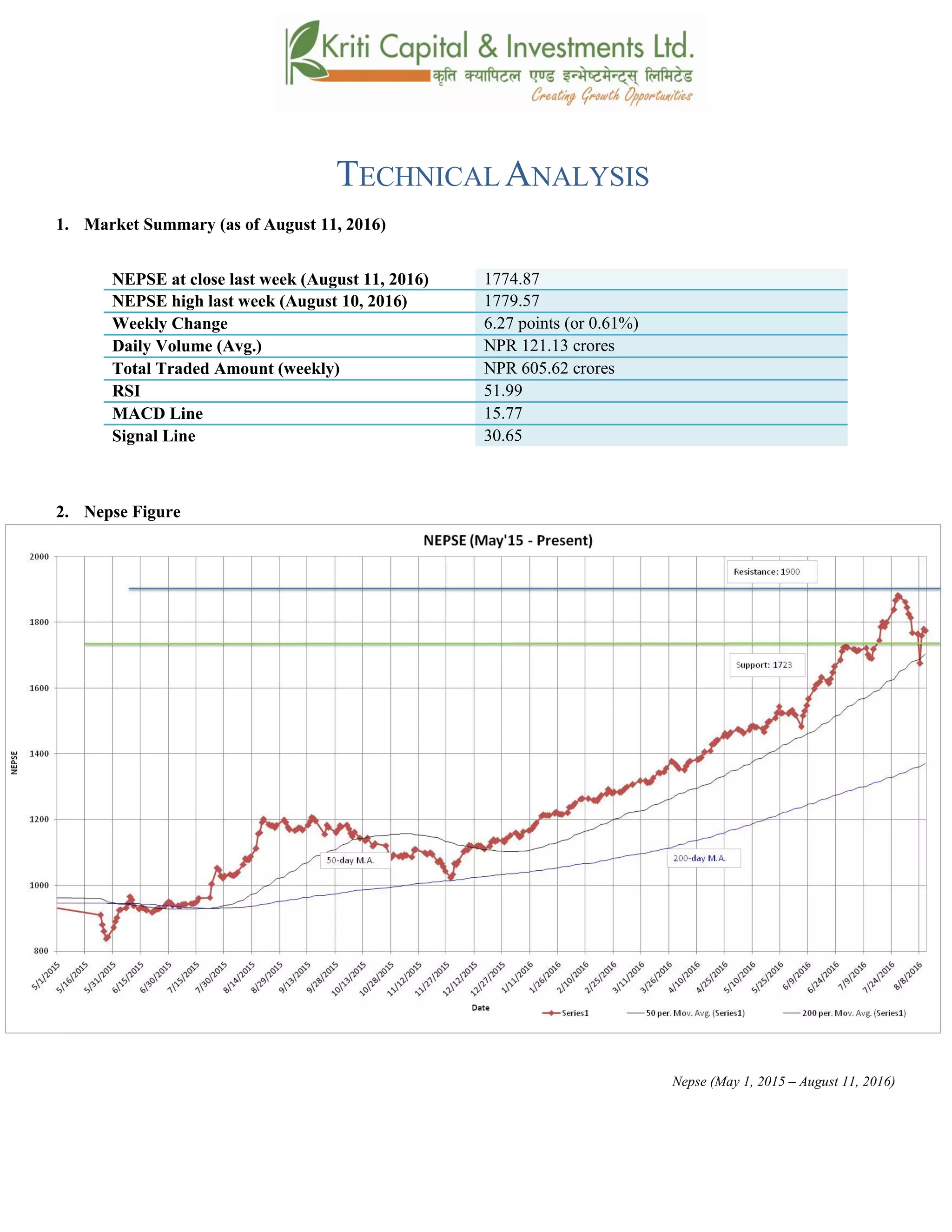

The Nepse index gained 0.61% over the past week to close at 1774.87 points. Technical indicators show the market is currently in a bullish state as the index remains above its 50-day and 200-day moving averages. However, the MACD line is below the signal line, suggesting a bearish signal in the short term. The RSI and Bollinger bands indicate buying pressure is decreasing and volatility is moderate. Near-term support and resistance levels are seen at 1723 and 1900 points respectively. Overall, the market outlook remains positive despite short term technical signals of weakness.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -;fpg@&, @)&#;Ddsf]_

aGb cªs -;fpg@&, @)&#_ !&&$=*&

pRr cªs -uPsf] ;ftf_ !&&(=%&

;fKtflxs kl/jt{g ^=@& -)=^!k|ltzt_

b}lgscf};t Jofkf/ ¿=!@!=!#s/f]8

s'n ;fKtflxsJofkf/ ¿ ^)%=^@ s/f]8

cf/P;cfO{ %!=((

PdP;L8L !%=&&

l;UgnnfO{g #)=^%

@_ ahf/ k|j[lt

Nepse (May 1, 2015 – August 11, 2016)](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust7-august112016-160816043742/85/Nepse-Technical-Analysis-August-7-August-11-2016-4-320.jpg)

