The document discusses options and their valuation. Some key points:

- An option is a contract that gives the holder the right to buy or sell an asset at an agreed price by a specified date.

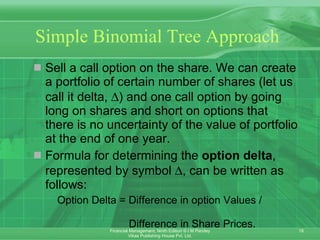

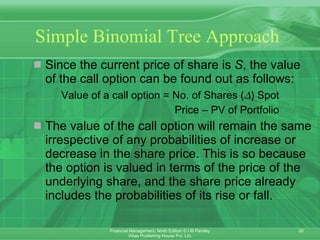

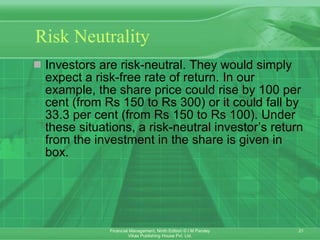

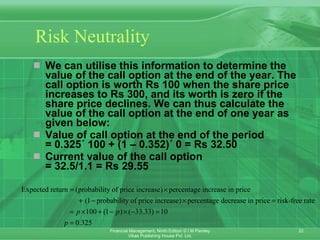

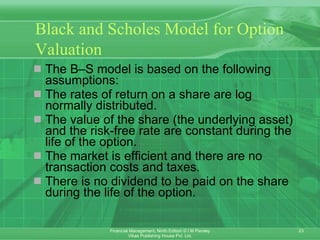

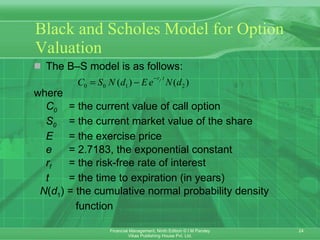

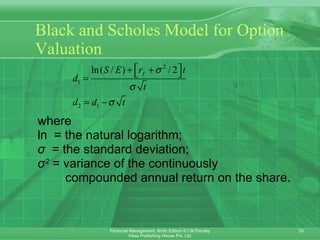

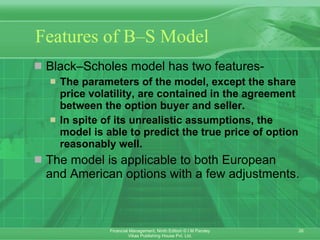

- The Black-Scholes model and binomial tree approach are two common models used to value options.

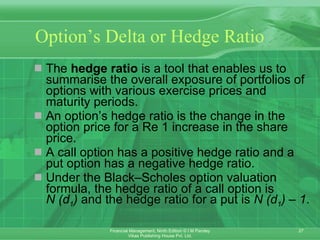

- Key factors that determine an option's value are the exercise price, underlying asset price, volatility, time to expiration, and interest rates.

![Call Option Buy a call option You should exercise call option when: Share price at expiration > Exercise price. Do not exercise call option when: Share price at expiration < Exercise price. The value of the call option at expiration is: Value of call option at expiration = Maximum [Share price – Exercise price, 0]. The expression above indicates that the value of a call option at expiration is the maximum of the share price minus the exercise price or zero. The call buyer’s gain is call seller’s loss.](https://image.slidesharecdn.com/ch07-100117212930-phpapp01/85/Ch-07-6-320.jpg)

![Put Option Buy a put option Exercise the put option when: Exercise price > Share price at expiration. Do not exercise the put option when: Exercise price < Share price at expiration. The value or payoff of a put option at expiration will be: Value of put option at expiration = Maximum [Exercise price – Share price at expiration, 0]. The put option buyer’s gain is the seller’s loss.](https://image.slidesharecdn.com/ch07-100117212930-phpapp01/85/Ch-07-7-320.jpg)