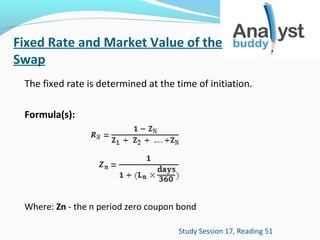

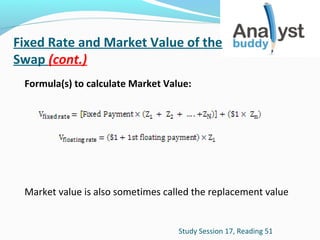

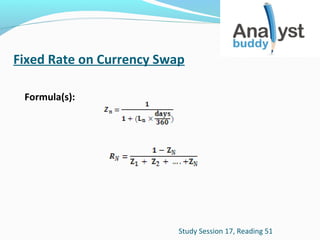

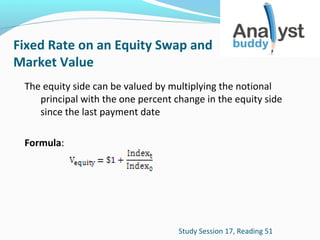

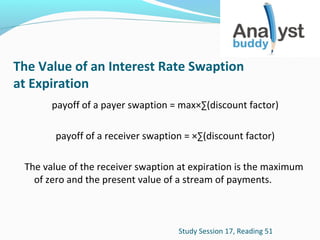

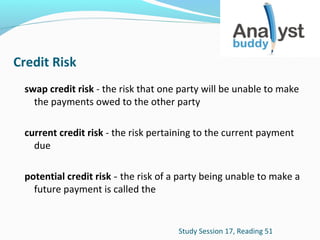

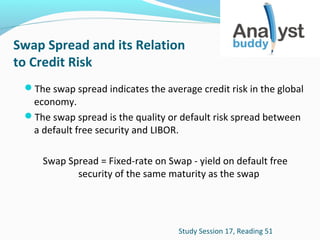

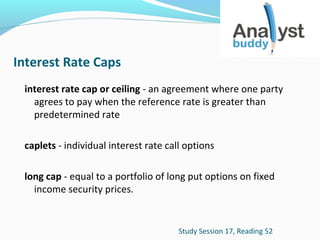

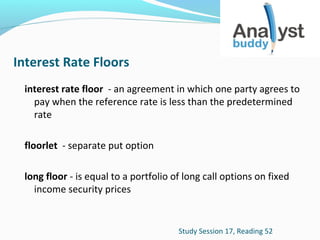

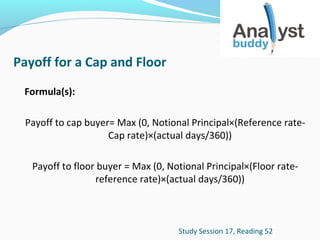

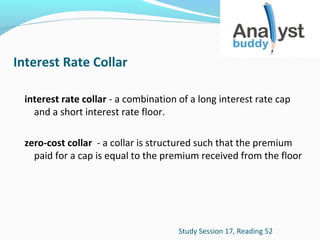

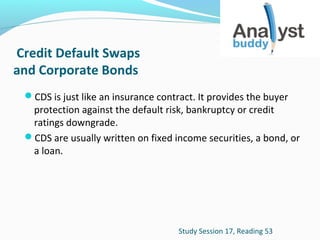

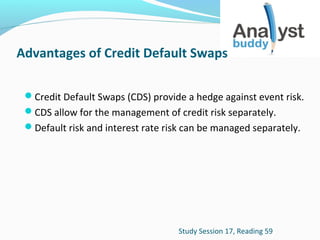

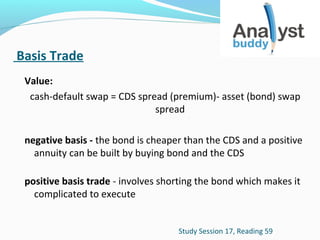

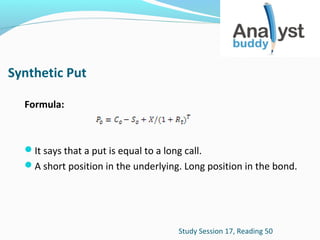

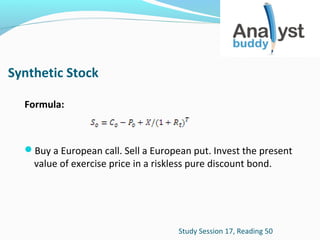

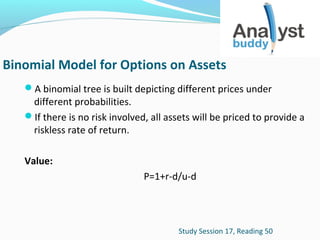

