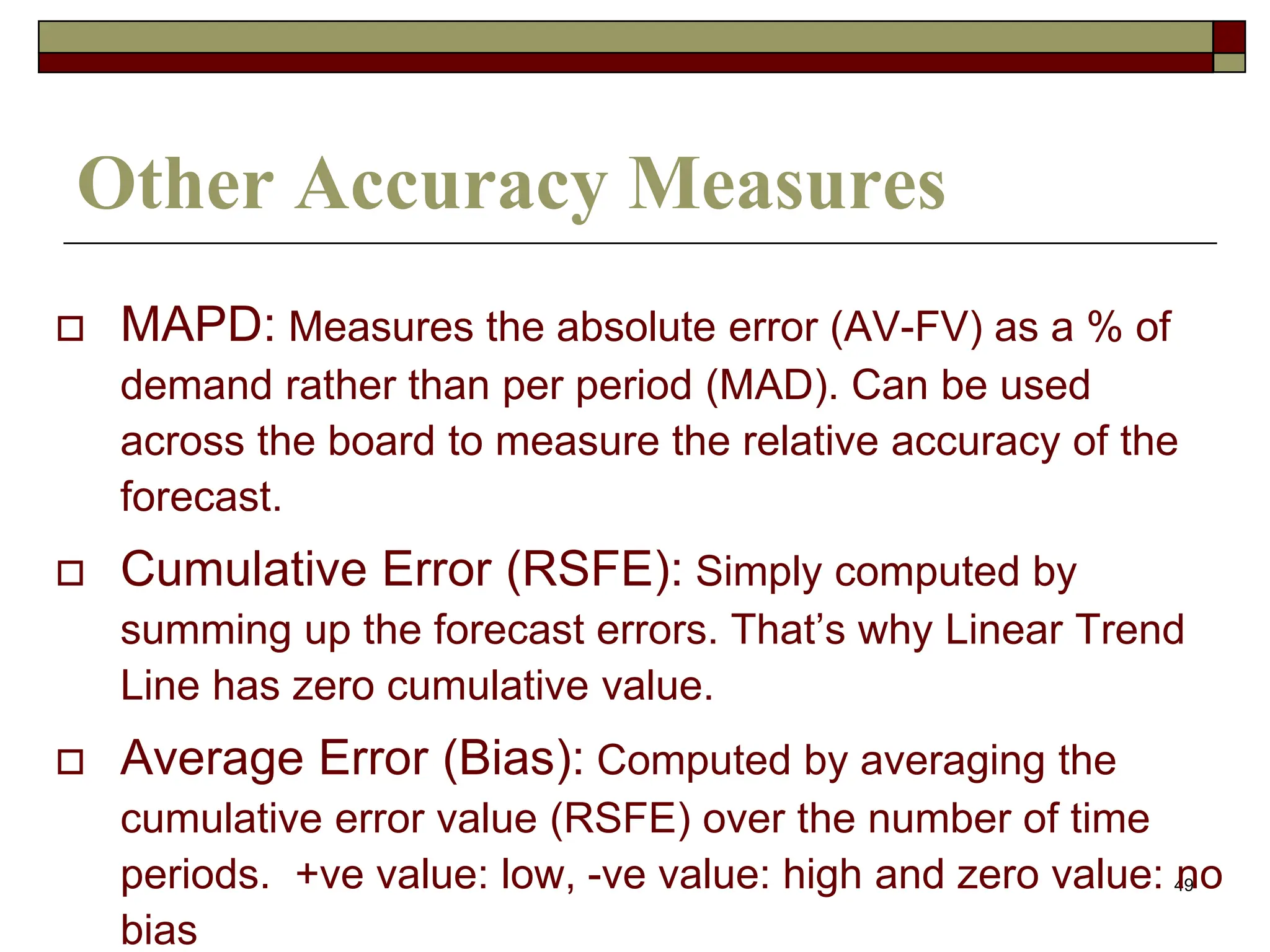

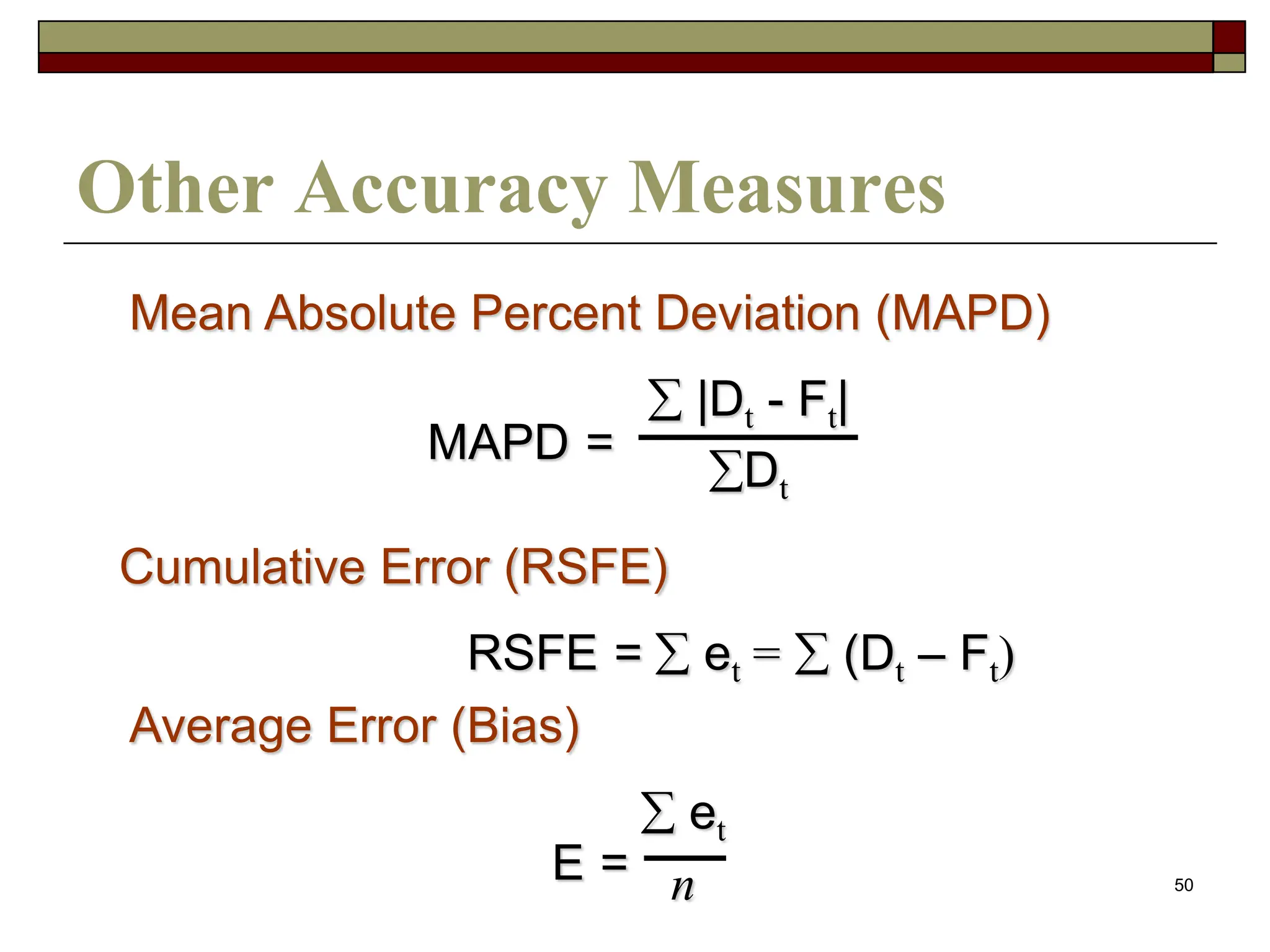

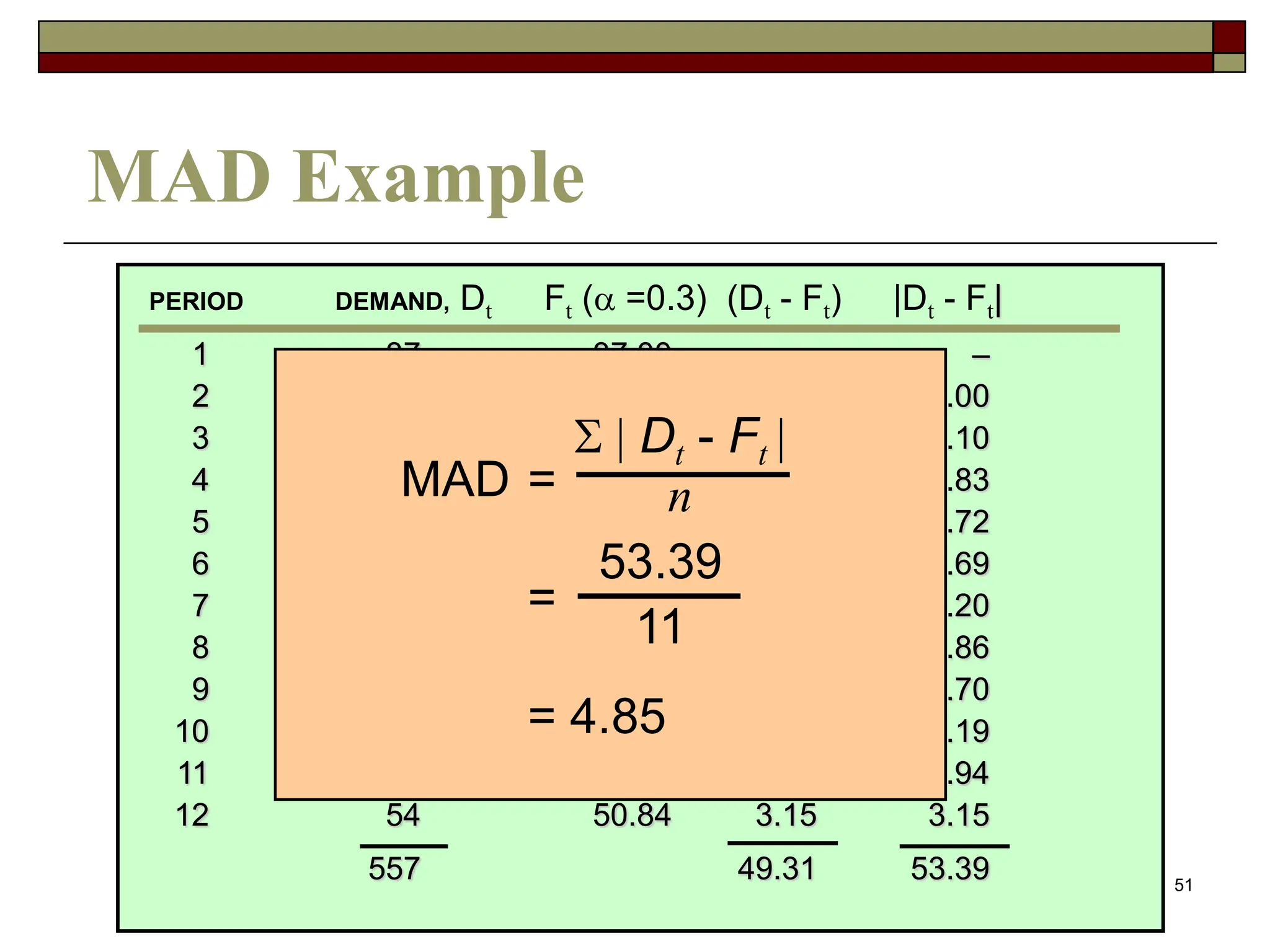

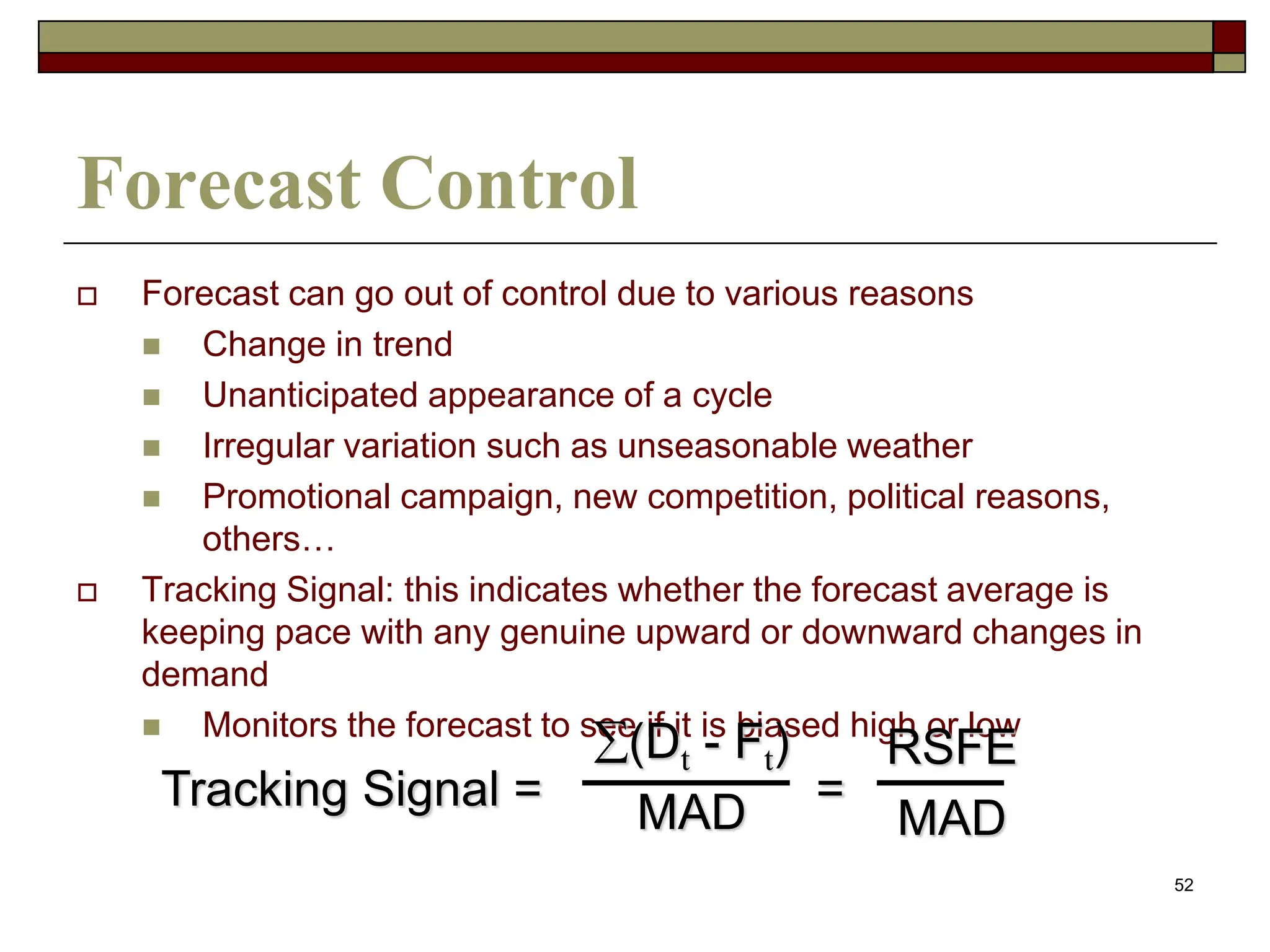

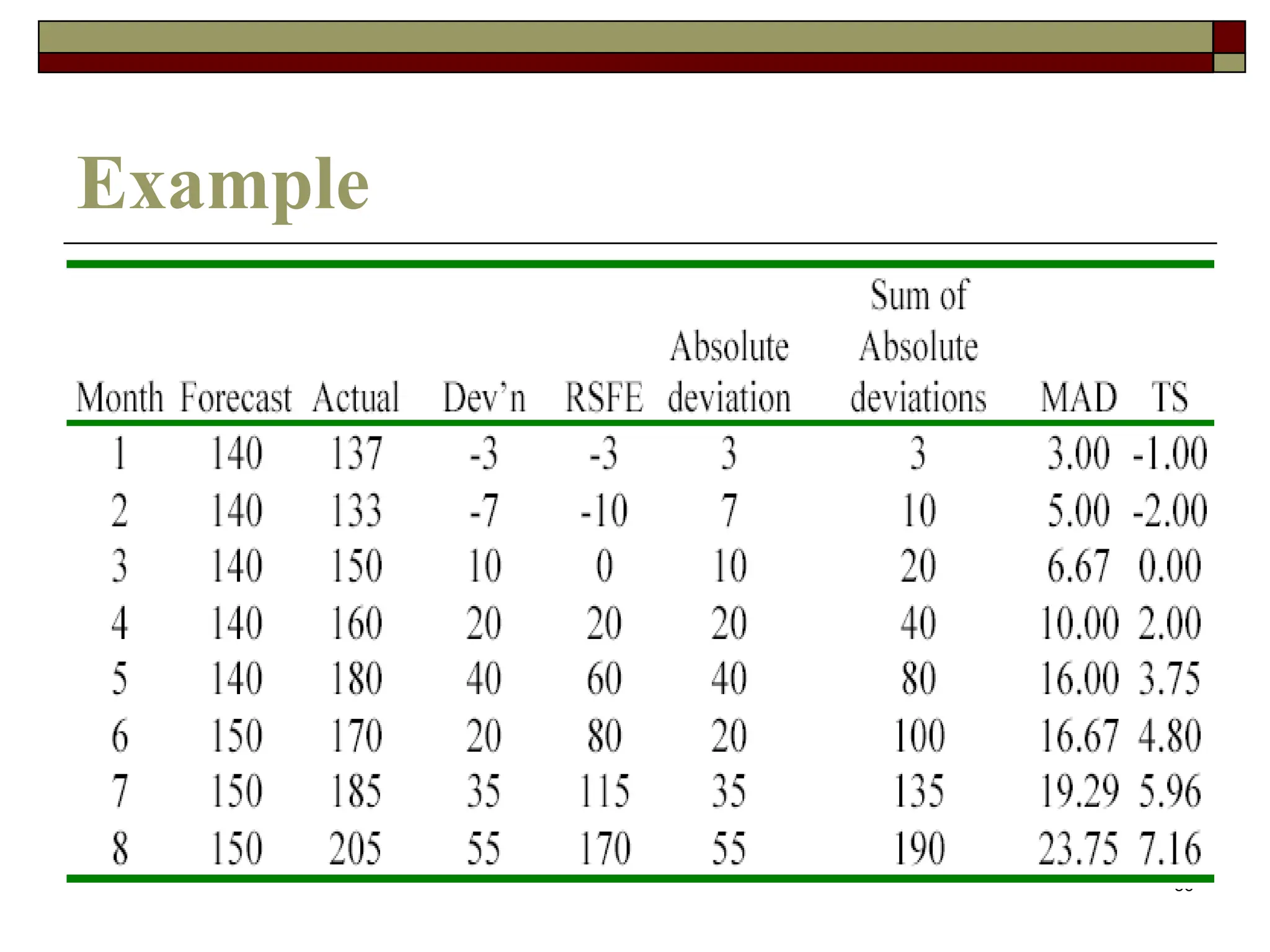

