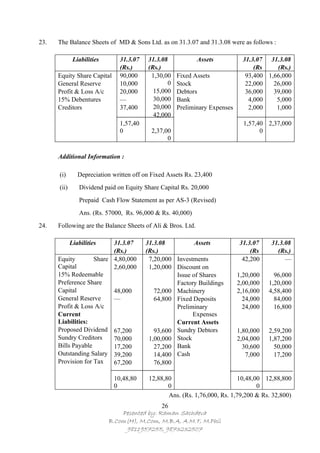

The document presents a format for preparing a cash flow statement according to Accounting Standard 3 (Revised). It includes sections for cash flow from operating, investing and financing activities. Cash flow from operating activities involves calculating cash generated or used by adjusting net profits for non-cash/non-operating items and changes in working capital. Cash flow from investing tracks cash from the sale and purchase of fixed/intangible assets and investments. Cash flow from financing includes cash from issuing/repaying debt and paying dividends. Worked examples are provided to illustrate how to prepare a cash flow statement using the direct and indirect methods.

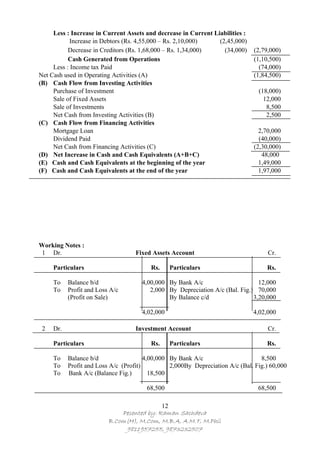

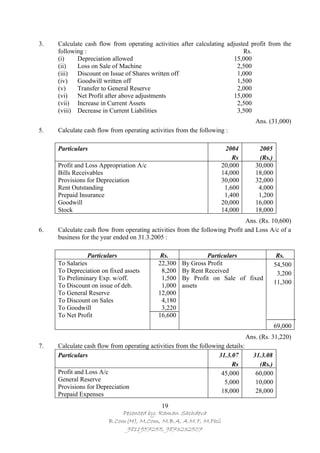

![2 INDIRECT METHOD

FORMAT FOR CASH FLOW STATEMENT

for the year ended ….

[ As per Accounting Standard-3 (Revised)]

Particulars Rs.

1. Cash Flow from Operating Activities

Net Profit and Loss A/c or Difference between Closing Balance and

Opening Balance of Profit and Loss A/c …

Add : (A) Appropriation of funds.

Transfer to reserve …

Proposed dividend for current year …

Interim dividend paid during the year …

Provision for tax made during the current year …

Extraordinary item, if any, debited to the Profit and Loss A/c …

Less : Extraordinary item, if any, credited to the Profit and Loss A/c (…)

Refund of tax credited to Profit and Loss A/c (…)

Net Profit before Taxation and Extraordinary Items ….

(B) Add : Non operating Expenses :

– Depreciation …

– Preliminary Expenses / Discount on Issue of Shares

and Debentures written off …

– Goodwill, Patents and Trade Marks Amortized ….

– Interest on Borrowings and Debentures ….

– Loss on Sale of Fixed Assets ….

….

(C) Less : Non Operating Incomes:

– Interest Income …

– Dividend Income …

– Rental Income …

– Profit on Sale of Fixed Assets … …

(D) Operating Profit before Working Capital Changes (A+B–C) …

(E) Add : Decrease in Current Assets and Increase in Current Liabilities

– Decrease in Stock/ Inventories …

– Decrease in Debtors/ Bills Receivables …

– Decrease in Accrued Incomes …

– Decrease in Prepaid Expenses …

– Increase in Creditors /Bills Payables …

– Increase in Outstanding Expenses …

– Increase in Advance Incomes …

– Increase in Provision for Doubtful Debts. …

…

(F) Less : Increase in Current Assets and Decrease in Current Liabilities

– Decrease in Stock/ Inventories …

– Decrease in Debtors/ Bills Receivables …

– Decrease in Accrued Incomes …

– Decrease in Prepaid Expenses …

– Increase in Creditors /Bills Payables …

– Increase in Outstanding Expenses …

– Increase in Advance Incomes …

1

Pesented by: Raman Sachdeva

B.Com(H), M.Com, M.B.A, A.M.T, M.Phil

9811957255, 9873232507](https://image.slidesharecdn.com/cashflowstatementnproblems-110428065553-phpapp02/85/Cash-flow-statement-n-problems-1-320.jpg)

