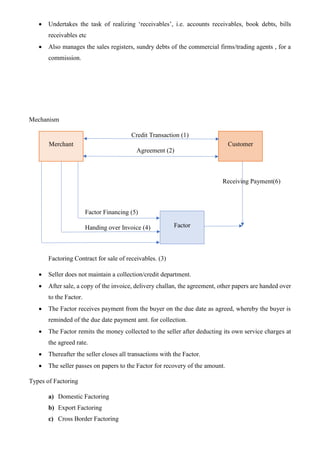

The document outlines the structure and functioning of the financial system, including financial assets, intermediaries, and markets in India. It discusses classifications of financial assets, the roles of capital and money market intermediaries, and the significance of both primary and secondary capital markets. Additionally, it highlights weaknesses in the Indian financial system, such as lack of coordination among institutions and dominance of development banks, affecting overall efficiency.