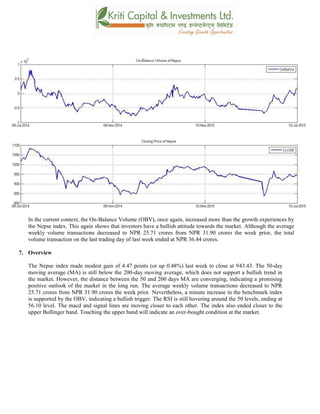

- The Nepse index gained 4.47 points last week to close at 943.43, a 0.48% increase.

- The index followed a bearish trend initially but gained momentum later in the week due to positive news on constitution drafting.

- Immediate support and resistance levels were at 913.02 and 950.97 respectively. The likelihood of crossing resistance seemed high given political optimism.

- Most indicators like MACD, RSI and OBV pointed to a bullish market, though volatility has declined.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -cfiff9 @$, @)&@ ;Ddsf]_

aGb cªs -cfiff9@$, @)&@_ ($#=$#

pRr cªs -uPsf] ;ftf_ ($#=$#

;fKtflxs kl/jt{g $=$& -)=$*k|ltzt_

b}lgscf};t Jofkf/ ¿=@%=&!s/f]8

s'n ;fKtflxsJofkf/ ¿ !@*=%& s/f]8

cf/P;cfO{ %^=!)

PdP;L8L $=@$

l;UgnnfO{g #=%%

@_ ahf/ k|j[lt

Nepse (Jan 01, 2014 – July09, 2015)](https://image.slidesharecdn.com/nepsetechnicalanalysisjuly05-july092015-150712080134-lva1-app6891/85/Nepse-Technical-Analysis-July-05-July-09-2015-5-320.jpg)

![#_ 6]«G8 ljZn]if0f

g]K;] kl/;"rsuPsf] ;ftfsf] z'?cftLlbgx?df (#*=)@ cªsdf /xof] . uPsf] ;ftfsf] z'?sf]

s]xLlbgdftnem/]sf] ahf/ kl5Nnf] lbgdf a9g uof] . dËnaf/ af6 a'lnz 6«]G8 b]lvgyfNof] h;sf]

kmn:j?kahf/ $=^ cªsn] dfly a9g uof] . ;+ljwfglgdf{0fsf] sfo{x?dfcfPsf] ;'wf/n] ubf{ ahf/df

;d]t o:sf] ;sf/fTds ;+s]tx? b]lvof] .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs (!#=)@

6]jfcªs @ ())

glhssf] k|lt/f]w cªs (%)=(&

k|lt/f]w cªs @ (&@

g]K;] kl/;"rsuPsf] ;ftf ;a} eGbftn (#^=&^ cªs ;Ddk'Uguof] . xfnsf] nfluglhssf] 6]jfcªsclxn] klg

(!#=)@ g} /xguPsf] 5 / ;f] cem} s]xL ;dosf] nfluoyfjt /xg ;Sg] cj:yf 5 . xfnsf] nfluglhssf] k|lt/f]w

(%)=(& g} /x]sf] 5 / /fhg}lts If]qdf b]lvb} uPsf] ;'wf/ ;+u ;+u} g]K;] kl/;"rsn] glhssf] k|lt/f]w cªs w]/}

rfF8f] kf/ ug{ ;Sg] cj:yf /x]sf] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

PdP;L8L nfO{guPsf] ;ftfsf] z'?df s]xLtnemof]{ t/ ;ftfsf] cGTolt/ km]l/ ;f] nfO{g dflyclSng]

s|dhf/L /xof] . l;UgnnfO{g ;d]t ;ftfsf] w]/} h;f] lbgdflyg} r9g] s|dhf/L g} /xof] . PdP;L8LnfO{g

tyfl;UgnnfO{g aLrsf] b'?Ldf ;d]t sdLcfPsf] cj:yf /xof] . PdP;L8L nfO{g n] l;UgnnfO{gnfO{ sf6L

tncfPsf] cj:yfdfo;n] ahf/dfa'lnz 6]«G8sf] ;+s]t ub{5 . ;ftfsf] cGTolt/ PdP;L8L nfO{g

tyfl;UgnnfO{g s|dz M $=@$ tyf #=%% cªssf] l:yltdf /xguof] .](https://image.slidesharecdn.com/nepsetechnicalanalysisjuly05-july092015-150712080134-lva1-app6891/85/Nepse-Technical-Analysis-July-05-July-09-2015-6-320.jpg)

