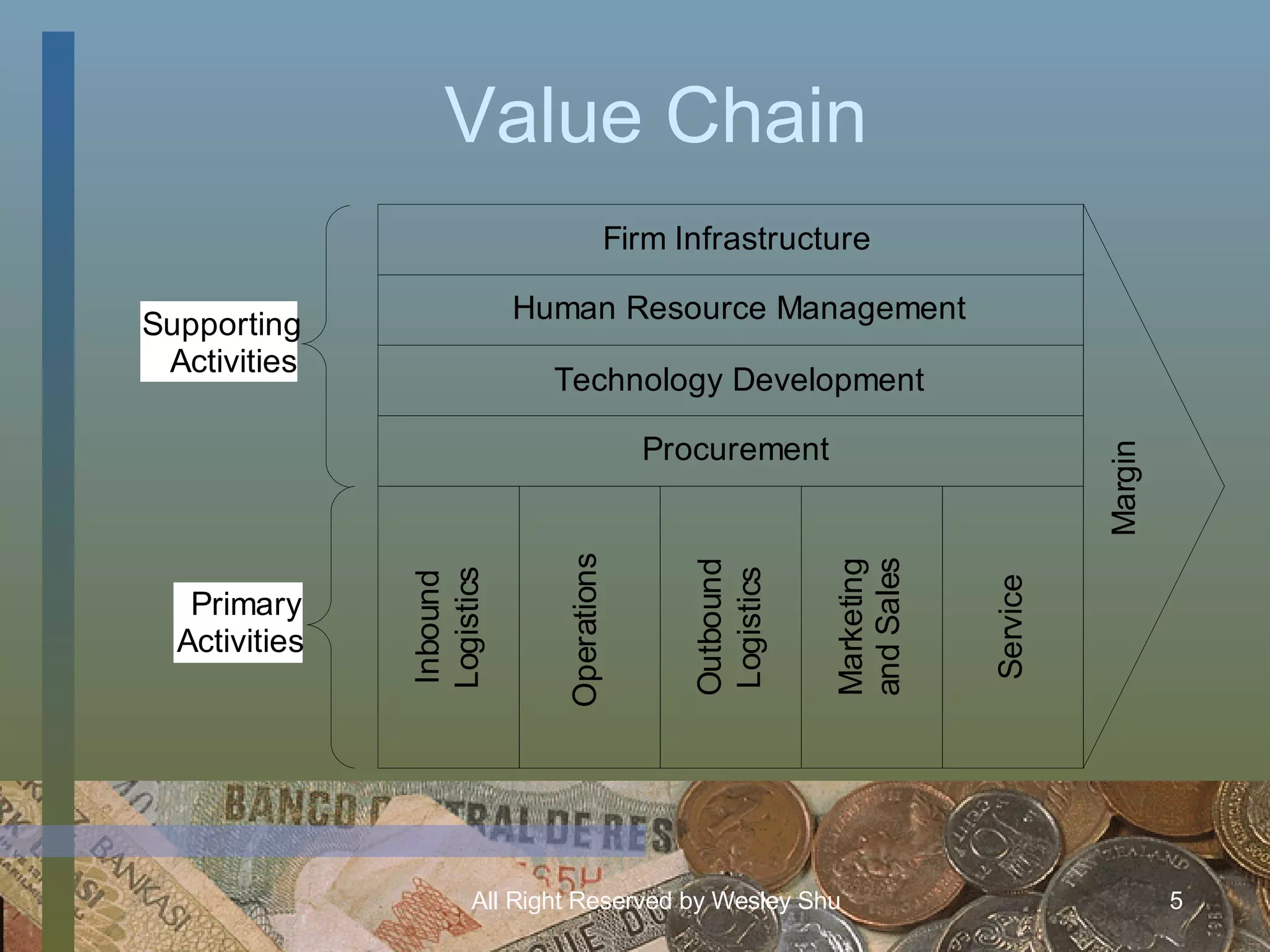

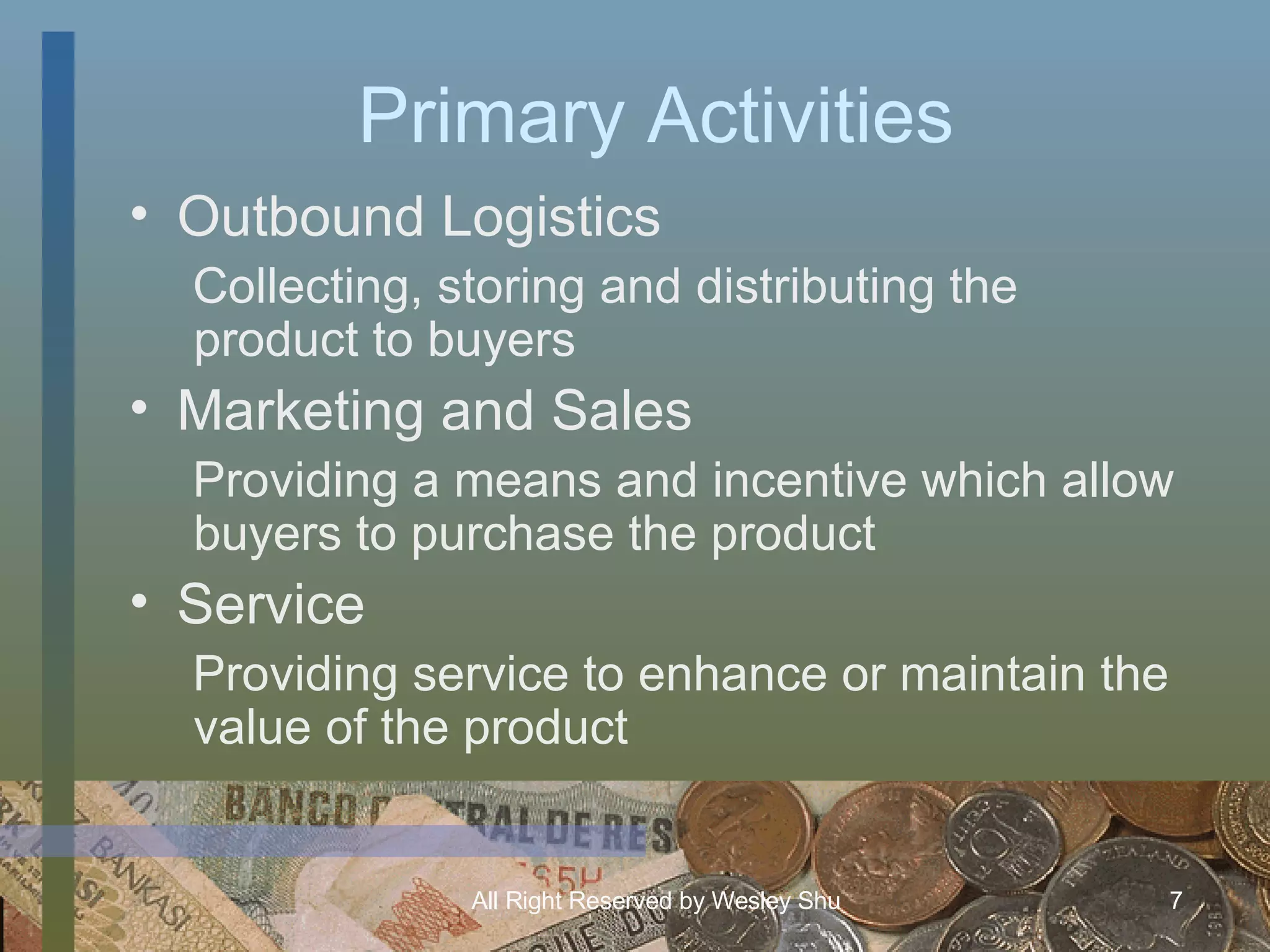

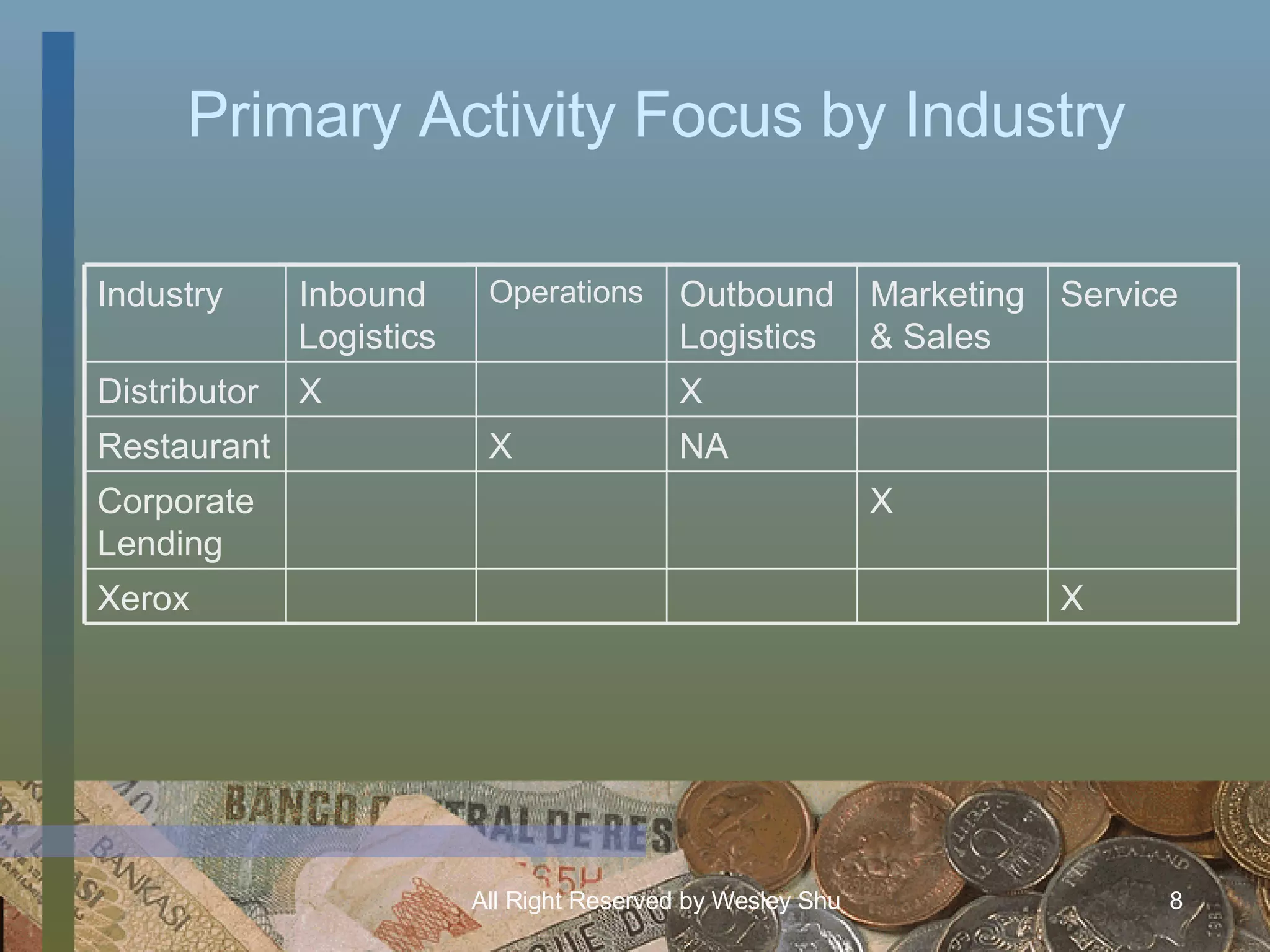

