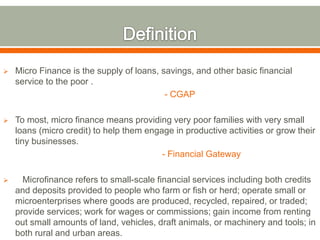

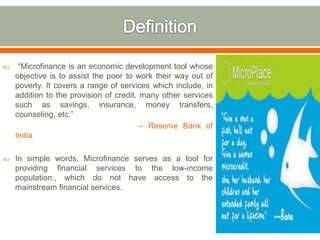

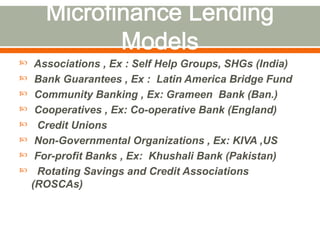

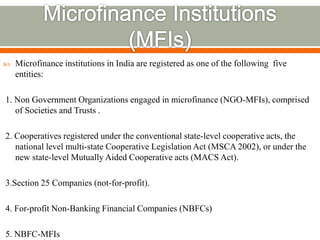

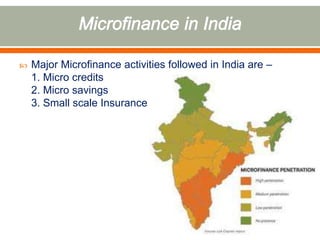

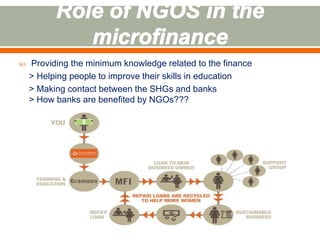

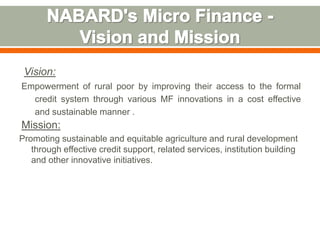

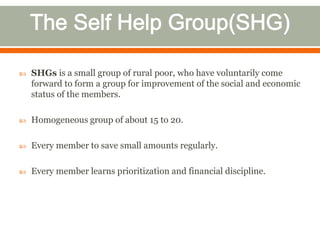

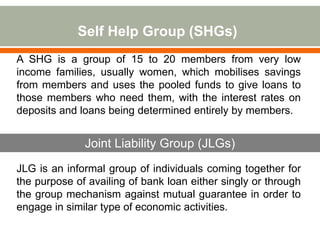

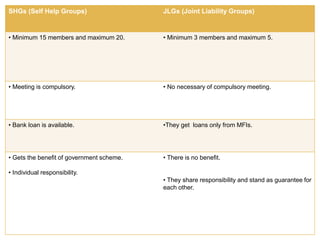

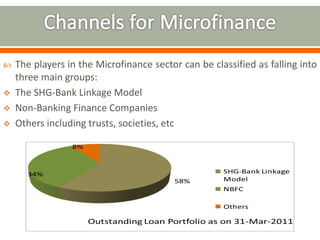

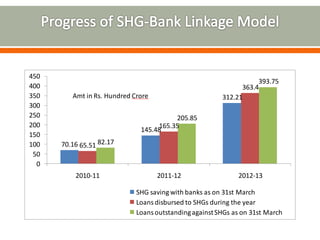

This document discusses microfinance and its role in providing financial services to low-income populations. It defines microfinance as the provision of small loans, savings opportunities, and other basic financial services to the poor. Microfinance helps the poor generate income through self-employment and smooth consumption. The major models of microfinance delivery in India are the self-help group (SHG) bank linkage model and non-banking financial companies (NBFCs). The SHG model involves groups of women saving regularly and taking small loans, with banks later providing larger loans. NBFCs encourage joint liability groups (JLGs) and make individual loans to members.