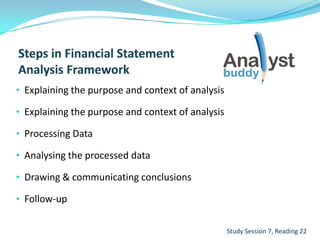

The document discusses key aspects of financial statements and financial reporting standards. It provides information on the four basic financial statements, accounting equations, notes to financial statements, auditing standards, and frameworks for setting accounting standards. The purpose of financial reporting is to provide transparent and useful information to investors and other stakeholders, though there are ongoing challenges in achieving global convergence due to differences in business and regulatory environments.