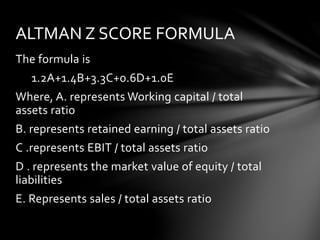

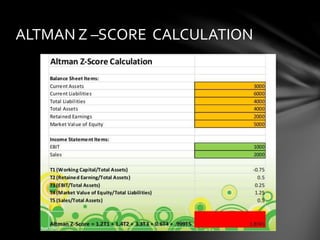

The document discusses the Altman Z-score formula, which was published in 1968 and can be used to predict bankruptcy. The formula uses five financial ratios to calculate a score. A score below 1.8 indicates likely bankruptcy, while a score between 1.8-3 means bankruptcy is possible and above 3 means the company is financially stable. The formula is: 1.2A+1.4B+3.3C+0.6D+1.0E. It requires data from a company's balance sheet and income statement. While the Z-score can help determine bankruptcy risk, it does not work for new companies and does not directly consider cash flow.