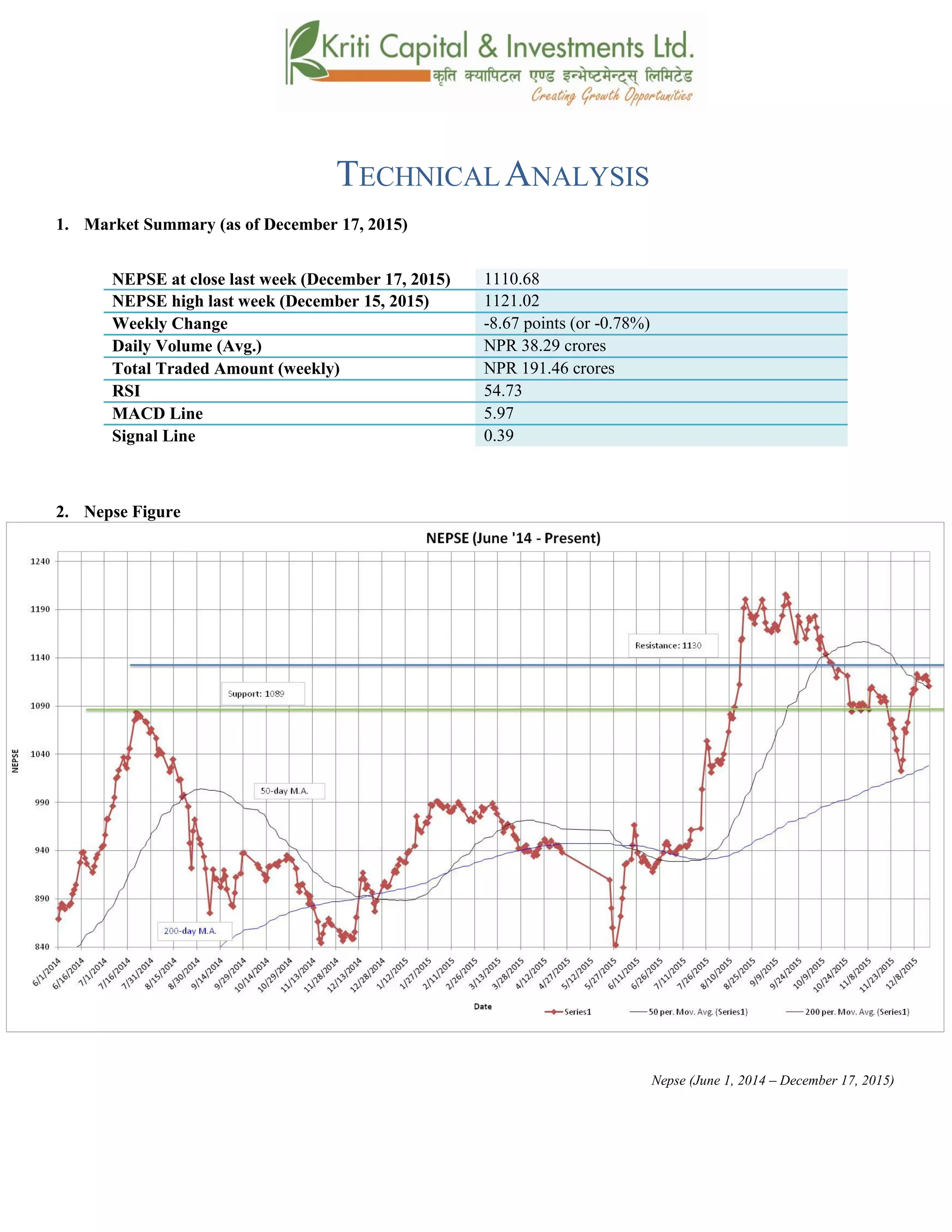

The Nepse index closed down 0.78% last week at 1110.68 points. The market remains bullish as the index is above its 50-day and 200-day moving averages, however volatility has increased slightly as the moving averages are converging. The MACD and RSI indicators show the market outlook is stable, while resistance and support levels were unchanged. Trading volume was slightly higher than the previous week.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -kf}if@, @)&@ ;Ddsf]_

aGb cªs -kf}if@, @)&@_ !!!)=^*

pRr cªs -uPsf] ;ftf_ !!@!=)@

;fKtflxs kl/jt{g –*=^& -–)=&*k|ltzt_

b}lgscf};t Jofkf/ ¿=#*=@(s/f]8

s'n ;fKtflxsJofkf/ ¿ !(!=$^ s/f]8

cf/P;cfO{ %$=&#

PdP;L8L %=(&

l;UgnnfO{g )=#(

@_ ahf/ k|j[lt

Nepse (June 1, 2014 – December 17, 2015)](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember13-december172015-151221061600/85/Nepse-Technical-Analysis-December-13-December-17-2015-5-320.jpg)

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftf g]K;] kl/;"rsdfs]xLlu/fj6 b]lvof] . kl/;"rsn] *=^&cªsu'dfof] . uPsf] ;ftf kl/;"rsdf

/fhgLltsl:yltssf] c;/ vf;} b]lvPg . xfnsf]cj:yfdfclxn] klg kl/;"rs %) lbg] d'leËPe/]h

eGbfdflyrln/x]sf] cj:yf /x]sf] 5h;n] ;du|dfahf/sf] l:yltdf clxn] klg s]xLdfqfdfa'lnz 6]«G8 /x]sf]

