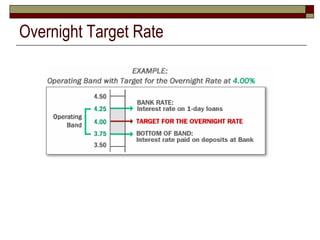

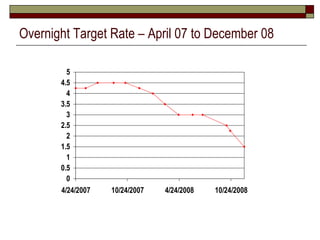

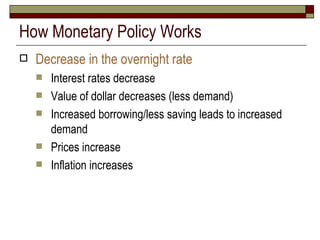

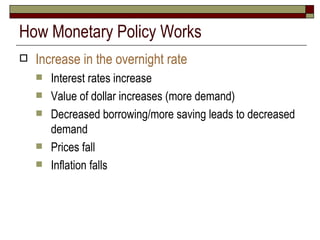

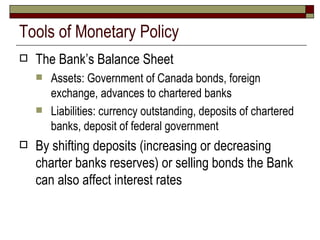

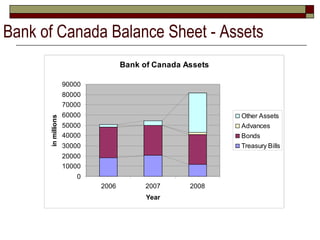

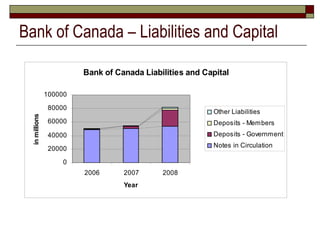

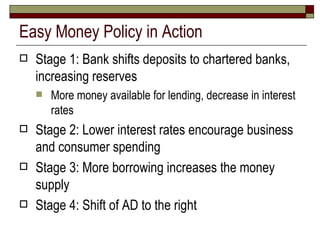

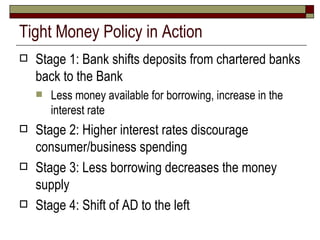

Monetary policy in Canada is carried out by the Bank of Canada and involves influencing interest rates and the money supply to impact the economy. The Bank of Canada uses its overnight target rate as the main tool of monetary policy, with higher rates making credit more expensive to tighten the money supply and curb inflation, while lower rates expand the money supply to stimulate the economy and curb recessions.