals, with the RSI at 15.22, MACD line below the signal line, and Bollinger bands diverging significantly.

- The market volatility is very high as reflected by the movement of technical indicators away from their average levels. The support and resistance levels are 844.42 and 875.56 respectively.

![k|fljlws ljZn]if0f

ahf/ ;f/f+z -h]7 !$, @)&@ ;Ddsf]_

aGb cªs -h]7 !$, @)&@_ *$!=(^

pRr cªs -uPsf] ;ftf_ ()(=*@

;fKtflxs kl/jt{g –(^=@# -–!)=^^ k|ltzt_

b}lgs cf};t Jofkf/ ¿=!$=(@s/f]8

s'n ;fKtflxs Jofkf/ ¿=&$=^@ s/f]8

tTsflng 6]jf *&%=%^

tTsflng k|lt/f]w *$$=$@

cf/P;cfO{ !%=@@

PdP;L8L –@$=^(

l;UgnnfO{g –!#=^*

बजारप्रवृत्ति](https://image.slidesharecdn.com/nepsetechnicalanalysis24may-29may2015-150531050721-lva1-app6892/85/Nepse-Technical-Analysis-24-may-29-may-2015-4-320.jpg)

![6. Nepse (Jan 01, 2014 – May 28, 2015)

l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{k|fljlws ljZn]if0fsf]o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdf rln/x]sf]

ahf/df Jofkf//0fgLltagfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/df vl/b /

ljlqmsf]:ki6 ;+s]t b]vfpg]u5{ .

;ftfsf]z'?df cf/P;cfO{@%=@^ cªsn] tn emof]{. To; kl5 klg cf/P;cfO{lg/Gt/

tn g} emg]{ s|d hf/L /xof] / ;ftf ;dfKtx'Fbf !%=@@ cªsdf /xg uof] . ;f] ;ftf

cf/P;cfO{!@=#@cªs ;Dd emg{ uof] .](https://image.slidesharecdn.com/nepsetechnicalanalysis24may-29may2015-150531050721-lva1-app6892/85/Nepse-Technical-Analysis-24-may-29-may-2015-5-320.jpg)

![RSI (Jan 01, 2014 – May 28, 2015)

d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldfb'O{cf]6f /]vf x'G5g, h;df Pp6fn]ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{

eg] csf]{n] ahf/sf] k|j[lQ -6«]08_ b]vfpg]u5{ . olb PdP;L8L /]vfn] l;Ung

/]vfnfO{ tnaf6 dfly sf6]df o;nfO{;sf/fTds ;+s]tsf ?kdflnO{G5 / o;n] z]o/x?

lsGg] ;+s]t ub{5 .

PdP;L8L nfO{g l;Ugn nfO{g lgs} tn g} emof]{. PdP;L8L tyf l;Ung nfO{g b'j}

C0ffTds If]qdf /xg uof] . PdP;L8L nfO{g ;ftfsf] cGTolt/ –@$=^( df tyf l;Ugn

nfO{g –!!=)! df /xg uof] .

MACD (Jan 01, 2014 – May 28, 2015)

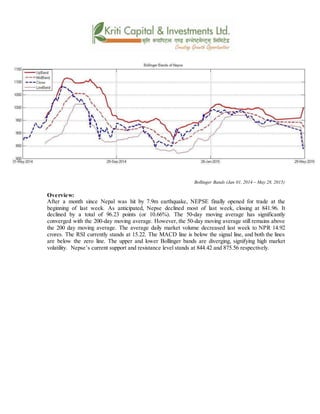

af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlws ljZn]if0f ;"rs xf] h;df @!–lbg]d'leË Pe/]hsf ;fy

b'O{ Aof08 -Pp6f dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf];+s]t

ub{5g, h'g :6fG88{8]leP;g u0fgf u/]/ kQf nufO{G5 .

g]K;] kl/;"rs ;ftfsf]z'?af6}lgs} tn emg]{ s|d hf/L /xof] . ;ftfsf]cGTo lt/ g]K;]

kl/;"rs tNnf] Aof08 eGbf tn g} /xg uof] . dflyNnf] tyf tNnf] Aof08 Ps

csf{af6 6f9f uO{/x]sf]cj:yfn] ahf/df cl:y/tf lgs} a9]sf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysis24may-29may2015-150531050721-lva1-app6892/85/Nepse-Technical-Analysis-24-may-29-may-2015-6-320.jpg)

![Bollinger Bands (Jan 01, 2014 – May 28, 2015)

;du{dfM

ljgfzsf/L e'sDk uPsf] Ps dlxgf kl5 ;+rfngdf cfPsf] g]K;] ;f]r] adf]lhd lg/Gt/ tn

g} emof]{/ ;ftfsf]cGTodf*$!=(^ cªsdf ;dfKteof] . ;ftfsf] cGTo ;Ddf g]K;] kl/;"rs

(^=@# cªsn] -!)=^^Ü_ 36g uof] . %)–lbg] d'leË Pe/]h @))–lbg] d'leË Pe/]h

eGbf dfly g} /x]sf] cj:yf /xof] . cf};t sf/f]af/ /sd 36g uO{ ?= !$=(@ /xg uof] .

cf/P;cfO{ xfn !%=@@ cªssf] l:yltdf /xg uof] . PdP;L8L nfO{g xfn l;Ugn nfO{g

eGbf tn g} /xof] . b'j} nfO{g xfn z'Go nfO{g eGbf tn g} /x]sf] cj:yf 5 . tNnf] tyf

dflyNnf] af]lnªu/ Aof08 Ps csf{af6 6f9fuO{/x]sf] cj:yfn] ahf/df cl:y/tf lgs} a9]sf]

;+s]t ub{5 . g]K;] kl/;"rsdf xfn 6]jf cªs tyf k|lt/f]w cªs s|dz M *$$=$@ tyf

*&%=%^ /xg uof] .](https://image.slidesharecdn.com/nepsetechnicalanalysis24may-29may2015-150531050721-lva1-app6892/85/Nepse-Technical-Analysis-24-may-29-may-2015-7-320.jpg)