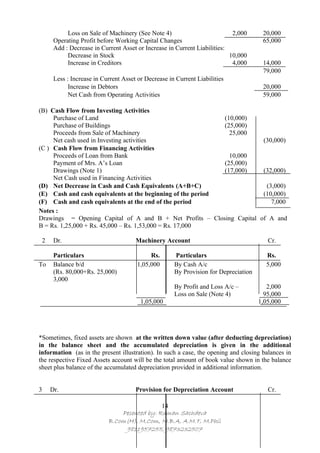

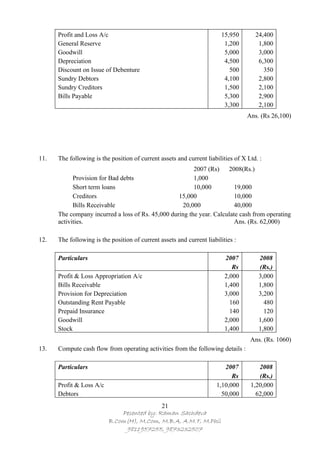

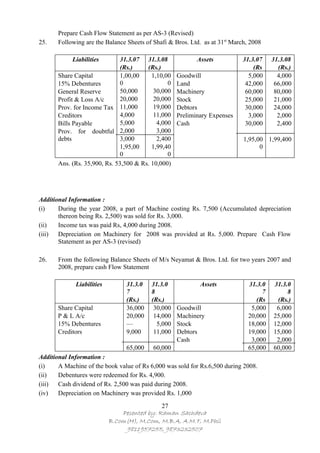

![Solution :

CASH FLOW STATEMENT (DIRECT METHOD)

for the year ended 31st March, 2007

Particulars Rs.

Cash Flow from Operating Activities

Receipts – Cash Sales 65,86,000

Cash receipts from customers 33,23,400

99,09,400

Payments –Payments for purchases and to suppliers 79,36,810

Payments to and for employees 9,87,500

89,24,310

Net Cash from Operating Activities (Receipts – Payments) 9,85,090

Cash Flow from Investing Activities

Purchase of Fixed Assets (83,160)

Proceeds from Sale of Fixed Assets 11,000

Cash Flow from Financing Activities (72,160)

Redemption of debentures at a premium [Rs. 3,00,000 + Rs. 6,000] (3,06,000)

Interest paid on debentures (84,000) (3,90,000)

Net Cash used in Financing Activities (3,90,000)

Net increase in cash and cash equivalents 5,22,930

Cash and cash equivalents as on 31st March, 2007 (Closing Balance) 51,070

Cash and cash equivalents as on 31st March, 2007 (Closing Balance) 5,74,000

Notes : Dividend for the year ended 31st March, 2007 was paid in May 2007. Hence, it is not an

outflow of cash for the year ended 31st March, 2007.

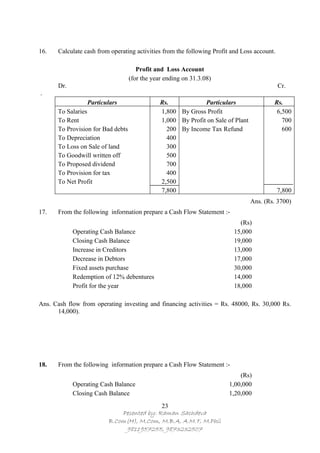

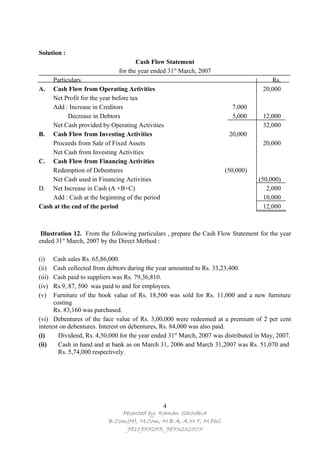

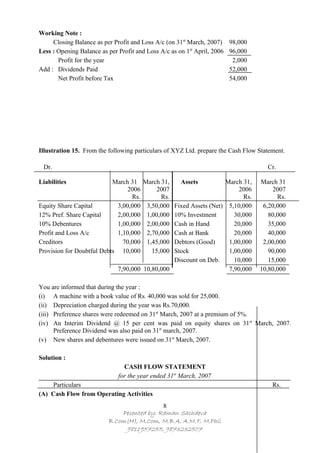

Illustration 13. From the summary cash account of X Ltd. prepare the Cash Flow Statement for

the year ended 31st March, 2007 by Direct Method.

