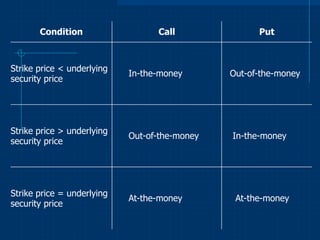

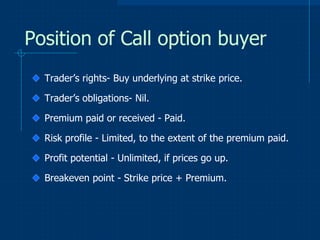

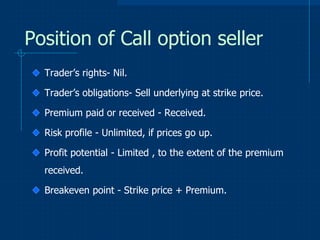

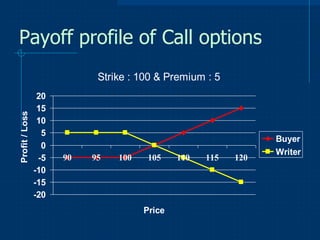

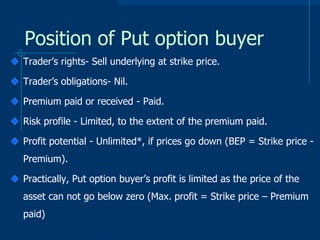

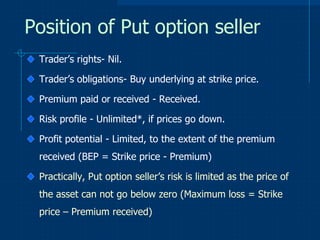

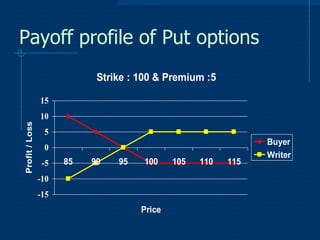

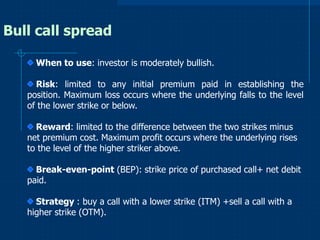

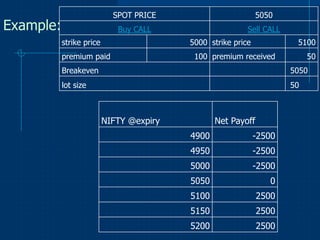

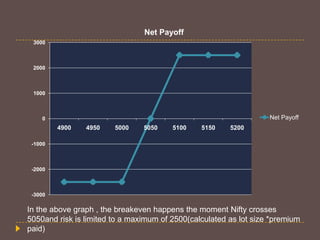

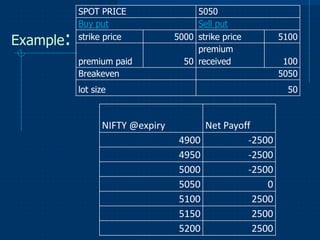

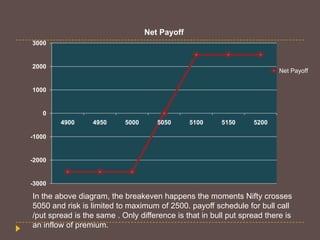

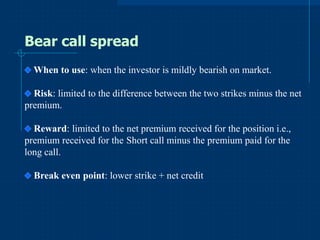

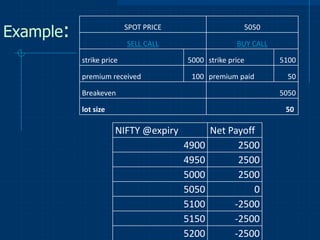

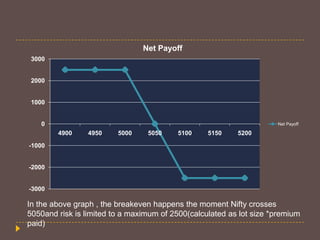

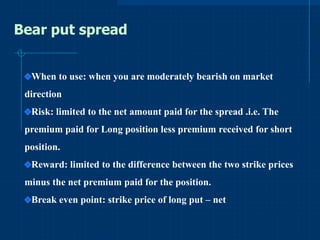

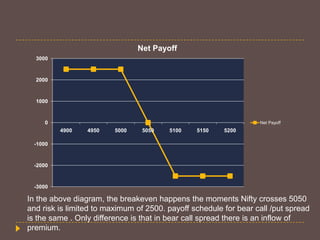

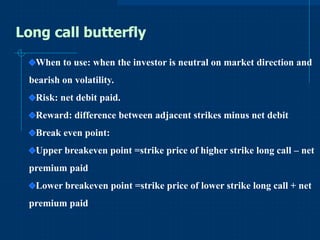

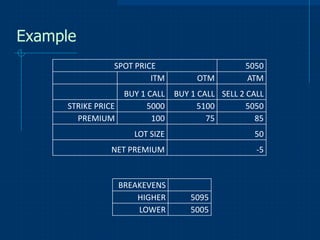

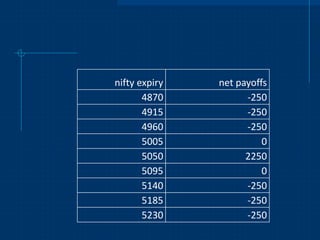

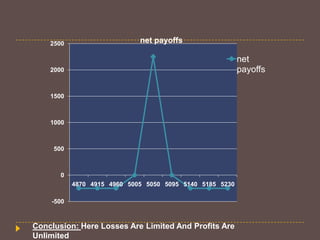

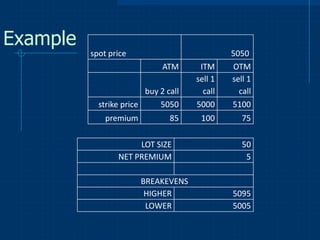

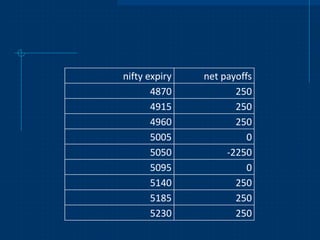

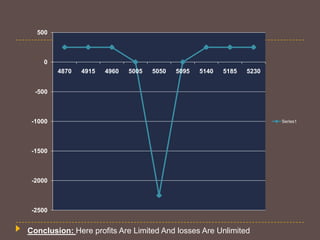