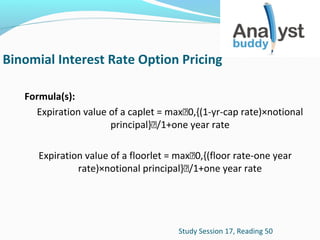

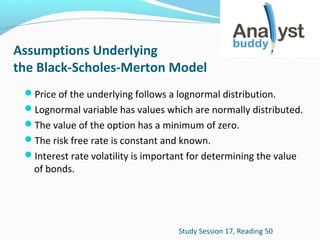

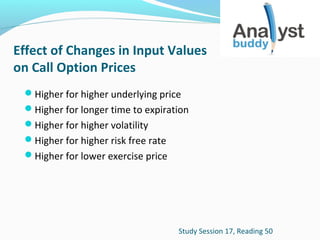

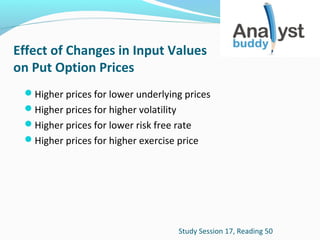

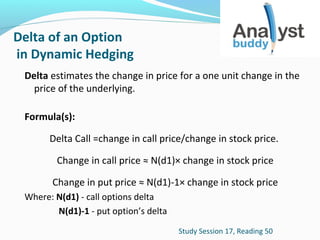

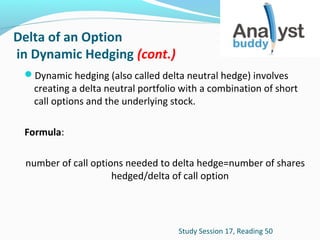

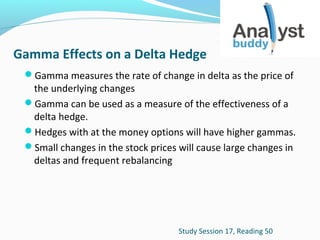

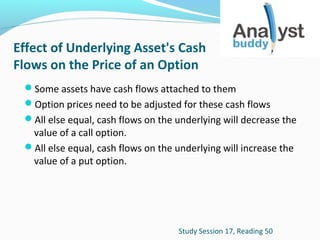

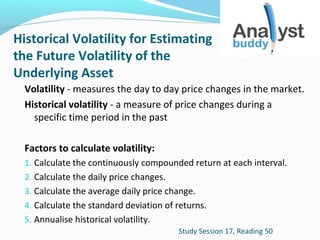

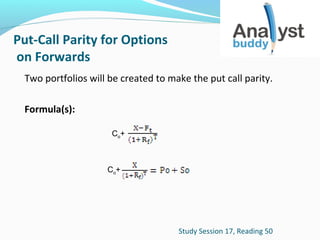

The document discusses various financial derivatives including synthetic instruments, options, interest rate derivatives, currency and equity swaps, credit default swaps, and credit derivative trading strategies. It provides formulas for pricing these instruments and outlines how their values are affected by various risk factors.

