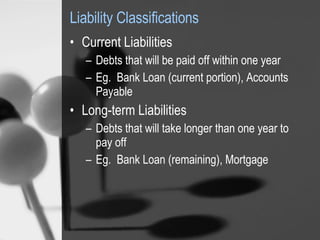

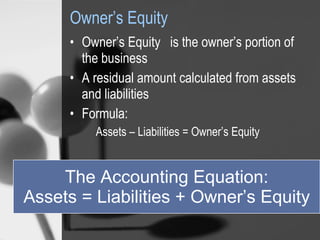

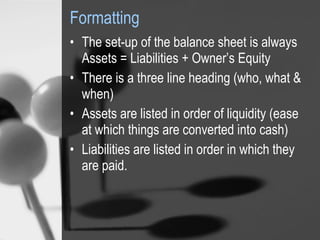

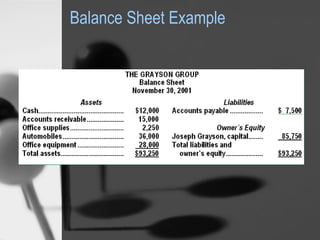

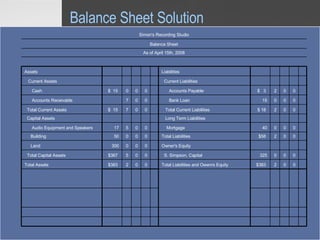

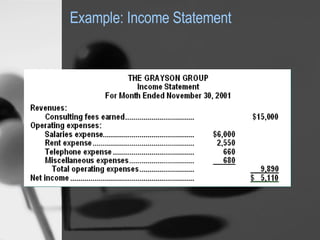

Accounting involves recording and analyzing a business's financial activities. There are two main types: financial accounting which analyzes a company's financial position, and managerial accounting which is used for internal decision making. Key financial documents include the balance sheet, which measures financial health at a point in time by listing assets, liabilities, and equity, and the income statement, which reports revenue, expenses, and profit over a period. Accounting helps ensure accountability, enable comparisons, and is a business's common financial language.