The document provides an overview of personal finance topics including what money is, how to earn and spend money, taxes, housing options, saving and investing, credit, and building a good credit history. Some key points:

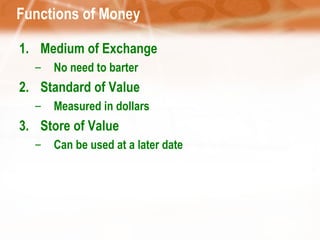

- Money is a form of payment accepted in exchange for goods and services. Coins, paper bills, cheques, and credit cards are common forms of money.

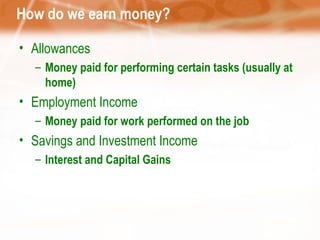

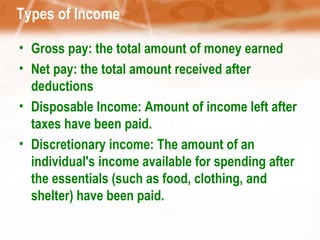

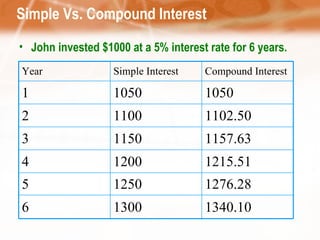

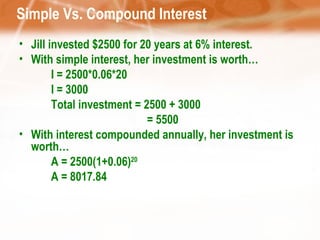

- People earn money through allowances, employment, savings and investments which provide interest and capital gains. Income is categorized as gross, net, disposable or discretionary.

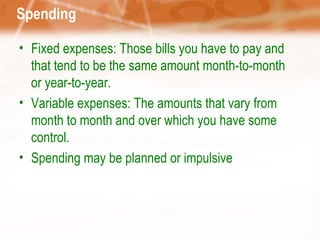

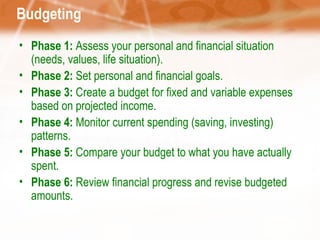

- Budgeting involves assessing finances, setting goals, creating a spending plan, monitoring spending, and revising the budget.

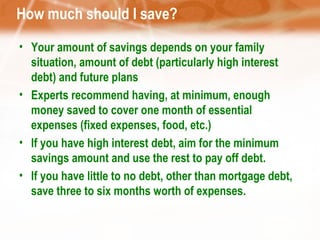

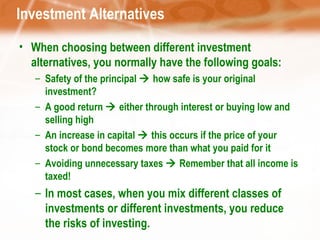

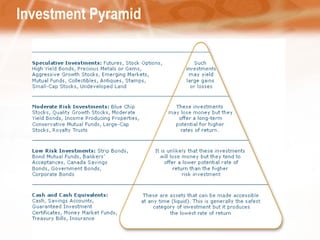

- Savings are used for large purchases