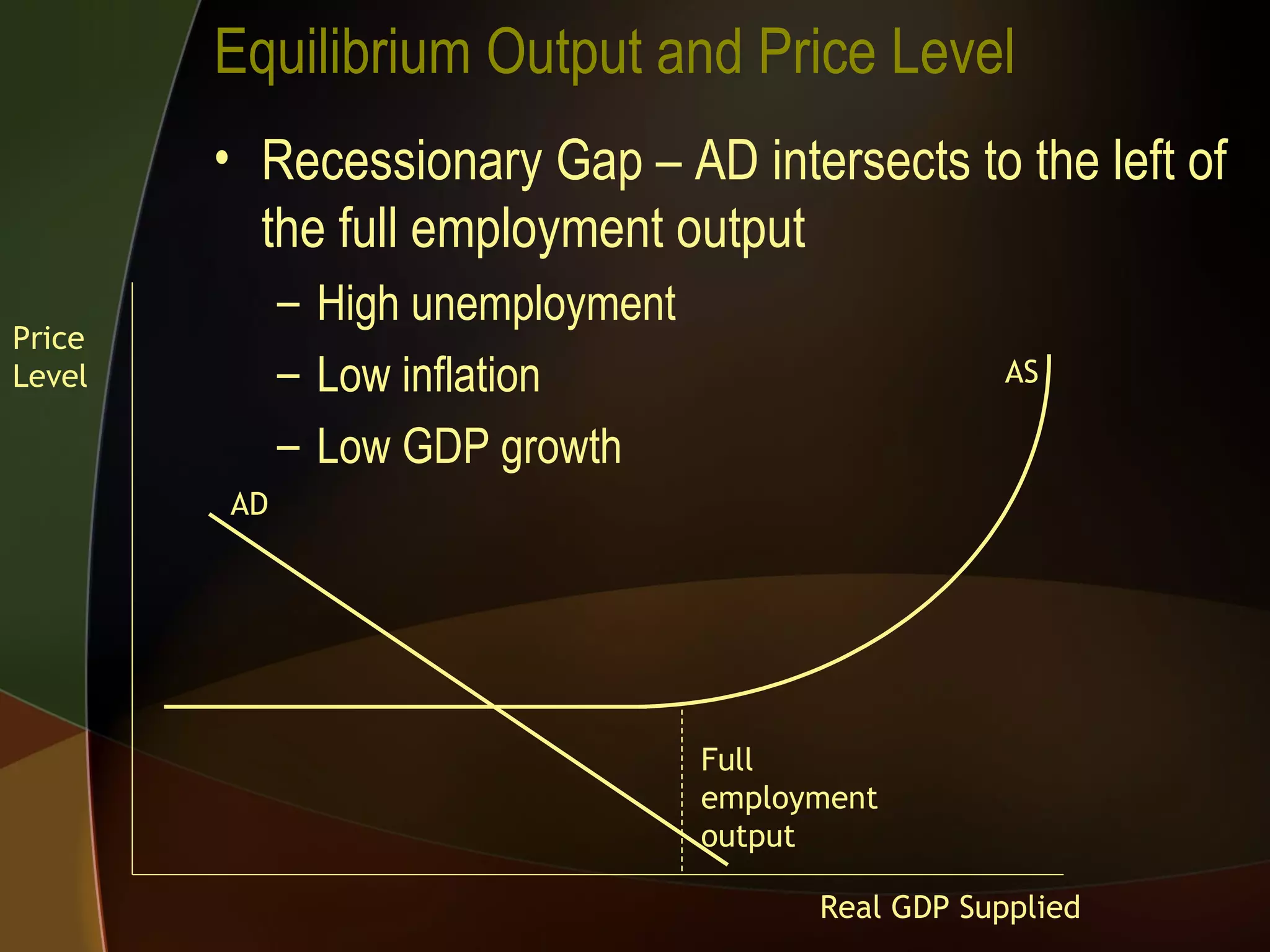

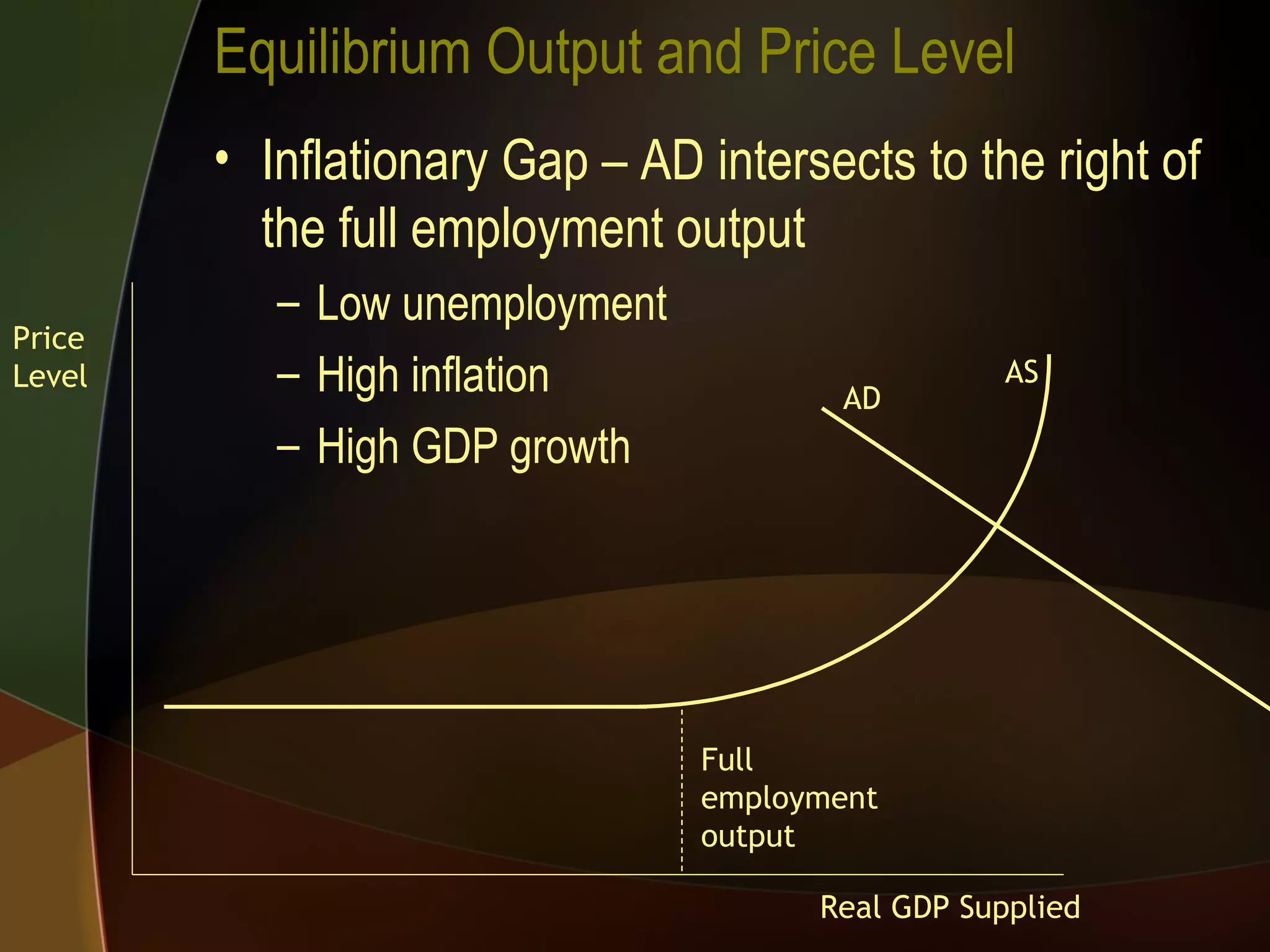

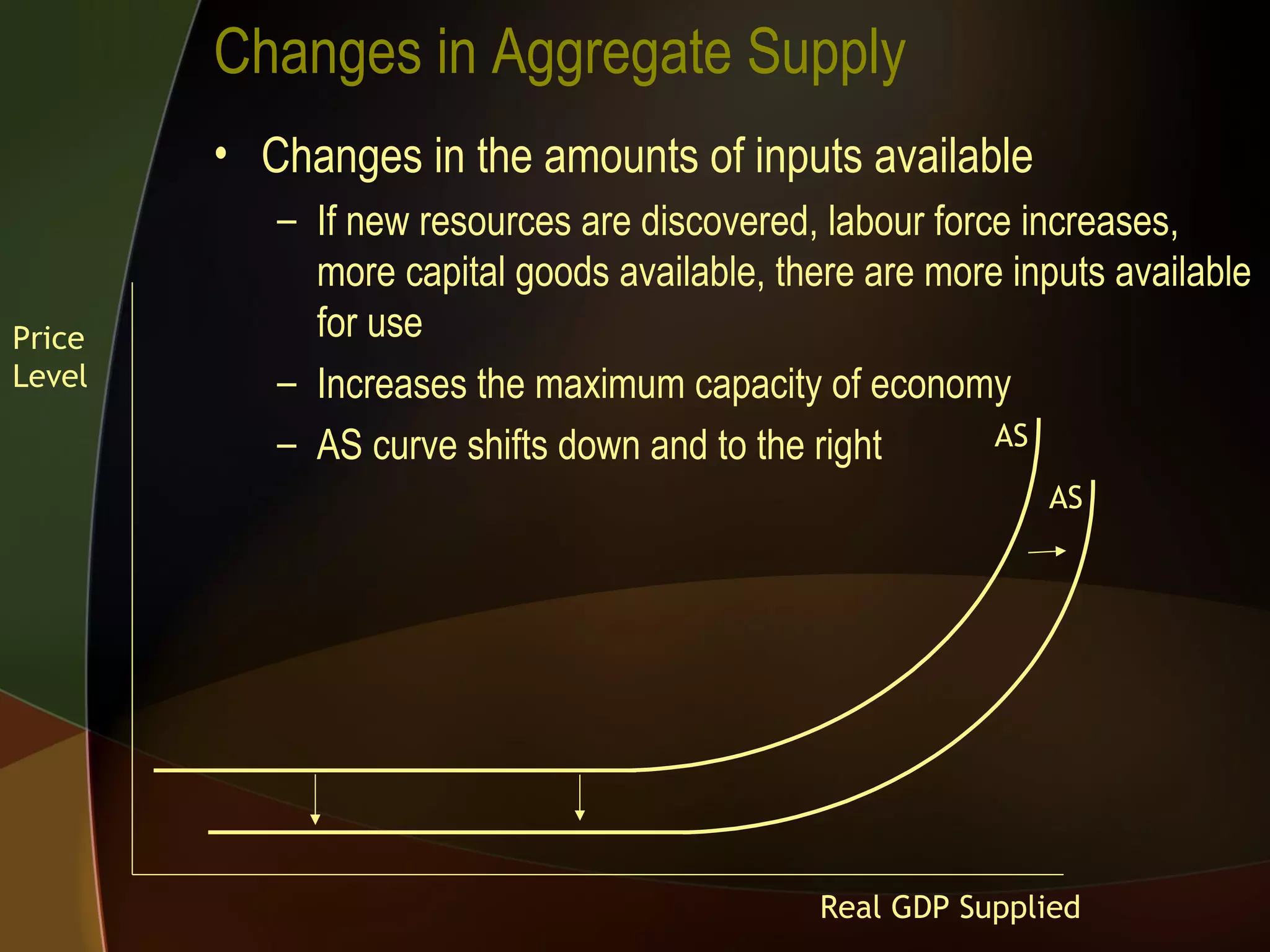

