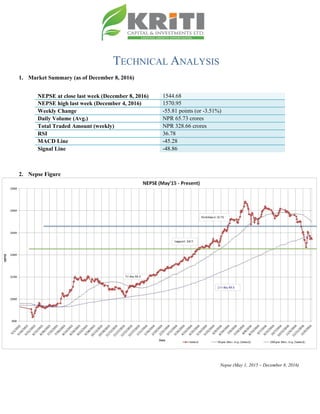

The Nepse index fell 55.81 points (3.51%) last week to close at 1544.68. Technical indicators like MACD and RSI show the market may be moving out of a bearish phase, though volatility remains high. Support and resistance levels are at 1465 and 1671 respectively. The market is hovering between these levels with no clear direction.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -d+l;/@#, @)&#;Ddsf]_

aGb cªs -d+l;/@#, @)&#_ !%$$=^*

pRr cªs -uPsf] ;ftf_ !%&)=(%

;fKtflxs kl/jt{g –%%=*! -–#=%!k|ltzt_

b}lgscf};t Jofkf/ ¿=^%=&#s/f]8

s'n ;fKtflxsJofkf/ ¿ #@*=^^ s/f]8

cf/P;cfO{ #^=&*

PdP;L8L –$%=@*

l;UgnnfO{g –$*=*^

@_ ahf/ k|j[lt

Nepse (May 1, 2015 – December 8, 2016)](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember4-december82016-161211044436/85/Nepse-technical-analysis-december-4-december-8-2016-5-320.jpg)

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftfg]K;] kl/;"rsdf%%=*!cªssf] lu/fj6 b]lvof]h;sf] kmn:j?kahf/ !%$$=^*cªsdfaGbeof]

.g]K;] kl/;"rsclxn@))lbg] d'leËPe/]heGbftn /x]sf] cj:yf 5 h;n] ahf/dflaol/; 6]«G8df /x]sf]

l:ylt b]vfpF5 . uPsf] s]xLlbgsf] ahf/ cl:y/tftyf /fhgLltstxdf ;Dd b]lvPsf] g}/Zotfn] ahf/df

s]xLxnrnsf] cj:yfeg] kSs} /x]sf] b]lvG5 . cf};tsf/f]af/ /sddfef/L lu/fj6 b]lvof] hf]^%=&# s/f]8df

cfPsf] 5 .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !$^%

6]jfcªs @ !$)%

glhssf] k|lt/f]w cªs !^&!

xfnsf] nflu 6]jfcªs !$^%tyfk|lt/f]w cªs !^&! /x]sf] 5 . g]K;] kl/;"rsxfn@))lbg] d'leËPe/]h

eGbftncfPsf] cj:yfn] ahf/dflaol/;6]«G8sfod /x]sf] blvG5 .xfnsf] ahf/kv{ / x]/ sf] cj:yfdf b]lvPsf]

x'Fbfclxn] ahf/df ;fO8j]h d'ed]G6 b]lvPsf] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

;ftfsf] z'?df PdP;L8L nfO{g tyfl;UgnnfO{g s|dzM–%)=!)tyf–%!=%@sf] l:yltdf /x]sf] lyof] .

PdP;L8L nfO{gtyfl;UgnnfO{gdfafFsLsflbgx?dfxnsfa[l4 g} b]lvof] .xfnsf] nflu PdP;L8LnfO{g

tyfl;UgnnfO{g s|dz M –$%=@*tyf$*=*^/x]sf] 5 t/ clxn] klg PdP;L8L nfO{gtyfl;UgnnfO{g

b'j}C0ffTds If]qdf /x]sf] xF'bfahf/ laol/; l:yltdf g} /x]sf] b]lvG5.](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember4-december82016-161211044436/85/Nepse-technical-analysis-december-4-december-8-2016-6-320.jpg)

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

cf/P;cfO{uPsf] ;ftfsf] z'?df#(=(@cªsdf/x]sf] lyof]tyf ;ftfsf] cGTolt/ cf/P;cfO{ #^=&*cªsdf

/xof].#) cªseGbftnem/]sf] cf/P;cfO{n] cf]e/;f]N8 ahf/sf] l:Ylt b]lvGYof] .xfncf/P;cfO{n] ahf/

Go'6«n l:yltdf /x]sf] b]vfpF5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember4-december82016-161211044436/85/Nepse-technical-analysis-december-4-december-8-2016-7-320.jpg)

![u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f dfly_ /

Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf u/]/ kQfnufO{G5 .

g]K;] kl/;"rsuPsf] ;ftftNnf] Jof08 tyfdWo Jof08aLrrln/x]sf] cj:yf /xof] h;n] clxn]

klgahf/dfa]Rg]xf]8afhL g} /x]sf] h:tf] b]lvG5 f t/ pkNnf] tyftNnf] Jof08 aLrdf b'/L sfod /x]sf]n]

cl:yt/tfcem} /x]sf] b]lvG5 .

;du{dfM

uPsf] ;ftf g]K;] kl/;"rsdf%%=*!cªssf] lu/fj6 g} b]lvof]h;sf] kmn:j?kahf/ !%$$=^*cªsdfaGbeof] .

PdP;L8L nfO{gdf b]lvPsf] a[l4n]eg]a]Rg]xf]8afhLdf s]xLsdLePsf]b]lvG5 . #)cªseGbfdflycfPsf]

cf/P;cfO{n] ahf/ cf]e/–;f]N8 l:yltaf6 aflx/cfO{ Go"6«n cj:yfdfcfPsf];+s]t ub{5 .pkNnf] tyftNnf]

Jof08 aLrsf] b'/Ldfeg]] s]xL kl/jt{g gcfPsf]n] ahf/sf] cl:y/tfdfeg]sdLgcfPsf] ;+s]t ub{5 .xfnsf]

cj:yfdfgofF 6]jfcªstyfk|lt/f]w cªs s||dzM !$^%tyf !^&!sfod /x]sf] 5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember4-december82016-161211044436/85/Nepse-technical-analysis-december-4-december-8-2016-8-320.jpg)