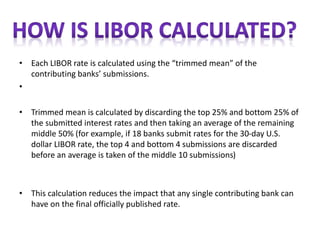

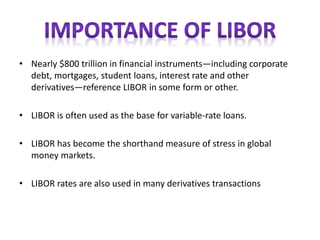

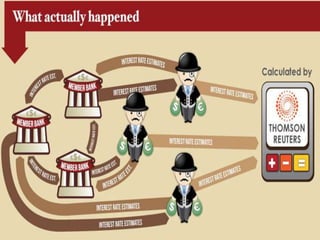

The London Interbank Offered Rate (LIBOR) is the average interest rate estimated by leading banks in London that they would be charged if borrowing from other banks. LIBOR rates are calculated daily for various currencies and loan periods and are used as a benchmark for trillions of dollars' worth of financial products. Regulators have found that banks manipulated LIBOR submissions between 2007-2009 to benefit derivatives trades and portray more favorable perceptions of their financial strength during the global financial crisis. Several banks have paid billions in fines, and major reforms are underway to improve the oversight and integrity of the LIBOR benchmark interest rate.

![The London Interbank Offered Rate is the average of interest rates estimated by each of the

leading banks in London that it would be charged were it to borrow from other banks.[1] It is

usually abbreviated to Libor or LIBOR, or more officially to ICE LIBOR (for Intercontinental

Exchange Libor). It was formerly known as BBA Libor (for British Bankers' Association Libor

or the trademark bba libor) before the responsibility for the administration was transferred

to Intercontinental Exchange. It is the primary benchmark, along with the Euribor, for short-

term interest rates around the world

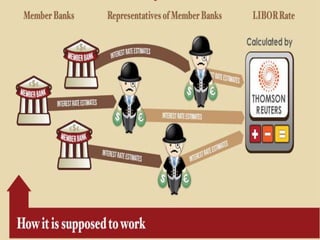

Libor rates are calculated for 5 currencies and 7 borrowing periods ranging from overnight

to one year and are published each business day by Thomson Reuters. Many financial

institutions, mortgage lenders and credit card agencies set their own rates relative to it. At

least $350 trillion in derivatives and other financial products are tied to the Libor.](https://image.slidesharecdn.com/libor-160225135840/85/Libor-2-320.jpg)

![• The administration of Libor has itself become a regulated activity overseen by the

UK's Financial Conduct Authority.[31] Furthermore, knowingly or deliberately making

false or misleading statements in relation to benchmark-setting was made a criminal

offence in UK law under the Financial Services Act 2012.

• The Danish, Swedish, Canadian, Australian and New Zealand Libor rates have been

terminated.

• From the end of July 2013, only five currencies and seven maturities will be quoted

every day (35 rates), reduced from 150 different Libor rates – 15 maturities for each of

ten currencies, making it more likely that the rates submitted are underpinned by real

trades.

• Since the beginning of July 2013, each individual submission that comes in from the

banks is embargoed for three months to reduce the motivation to submit a false rate

to portray a flattering picture of creditworthiness.](https://image.slidesharecdn.com/libor-160225135840/85/Libor-13-320.jpg)