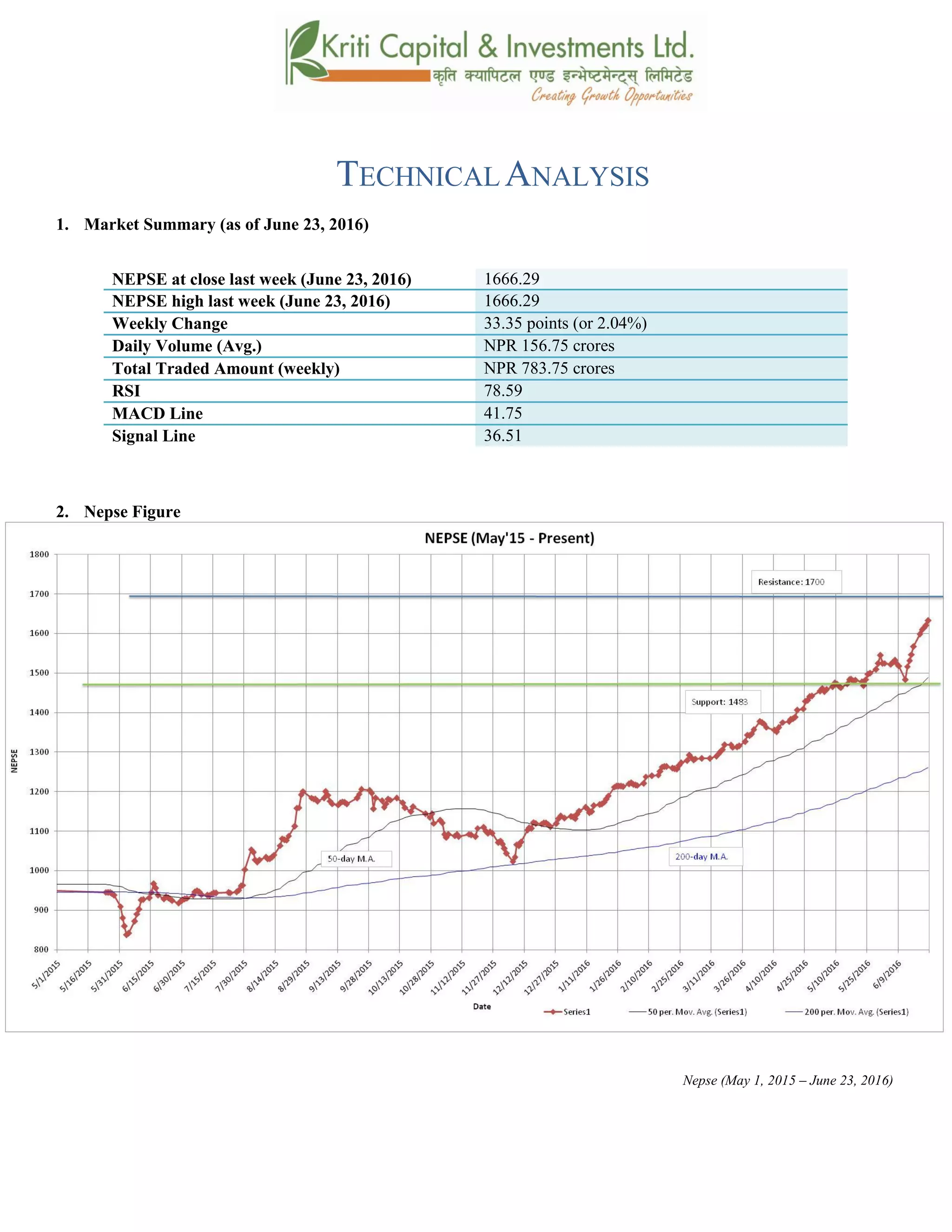

The Nepse index gained 33 points last week to close at 1666, supported by high trading volumes. Technical indicators like MACD and RSI show the market remains in a bullish trend above the 50-day and 200-day moving averages. Immediate support is at 1483 with resistance at 1700, and the bullish momentum may help break through resistance this week. Overall, market volatility has increased but conditions remain positive.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -cfiff9 (, @)&#;Ddsf]_

aGb cªs -cfiff9 (, @)&#_ !^^^=@(

pRr cªs -uPsf] ;ftf_ !^^^=@(

;fKtflxs kl/jt{g ##=#% -@=)$k|ltzt_

b}lgscf};t Jofkf/ ¿=!%^=&%s/f]8

s'n ;fKtflxsJofkf/ ¿ &*#=&% s/f]8

cf/P;cfO{ &*=%(

PdP;L8L $!=&%

l;UgnnfO{g #^=%!