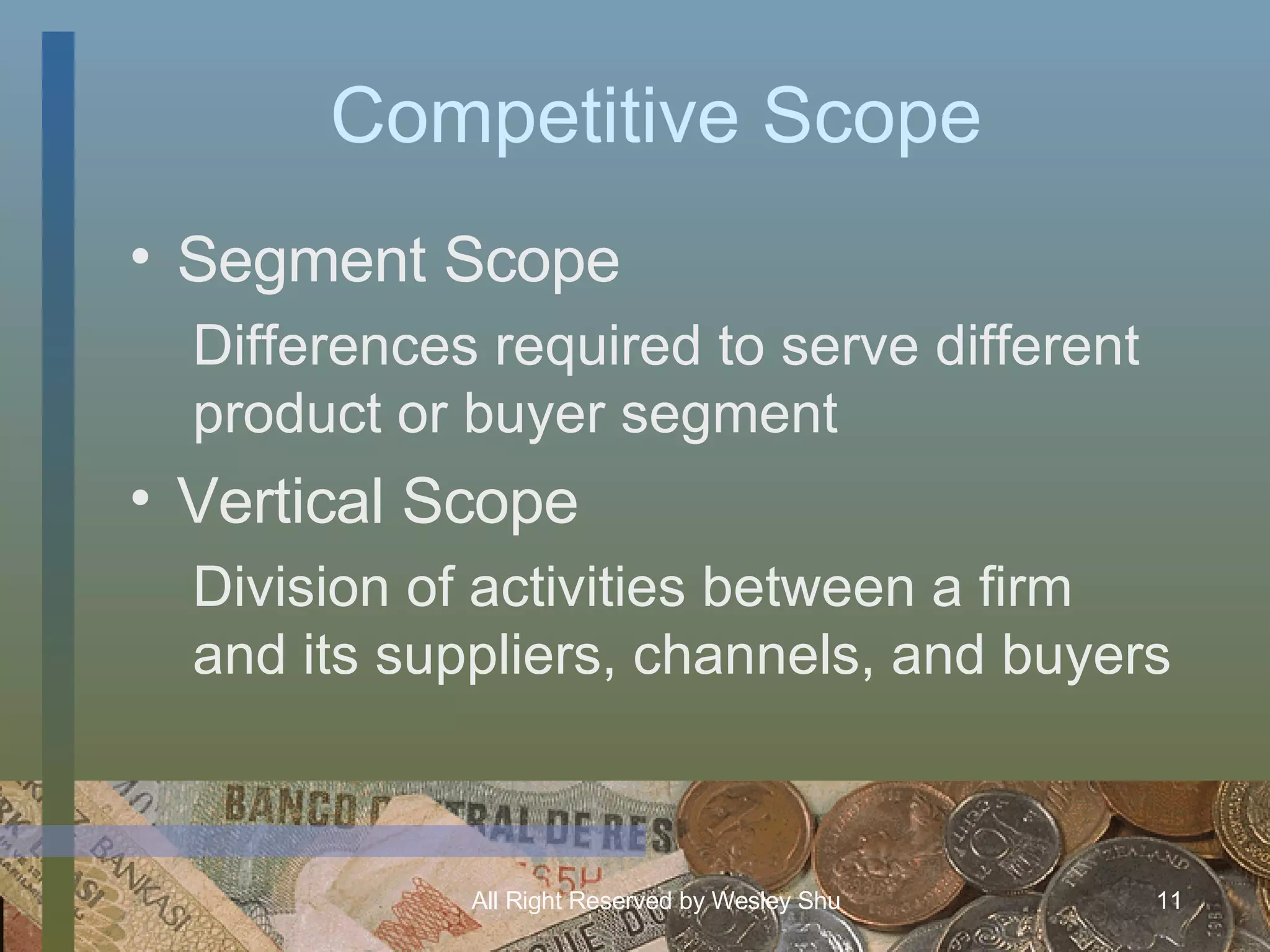

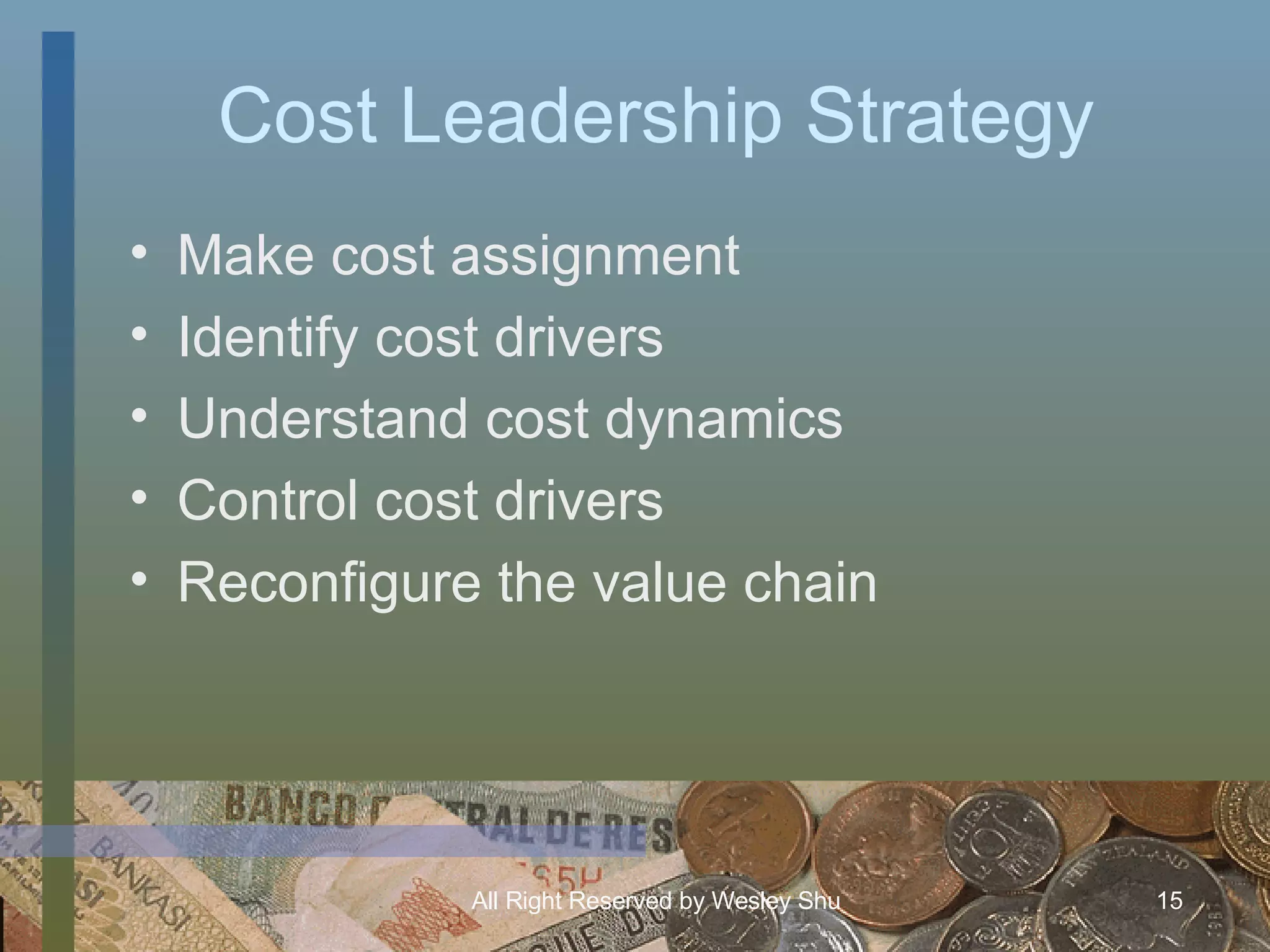

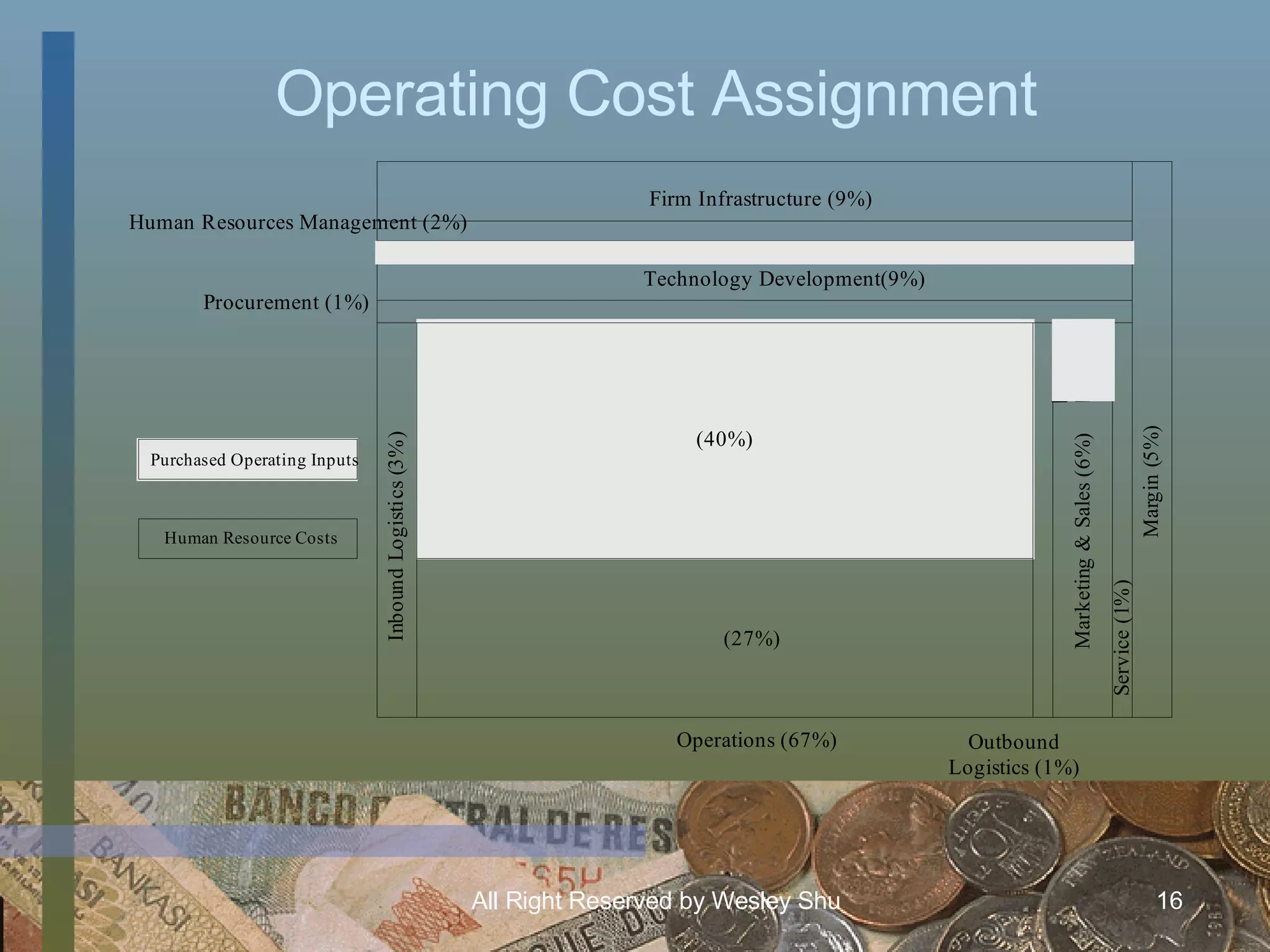

