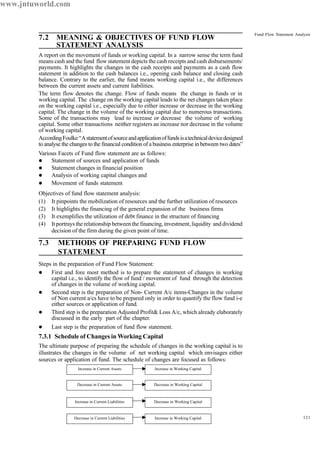

This document discusses fund flow statement analysis. It defines a fund flow statement as a report on the movement of funds or working capital between two points in time. The document outlines several objectives of fund flow statement analysis, including identifying how resources are mobilized and utilized by a business. It also describes several methods for preparing a fund flow statement, such as using the net profit method, sales method, schedule of changes in working capital approach, and adjusted profit and loss account. The advantages of preparing a fund flow statement are explained as well, such as fulfilling financial management objectives and aiding working capital management.