@_ ahf/ k|j[lt

Nepse (Jan 1, 2015 – June 23, 2016)](https://image.slidesharecdn.com/nepsetechnicalanalysisjune19-june232016-160628043023/85/Nepse-Technical-Analysis-June-19-June-23-2016-5-320.jpg)

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftfg]K;] kl/;"rsdf##=#%cªssf] a[l4 b]lvof]h;sf] kmn:j?kahf/ !^^#=@( cªsdfaGbeof] .

;du|dfclxn] klg kl/;"rs %) lbg] d'leËPe/]h tyf @)) lbg] d'leËeGbfdfly g} rln/x]sf] cj:yf

;du|dfahf/sf] l:ylt /fd|f] b]lvG5 . ;ftfsf] s]xLlbgdftnem/]sf] ahf/ km]l/ dfly g} r8]sf] cj:yf /xof]

.

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !$*#

6]jfcªs @ !$^#

glhssf] k|lt/f]w cªs !&))

uPsf] ;ftf g]K;] kl/;"rsn]cfkmgf] Oltxf; s} pRrcªs !^^^=@( nfO{ kf/ u/]sf] cj:yf /xof] . xfnsf]

cj:yfdfahf/n] rfF8} g} !&)) cªsnfO{ ;d]t kf/ ug]{ ;+s]t b]lvG5 t/ ;f] aLrdfahf/df s]xL s/]S;g

b]vg ;Sg] ;+Defjgfsfod g} 5 .xfnsf] cj:yfdfglhssf] 6]jfcªstyfglhssf] k|lt/f]w cªss|dz M !$*#

tyf !&)) g} /x]sf] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

uPsf] ;ftfsf] z'?df PdP;L8L nfO{gtyfl;UgnnfO{g s|dzM#*=^)tyf#!=^(sf] l:yltdf /x]sf] lyof]/

;ftfsf] cGTodf PdP;L8L nfO{g tyfl;UgnnfO{g s|dzM$!=&%tyf#^=%! /x]sf]] 5 . l;UgnnfO{g

eGbfdflyrln/x]sf] PdP;L8L nfO{gn] ahf/sf] a'lnz 6]«G8df /x]sf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisjune19-june232016-160628043023/85/Nepse-Technical-Analysis-June-19-June-23-2016-6-320.jpg)

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

cf/P;cfO{uPsf] ;ftfsf] z'?df&$=!$cªsdf/x]sf] lyof] .cf/P;cfO{ &) cªseGbfdflyhfg'n] ahf/

cf]e/a6 l:yltdf /x]sf] 5 . ;ftfsf] cGTodf&*=%(cªsdf /x]sf] cf/P;cfO{ ahf/dflsGg] xf]8afhL lgs}

g} /x]sf] ;+s]t lbG5 .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .

g]K;] kl/;"rsuPsf] ;ftfsf] km]l/ pkNnf] Aof08 glhsk'u]sf] cj:yfn] ahf/dflsGg] xf]8afhL lgs} g}

/x]sf] ;+s]t ub{5 . ;fy} pkNnf] tyftNnf] Jof08 aLrsf] b'/L a9gfn] ;d]t ahf/sf] cl:yt/tfdfcem}

a[l4 ePsf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisjune19-june232016-160628043023/85/Nepse-Technical-Analysis-June-19-June-23-2016-7-320.jpg)

![;du{dfM

uPsf] ;ftf g]K;] kl/;"rsdf##=#%cªssf] a[l4 b]lvof]h;sf] kmn:j?kahf/ !^^^=@(cªsdfaGbeof] . clxn]

klg kl/;"rs %) lbg] d'leËPe/]h tyf @)) lbg] d'leËeGbfdflyuO{/x]sf] cj:yfn] ahf/ ;sf/fTds l:yltdf

g} /x]sf] ;+s]t ub{5 . PdP;L8L nfO{g l;UgnnfO{g eGbfdflycfPsf] cj:yfn] ahf/ a'lnz 6]«G8df /x]sf] ;+s]t

ub{5 . &) cªseGbfdfly /x]sf] cf/P;cfO{n] klgahf/ cf]e/ a6 l:yltdf /x]sf] ;+s]t ub{5 .;fy} pkNnf]

tyftNnf] Jof08 aLrsf] b'/LdfcfPsf] a[l4n] ahf/sf] cl:y/tfeg] lgs} g} a9]sf] ;+s]t ub{5 .xfnsf]

cj:yfdfgofF 6]jfcªstyfk|lt/f]w cªs s||dzM !$*# tyf !&)) g} sfod /x]sf] 5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisjune19-june232016-160628043023/85/Nepse-Technical-Analysis-June-19-June-23-2016-8-320.jpg)