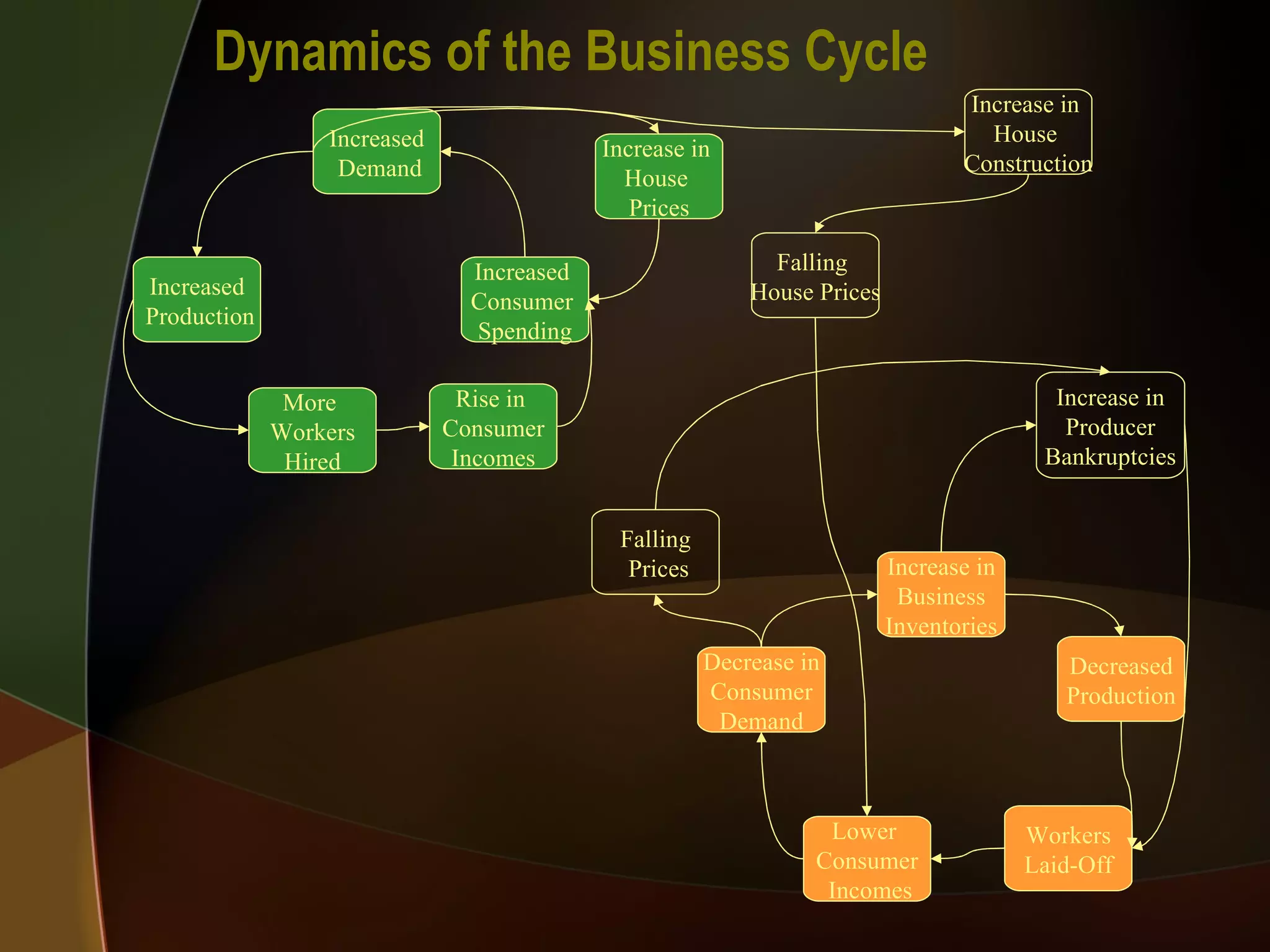

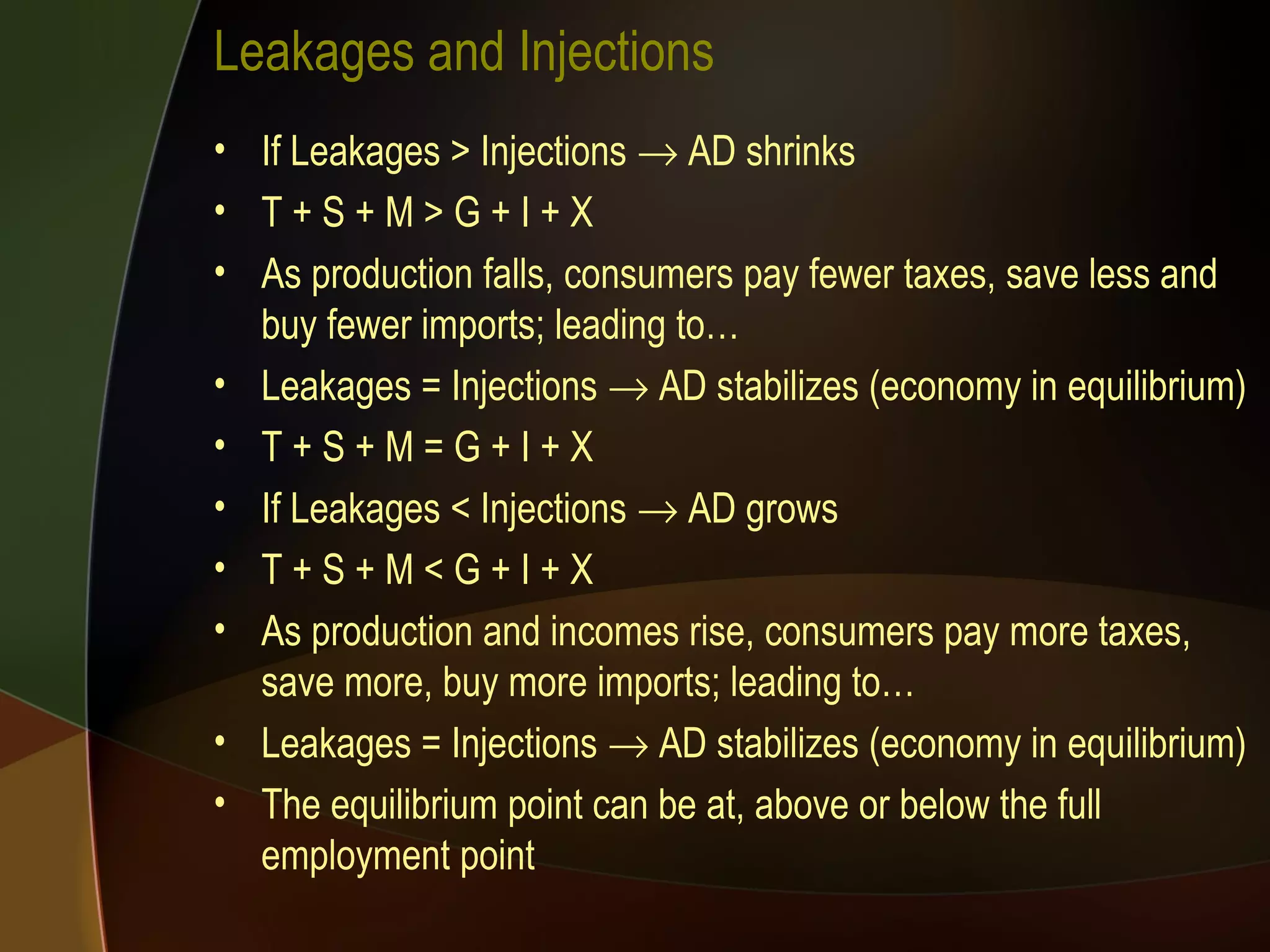

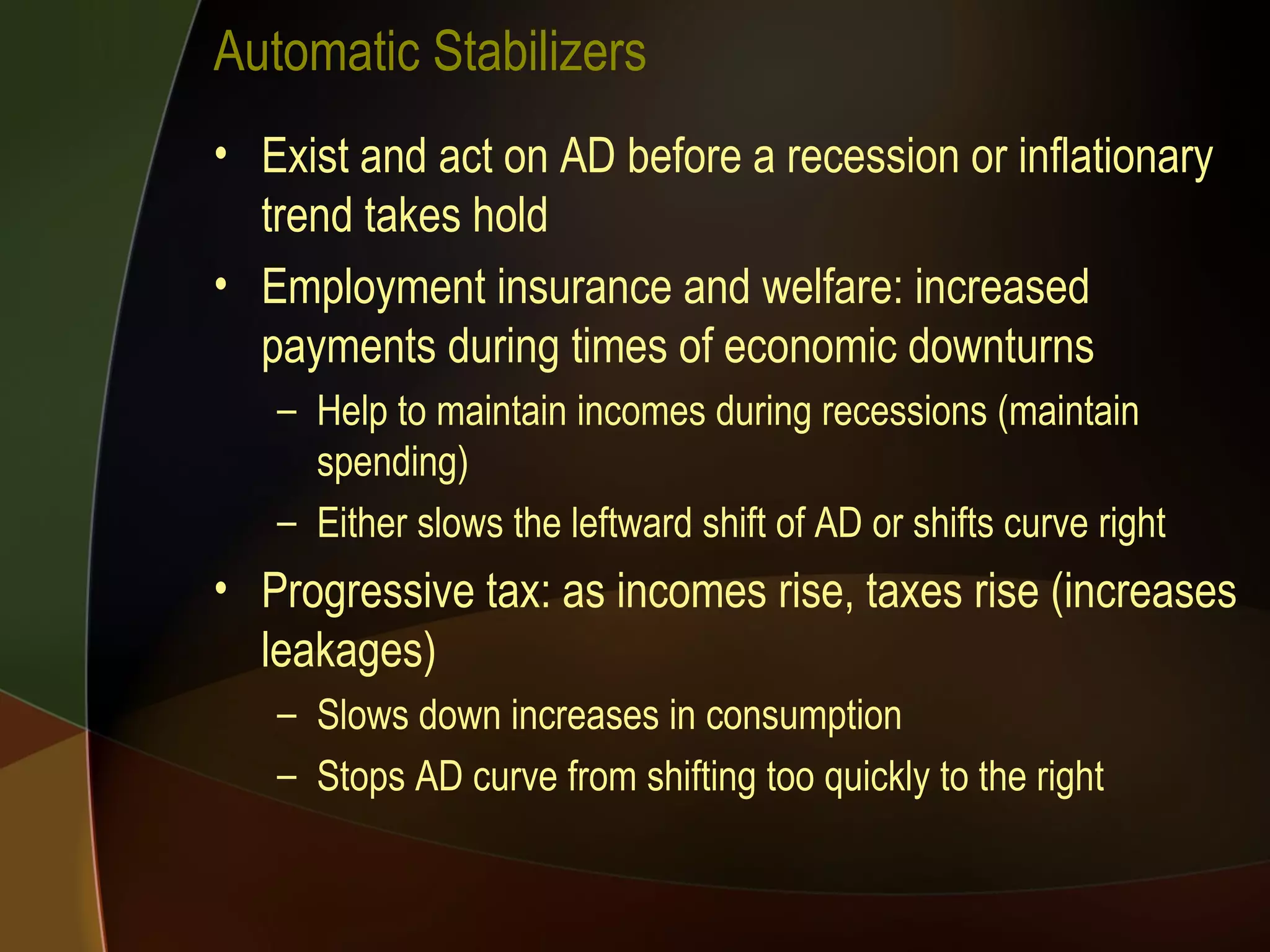

