The Nepse index decreased 3.15% over the past week to close at 1092.04, as the market remained bearish due to the ongoing fuel crisis. Technical indicators like MACD and RSI showed a bearish momentum, while volatility is rising as Bollinger bands widen. The new support level is 1084 and resistance at 1183. Overall, the market outlook is positive in the long run as the 50-day MA remains above the 200-day MA, but the index may see further declines in the short term due to prevailing market conditions.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -sflt{s!@, @)&@ ;Ddsf]_

aGb cªs -sflt{s !@, @)&@_ !)(@=)$

pRr cªs -uPsf] ;ftf_ !!@!=)%

;fKtflxs kl/jt{g –#%=#* -–#=!%k|ltzt_

b}lgscf};t Jofkf/ ¿=@)=!$s/f]8

s'n ;fKtflxsJofkf/ ¿ *)=%& s/f]8

cf/P;cfO{ ##=*%

PdP;L8L – !^=$$

l;UgnnfO{g –&=@!

@_ ahf/ k|j[lt

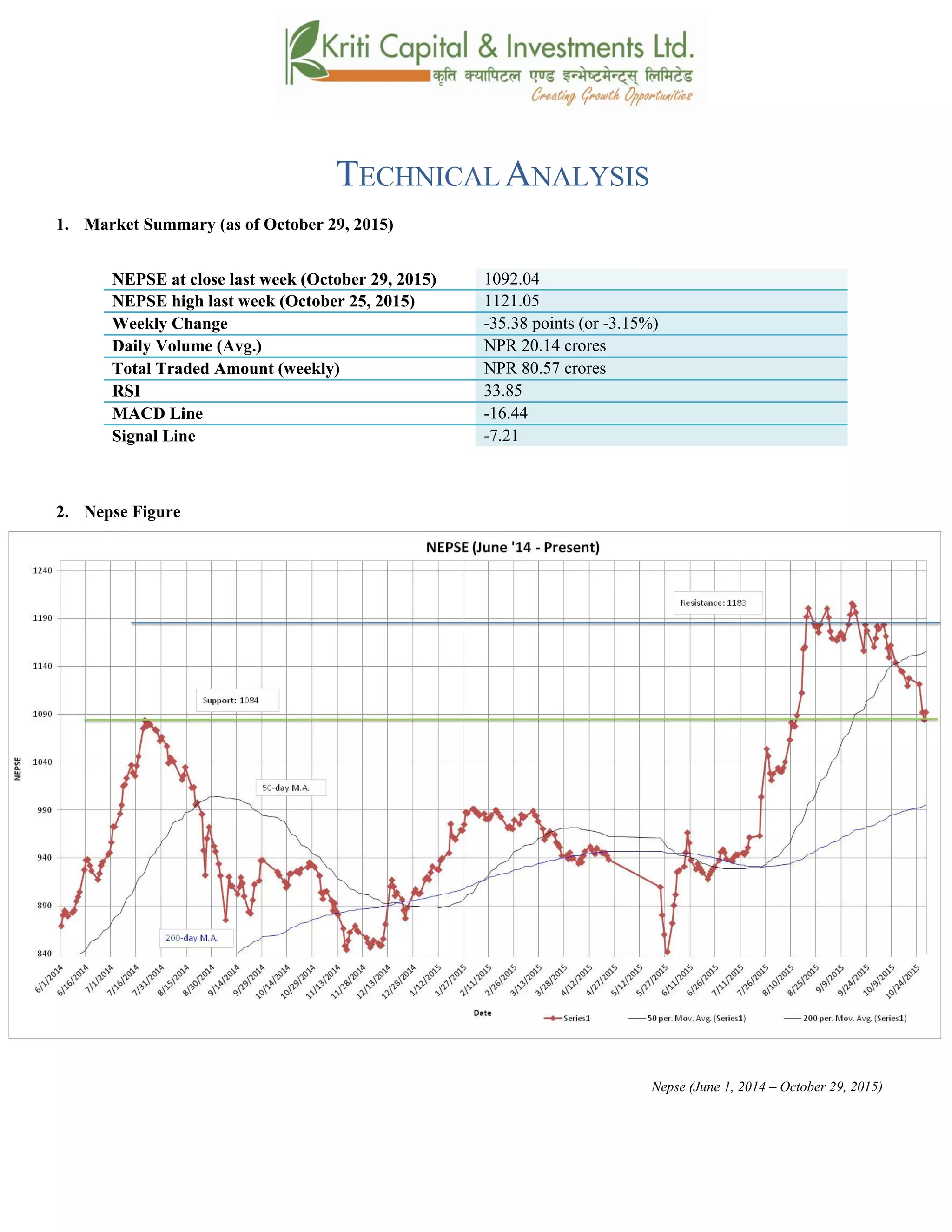

Nepse (June 1, 2014 – October 29, 2015)](https://image.slidesharecdn.com/nepsetechnicalanalysisoctober25-october302015-151102070714-lva1-app6892/85/Nepse-Technical-Analysis-October-25-October-30-2015-5-320.jpg)

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftfklgahf/ tneg]{ s|dhf/L g} /xof] . b]zsf] xfnsf] ufx|f] /fhgLlts kl/l:yltsf] kmn?j?k

kl/;"rsn] uPsf] ;ftf #%=#* cªsu'dfof] . t/ ;ftfsf] cGtodf kl/;"rsdf&=^&cªssf] a[l4 /xof] .

