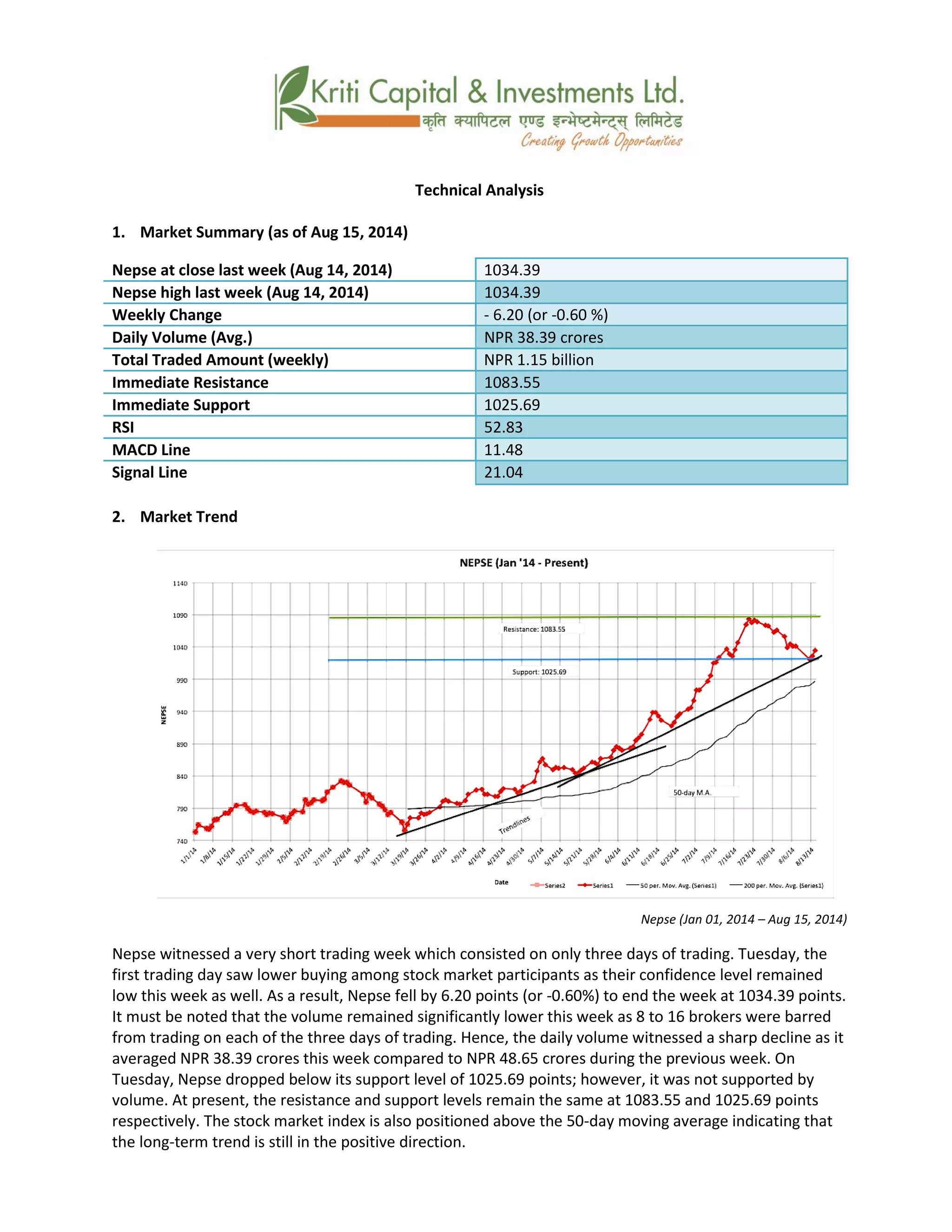

As of August 15, 2014, the Nepal Stock Exchange (NEPSE) closed at 1034.39 points, marking a decrease of 6.20 points (or -0.60%) from the previous week, with an average daily trading volume of NPR 38.39 crores. Key technical indicators show that while the RSI is at 52.83 indicating a neutral market, the MACD suggests ongoing downward momentum, and Bollinger Bands indicate potential overselling conditions. Overall, low trading volumes and halted broker activities have resulted in a subdued market environment despite a recent drop in stock prices.

![k|fljlws ljZn]if0f

ahf/ ;f/f+z ->fj0f @% b]vL >fj0f @( ;Ddsf]_

aGb cªs ->fj0f @(_ M !)#$=#(

pRr cªs ->fj0f @(_ M !)#$=#(

;fKtflxs kl/jt{g M –^=@) cªs -–)=^) k|ltzt_

b}lgs cf};t Jofkf/ M ¿= #*=#( s/f]8

s'n ;fKtflxs Jofkf/ M ¿= ! ca{ !% s/f]8

tTsflng 6]jf M !)*#=%%

tTsflng k|lt/f]w M !)@%=^(

cf/P;cfO{ M %@=*#

PdP;L8L M !!=$*

l;Ugn nfO{g M @!=)$

%) tyf @)) lbg] d'leª Pe/]h

g]K;]df o; ;ftf tLg lbgdfq sf/f]af/ ePsf] 5 . o; ;ftf klg nufgLstf{x?sf] ahf/ k|ltsf] efj sd

/x]sfn] ;ftfsf] klxnf] sf/f]af/ lbg, d+unaf/, ahf/df vl/b bafa sd b]lvof] . kmn:j?k, g]K;] ^=@) cªs –

jf )=^) k|ltzt_ n] 36]/ !)#$=#( cªs k'u]sf] 5 . o; ;ftf klg nuftf/ tLg k|To]s lbg * b]lv !^

a|f]s/x?n] sf/f]af/ ug{ gkfPsf sf/0f klg Jofkf/ -ef]No"d_ t'ngfTds ?kdf sd /x]sf] lyof] . t;y{, ut xKtf

