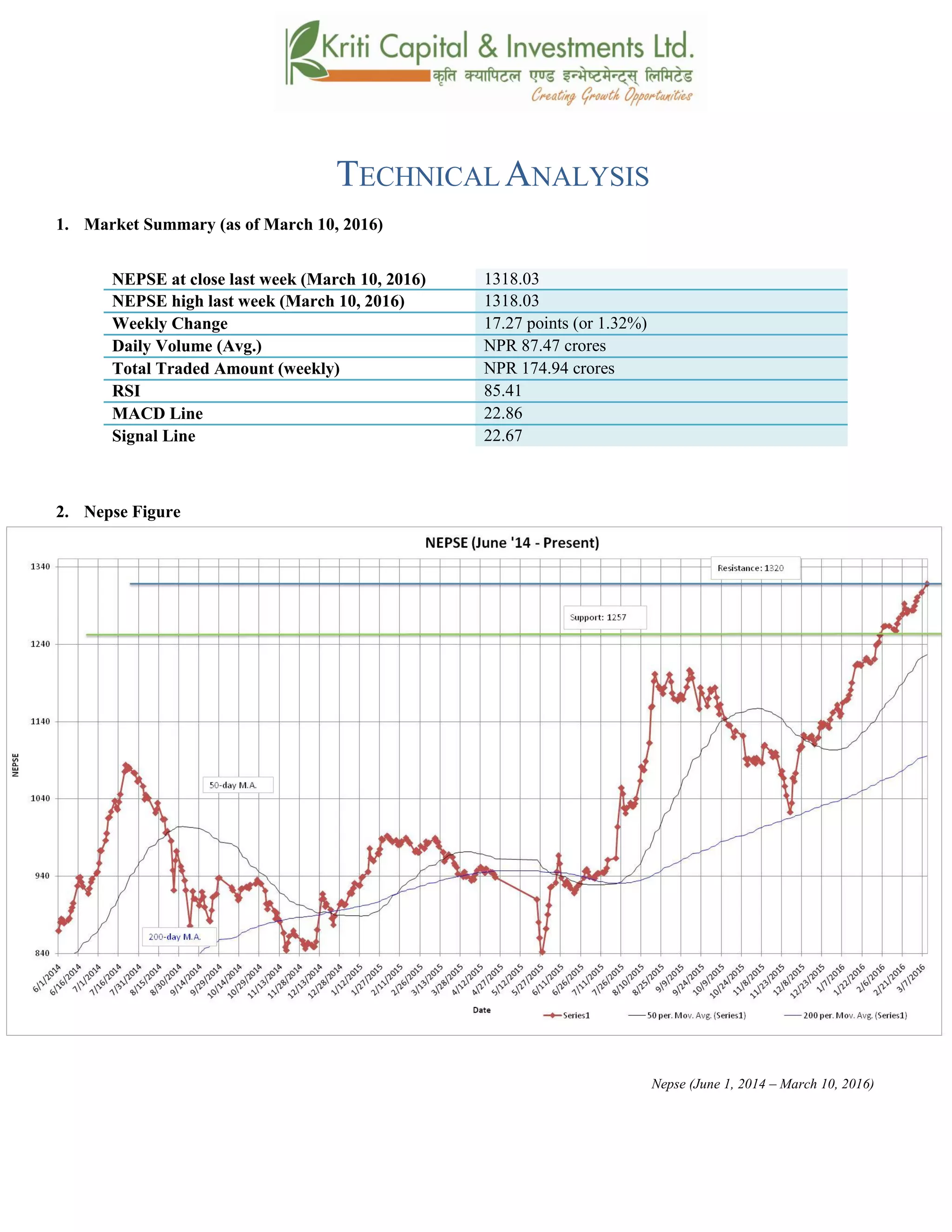

- The Nepse index gained 17.27 points last week to close at 1318.03, reaching a new all-time high and close to the immediate resistance level of 1320.

- Most technical indicators continue to signal bullish momentum, with the RSI hovering above 70 and the MACD line moving above the signal line.

- Volumes increased compared to the previous week, supporting the index's upward movement, while the Bollinger bands show a minor rise in volatility.

