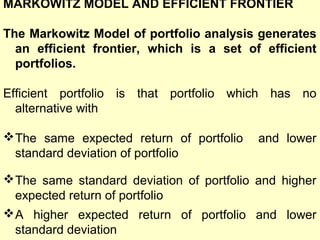

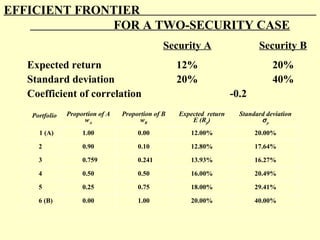

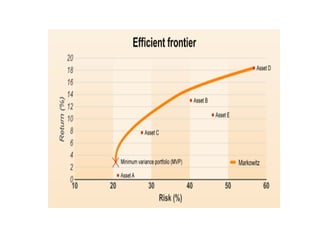

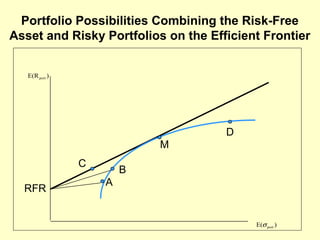

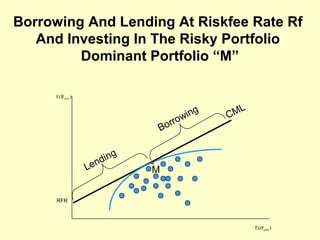

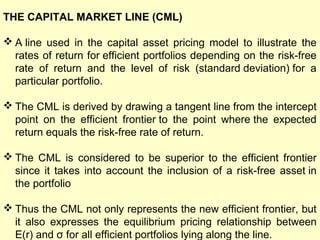

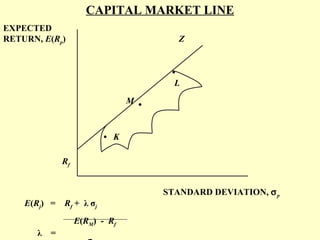

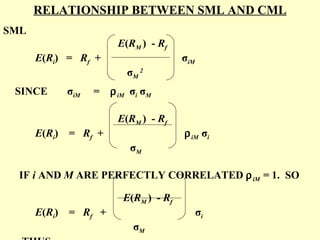

The Markowitz model generates an efficient frontier of optimal portfolios that maximize return for a given level of risk. The Capital Asset Pricing Model (CAPM) builds on this by deriving the security market line (SML) which plots the expected return of individual securities based on their beta coefficient in relation to the market portfolio. The capital market line (CML) extends the efficient frontier by including a risk-free asset, demonstrating how investors can optimize the trade-off between risk and return through borrowing and lending at the risk-free rate.

![COVARIANCE OF RISK-FREE ASSET WITH A RISKY

ASSET

The covariance between two sets of returns, A and B where

asset A is a risk free asset.

n

CovAB

= Σ[rA- E(rA)] [ rB - E(rB)]/n

A=1

The uncertainty for a risk-free asset is known, so σA=0,

which implies that rA = E(rA) for all the periods. Thus, rA E(rA) =0, which further leads to the facts that the product of

any other expressions with this expression will be zero. This

will result in the covariance of the risk-free asset with any

risky asset or portfolio to be also zero. Similarly, the

correlation between any risky asset and risk-free asset, will](https://image.slidesharecdn.com/capitalmarkettheory-131030042348-phpapp01/85/Capital-market-theory-11-320.jpg)

![RISK-RETURN POSSIBILITIES WITH LEVERAGE

An investor always wants to increase his expected

returns. Say, a person has borrowed an amount

which is 50 percent of his original wealth, the effect of

this on the expected return for the portfolio would be:

E(ri)

= Wf (rf) + (1 - Wf) E(rk) where k is the

risky assets portfolio

= – 0.50 (rf) + [1 – (–0.50)] E(rk)

= – 0.50 (rf) + 1.50 E(rk)

Continued](https://image.slidesharecdn.com/capitalmarkettheory-131030042348-phpapp01/85/Capital-market-theory-13-320.jpg)

![Thus, we see that the return increases in a linear fashion

along the line of risk-free rate (rf) and ‘k’.

Now, suppose E(rf) = 0.10

And E(rk) = 0.24

E(ri) = = – 0.50 (0.10) + 1.5 (0.24) = 0.31 or 31%

Similar is the effect of standard deviation of the

leveraged portfolio.

E(σi) = (1 – Wf) σk

= [1 – (–0.5)] σk = 1.50 σk](https://image.slidesharecdn.com/capitalmarkettheory-131030042348-phpapp01/85/Capital-market-theory-14-320.jpg)

![Explanation:

The CAPM states that the expected return of a security

or a portfolio equals the rate on a risk-free security plus

a risk premium. If this expected return does not meet or

beat the required return, then the investment should not

be undertaken. The security market line plots the results

of the CAPM for all different risks (betas).

thus the CML is important in describing the

equilibrium relationship between expected return and

risk for efficient portfolios that contains no unsystematic

risk.

Thus as per the CAPM model, the expected return of

any asset is given by a formula of the form:

E[ri] = rf + [Number of Units of Risk][Risk Premium per

Unit]](https://image.slidesharecdn.com/capitalmarkettheory-131030042348-phpapp01/85/Capital-market-theory-26-320.jpg)

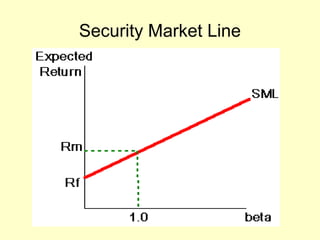

![SECURITY MARKET LINE (SML)

The SML essentially graphs the results from the capital

asset pricing model (CAPM) formula. The x-axis

represents the risk (beta), and the y-axis represents

the expected return. The market risk premium is

determined from the slope of the SML.

E (R i ) = R f + [ E (R M) - R f ] β i](https://image.slidesharecdn.com/capitalmarkettheory-131030042348-phpapp01/85/Capital-market-theory-27-320.jpg)

![TESTS OF ASSET PRICING THEORIES

The CAPM pricing model is given by the

equation:

E(ri) = rf + [E(rM) – rf] βi

According to the theory, the expected return on

security i, E(ri), is related to the risk-free rate, rf,

plus a risk premium, [E(rM) – rf] βi ,which

includes the expected return on the market

portfolio.](https://image.slidesharecdn.com/capitalmarkettheory-131030042348-phpapp01/85/Capital-market-theory-32-320.jpg)