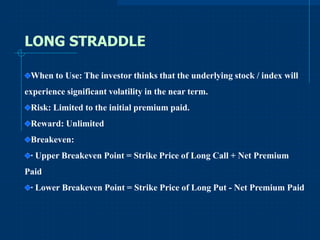

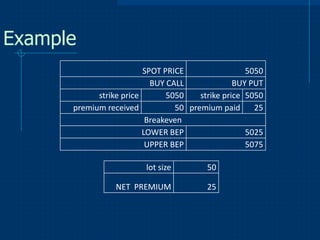

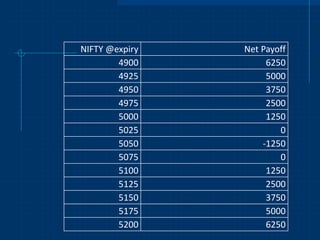

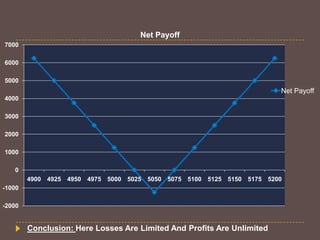

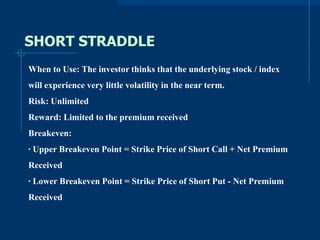

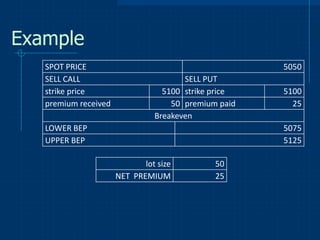

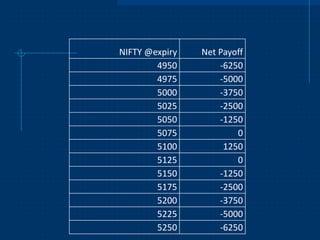

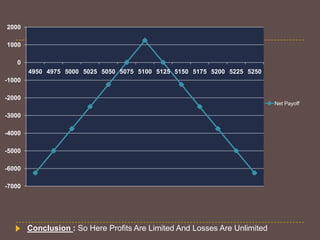

This document provides an overview of options strategies. It defines derivatives and describes how they derive value from underlying assets. Common types of derivatives are discussed including futures and options. Basic option positions like calls and puts are explained. Popular options strategies like bull call spreads, bear put spreads, and butterfly spreads are defined and examples are provided to illustrate how the payoffs work. Long straddles and short straddles are also introduced as strategies used when volatility is expected to increase or decrease. Key option terms are defined throughout like premium, strike price, expiration date, and different option types.