![k|fljlwsljZn]if0f

!_ahf/ ;f/f+z -kmfNu'0f@&, @)&@ ;Ddsf]_

aGb cªs - kmfNu'0f@&, @)&@_ !#!*=)#

pRr cªs -uPsf] ;ftf_ !#!*=)#

;fKtflxs kl/jt{g !&=@& -!=#@k|ltzt_

b}lgscf};t Jofkf/ ¿=*&=$&s/f]8

s'n ;fKtflxsJofkf/ ¿ !&$=($ s/f]8

cf/P;cfO{ *%=$!

PdP;L8L @@=*^

l;UgnnfO{g @@=^&

@_ ahf/ k|j[lt

Nepse (June 1, 2014 – March 10, 2016)](https://image.slidesharecdn.com/nepsetechnicalanalysismarch6-march102016-160313045150/85/Nepse-Technical-Analysis-March-6-March-10-2016-5-320.jpg)

![#_ 6]«G8 ljZn]if0f

uPsf] ;ftfklgg]K;] kl/;"rsdf a9g] s|dhf/L g} /xof] .b'O{ lbgdfqsf/f]af/ x'Fbfklg g]K;] kl/;"rsdf

!&=@&cªssf] a[l4 b]lvof] h;sf] kmn?j?kahf/ !#!*=)# cªsdfaGbeof] h'gxfnsf] glhssf] k|lt/f]w

cªssf] lgs} glhs /xof] . clxn] klg g]K;] kl/;"rsnfO{ aLdf If]qn] dflytfGg] s|dsfod g} /xof] . clxn]

klg kl/;"rs %) lbg] d'leËPe/]h tyf @)) lbg] d'leËeGbfdfly g} rln/x]sf] cj:yf ;du|dfahf/sf]

l:ylt /fd|f] b]lvG5 / ahf/ clxn] klga'lnzcj:yfdf g} /x]sf] ;+s]t ub{5 .

$_ 6]jftyfk|lt/f]w cªs

glhssf] 6]jfcªs !@%&

6]jfcªs @ !@!^

glhssf] k|lt/f]w cªs !#@)

uPsf] ;ftfg]K;] kl/;"rsn]cfkmgf] Oltxf; s} pRrlaGb' xfl;n u/]sf] cj:yf /xof] . h;sf] kmn:j?kahf/n]

!#)) cªseGbfdfly g} /xg ;kmneof] . xfnsf] l:yltdfahf/n] cfkmgf] glhssf] k|lt/f]w cªs rfF8} g} kf/

ug{ ;Sg] ;+Defjgfalnof] /x]sf] 5 .

%_ g]K;] 6]«G8 ;"rs

s_ d'leª Pe/]hsGeh]{G; 8fOeh]{G; -PdP;L8L_

PdP;L8Ldf b'O{ cf]6f /]vf x'G5g, h;df Pp6fn] ahf/sf] lbzf kl/jt{gsf] ;+s]t u5{ eg] csf]{n] ahf/sf]

k|j[lQ -6«]08_ b]vfpg] u5{ . olb PdP;L8L /]vfn] l;Ung /]vfnfO{ tnaf6 dfly sf6]dfo;nfO{ ;sf/fTds

;+s]tsf ?kdflnO{G5 / o;n] z]o/x? lsGg] ;+s]t ub{5 .

uPsf] ;ftfsf] z'?df PdP;L8L nfO{gtyfl;UgnnfO{g s|dzM @!=(* tyf @@=^#sf] l:yltdf /x]sf] lyof] .

clxn] klgb'j} nfO{g ;Fu ;Fu} w]/} g} glhsrln/x]sf] cj:yf /xsf] 5 . b'O{nfO{g aLrsf] b'/L

s]jn)=$^cªssf] /x]sf] 5 .clxn]sf] cj:yfdfl;UngnfO{g PdP;L8L eGbfxNsftn /x]sf] 5 /

cfufdLlbgx?dfPdP;L8L nfO{g cem} a9g] s|dhf/L /x]dfo;n] ahf/ k"0f{ ?kdfa'lnz l:yltd /x]sf] ;+s]t

ub{5 .

;ftfsf] cGTodfPdP;L8L tyfl;UgnnfO{g s|dzM @@=*^tyf @@=^&cªssf] l:yltdf /xgk'Uof] .