$*=^% s/f]8 ?k}Fof /x]sf] b}lgs cf}ift Jofkf/ -ef]No"d_ o; ;ftf 36]/ #*=#( s/f]8 ?k}Fof k'u]sf] 5 .

d+unaf/sf lbg g]K;] !)@%=^( cªssf] ;dy{g tx eGbf d'gL v;]sf] lyof] / Jofkf/ -ef]No"d_ eg] sd /x]sf]

lyof] . jt{dfgdf, ahf/sf] k|lt/f]w / 6]jf÷;dy{g cªs s|dzM !)*#=%% / !)@%=^( cªs /x]sf] 5 . g]K;]

%)–lbg] d'leË Pe/]h eGbf dfly g} /x]sfn] ahf/sf] bL3{sfnLg k|j[lt a'ln; g} /x]sf] 5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust12-august142014engnep-140815025929-phpapp01/85/Nepse-technical-analysis-august-12-august-14-2014-eng-nep-4-320.jpg)

![Nepse (Jan 01, 2014 – August 14, 2014)

l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlws ljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdf rln/x]sf] ahf/df Jofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/df vl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

nufgLstf{x? lar ahf/k|ltsf] pT;fxdf sld / Jofkf/ -ef]No"d_ df lu/fj6sf sf/0f cf/P;cfO{ 36]/ %@=*#

cªs k'u]sf] 5 . kmn:j?k, g]K;] ce}m klg t6:y If]q leq sfod /x]sf] 5 .

RSI (Jan 01, 2013 – August 14, 2014)

d'leª Pe/]h sGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf] k|j[lQ

-6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]df o;nfO{ ;sf/fTds ;+s]tsf

?kdf lnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 . cl3Nnf] xKtfsf] k|j[lt ;+u}, PdP;L8L /]vf / l;Ugn /]vf b'j}

36]sf] 5 h;df PdP;L8L /]vf a9L ultn] 36]sf] 5 . o;n] lgs6 eljiodf ahf/ 36g] bafadf /x]sf] ;+s]t

u/]sf] 5 .

MACD (Jan 01, 2013 – August 14, 2014)

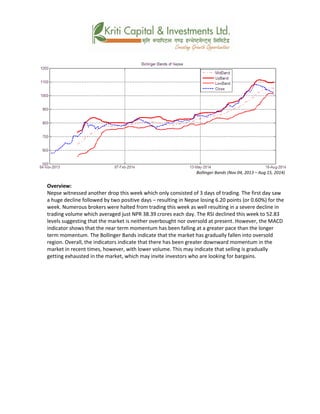

af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlws ljZn]if0f ;"rs xf] h;df @!–lbg] d'leË Pe/]hsf ;fy b'O{ Aof08 -Pp6f dfly_

/ Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf u/]/ kQf nufO{G5

. csf]{ lu/fj6sf] xKtf ;+u}, g]K;]n] nueu tNnf] Aof08 5f]Psf] 5 . o;n] lgs6 eljiodf ahf/ cf]e/;f]N8

/xg ;Sg] ;+s]t u/]sf] 5 . b'O{ Aof08x? lar 3l6/x]sf] b'/Ln] ahf/df cl:y/tf 3l6/x]sf] ;+s]t u/]sf] 5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust12-august142014engnep-140815025929-phpapp01/85/Nepse-technical-analysis-august-12-august-14-2014-eng-nep-5-320.jpg)

![Bollinger Bands (Jan 01, 2013 – August 14, 2014)

;du{dfM

o; ;ftf klg g]K;]df csf]{ lu/fj6 b]lvPsf] 5 h;df tLg lbg dfq sf/f]af/ ePsf] lyof] . klxnf] sf/f]af/ lbg,

g]K;]df 7"nf] lu/fj6 b]lvPsf] lyof] To; kl5 g]K;] b'O{ lbg ;sf/fTds /xof] . ;ftfsf] cGTodf g]K;] ^=@) cªs

-jf )=^) k|ltzt_ n] 36]sf] 5 . o; ;ftf klg y'k|} a|f]s/x?n] ljleGg sf/0fj; sf/f]af/ ug{ kfPgg h;n]

ubf{ Jofkf/ -ef]No"d_ df lu/fj6 b]lvPsf] 5 h'g o; ;ftf #*=#( s/f]8 ?k}Fof dfq /xof] . o; ;ftf,

cf/P;cfO{ 36]/ %@=*# cªsdf k'u]sf] 5 h;n] tTsfn ahf/ g cf]e/a6 g cf]e/;f]N8 /x]sf] ;+s]t u/]sf] 5 .

t/, PdP;L8L ;"rsn] eg] lgs6 eljiosf] d'leË Pe/]h, bL3{sfnLg d'leË Pe/]h eGbf a9L ultn] 3l6 /x]sf]

b]vfPsf] 5 . af]lnË/ Aof08n] ahf/ lj:tf/} cf]e/;f]N8 tk{m al9 /x]sf] ;+s]t u/]sf] 5 . ;du{df, ;"rsx?n]

xfnsf] ;dodf sd Jofkf/ -ef]No"d_ ;+u} ahf/ emg]{ k|j[ltdf /x]sf] ;+s]t u/]sf] 5 . o;n] ahf/df a]Rg] bafa

lj:tf/} 36b} uO{/x]sf] ;+s]t u/]sf] 5 h;n] ahf/df ;:tf] z]o/x? k|lt nufgLstf{x?sf] cfsif{0f a9g ;Sg] 5

.](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust12-august142014engnep-140815025929-phpapp01/85/Nepse-technical-analysis-august-12-august-14-2014-eng-nep-6-320.jpg)