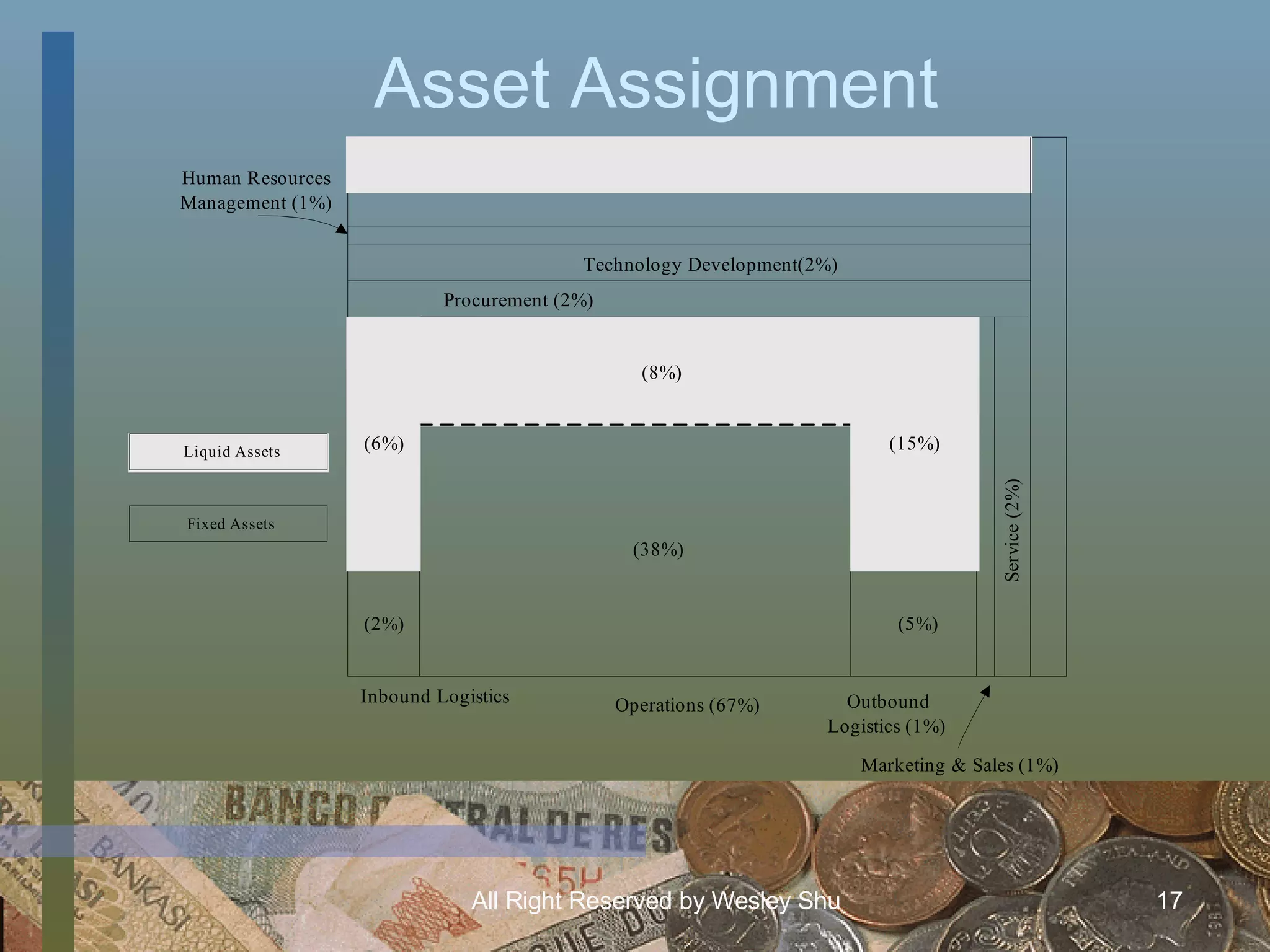

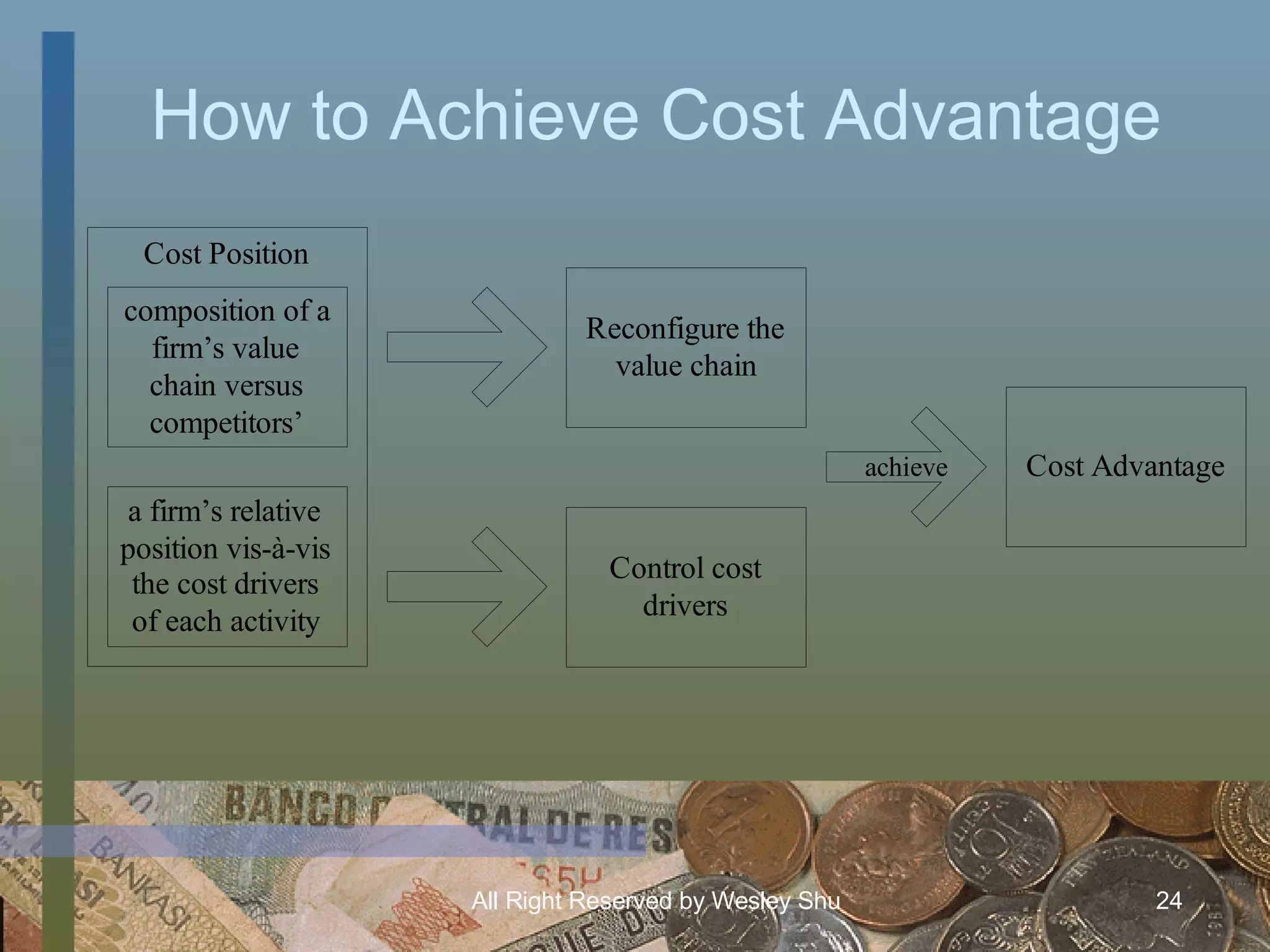

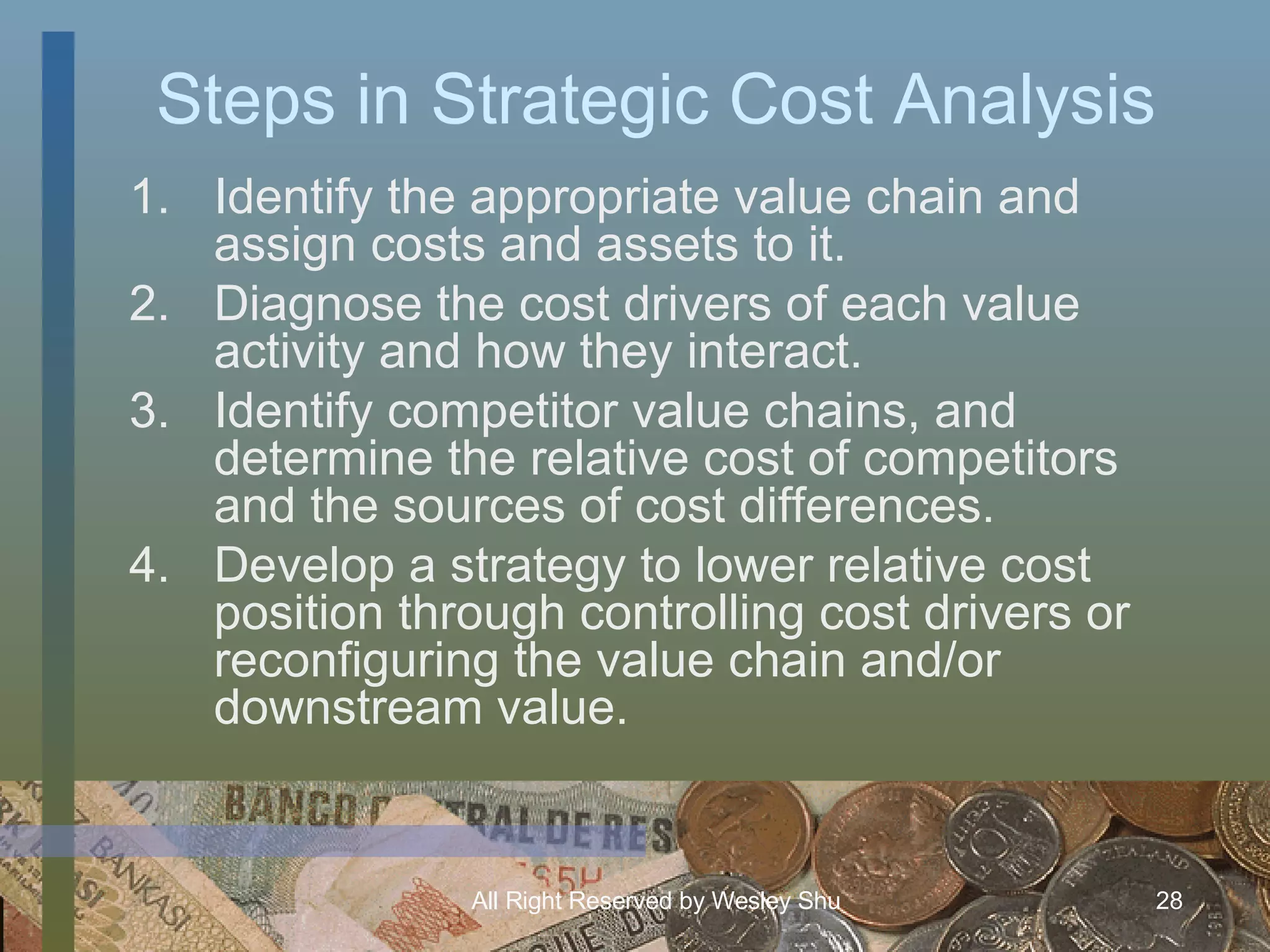

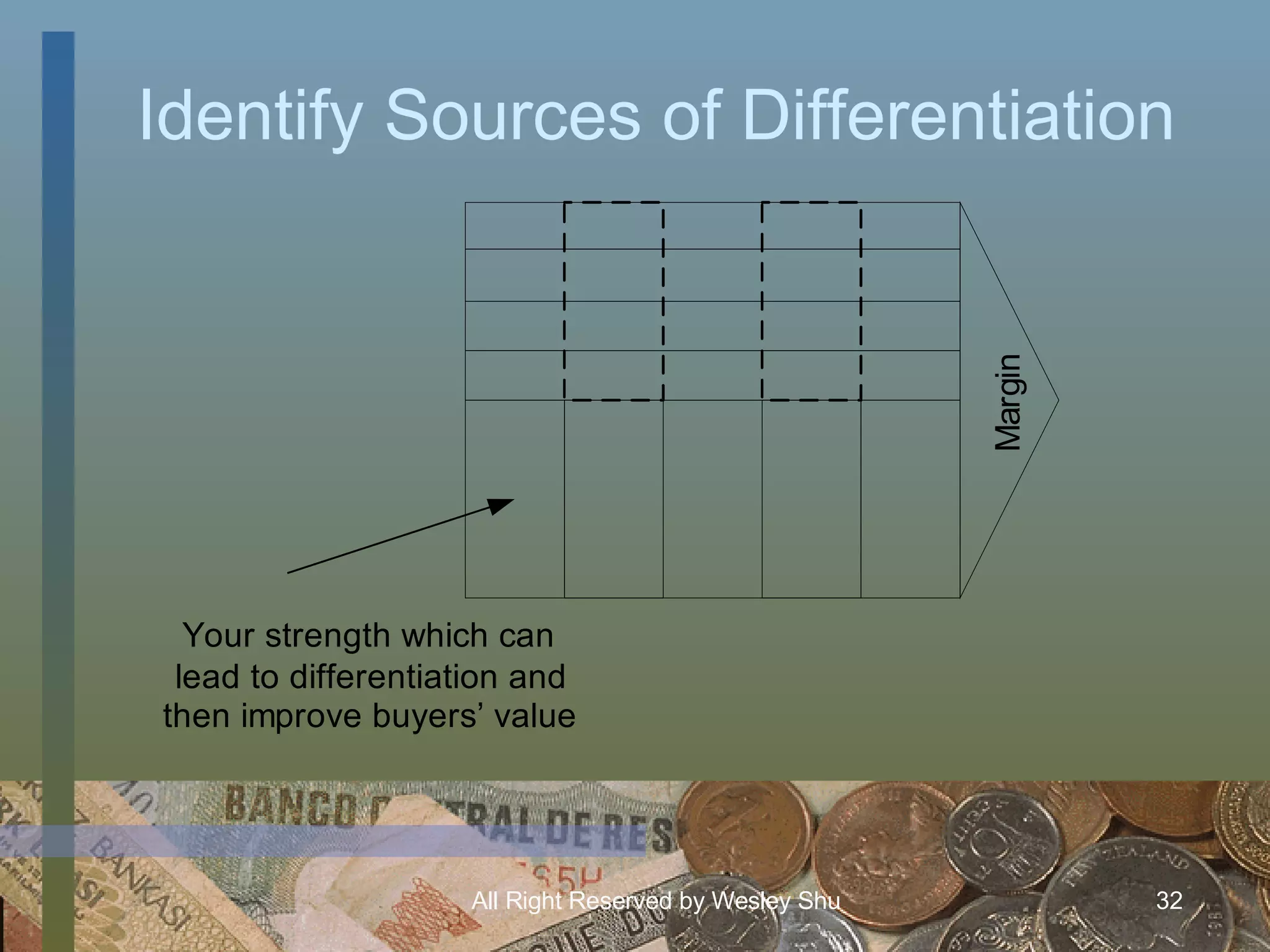

The document discusses Michael Porter's concepts of competitive advantage and value chain analysis. It explains that firms can achieve competitive advantage through cost leadership or differentiation. Value chain analysis involves identifying activities that contribute to these strategies and analyzing the sources of competitive advantage. Primary and support activities that make up a firm's value chain are described. Cost leadership is achieved by controlling cost drivers through optimizing activities in the value chain. Differentiation is achieved by emphasizing unique sources of differentiation in the value chain to create value for buyers.