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftfg]K;] kl/;"rsdf^=@&cªssf] ;fdfGo a[l4 b]lvof]h;sf] kmn:j?kahf/

!,&&$=*&cªsdfaGbeof] . uPsf] ;ftf g]K;] kl/;"rsdfef/L lu/fj6 b]lvof] h;nfO{

ljleGgnufgLstf{x?n] ;fdfGoahf/ s/]S;gsf] ;+1f lbP . t/ ;du|dfclxn] klg kl/;"rs %) lbg]

d'leËPe/]h tyf @)) lbg] d'leËeGbfdfly g} rln/x]sf] cj:yfn] ;du|dfahf/sf] l:ylt /fd|f] b]lvG5 .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !&@#

6]jfcªs @ !^))

glhssf] k|lt/f]w cªs !())

uPsf] ;ftf g]K;] kl/;"rscfkmgf] glhssf] 6]jfcªs !&@# eGbftnuPsf] cj:yf /xof] . t/ ;f] cªs km]l/

ahf/n] t'?Gt} csf]{ lbgk|fKt u/]sf] cj:yf /xof] .clxn] klggofFglhssf] k|lt/f]w cªs !()) tyf 6]jfcªs

!&@# g} /x]sf] cj:yf /x]sf] 5 . s]xLlbgsf] lu/fj6 ;Fu} ahf/dfnufgLstf{x? dfemljZjf;sf] jftfj/0f b]lvof]

cj:yf /xof] .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

uPsf] ;ftfsf] z'?df PdP;L8L nfO{gtyfl;UgnnfO{g s|dzM#%=&@tyf$*=^)sf] l:yltdf /x]sf] lyof]t/

;ftfsf] afFsLlbgx?df b]lvPsf] ef/L lu/fj6 ;Fu} PdP;L8LnfO{g l;UgnnfO{g eGbftncfPsf] cj:yfn]

ahf/ laol/; l:yltdf cfPsf] ;+s]t ub{5 . ;ftfsf] cGTodfPdP;L8L nfO{g tyfl;UgnnfO{g

s|dzM!%=&&tyf#)=^% sf] l:yltdf /x]sf] lyof] .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust7-august112016-160816043742/85/Nepse-Technical-Analysis-August-7-August-11-2016-5-320.jpg)

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

cf/P;cfO{uPsf] ;ftfsf] z'?df$(=^^cªsdf/x]sf] lyof]tyf ;ftfsf] cGTolt/ cf/P;cfO{ %!=((cªsdf

/xof].h;n] ahf/dfa]Rg]xf]8afhLsf] ;+s]t ub{5 . &) cªseGbflgs} tnem/]sf]] cf/P;cfO{ clxn] ahf/df

a]Rg] xf]8afhL a9]sf] ;+s]t ub{5 .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust7-august112016-160816043742/85/Nepse-Technical-Analysis-August-7-August-11-2016-6-320.jpg)

![g]K;] kl/;"rsuPsf] ;ftfpkNnf] Jof08eGbf k/ uPsf] cj:yfn] ahf/ cf]e/ a6 l:ylt af6 aflx/

cfPsf] ;+s]t ub{5 . pkNnf] tyftNnf] Jof08 aLrsf] b'/LdfcfPsf] sdLcl:yt/tfeg] 36]sf] ;+s]t

ub{5 .tNnf] Aof08 af6 dflydWo Aof08 lt/ cfPsf] ahf/n] ca ;fO{8 j]h d'ed]G6 x'g ;Sg] ;+s]u

ub{5 .

;du{dfM

uPsf] ;ftf g]K;] kl/;"rsdf^=@&cªssf] ;fdfGo a[l4 b]lvof]h;sf] kmn:j?kahf/ !&&$=*&cªsdfaGbeof] .

clxn] klg kl/;"rs %) lbg] d'leËPe/]h tyf @)) lbg] d'leËeGbfdflyuO{/x]sf] cj:yfn] ahf/ ;sf/fTds

l:yltdf g} /x]sf] ;+s]t ub{5 . PdP;L8L nfO{gl;UgnnfO{g eGbftncfPsf]cj:yfn] ahf/dflsGg] xf]8afhLdf

sdLcfPsf] b]lvG5 . &) cªseGbflgs} tnem/]sf]] cf/P;cfO{n] ahf/ cf]e/ a6 l:yltaflx/ cfPsf] ;+s]t

ub{5 . pkNnf] tyftNnf] Jof08 aLrsf] b'/Ldfeg] s]xLsdLcfPsf]n]ahf/sf] cl:y/tfdfeg]s]xLsdLcfPsf] ;+s]t

ub{5 .xfnsf] cj:yfdfgofF 6]jfcªstyfk|lt/f]w cªs s||dzM !&@# tyf !()) g} sfod /x]sf] 5 . ;du|df

x]bf{ ahf/ laol/; l:yltdf /x]sf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust7-august112016-160816043742/85/Nepse-Technical-Analysis-August-7-August-11-2016-7-320.jpg)