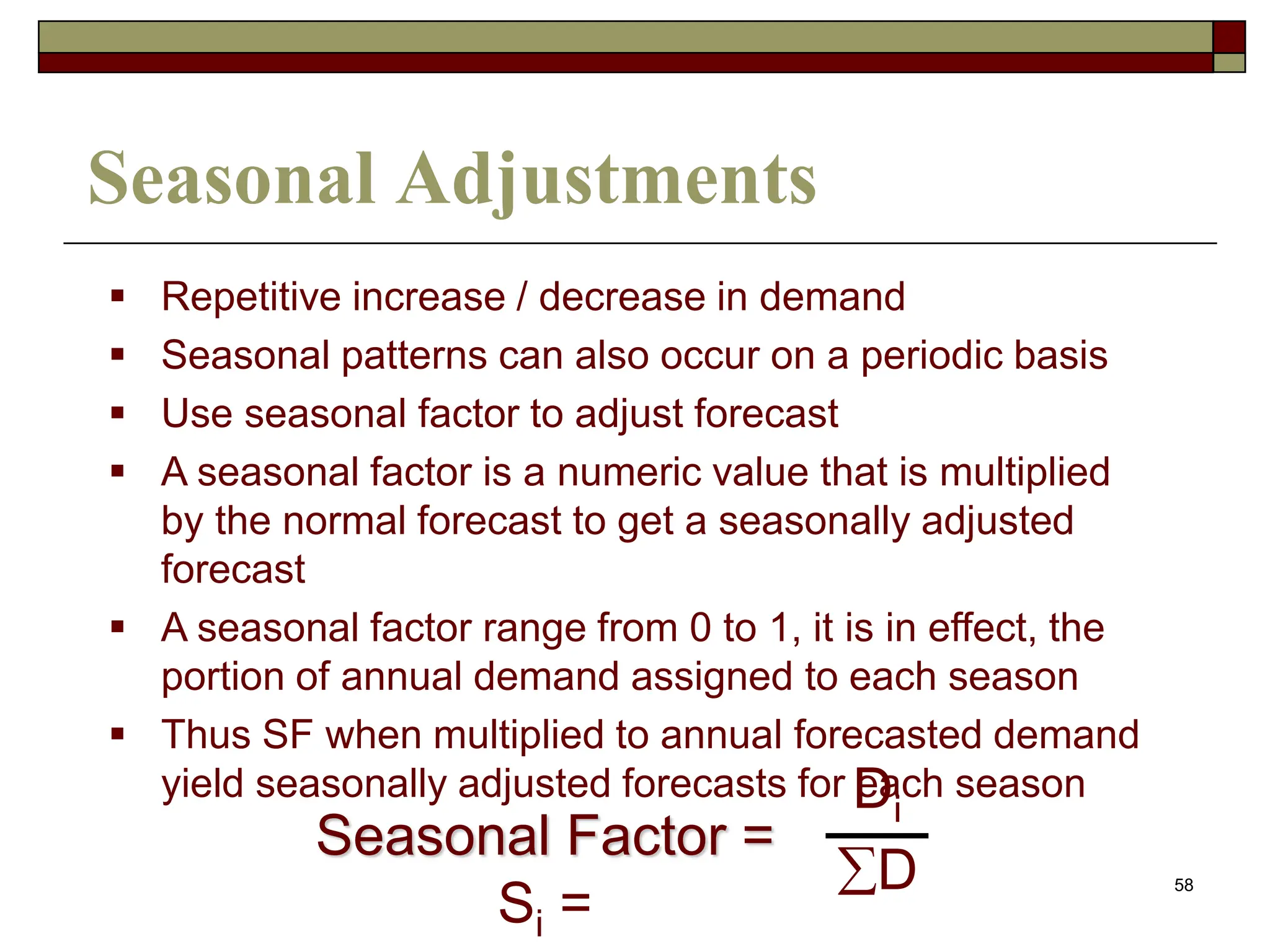

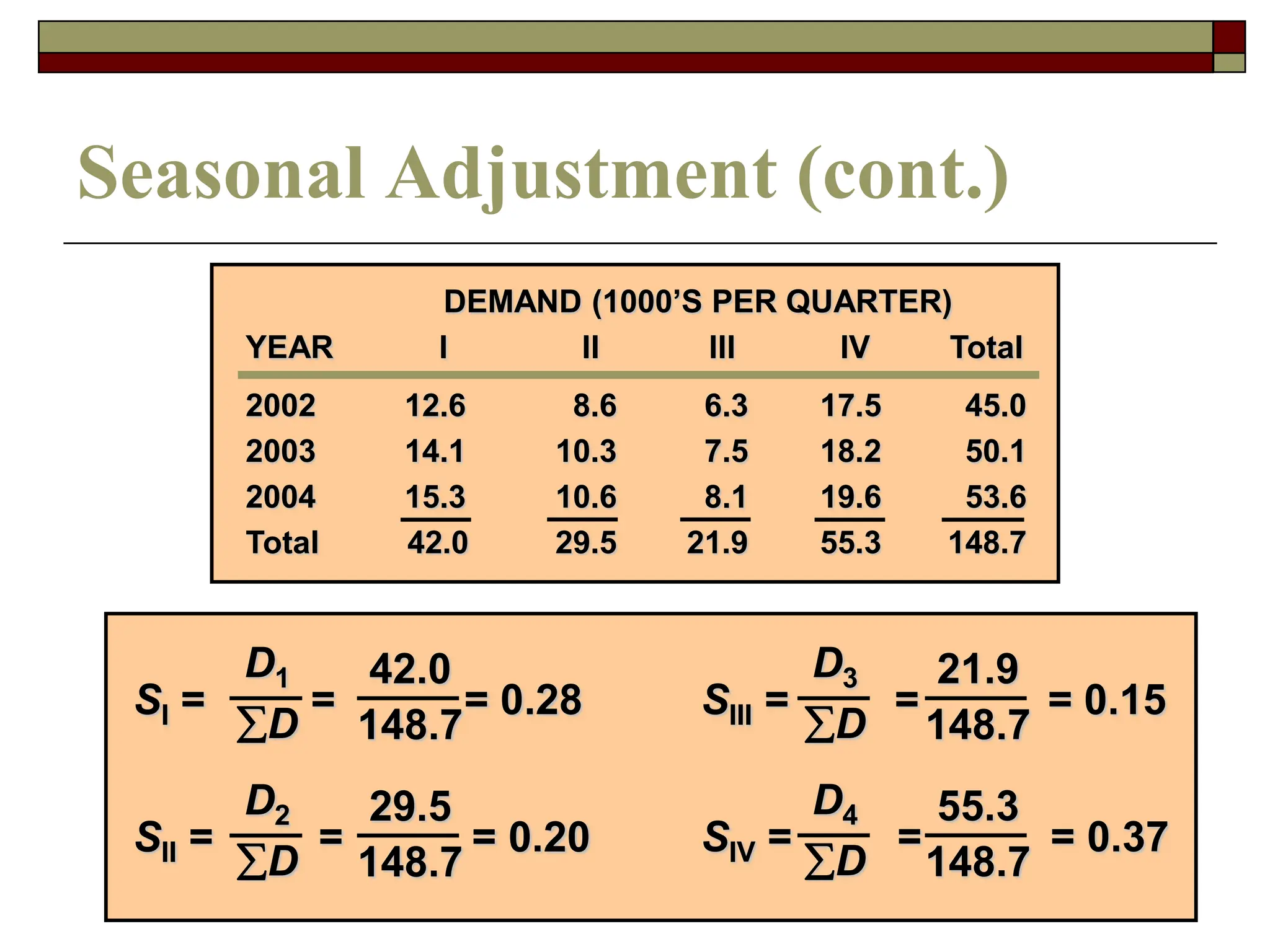

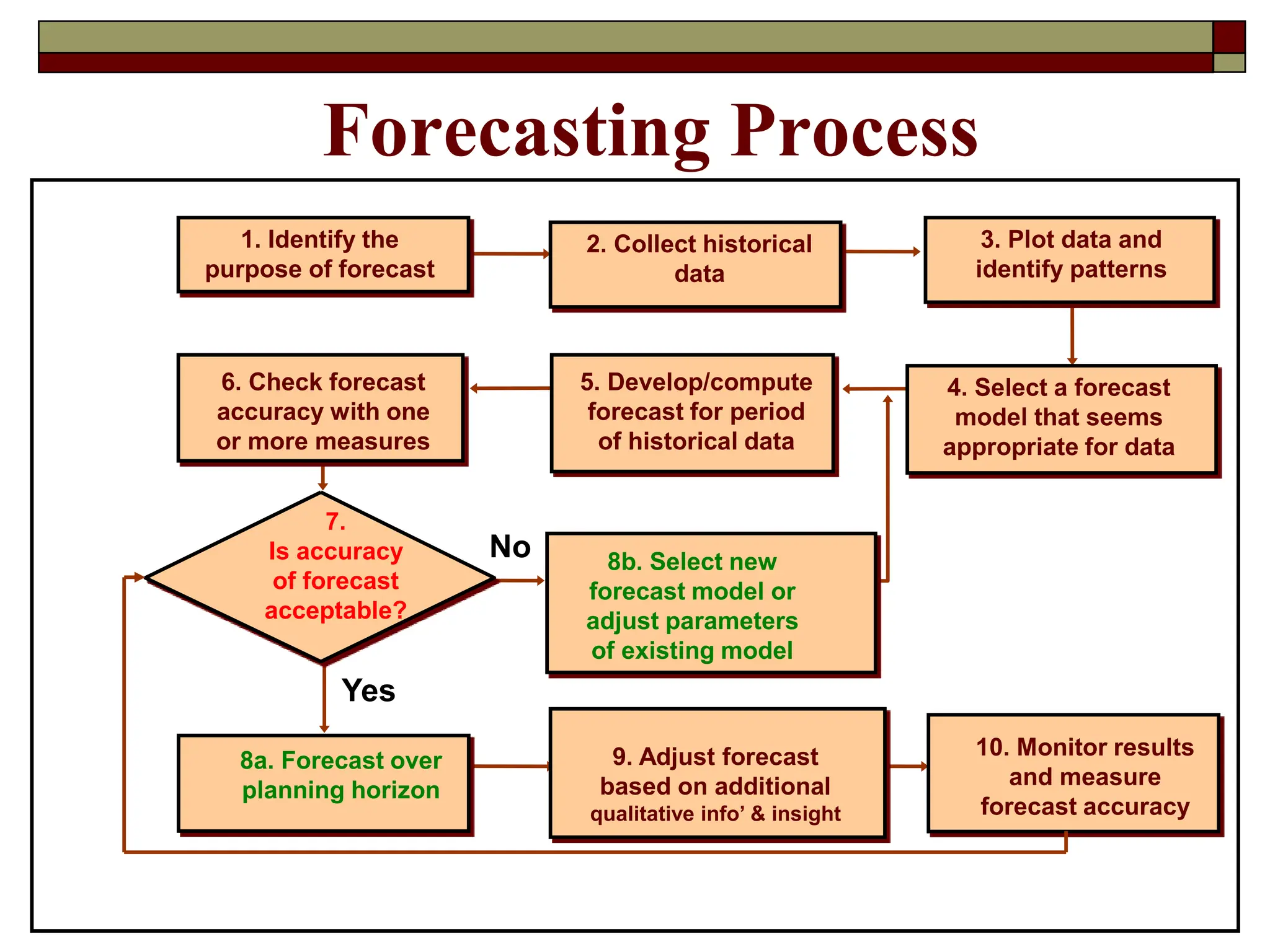

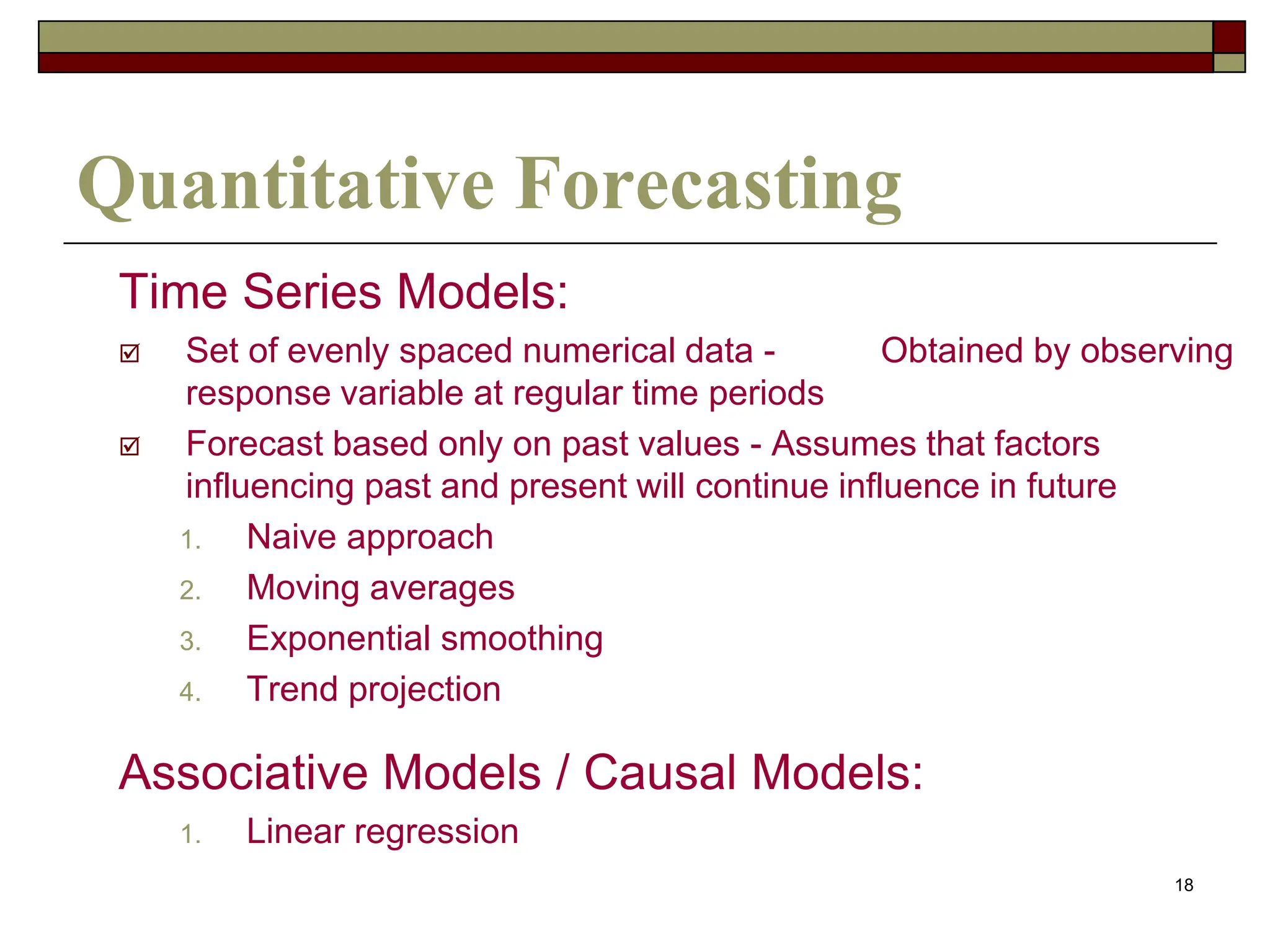

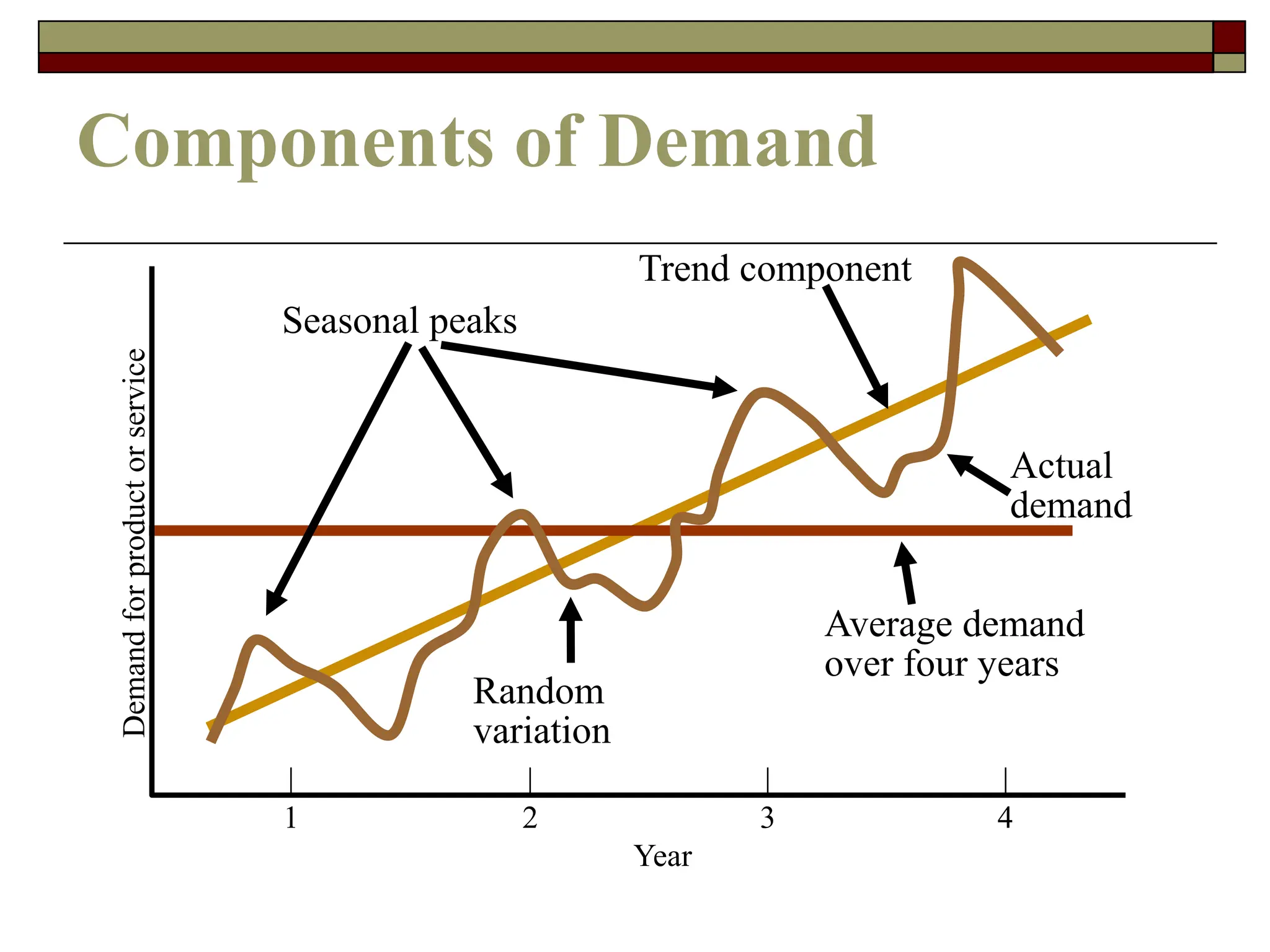

