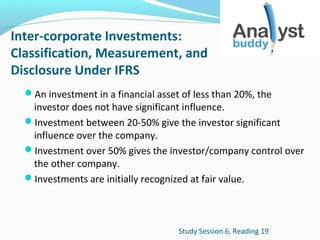

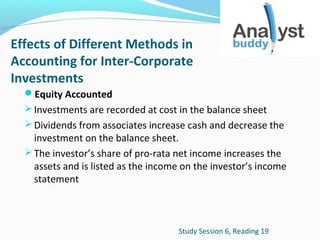

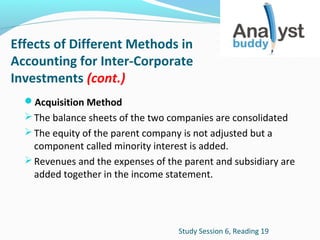

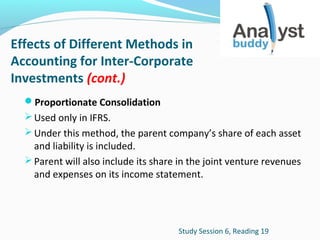

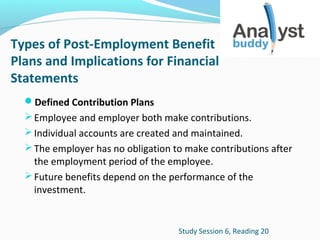

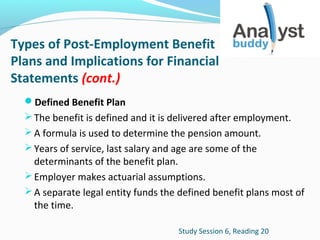

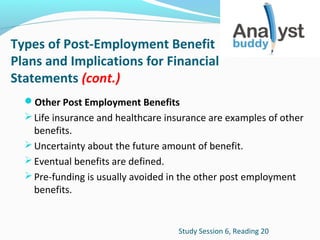

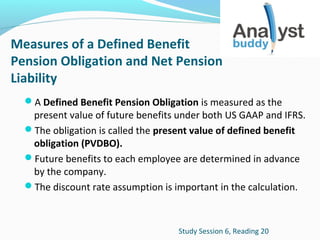

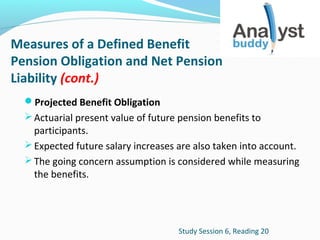

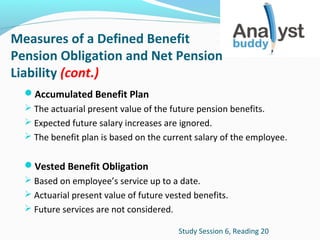

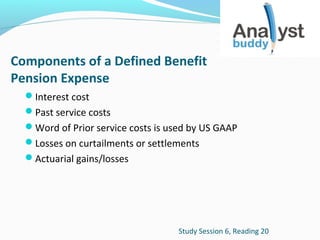

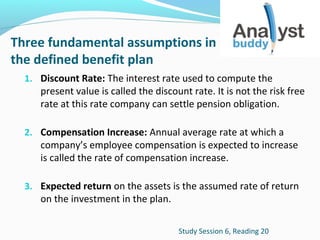

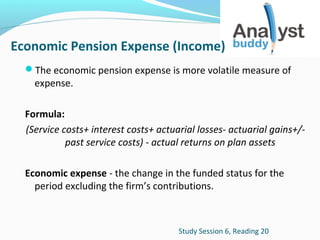

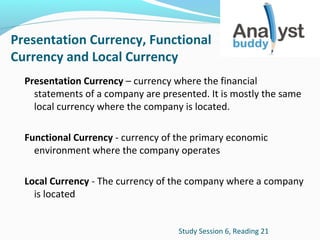

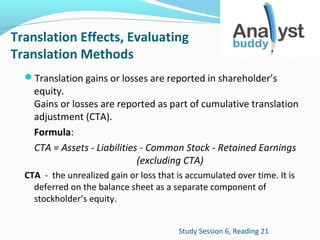

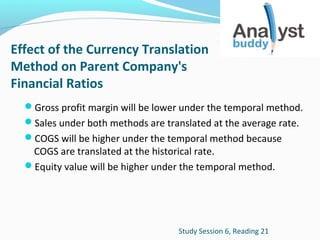

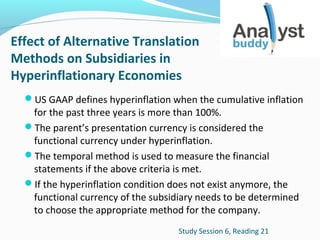

The document discusses various topics related to accounting for inter-corporate investments and post-employment benefits under IFRS. It covers classification of investments, effects of different accounting methods, components of pension obligations and expenses, assumptions used in valuations, and impact on financial statements. Translation of foreign subsidiary financial statements using current and temporal methods is also summarized, along with effects of translation on parent company ratios and treatment of hyperinflationary economies.