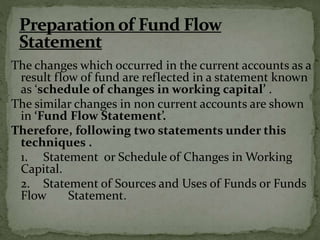

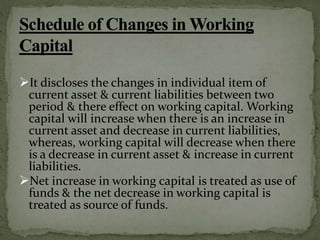

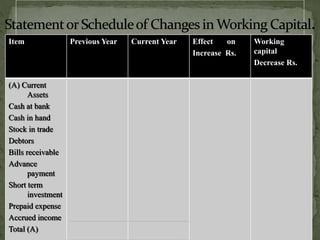

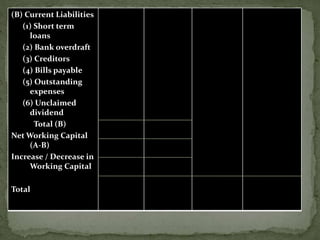

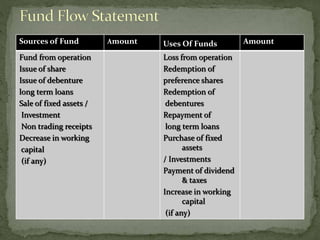

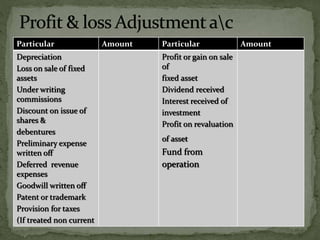

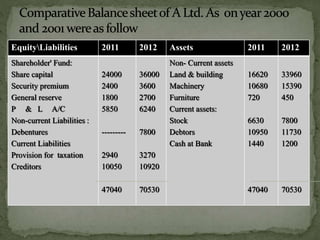

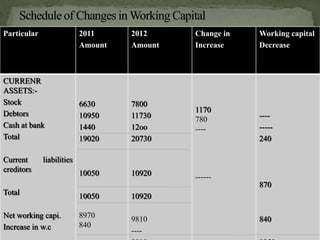

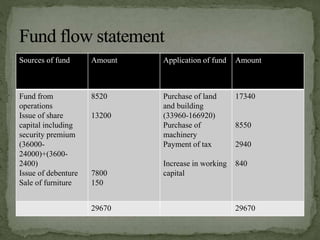

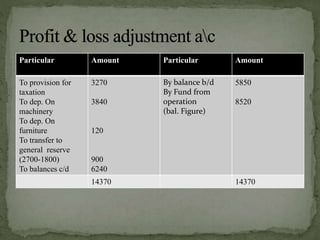

The document discusses fund flow statements, which summarize the sources and uses of funds for a business between two periods. A fund flow statement has two parts - sources of funds, which come from items like profits, share issues, and decreases in working capital; and uses of funds, which include purchases of assets, repayment of loans, and increases in working capital. The difference between sources and uses is the change in working capital. Several examples are provided of fund flow statements for companies, showing the sources and uses of funds.