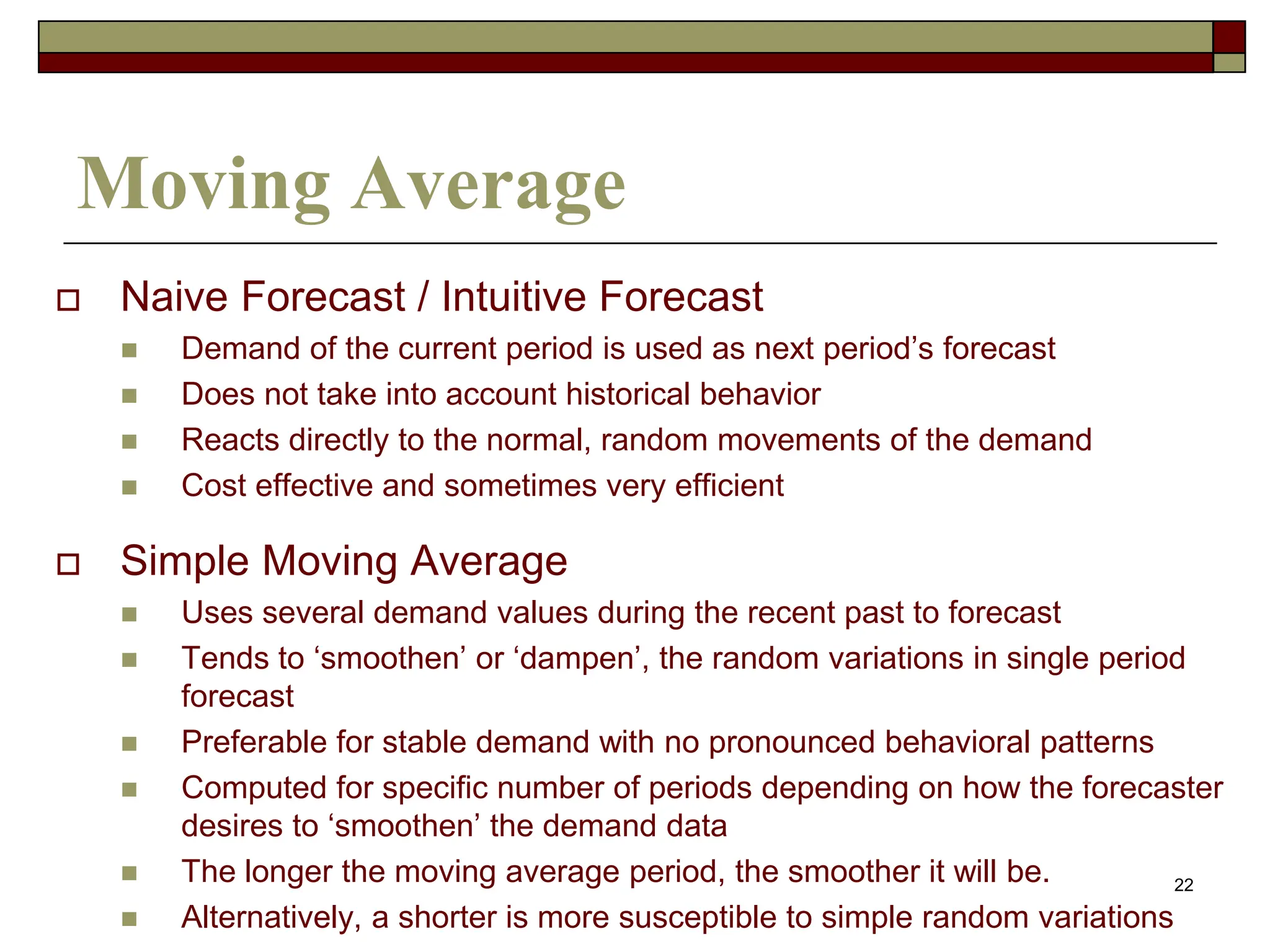

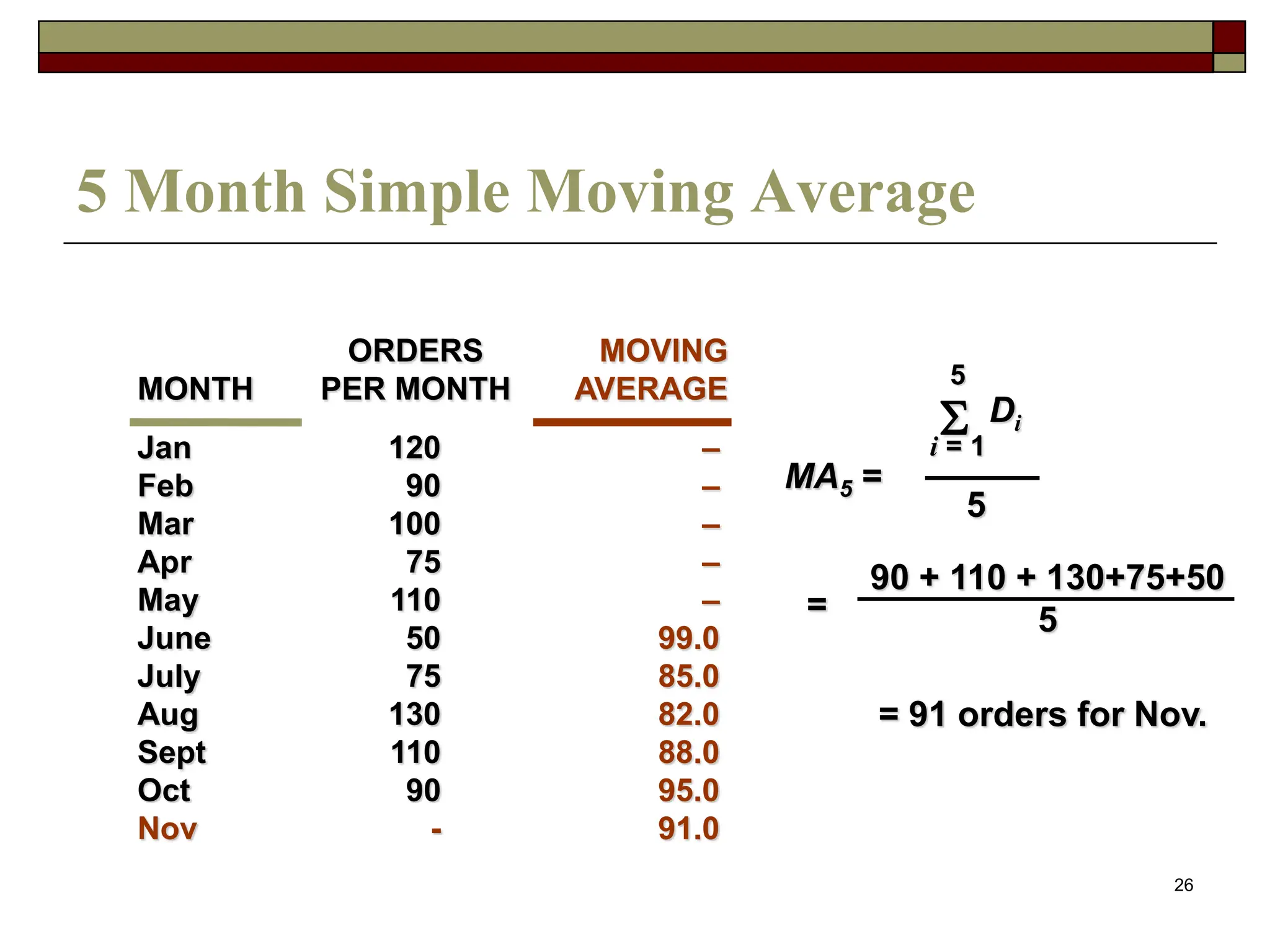

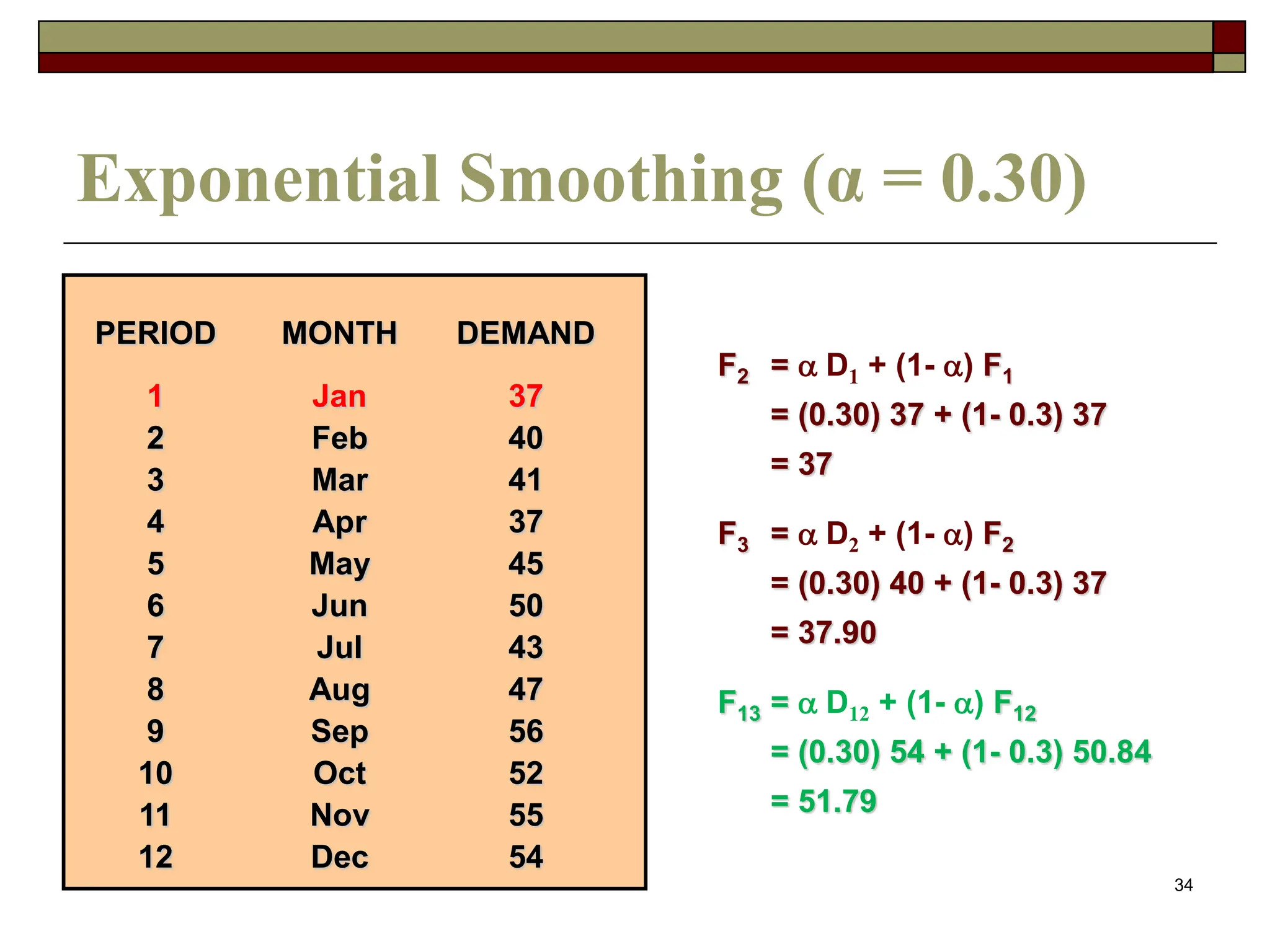

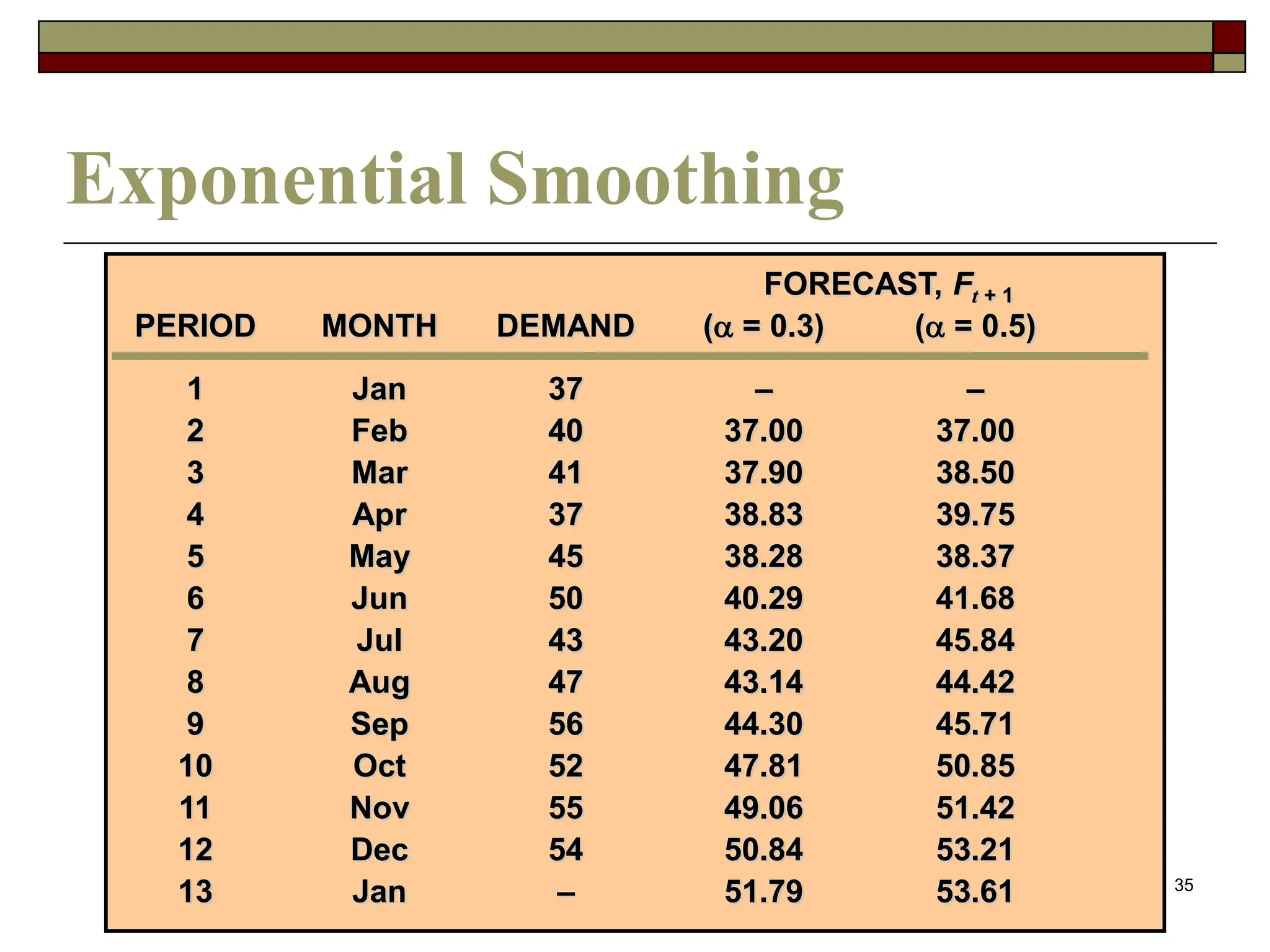

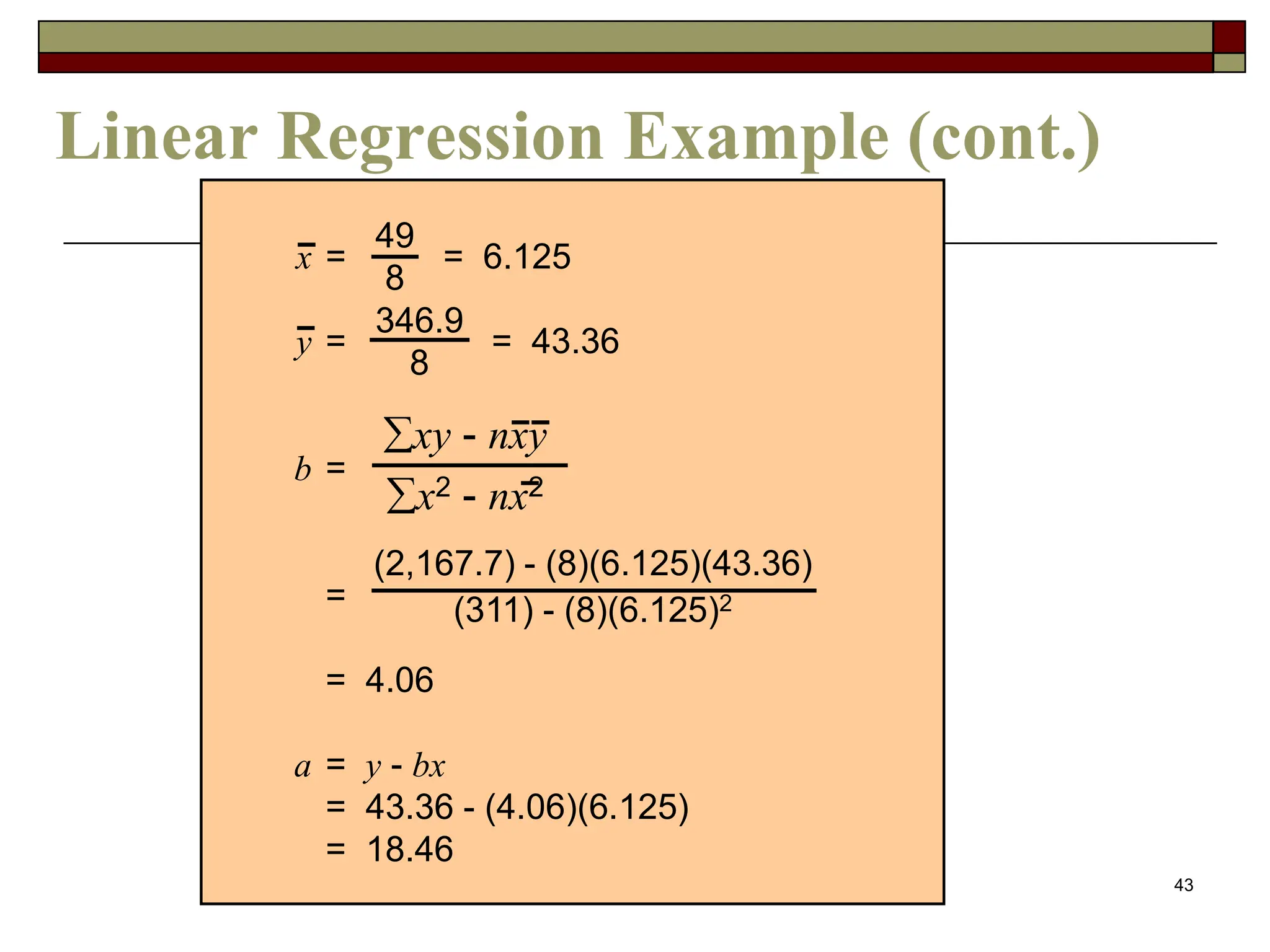