gofF /fi6«kltsf] lgo'ltmtyf g]kfn / rLgaLr t]n vl/b ug{ ;Def}tfePcg'?kahf/df s]xLpT;fx b]lvPsf]

xf] .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !)*$

6]jfcªs @ !)%#

glhssf] k|lt/f]w cªs !!*#

uPsf] ;ftf kl/;"rs 6]jfcªs !!!@ eGbfcem} tn g} /xguof] .;f] ;ftf kl/;"rs ;a}eGbftn

!)*$=#&cªs ;Ddk'Uguof] hf] clxn] sf] nflugofF 6]jfcªs /xguPsf] 5 . ;ftfsf] cGtolt/

/fhgLltstxdftyfrLg ;Fu ePsf] OGwgvl/b ug]{ ;Demf}tfsf] kmn:j?k s]xL ;'wf/ b]lvof] . xfnsf]

nflugofFk|lt/f]w cªs !!*# /x]sf] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

uPsf] ;ftfl;UgnnfO{gn] qm0ffTds If]q 5'g uof] . cfO{tjf/sf] lbgdf PdP;L8L tyfl;UngnfO{g s|dzM

–&=(^ tyf –)=!( sf] l:yltdf /x]sf] lyof] hf] ;ftfsf] cGtolt/ xfnsf] laol/; l:yltsf] kmn:j?ks|dzM

–!^=$$ tyf –&=@! Dff /xguof] .](https://image.slidesharecdn.com/nepsetechnicalanalysisoctober25-october302015-151102070714-lva1-app6892/85/Nepse-Technical-Analysis-October-25-October-30-2015-6-320.jpg)

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

uPsf] ;ftfsf] z'?dfcf/P;cfO{ #*=*^ cªsdf /x]sflyof] . ;ftfsf] w]/} h;f] lbglu/fj6 g} b]lvPsf]

kl/;"rsdfcf/P;cfO{ ;ftfsf] cGtolt/ ##=*% /xguof] / ahf/dflaol/; 6]«G8 sfod /x]dfcf/P;cfO{

#) cªssf] n]en eGbftnhfg ;Sg] ;Defjgf a9L /x]sf] 5 .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .

g]K;] kl/;"rsuPsf] ;ftftNnf] Aof08sf] glhsk'Uof] h;n] ahf/df a]Rg] xf]8afhL w]/} a9]sf] ;+s]t

ub{5. pkNnf] tyftNnf] Jof08 aLrsf] b'/L s]xL a9g yfn]sf] cj:yfn] ahf/df km]l/ cl:yt/tf a9g

;Sg] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisoctober25-october302015-151102070714-lva1-app6892/85/Nepse-Technical-Analysis-October-25-October-30-2015-7-320.jpg)

![^_ eNo'd ;'rs -cg–Aofn]G; eNo'd_

cg–Aofn]G; eNo'd n] ahf/dflsGg] tyf a]Rg] k|];/sf] ;+s]t ub{5 . ;d|udf of] ;"rsn] ahf/ dflyuPsf]

cj:yftyftnem/]sf] cj:yfdfahf/dfsf/f]af/sf] eNo'd s:tf] /xof] ;+s]t ub{5 .

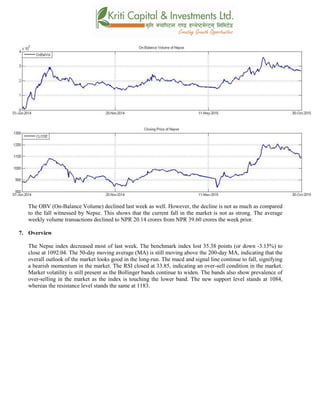

cg–Aofn]G; eNo'ddftyf g]K;] kl/;"rsdf ;d]tuPsf] ;ftflu/fj6 b]lvof] t/ ;f] lu/fj6 g]K;] kl/;"rssf]

lu/fj6 eGbfsd g} /xof] h;n] xfnsf] lu/fj6 Toltalnof] lu/fj6 g/x]sf] ;+s]t ub{5 . uPsf] ;ftfcf};t

sf/f]af/ /sd ?= #(=^) s/f]8af6 36L ?=@)=!$ s/f]8 /xguof] .

.](https://image.slidesharecdn.com/nepsetechnicalanalysisoctober25-october302015-151102070714-lva1-app6892/85/Nepse-Technical-Analysis-October-25-October-30-2015-8-320.jpg)

![;du{dfM

uPsf] ;ftf g]K;] kl/;"rsdf 36g] s|dhf/L /xof] . kl/;"rsn] #%=#*cªsu'dfof] . xfnsf]

cj:yfdf%) lbg] d'leËPe/]h @)) lbg] d'leËPe/]hnfO{ sf6L dfly lxl8/x]sf] cj:yf /x]sf] 5 h;n]

ahf/dflaol/; 6]«G8 b]lvPtfklg;d|ddf bL3{sfnLglx;fan] ahf/ ce} klg /fd|} l:yltdf /x]sf] ;+s]t

ub{5 . PdPl;8L tyfl;UgnnfO{g df b]lvPsf] lu/fj6n] ahf/ laol/; 6]«G8df /x]sf] ;+s]t ub{5 .

##=*%cªsf] l:yltdf /x]sf] cf/P;cfO{n] ahf/ cf]e/ z]nsf] cj:yfdf /x]sf ;+s]t ub{5 . af]lnªu/

Aof08n] xfnahf/df a]Rg] xf]8afhL a9L /x]sf] ;+s]t lbG5 . xfnsf] nflugofF 6]jfcªstyfk|lt/f]w

cªs !)*$tyf !!*# /x]sf] 5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisoctober25-october302015-151102070714-lva1-app6892/85/Nepse-Technical-Analysis-October-25-October-30-2015-9-320.jpg)