![American and European Options

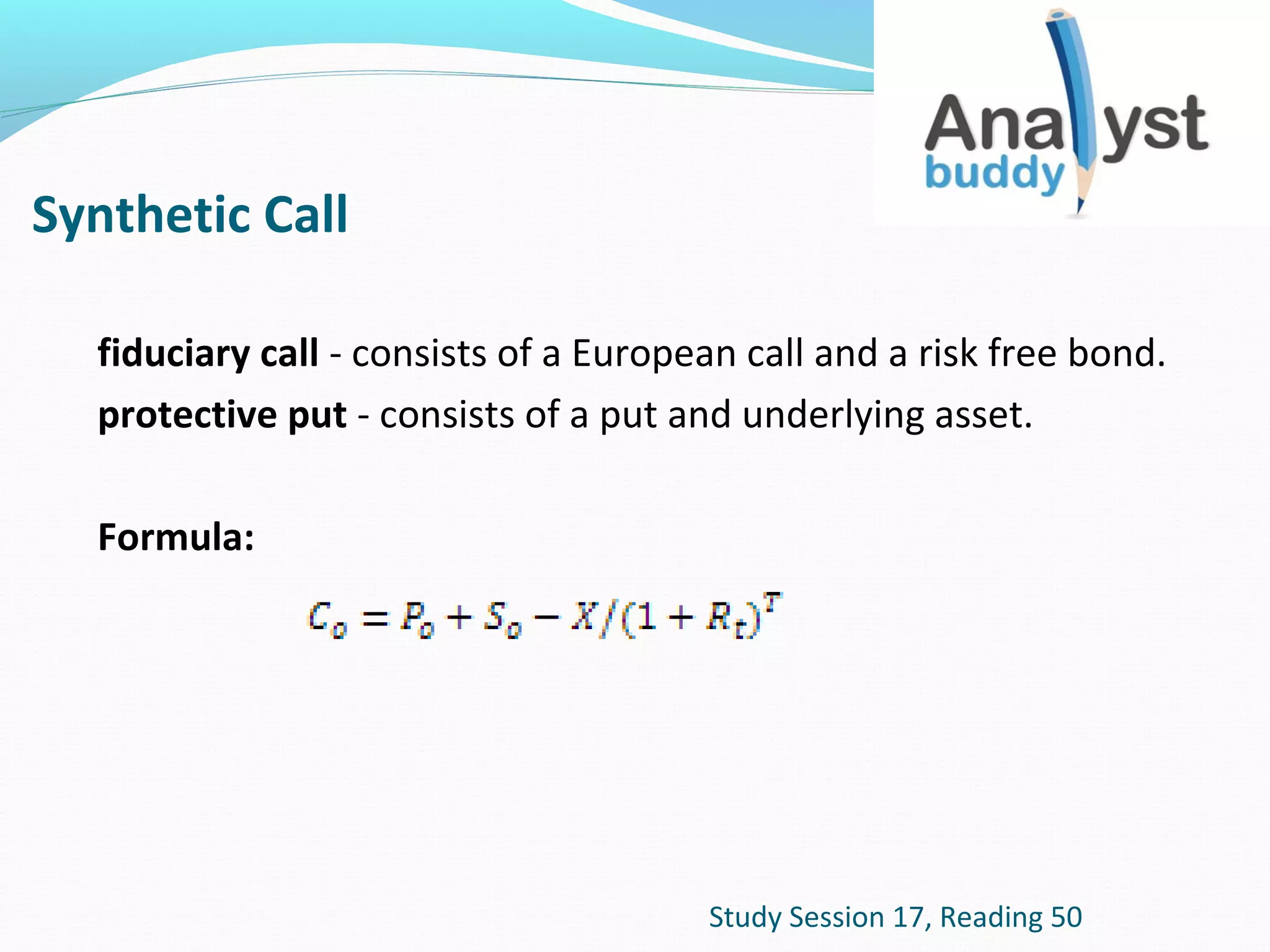

on Forwards and Futures

The Black model can be used to price the European options on

futures:

c = e − rcT[FN(d1) − XN(d2)]

p = e − rcT[X(1-N( − d2)) – F(1-N( − d1))]

Study Session 17, Reading 50](https://image.slidesharecdn.com/l2flashcardsderivatives-ss17-131222035539-phpapp02/85/L2-flash-cards-derivatives-ss-17-17-320.jpg)