- The Nepse index gained 112.5 points last week to close at a record high of 1200.92.

- Trading volume and amount were higher than the previous week, signaling continued bullish momentum in the market.

- Most technical indicators like MACD, RSI, and Bollinger Bands show the market is in an overbought state with high volatility, but continuing an upward trend.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -ebf}#, @)&@ ;Ddsf]_

aGb cªs -ebf}#, @)&@_ !@))=(@

pRr cªs -uPsf] ;ftf_ !@))=(@

;fKtflxs kl/jt{g !!@=)% -(=(*k|ltzt_

b}lgscf};t Jofkf/ ¿=*)=##s/f]8

s'n ;fKtflxsJofkf/ ¿ $)!=^^ s/f]8

cf/P;cfO{ ()=)(

PdP;L8L %@=^!

l;UgnnfO{g $)=@&

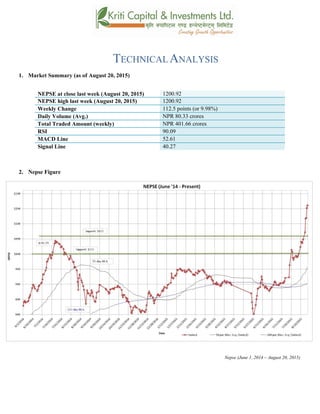

@_ ahf/ k|j[lt

Nepse (June 1, 2014 – August20, 2015)](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust16-august202015-150825051637-lva1-app6891/85/Nepse-Technical-Analysis-August-16-August-20-2015-5-320.jpg)

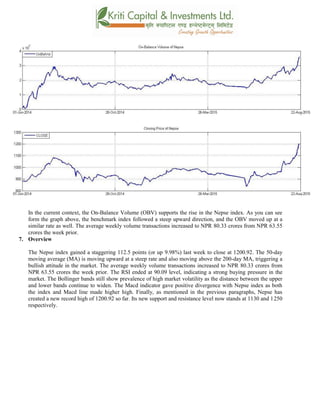

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftf g]K;] kl/;"rs ;ftf ;a} sf/f]af/ lbg a9g] s|dhf/L g} /xof] . g]K;]dfePsf] sf/f]af/n] ;d]t

kl/;"rs a9g] s|dnfO{ ;fylbof] . g]K;] kl/;"rsn] !!@=% cªssf] pknAwLxfl;n u/of] h;sf] kmn:j?k

g]K;] !@))=(@ cªsdfaGbeof] . g]K;]n] cfkmgf] glhssf] k|lt/f]w cªsx? ;a} ;d]t kf/ u/]sf] cj:yf

/xof] . uPsf] ;ftfsf] cGTolt/ g]K;]n] cfkmgf] Oltxf;sf] pRrcªs !!&%=%%kf/ u/L dfly a9]sf] cj:yf

/xof] . ;fy} g]K;] kl/;"rsxfnsf] nflu %) lbg] d'leËPe/]h tyf @)) lbg] d'leËPe/]h eGbfdfly g}

lxl8/x]sf] cj:yfn] ahf/df k'/} ?kdfa'lnz 6]«G8 /x]sf] ;+s]t ub{5 .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !!#)

6]jfcªs @ !!))

glhssf] k|lt/f]w cªs !@%)

g]K;] kl/;"rsn] cfkmgf] glhssf] k|lt/f]w cªsx? ;d]t kf/ u/]sf] cj:yf /xof] . uPsf] ;ftfsf] cGtolt/

g]K;] kl/;"rsn] cfkmgf] Oltxf; s} pRrlaGb' !!&%=%%cªskf/ u/L dfly a9]sf] cj:yf /xof] . xfnsf] nflu

6]jfcªstyfk|lt/f]w cªs !!#) tyf !@%) /x]sf] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

PdP;L8LnfO{gtyfl;UngnfO{g uPsf] ;ftfklg a9g] s|dhf/L g} /xof] .PdP;L8L nfO{g l;UgnnfO{g

eGbfdfly g} /x]sf] cj:yf /xof] / b'O{ nfO{g aLrsf] b'/L ;d]t a9L /x]sf] cj:yfn] ahf/ xfnsf] nflu k'/}

?kdfa'lnz /x]sf] cj:yf /xof] . xfnsf] nfluPdP;;L8L nfO{g tyfl;UgnnfO{g %@=^!tyf$)=@&df /x]sf]

5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust16-august202015-150825051637-lva1-app6891/85/Nepse-Technical-Analysis-August-16-August-20-2015-6-320.jpg)