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

cf/P;cfO{ ;ftfsf] z'?df %#=@) cªsdf /x]sf] lyof] . ;ftfsf] w]/} h;f] lbgcf/P:cfO{ dfly g} a9of] .

uPsf] s]xL ;ftfx?dfcf/P;cfO{ %) cªssf] xf/fxf/Ldf /x]sf] x'Fbfxfnsf] nfluahf/ Go"6«ncj:yfdf g}

/x]sf] ;+s]t ub{5 / cem} of] eGbfdflyhfg] xf] eg] ahf/ cf]e/–a6sf] l:yltdf k'Ug ;Sg] ;+Defjgf /x]sf]

5 .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .

xfnsf] nflu g]K;] kl/;"rsdflyNnf] af]lnªu/ Aof08sf] glhsk'u]sf] 5 . g]K;] kl/;"rstyfdWo Jof08

xfnsf] nflu ;+u ;+u} rln/x]sf] cj:yf 5 tyfdWo Jof08n] ;d]t 6]jfcªssf] sfdul//x]sf] 5 . g]K;]

kl/;"rscem} pkNnf] Jof08sf] glhshfg] xf] eg] o;n] ahf/dfcf]e/–a6 sf] l:ylt b]vfpF5 . pkNnf]

tyftNnf] Jof08 aLrsf] b'/LdfcfPsf] sdLn] ahf/dfcl:y/tfdfsdLcfPsf]

;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisjuly05-july092015-150712080134-lva1-app6891/85/Nepse-Technical-Analysis-July-05-July-09-2015-7-320.jpg)

![^_ eNo'd ;'rs -cg–Aofn]G; eNo'd_

cg–Aofn]G; eNo'd n] ahf/dflsGg] tyf a]Rg] k|];/sf] ;+s]t ub{5 . ;d|udf of] ;"rsn] ahf/ dflyuPsf]

cj:yftyftnem/]sf] cj:yfdfahf/dfsf/f]af/sf] eNo'd s:tf] /xof] ;+s]t ub{5 .

uPsf] ;ftfcg–Aofn]G; eNo'ddf g]K;] kl/;"rseGbf /fd|f] ;'wf/ b]lvof] . h;n] ahf/dfnufgLstf{x?

dfemahf/ k|ltsf] b[li6sf]0f ;sf/fTds ?kdfa'ln; /x]sf] ;+s]t ub{5 . ;ftfsf] cf};t sf/f]af/ /sddfrfxL

s]xLlu/fj6 b]lvof] hf] uPsf] ;ftf ?= #!=() s/f]8 lyof] eg] of] ;ftf ?= @%=&! s/f]8df /xguof] . ;ftf]sf]

clGtdlbgeg] sf/f]af/ /sd ?= #^=$$ /xguof] .

;du{dfM

uPsf] ;ftfsf/f]af/ lbgsf] clGtdb'O{ lbgafx]s g]K;]df a9g] s|d g} /xof] . (#*=(^ cªsdfaGbePsf]

g]K;] kl/;"rsdf *=%* -)=(#Ü_ cªssf] a[l4 /xof] . tn /x]sf] cj:yfn] ahf/dfcl:y/tfcem} sfod

/x]sf] ;+s]t ub{5 . t/ xfnsf] nflu%)–lbg] d'leËPe/]htyf@))–lbg] d'leËPe/]h ;+u ;+u} rln/x]sf]

cj:yf 5 . cf};t sf/f]af/ /sddf ;d]t ;'wf/ b]lvof] hf] uPsf] ;ftf ?= #!=() s/f]8 /xguof] / ;f]

/sd cl3Nnf] ;ftfeg] ?= @%=&! s/f]8 /x]sf] lyof] .%#=&$ cªsdf /x]sf] cf/P;cfO{ clxn] klg Go"6«n

cj:yfdf /x]sf] 5 . z"GonfO{g eGbfdfly r9]sf] PdP;L8LnfO{gn] ahf/dfa'ln; 6«]G8 /x]sf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisjuly05-july092015-150712080134-lva1-app6891/85/Nepse-Technical-Analysis-July-05-July-09-2015-8-320.jpg)

![pkNnf] tyftNnf] af]lnªu/ Jof08sf] b'/LdfcfPsf] sdLn] ahf/sf] cl:yt/tfdfsdLcfPsf] ;+s]t ub{5 .

g]K;] kl/;"rscem} pkNnf] Jof08sf] glhshfg] xf] eg] o;n] ahf/dfcf]e/–a6 sf] l:ylt b]vfpF5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisjuly05-july092015-150712080134-lva1-app6891/85/Nepse-Technical-Analysis-July-05-July-09-2015-9-320.jpg)