CASH BOOK

Dr. for the year ended March 31,2007 Cr.

Particulars Rs. Particular Rs.

To Balance on April 1,2006 50,000 By Payment to Suppliers 20,00,000

To Issue of Equity Shares 3,00,000 By Purchased of Fixed Assets 2,00,000

To Receipts from Customers 28,00,000 By Overhead Expenses 2,00,000

To Sale of Fixed Assets 1,00,000 By Wages and Salaries 1,00,000

By Income Tax Paid 2,50,000

By ‘Dividend Paid 3,00,000

By Re payment of Bank Loan 3,00,000

5

Pesented by: Raman Sachdeva

B.Com(H), M.Com, M.B.A, A.M.T, M.Phil

9811957255, 9873232507](https://image.slidesharecdn.com/cashflowstatementnproblems-110428065553-phpapp02/85/Cash-flow-statement-n-problems-5-320.jpg)

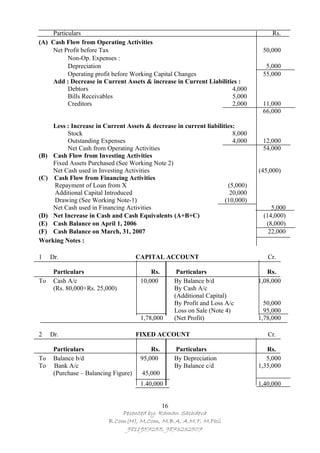

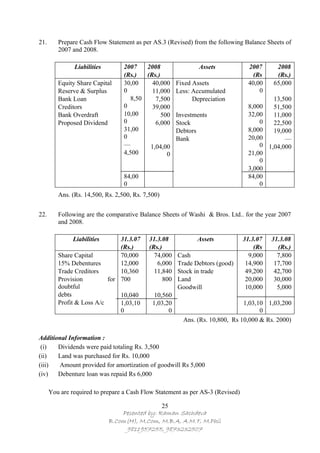

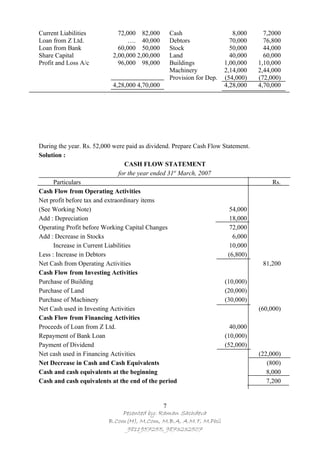

![Closing Balance as per Profit and Loss A/c 2,70,000

Less : Opening Balance as per Profit and Loss A/c 1,10,000

1,60,000

Add : Appropriation of Fund

Preference Dividend 24,000

Interim Dividend 45,000

Increase in Provision for Doubtful Debts (Since all debtors are good) (Note 1)5,000

74,000

Net Profit before tax 2,34,000

Add : Non operating Expenses :

Depreciation 70,000

Interest on Long Term Borrowings (Debentures) 10,000

Loss on Sale of Machinery 15,000

Premium Payable on Redemption of Preference Shares 5,000 1,00,000

3,34,000

Less : Non operating Incomes :

Interest on Investment 3,000

Operating Profit before Working Capital Changes 3,31,000

Add : Decrease in Current Assets and Increase in Current Liabilities

Decrease in Stock 10,000

Increase in Creditors 75,000 85,000

4,16,000

Less : Increase in Current Assets and Decrease in Current Liabilities

Increase in Debtors 1,00,000

Net Cash from Operating Activities 3,16,000

B. Cash Flow from Investing Activities

Purchase of Fixed Assets (2,20,000)

Proceeds from Sale of Machinery 25,000

Interest on Investment 3,000

Purchase of Investments (50,000)

Net Cash Used in Investing Activities (2,42,000)

(C ) Cash Flow from Financing Activities

Proceeds from Issue of Share Capital 50,000

Proceeds from long-term borrowings (Debentures) 95,000

[ Rs. 1,00,000 – Rs. 5,000 (Discount on Issue of Debentures) (Note 2)]

9

Pesented by: Raman Sachdeva

B.Com(H), M.Com, M.B.A, A.M.T, M.Phil

9811957255, 9873232507](https://image.slidesharecdn.com/cashflowstatementnproblems-110428065553-phpapp02/85/Cash-flow-statement-n-problems-9-320.jpg)