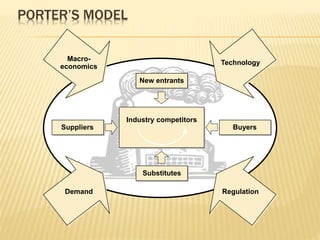

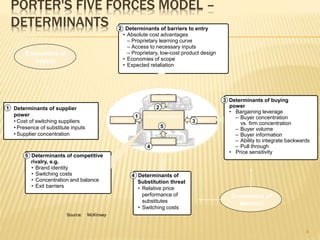

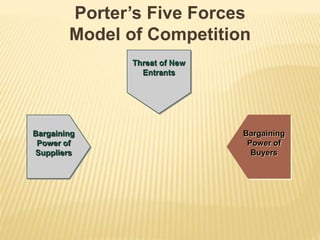

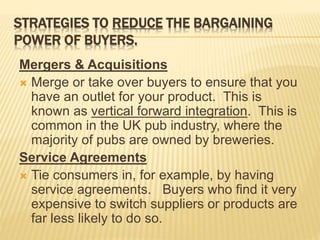

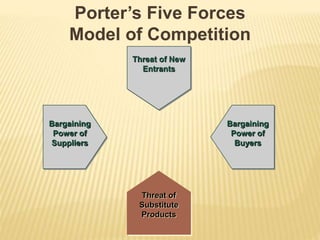

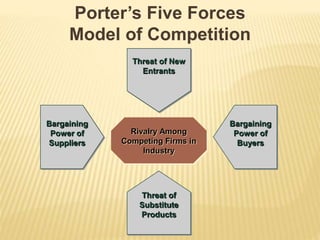

Porter's Five Forces model examines five key competitive forces that shape every industry: the threat of new entrants, the power of suppliers, the power of buyers, the threat of substitutes, and competitive rivalry among existing competitors. The model helps analyze an industry's structure to determine its attractiveness and develop appropriate business strategies. For example, strategies to reduce supplier bargaining power include vertical integration and diversifying suppliers. The model is useful for understanding an industry's dynamics as the five forces vary in intensity across industries.