![v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_

cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

uPsf] ;ftfsf/f]af/sf] w]/}h;f] lbgcf/P;cfO{ *) cªsf] n]endf g} /xguof]h;nfO{ lgs} pRrcf]e/ a6

cj:yf dflgG5 .xfndfq g]kfn /fi6« a}+s af6 3f]if0ff ul/Psf] df}lb|sgLltsf] sf/0f nufgLstf{x? dfem

b]lvPsf] pT;fx :j?kahf/dflsGg] xf]8afhL lgs} g} b]lvof] . ;ftfsf] z'?df*@=*%cªsdf /x]sf]

cf?P;cfO{ ;ftfsf] cGTodf&=@$cªsn] a9]/()=)(cªsdf /xguof] .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .

g]K;] kl/;"rsuPsf] ;ftfpkNnf] tyfdWoaf]lnªu/ Aof08sf] aLrdfg} /xguof] / ;ftfsf] cGTolt/

pkNnf] Aof08nfO{ sf6L dfly /x]sf] cj:yf /xof] .g]K;] kl/;"rstyf;a} Aof08x? xfnsf] nfludflylt/

g} uO{/x]sf] cj:yf /xof] .pkNnf] tyftNnf] Jof08 aLrsf] a9g uPsf] b'/Ln] ahf/dfcl:y/tf a9g

uPsf] ;+s]t ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust16-august202015-150825051637-lva1-app6891/85/Nepse-Technical-Analysis-August-16-August-20-2015-7-320.jpg)

![^_ eNo'd ;'rs -cg–Aofn]G; eNo'd_

cg–Aofn]G; eNo'd n] ahf/dflsGg] tyf a]Rg] k|];/sf] ;+s]t ub{5 . ;d|udf of] ;"rsn] ahf/ dflyuPsf]

cj:yftyftnem/]sf] cj:yfdfahf/dfsf/f]af/sf] eNo'd s:tf] /xof] ;+s]t ub{5 .

xfnsf] cj:yfdfcg–Aofn]G; eNo'dn] ;d]t kl/;"rssf] a[l4df ;fylbO{/x]sf] cj:yf /xof] . cg–Aofn]G;

eNo'dtyf g]K;] kl/;"rsb'j} ;"rfÍx? nueu Pp6} l:yltdfdfly a9L /x]sf] cj:yf /xof] . ;ftfsf] cf};t

sf/f]af/ /sddfa[l4 b]lvof]h'guPsf] ;ftfsf] cl3Nnf] ;ftf ?= ^#=%% s/f]8 lyof] eg] uPsf] ;ftf ?= *)=##

s/f]8df /xguof] .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust16-august202015-150825051637-lva1-app6891/85/Nepse-Technical-Analysis-August-16-August-20-2015-8-320.jpg)

![;du{dfM

uPsf] ;ftf g]K;] kl/;'rsdf !!@=% cªssf] a[l4 b]lvof] h;sf] kmn?j?k kl/;"rs !@))=(@

dfaGbeof] . xfnsf] cj:yfdf%) lbg] d'leËPe/]h @)) lbg] d'leËPe/]hnfO{ sf6L dfly lxl8/x]sf]

cj:yf /x]sf] 5 h;n] ahf/cem} k"0f{ ?kdfa'lnz 6]«G8df /x]sf] ;+s]t ub{5.cf};tsf/f]af/ /sd ?

^#=%% s/f]8af6 a9]/ ?= *)=## s/f]8 /xguof] . ()=)( cªsdf /x]sf] cf/P;cfO{n] xfnahf/ lgs}

alnof] cf]e/ a6 l:yltdf /x]sf] ;+s]t ub{5 . pkNnf] tyftNnf] af]lnªu/ Jof08 aLrsf] a9g uPsf]

b'/Ln] ahf/dfcl:y/tf a9g uPsf] ;+s]t ub{5 . g]kfnsf] kF"hLahf/sf] Oltxf;sf] ;a} eGbfpRrcªs

!!&%=%%nfO{ kf/ u/L dflyk'u]sf] cj:yfn] xfnahf/ k"0f{ ?kdfa'lnz 6]«G8df /x]sf] ;+s]t ub{5 .

h;sf] kmn:j?kxfnsf] nflugofF 6]jfcªstyfk|lt/f]w cªs!!#)tyf !@%) /x]sf] 5 .](https://image.slidesharecdn.com/nepsetechnicalanalysisaugust16-august202015-150825051637-lva1-app6891/85/Nepse-Technical-Analysis-August-16-August-20-2015-9-320.jpg)