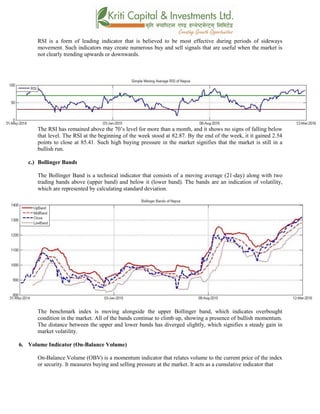

v_ l/n]l6j :6«]Gy OG8]S; -cf/P;cfO{_](https://image.slidesharecdn.com/nepsetechnicalanalysismarch6-march102016-160313045150/85/Nepse-Technical-Analysis-March-6-March-10-2016-6-320.jpg)

![cf/P;cfO{ k|fljlwsljZn]if0fsf] o:tf] cf}hf/ xf], h;nfO{ Pstlkm{ ?kdfrln/x]sf] ahf/dfJofkf/ /0fgLlt

agfpg a9L pkof]uL dflgG5 . To;}u/L, o;n] ahf/dfvl/b / ljlqmsf] :ki6 ;+s]t b]vfpg] u5{ .

xfnsf] cj:yfdfuPsf] Ps dlxgf b]lv g} cf/P;cfO{ &) cªseGbfdflysf] xf/fxf/L d} /x]sf] 5 / hf] xfn

t'?Gt} tn l:ylt b]lvb}g . ;ftfsf] z'?df*@=*&cªsdf /x]sf] cf/P;cfO[{ ;ftfsf] cGTodf

*%=$!cªsaGbeof] . xfnsf] cf]e/ a6 cj:yfdfahf/ clxn] klga'lnzcj:yfdf g} /x]sf] 5 .

u_ af]lnªu/ Aof08

af]lnªu/ Aof08 Ps k|fljlwsljZn]if0f ;"rsxf] h;df @!–lbg] d'leËPe/]hsf ;fyb'O{ Aof08 -Pp6f

dfly_ / Pp6f tn_ x'G5g . lo Aof08x?n] cl:y/tfsf] ;+s]t ub{5g, h'g :6fG88{ 8]leP;g u0fgf

u/]/ kQfnufO{G5 .

g]K;] kl/;"rsuPsf] ;ftfpkNnf] Aof08 ;Fu ;Fu} rln/x]sf] cj:yfn] ahf/ a'lnz 6]«G8df /x]sf] ;+s]t

ub{5 / h;sf] kmn:j?kahf/dflsGg] xf]8afhLdf /x]sf] l:ylt b]lvG5 . pkNnf] Aof08 ;Fu ;Fu} c?

Aof08x? klgdfly g} uO{/x]sf] l:yltn] ahf/ a'lnz g} /x]sf] ;+s]t ub{5 . pkNnf] tyftNnf] Jof08

aLrsf] b'/Ldfs]xL km/flsnf] kg b]lvgyfn]sf]n]o;n] ahf/sf] cl:ylt/tf km]l/ la:tf/} a9g ;Sg] ;+s]t

ub{5 .](https://image.slidesharecdn.com/nepsetechnicalanalysismarch6-march102016-160313045150/85/Nepse-Technical-Analysis-March-6-March-10-2016-7-320.jpg)

![;du{dfM

uPsf] ;ftf g]K;] kl/;"rsdf!&=@&cªssf]] a[l4 b]lvof] h;sf] kmn:j?k

kl/;"rs!#!*=)#cªsdfaGbeof]hf] g]K;]sf] O{ltxf; s} clxn] ;Ddsf] g} pRrlaGb' /xof] .

clxn]klgkl/;"rs %) lbg] d'leËPe/]htyf @)) lbg] d'leËeGbfdflyuO{/x]sf] cj:yfn] ahf/ ;sf/fTds

l:yltdf g} /x]sf] ;+s]t ub{5 .*) cªssf]xf/fxf/Ldfrln/x]sf]cf/P;cfO{n] clxn] klgahf/ cf]e/a6

l:yltdf /x]sf] ;+s]t ub{5 . af]lnªu/ Aof08n] ahf/sf]a'lnz l:ylt ;Fu} ahf/sf]cl:yt/tfeg] la:tf/}

a[l4cfPsf] ;+s]t ub{5 . xfnsf] cj:yfdfgofF 6]jfcªstyfk|lt/f]w cªs s||dzM !@%&tyf !#@) /x]sf] 5

.](https://image.slidesharecdn.com/nepsetechnicalanalysismarch6-march102016-160313045150/85/Nepse-Technical-Analysis-March-6-March-10-2016-8-320.jpg)