;+s]t ub{5 . %) lbg] tyf @)) lbg] d'leËPe/]h Ps csf{sf] glhscfPsf] cj:yfn] ahf/dfcl:y/tf

s]xLsdePsf] ;+s]t ub{5 . ;fy} ahf/dfOG:of]/]G; If]qdfk"FhL a[l4 x'g ;Sg] ;dfrf/n] ;f] If]qdfsfdug]{

sDkgLx?sf] z]o/ lsGgnufgLstf{x? dfemxf]8afhL b]lvof] / n3'ljQ ljsf; a}+sx?

tkm{klgnufgLstfx?sf] hf]z lgs} g} b]vfk/] .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !)*(

6]jfcªs @ !)@)

glhssf] k|lt/f]w cªs !!#)

xfnsf] cj:yf g]K;] kl/;"rsglhssf] 6]jfcªstyfk|lt/f]w cªssf] aLrdfrln/x]sf] l:Ylt /xof] . OG:of]/]G;

If]q tyf n3'ljQ If]qdf b]lvPsf] pT;fx ;Fu} kl/;"rsdf ;fO{8j]h d'ed]G6 b]lvof] . clxn] klgb]zsf]

/fhgLlts l:yltdf s]xL ;'wf/ b]lvPdf g]K;] kl/;"rsn] cfkmgf] k|lt/f]w cªssf] l;dfx? Kff/ ug{ ;Sg]

;+Defjgfalnof] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

uPsf] ;ftf z'?sf] lbgdf PdP;L8L nfO{g l;UngnfO{gs|dzM@=#!tyf –^=(*cªsdf /x]sf] lyof] .

b'j} nfO{gx? dflylt/ nDsg] s|dhf/L /xof] h;sf] kmn:j?k PdP;L8L nfO{g l;UgnnfO{g eGbfdfly

/x]sf] cj:yf /xof] . ;fy} l;UgnnfO{g ;d]t C0ffTds If]qnfO{ 5f8L dflycfPsf] cj:yfn]

;du|dfahf/sf] l:ylt /fd|f] /x]sf] ;+s]t ub{5 . ;ftfsf] cGtodf PdP;L8L tyfl;UngnfO{g s|dzM

%=(&tyf)=#(sf] l:yltdf /xguof] .](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember13-december172015-151221061600/85/Nepse-Technical-Analysis-December-13-December-17-2015-6-320.jpg)

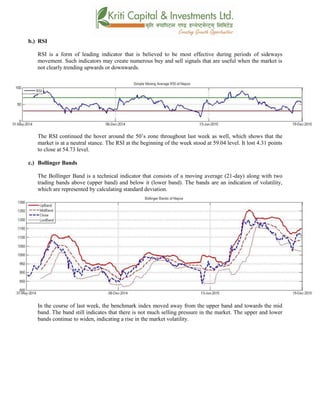

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

uPsf] ;ftfsf]w]/} h;f] lbgx? cf/P;cfO{ %) cªssf] xf/fxf/L rln/x]sf] cj:yf /xof] h;n] ahf/ cf]e/

;]nsf] l:yltaf6 6f9fcfO{ Go6«ncj:yfdfkms]{sf] 5 . b]zsf] /fhgLlts l:yltdf cem} s]xL ;'wf/

b]lvPdfahf/ km]l/ dflyhfg ;Sg] ;+Defjgfalnof] /xof] . ;ftfsf] cGTolt/ $=#!cªssf] lu/fj6 ;Fu}

cf/P;cfO{ %$=&#cªsdfaGbeof] .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .

g]K;] kl/;"rsuPsf] ;ftfpkNnf] Jof08nfO{ 5f8L dWo Jof08 glhscfPsf] cj:yf /xof] . xfnsf]

cj:yfdf a]Rg] xf]8afhLdf s]xLsdLcfPsf] ;+s]t ub{5 . ;fy} pkNnf] tyftNnf] Jof08 aLr a9g

uPsf] b'/Ln] ;d]t xfnsf] cj:yfdfcl:y/tf s]xL a9]sf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember13-december172015-151221061600/85/Nepse-Technical-Analysis-December-13-December-17-2015-7-320.jpg)

![;du{dfM

uPsf] ;ftf g]K;] kl/;"rsdf*=^&cªslu/fj6 dxz'; ul/of] . xfn kl/;"rs %) lbg] d'leËPe/]h

eGbfdflyrln/x]sf] cj:yfn] ahf/df km]l/ a'lnz 6]«G8 cfpg ;Sg] ;+Defjgf b]vf k/]sf] 5 . cem} klg

/fhgLltstxdf s]xL ;'wf/ gb]lvPsf] x'Fbfahf/ vf;} dflyhfg ;s]sf] l:ylt 5}g . PdP;L8L nfO{g ;Fu}

l;UgnnfO{g klg;sf/fTds If]q lt/ k|j]z u/]sf]n] ahf/df s]xLcfzfx? km]l/ b]lvPsf 5g .cf/P;cfO{n]

ahf/ cf]e/ ;]n l:yltnfO{ 5f8L Go"6«n cj:ydfkms]{sf] ;+s]t ub{5 . ;fy} af]lnªu/ Aof08n]

kl/;"rsdflyNnf] Jof08sf] glhsk'u]sf] cj:yfn] ahf/sf] cl:y/tf s]xL a9]sf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisdecember13-december172015-151221061600/85/Nepse-Technical-Analysis-December-13-December-17-2015-8-320.jpg)