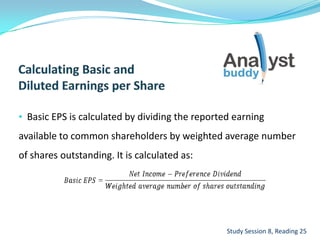

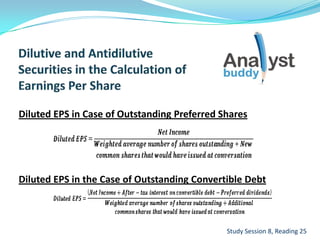

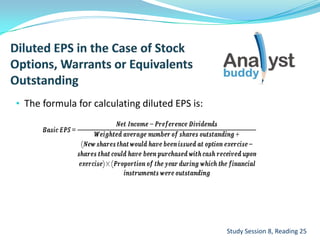

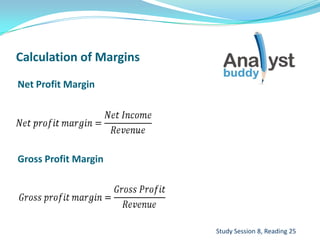

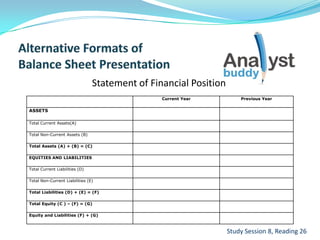

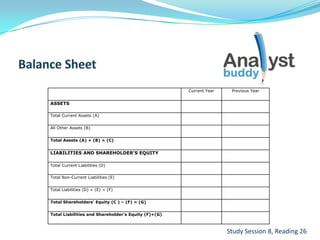

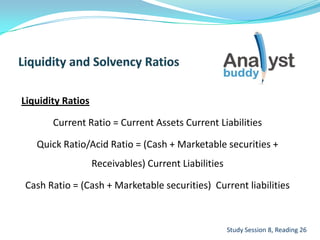

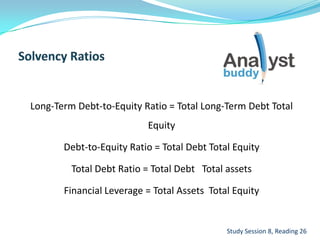

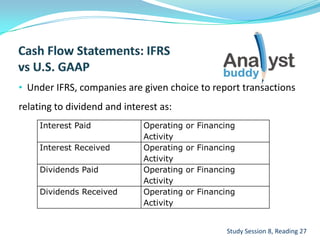

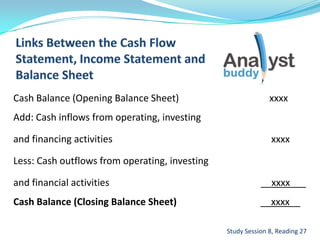

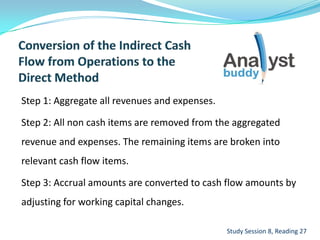

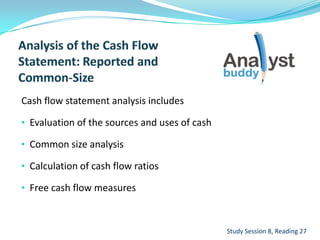

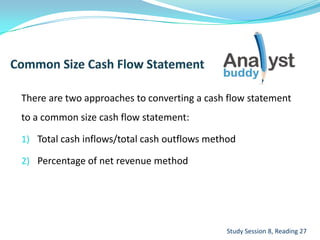

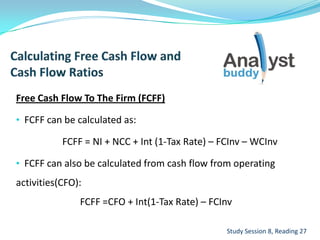

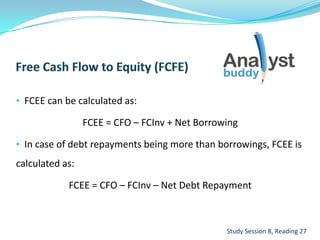

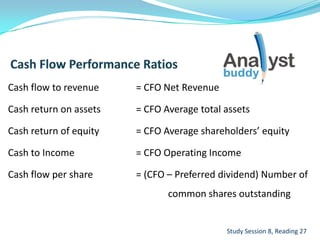

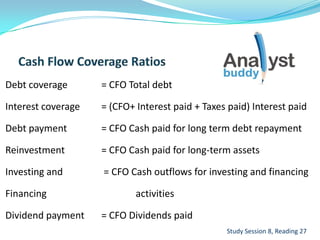

The document discusses key components of the income statement, balance sheet, and cash flow statement. It provides definitions and formulas for items such as net income, revenue, expenses, assets, liabilities, equity, operating activities, investing activities, financing activities, and common liquidity and profitability ratios. Calculation of items like net cash from operating activities using both the direct and indirect method is also covered.