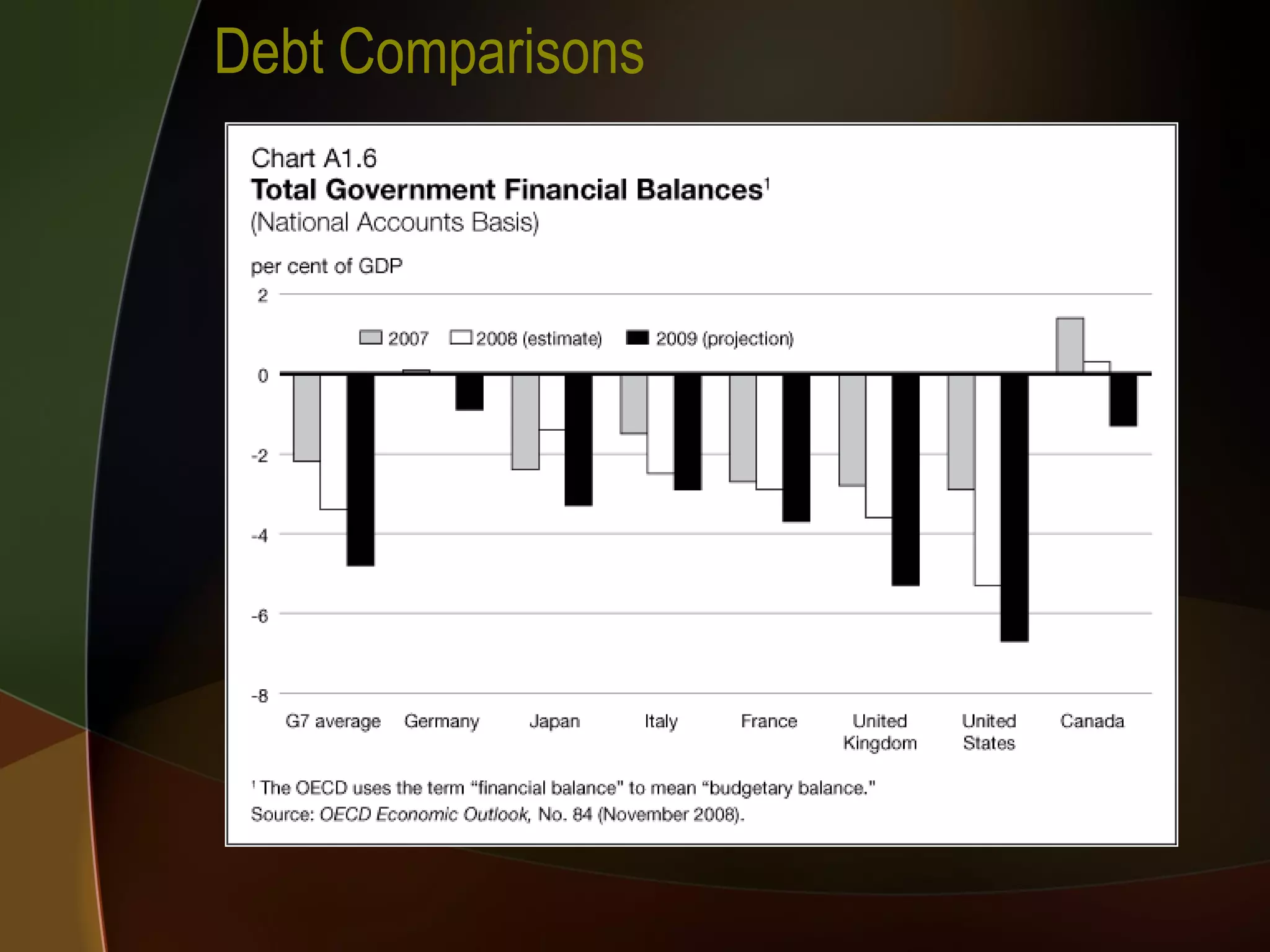

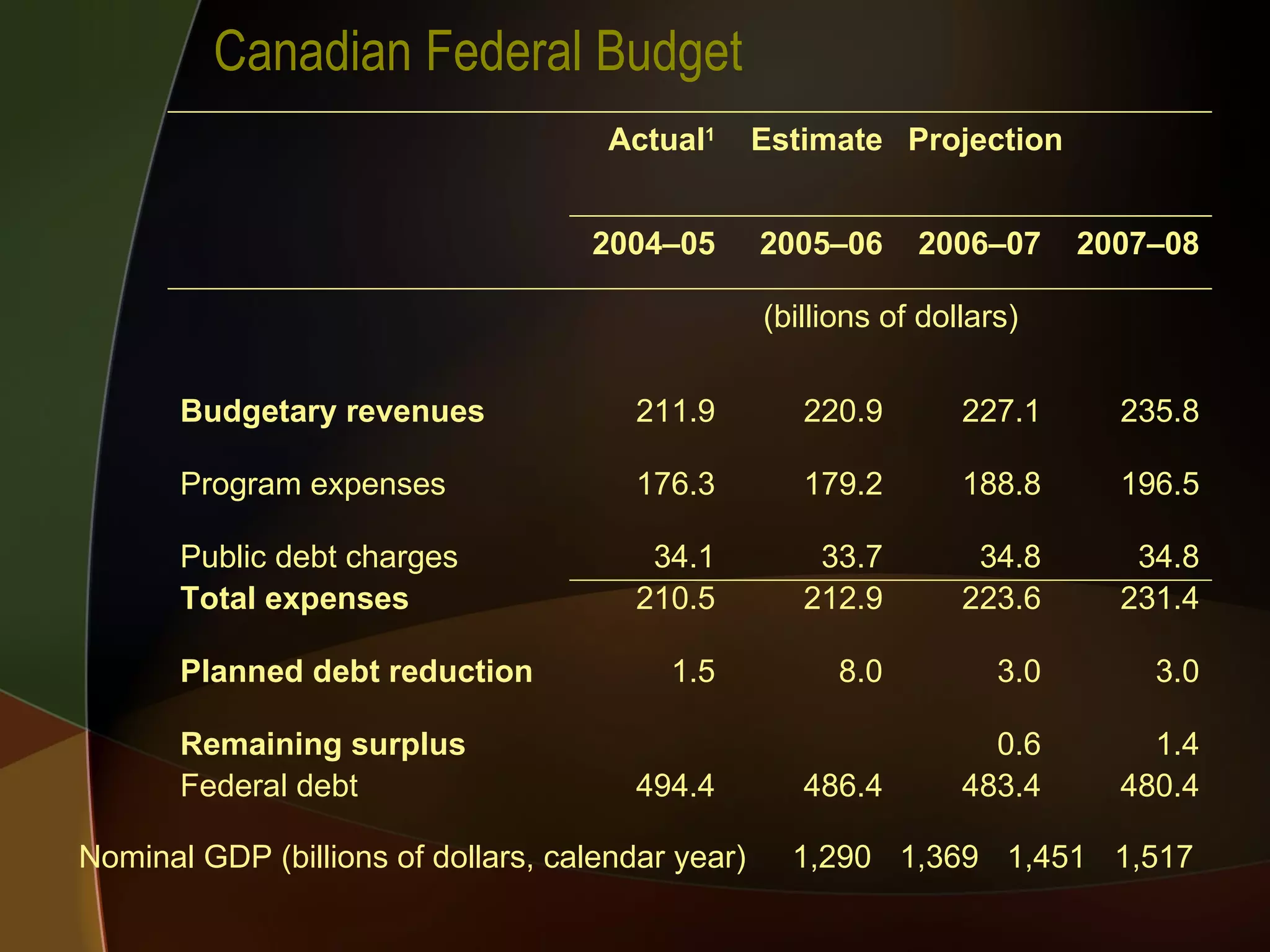

The document discusses fiscal policy and the business cycle. It explains that aggregate demand is the total demand for goods and services in an economy. Fiscal policy uses government spending and taxation to influence aggregate demand and output. The government can implement expansionary fiscal policy through tax cuts and spending increases to boost a recession-plagued economy. It can enact contractionary fiscal policy via tax hikes and spending decreases to curb inflation. Automatic stabilizers and the multiplier effect also impact how fiscal policy affects aggregate demand and the business cycle.