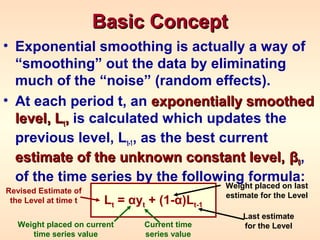

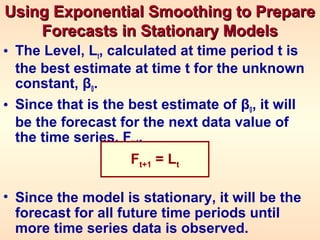

Exponential smoothing uses all past time series values to generate forecasts, with less weight given to older values. It works by calculating a smoothed level (Lt) at each period t as a weighted average of the current value (yt) and the previous smoothed level (Lt-1). The forecast for the next period (Ft+1) is then set equal to the current smoothed level (Lt). Choosing the smoothing constant (α) determines how responsive the smoothed level is to recent changes in the data.