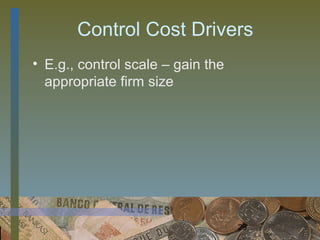

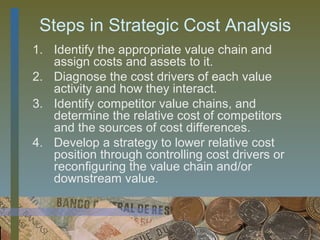

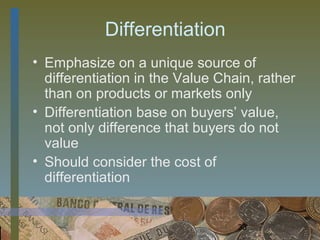

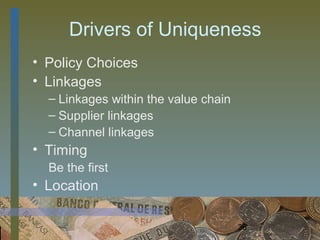

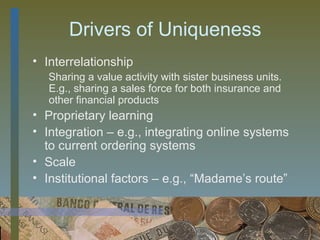

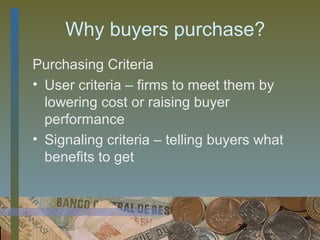

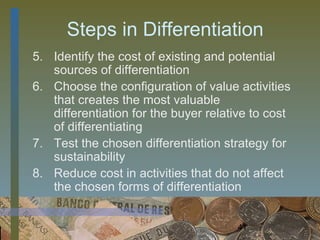

The document discusses Michael Porter's analysis of competitive advantage through his concept of the value chain. It provides an overview of Porter's view that competitive advantage can be achieved through either cost leadership or differentiation. It then explains Porter's value chain framework which identifies primary and support activities that can contribute to cost leadership or differentiation. The document outlines Porter's perspectives on analyzing costs, identifying cost drivers, and reconfiguring activities to achieve a competitive advantage through lower costs. It also discusses differentiating products and services in a way that creates value for buyers. The goal is to shift competition from red oceans of head-to-head competition to blue oceans of creating uncontested market space.