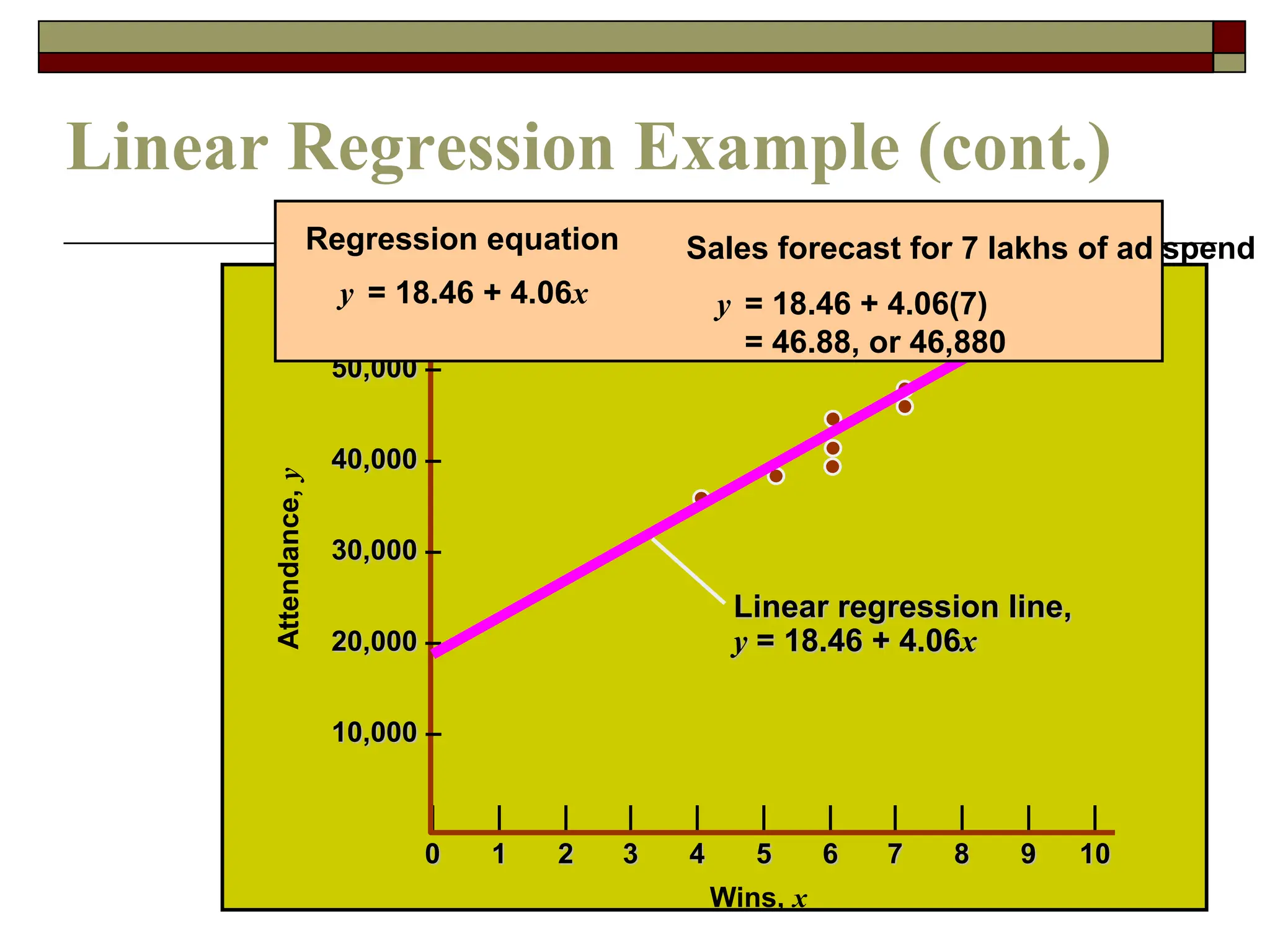

This document discusses various forecasting techniques. It begins by outlining qualitative and quantitative forecasting approaches. Several quantitative time series models are then described in detail, including naive methods, moving averages, exponential smoothing, and regression techniques. Specific examples are provided to illustrate how to calculate forecasts using simple and weighted moving averages, exponential smoothing with different alpha values, and linear regression with correlation and coefficient of determination. The document provides an overview of key forecasting concepts and quantitative methods.

![46

Computing Correlation

n xy - x y

[n x2 - ( x)2] [n y2 - ( y)2]

r =

Coefficient of Determination

r2 = (0.947)2 = 0.897

r =

(8)(2,167.7) - (49)(346.9)

[(8)(311) - (49)2] [(8)(15,224.7) - (346.9)2]

r = 0.947](https://image.slidesharecdn.com/forecasting2015-17-231017092032-ae34edff/75/FORECASTING-2015-17-pptx-46-2048.jpg)